Who’s to Blame For Growing

U.S. Income Inequality?

by The Curmudgeon

Income

disparity in the U.S. has reached an extreme that is so unbelievable it would

make our founding fathers shudder. At

the same time that we have a new gilded age of super-rich getting

richer, we have more people than ever struggling to pay for food and basic

necessities.

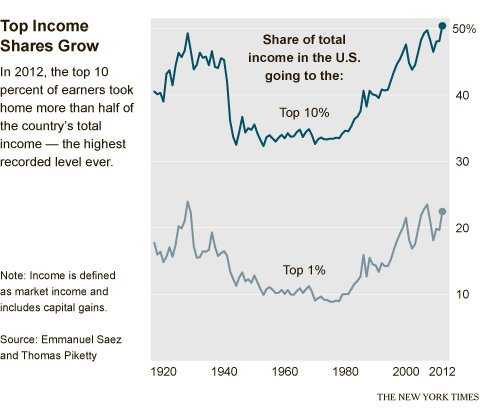

The NY Times

and SF Chronicle reported this week that the top 10 percent of

earners accounted for more than half of the country’s total income in

2012. That’s the highest level recorded

since the government began collecting the relevant data in 1913, according to

an updated study titled "Striking

It Richer" by economists Emmanuel Saez

and Thomas Piketty.

As shown in the

figure below, the top 10% of earners accounted for more than half of all income

in 2012. The share of the top 1% of

income earners was about 23% last year.

From 2009 to

2012, the top 1% incomes grew by 31.4% while bottom 99% incomes grew only by

0.4%. Those super rich enjoyed 95% of

the total U.S. income gains since the great recession "ended" in June

2009. In 2012, the top 1% incomes

increased sharply by 19.6%. Meanwhile,

incomes for the other 99% of Americans stagnated from 2009 to 2011. They grew only about 1% in 2012, based on

preliminary projections by the economists.

The figures

underscore that after the recession "ended," the country remains in a

new Gilded Age, with income even more concentrated as it was in the

years that preceded the Great Depression of the 1930s. High stock prices, rising home values and

surging corporate profits have buoyed the recovery-era incomes of the most affluent

Americans, with the incomes of the rest still weighed down by high unemployment

and stagnant wages for many blue- and white-collar workers.

“These results

suggest the Great Recession has only depressed top income shares temporarily

and will not undo any of the dramatic increase in top income shares that has

taken place since the 1970s,” Mr. Saez, an economist

at the University of California, Berkeley, wrote in his analysis of the

data. Mr. Saez

and Mr. Piketty have argued that the concentration of

income among top earners is unlikely to reverse without radical changes in the

economy or in tax policy. Tax increases

that Congress approved this January are not likely to have a major effect, Mr. Saez wrote: "they're not negligible, but they are

modest.”

Yahoo Finance

explores this egregious income inequality in a video and article with several

excellent references: Top

1% Getting 95% of Income Gains: Is Washington Responsible?

Meanwhile, a

Gallup Poll article More

Americans Struggle to Afford Food states that 20% of Americans' struggle to afford food and their overall

access to basic needs is close to record-low.

The 20% who

reported this August that they have often lacked enough money to buy the food

that they or their families needed during the past year, is up from 17.7% in

June, and is the highest percentage recorded since October 2011. The percentage

who struggle to afford food now is close to the peak of 20.4% measured in

November 2008, as the global economic crisis unfolded.

Who Does Gallup

Blame? Citing the Wall Street Journal,

Gallup blames stagnant wages. According

to an August 2013 Wall Street Journal analysis of Labor Department data, “the

average hourly pay for a nongovernment, non-supervisory worker, adjusted for

price increases, declined to $8.77 [in July 2013] from $8.85 at the end of the

recession in June 2009.” Depressed wages are likely negatively affecting the

economic recovery by reducing consumer spending, but another serious and costly

implication may be that fewer Americans are able to consistently afford food

and meet other basic needs.

Gallup also

blames Republicans. Federal government

programs also play a role in addressing this issue. As food stamp (SNAP)

enrollment increases, Republicans in Congress are proposing substantial cuts

and reforms to the program, while Democrats are resisting such reductions.

Regardless, food stamp benefits are set to be reduced in November after a

provision of the 2009 fiscal stimulus program expires. Therefore, it is

possible that even more Americans may struggle to afford food in the immediate

future.

In a blog

post that addresses this same topic, Mike (Mish) Shedlock

provides answers for who is really to blame?

1. The Fed

2. Fractional Reserve Lending (Central banks

in general for sloshing money around).

3. Lack of a Gold Standard

4. Congress (for throwing money at numerous

programs)

5. War-mongers

Mish wrote,

"Raising the minimum wage does not fix the problem. And wasting money

waging wars we cannot afford is counterproductive. The two primary reasons are: fractional

reserve lending (FRL) and the Fed (central banks in general). Combined, the

Fed, FRL, and lack of a gold standard enable Congress and the war-mongers to

waste money. The Fed and the ECB praise

themselves as "defenders against inflation". One look at health-care

or education costs is enough to prove they are in Fantasyland."

Curmudgeon Opinion: Who's to Blame for U.S. Income Inequality?

We place the

blame primarily on the Fed's QE and ZIRP, a dysfunctional Congress, and

unaffordable Obama-care that has exacerbated income disparity in the U.S. In many previous Curmudgeon posts, we've made

the case that the Fed's monetary policies have been counter-productive for U.S.

economic growth, wages and creation of good full-time jobs. The "do nothing" and "say

no" Congress is very well known and accepted- we have nothing to add other

than we think they are influenced way too much by lobbyists and political

pressure groups.

But we think

the damage ALREADY caused by Obama-care has not been properly reported by the

news media. Obama-care has caused

employers to hire part-time workers (vs. full time) that are not subject to

mandatory health insurance. As a result,

the U.S. labor force has more "part-timers" than ever before. Moreover, many people have stopped looking

for work because they feel it's hopeless as employers are not hiring due to

economic uncertainty. Several pundits

have said, "the U.S. has become a nation of

part-timers." If Obama-care was

repealed, we believe companies would be more willing to hire full time

employees and the US economy would be a lot healthier!

Meanwhile, the

Fed's QE and ZIRP have benefited real estate speculators and equity investors,

but has not at all helped wage earners, retired folks

on fixed incomes, or the middle/working classes. Hence the rich are getting much richer and

everyone else is getting poorer or struggling to make ends meet.

Victor Sperandeo adds: "I

would agree -a good list. I would add

the sum of all taxes and far too many regulations on business, which inhibits

capital investment and raises the price of almost everything."

Till next time.....................

The Curmudgeon

ajwdct@sbumail.com

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.