Why

America is in a Steep Decline - Part I

By Victor

Sperandeo with the Curmudgeon

Disclaimer: The opinions in this post are exclusively that of

Victor Sperandeo. The Curmudgeon is not

knowledgeable enough to comment on this problematic topic.

This is the first of a two-part article. We hope to complete

part II early this coming week.

Introduction:

For several years now, I’ve been stating that the U.S. is

in a prolonged, steep decline – morally, spiritually, politically, and

economically. We are doing the exact opposite of what the analysis of liberty

says creates wealth. Liberty is

the basic principle of what enables wealth to be created and nations to

prosper.

Sadly, the status of liberty

in the U.S. has greatly deteriorated in recent years. That’s primarily due to politicians in power

that put their donors’ interests ahead of their constituency and the Fed

serving its masters rather than doing what’s right for the American people

(main street).

Discussion:

Greek Philosopher Aristotle

maintained that moral virtue is the only practical road to effective action. Aristotle had taught that happiness is “not a

state of mind” but is rather “an activity in accordance with virtue.”

The answers to the world’s problems are not new and have been

repeated many times in history. The reason we can answer these recurring

problems is “HUMAN NATURE.” It never

changes. Shakespeare's plays reveal that no matter how much language,

technology and mores have changed in the past 400 years, human nature is

largely undisturbed.

Of course, variations among people occur, but humans in power

act in a similar fashion. Kings act like Kings but have no magic powers.

One of the best analyses of how the economic world works was

explained by Scottish economist and moral philosopher Adam Smith in his book, The Wealth of Nations.

[IMHO, it is one of the best five books ever written. The actual title: An Inquiry into the Nature and Causes of the Wealth of Nations.]

We provide a summary of the book, whose importance was

immediately recognized by Smith’s peers, and later economists showed an unusual

consensus in their admiration for his ideas.

Retelling Smith’s arduous study and conclusions are best said

in his words rather than by me paraphrasing them. What is important is his research and

conclusions being stated in Smith’s own words. So please forgive the quotes,

but they are far more omniscient than any rewritten representations by me or

anyone else.

Summary of Wealth of Nations:

The Wealth of

Nations was the product of seventeen years of notes and earlier

studies, as well as an observation of conversation among economists of the time

(like Nicholas Magens) concerning economic and

societal conditions during the beginning of the Industrial Revolution. It took Smith some ten years to produce this

monumental work of multiple disciplines.

Smith anticipated the writings of Karl Marx. Like Marx's Das

Capital and Machiavelli's The Prince, his great book marked the

dawning of a new historical epoch.

This book was first published in 1776 – the same year Thomas

Jefferson wrote the “Declaration of Independence.” Smith’s economic views were based on liberty. America’s Freedom was also based on liberty through the U.S. constitution.

Combining economics, political theory, history, philosophy,

and practical programs, Smith assumes that human self-interest is the basic

psychological drive behind economics and that a natural order in the universe

makes all the individual, self-interested strivings add up to the social good.

Smith’s conclusion is now known as “laissez-faire

economics” or non-interventionism.

In essence, it is to leave the economic process alone and to use

government only as an agent to preserve order and to perform routine functions.

Smith argued that “by giving everyone the freedom to produce

and exchange goods as they pleased (free trade) and opening the markets up to

domestic and foreign competition, people's natural self-interest would promote

greater prosperity than could stringent government regulations.”

His three primary axioms were:

1.

Enlightened Self-Interest

2.

Limited Government

3.

Solid Currency and Free-Market Economy

With hard currency acting as a check on spending, Smith

wanted the government to follow free-market principles. These included keeping

taxes low and eliminating tariffs to allow for free trade across borders. Smith

noted that “tariffs and other taxes only succeeded in making life more

expensive for the people, while stifling industry and trade abroad.”

The key to understanding the wealth of nations is to talk of

the abundance of its PEOPLE. Adam Smith wrote:

“The State is opulent where the NECESSARIES and convenience

of life are easily come at … To talk of wealth of nations is to talk of the

abundance of its PEOPLE. Therefore, whatever raises the market price diminishes

public opulence and the wealth of the State, and hence it diminishes the

necessaries and happiness of the people.”

“A criminal is a person with predatory instincts who has not

sufficient capital to form a corporation. Most government is by the rich for

the rich. Government comprises a large part of the organized injustice in any

society, ancient or modern. Civil

government, insofar as it is instituted for the security of property, is in reality instituted for the defense of the rich against

the poor, and for the defense of those who have property against those who have

none.”

Benjamin Franklin was asked

by a woman (after the men who created the Constitution were leaving the

Philadelphia Convention), “What form of government have you given us?” Franklin

responded, “A Constitutional Republic, if

you can keep it.”

That essence of the last point was that you have to work hard to retain your liberty

in order to keep the Constitutional Republic intact. It also assumed that U.S. citizens must fight

diligently to prevent tyrants (or politicians) from attempting to take or steal

your liberty and make you into a serf/slave.

Only then can the Constitutional Republic be saved and preserved.

……………………………………………………………………………………………………………

Flash Forward to Today:

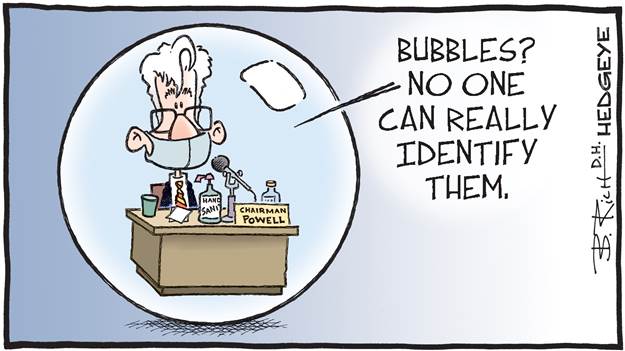

We don’t have to wonder if Fed Chairman Jerome Powell ever

read “The Wealth of Nations” or agreed with Smith’s essential

discourse. Of course not! Everything

the Fed (and the U.S. government) does is contrary to Smith’s findings!

Instead of pursuing the best policies for the benefit of the

nation, the Fed and U.S. federal government have been corrupted to serve their

masters (the secret owners of the Fed and the major donors to U.S. politicians

who no longer put the best interest of their constituencies first).

Cartoon of the Week:

U.S.

Economic Historical Comparison:

The Wealth of America is in deep decline. To wit:

From 1949 to 1999 Real GDP in the U.S. rose at a compounded

rate of 3.57%. However, from 1999 to

the end of 1st Quarter of 2022 Real GDP rose at 1.85%. That’s 48.2% less!

If real GDP grew at 3.57% from 1999 to date it would be

$29,136.41 trillion instead of is current $19,727.9 trillion (or 47.7%

greater).

Meanwhile, stated U.S. government debt is increasing at 8.71%

annually since America went off the gold standard in August 1971. Today, the

U.S. spends $16.5 billion a day and incurs a $1.5-2 trillion annual deficit.

Conclusions:

Today, we are all poorer due to a politically corrupt U.S.

Congress (both houses), President Biden’s “clean energy” policy, and the Fed’s

erratic monetary policy.

For sure, the financial health of the U.S. has

deteriorated. We will try to explain

more in part II. of this article.

Be well, stay healthy, try to find

diversions to uplift your spirits. Wishing you peace of mind, and till next

time………

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2022 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).