Why

America is in a Steep Decline - Part II

By Victor

Sperandeo with the Curmudgeon

Introduction:

As a follow-on to our Part I article posted yesterday, we

provide a deeper perspective on how the U.S. has lost its way. We explain how Americas current economic and

political systems strongly conflicts with Adam Smiths Wealth of Nations. Free

trade vs. tariffs is cited as a standout example.

Its important to note that Smith attacked government

intervention in the economy and provided a blueprint for free markets and free

trade. Those two principles eventually would become the hallmarks of U.S.

capitalism which no longer exists we dont have free trade (due to excessive

tariffs) and free markets are a thing of the past (thanks to the Fed and PPT

intervention).

Point- Counterpoint Adam

Smith vs. U.S. Today:

1.

Smiths laissez-faire capitalism would require very few regulations. However, the U.S. economic system is totally

regulated today. In general, regulations

reduce efficiency and inhibit innovation.

Heres a

table tracking regulatory changes in the Biden administration.

2.

Smith argued that by giving

everyone the freedom to produce and exchange goods as they pleased (free trade) and opening the markets up

to domestic and foreign competition, people's natural self-interest would

promote greater prosperity than could stringent government regulations. Today, we use tariffs for virtually all

foreign trade.

3.

Smith advocated limited Government. Yet the U.S. federal government has become a

Leviathan and has the largest budget in its history of over $6 trillion.

4.

Solid Currency and Free-Market Economy, was one of Smiths

axioms. The U.S. gave up its hard money

system in stages over the last 110 years and has been on a fiat money system

since August 1971 when America went off the gold standard.

5.

Smith wanted to use hard currency as a check on spending,

but since the Fed started QE in 2008, there hasnt been any checks on

spending. The U.S. federal government

has financed almost all its needs by printing dollars (aka Keystroke entries;

see Modern Monetary Theory).

6.

The Wealth of A Nation- puts forth this proposition: The State is opulent

where the NECESSARIES and convenience of life are easily come at

To talk of

wealth of nations is to talk of the abundance of its PEOPLE. Therefore, whatever raises the market price diminishes

public opulence and the wealth of the State, and hence it diminishes the

necessaries and happiness of the people. Today, the people are NOT happy! The U.S. has the highest inflation rate in over

40 years, the average citizen cant make ends meet and is suffering mightily.

Free Trade vs Tariffs

and the U.S. China Trade War:

Restrictions on trade like tariffs make a nation poorer. In

Smiths words:

If a foreign country can

supply us with a commodity cheaper than we ourselves can make it, better buy it

of them with some part of the produce of our own industry employed in a way in

which we have some advantage. [

] The value of [a countrys] annual produce is

certainly more or less diminished when it is thus turned away from producing

commodities evidently of more value than the commodity which it is directed to

produce [by trade policies]. [

] The industry of the country, therefore, is

thus turned away from a more to a less advantageous employment, and the

exchangeable value of its annual produce, instead of being increased, according

to the intention of the lawgiver, must necessarily be diminished by every such

regulation.

A recent example of tariffs that were (and are still) costly

to U.S. companies and residents were the tariffs on goods produced in China (solar panels, electronics, PCs,

washing machines, etc.). Indeed, the

China tariffs have indeed hurt both U.S. industry and workers. Another consequence

of the U.S. imposed tariffs is that they invited retaliatory tariffs, primarily

from China, on U.S. exports. Retaliatory tariffs have further hurt American

firms and workers, with certain geographies and industries bearing the brunt of

the impact.

The U.S. China trade war has not yielded any tangible

benefits for U.S. firms and workers. While the U.S. tariffs were intended to

protect American industries, they have largely hurt the U.S. economy. And they

incentivized foreign countries to retaliate with their owns tariffs, which have

damaged the economy even more.

Conclusions:

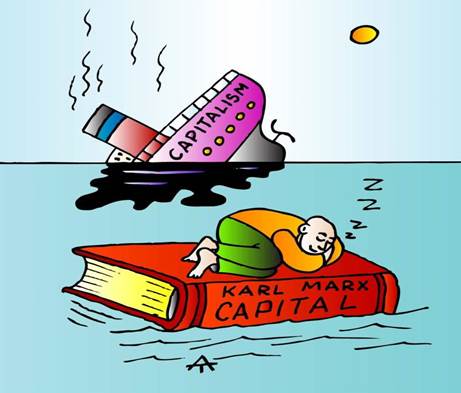

We conclude with a few cartoons as a picture speaks louder

than 1,000 words!

Free Trade vs

Protectionism:

Down with capitalism,

says the millennial:

Cartoon by Alexei Talimonov from Devon, England:

...

Be well, stay healthy,

try to find diversions to uplift your spirits. Wishing you peace of mind, and

till next time

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2022 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).