Investors

Advised to Prepare for an Upcoming Economic Hurricane

By Victor Sperandeo

with the Curmudgeon

Introduction:

We review U.S. economic highlights this past week, then

provide opinions on the Fed and Congress.

Our deep dive into the CBOs Budget and Economic Outlook reveals several

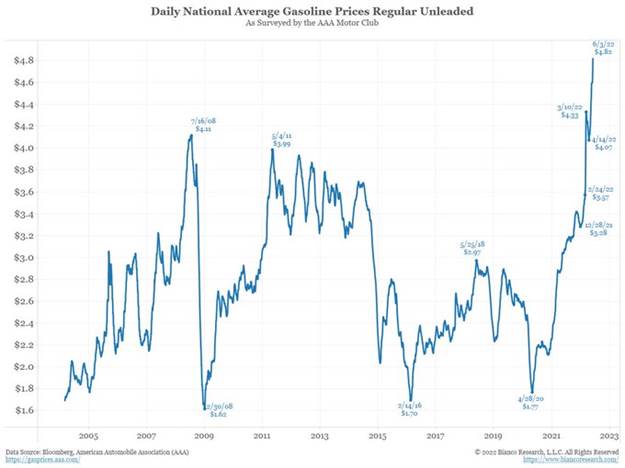

interesting forecasts, which we augment with charts from that publication. Next is an eye-popping chart of U.S.

unleaded regular gas prices. We

close with a couple of graphs on money flows into bonds and out of financial

stocks.

Please let us know what you think of our work (email the

Curmudgeon at ajwdct@gmail.com).

The U.S. Economy Week in Review:

1. Nonfarm payrolls increased 390,000 last month after

a revised 436,000 gain in April, a BLS report said on Friday. The unemployment

rate held steady at 3.6%, and the labor force participation rate

inched higher. The report suggests that employers had success filling open positions

in the month and that a recession is not imminent.

Average hourly earnings rose

a less-than-forecast 0.3% from April, the same as the previous month. They were

up 5.2% from a year earlier, a slowdown from 5.5% in April.

The jobs report will provide mixed feelings for the Fed,

which will welcome the steadier jobless rate, firmer participation rate, and

possible softening in wages, while worrying that the economy is still running

too hot to convincingly drive inflation back to the target, Sal Guatieri, senior economist at BMO Capital Markets,

said in a note to clients.

The dollar and Treasury yields jumped after the report.

Traders were pricing in about 200 basis points of additional rate hikes over

the next five Fed meetings. Victor

weighs in on that below.

2. Strong Dollar is Negative for US

Multinationals:

Having already climbed about 10% this year, the US dollar, as

measured against a basket of foreign currencies, is hovering near a two decade

high. That is shaping up to be credit negative for many US multinational

corporations, which expect to take a hit this year as they translate

foreign-sourced earnings back to US dollars.

Recently, several prominent US multinational corporations

have warned that the strengthening dollar is likely to be a drag on their 2022

earnings. More such announcements are likely, according to Moodys.

3. Jamie Dimon, CEO of JPMorgan Chase Bank (JPM), warned

of a Hurricane Coming Our Way. He advised people to prepare for an upcoming

economic hurricane. At an investor

conference on Wednesday Dimon said, That hurricane is right out there down the

road coming our way. We dont know if its a minor one or Superstorm Sandy.

You better brace yourself.

JP Morgan CEO Jamie Dimon explaining an economic hurricane

coming our way

..

..

..

.

..

..

.

..

This reminds me of the opening lyrics in the Rolling

Stones, Jumpin Jack Flash.

I was born in a cross-fire hurricane. And I howled at my ma

in the driving rain. But it's all right now, in fact, it's a gas. But it's all

right. I'm Jumpin' Jack Flash...

Dimons warning is foreboding. JPMs stock is down

from $167.83 to $130.16 (with a low of $117.34 on May 18th) this

year. If JPM and other investment bank CEOs dont start questioning the Feds

rate rising rhetoric soon, their stocks will be much lower.

In my opinion, the Fed crashing the U.S. economy would be a

pitiful way to curb inflation (more below).

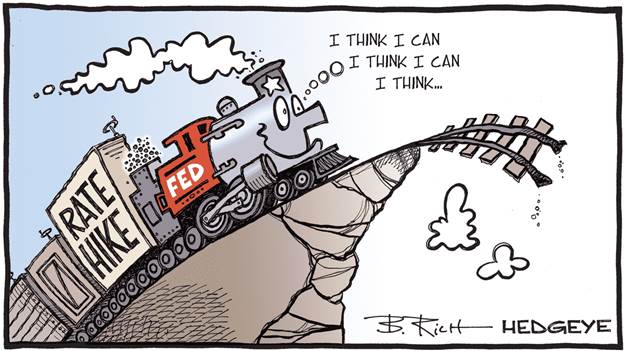

The Fed and U.S. Congress:

Watching the Fed and Congress is like watching a Ringling

Brothers Barnum & Bailey Circus clown show. The Fed does not seem to be concerned about a

recession this year or next, despite its increasing probability.

By raising rates and doing some form of Quantitative

Tightening (QT), I believe inflation (as measured by the CPI) will decline

to a range of 4 to 5% YoY by this November.

As the Fed continues its threats to raise rates by 50bps at

upcoming FOMC meetings (with no pause in sight as Fed Vice Chair Brainard said

this week) one has to wonder what these bureaucrats are thinking (or smoking)? Raising rates will NOT resolve supply

chain issues or the war in Ukraine, which are strongly contributing

to rising prices.

..................................

.......................

..

For the first time ever, Victor and the Curmudgeon agree with

Congresswoman Alexandria

Ocasio-Cortez (AOC) who called Congress a corrupt institution. She

stated, It's really wild to be a person who works in a corrupt institution,

which is what Congress is. She

added that it was very difficult to be surrounded by so much decay and moral

emptiness, that transcends (political) parties.

..................................

.......................

..

Analysis of CBOs Budget and Economic Outlook: 2022 to 2032:

The Congressional Budget Office (CBO) recently

released its US Budget Outlook for

the next 10 years, starting with the fiscal year starting October 1, 2022. While I must read it for business purposes,

its all terrible fiction like reading a bad novel. The report is 143 pages long enough to lull

anyone to sleep. Nonetheless, its

interesting to see what the CBOs official projections are.

First, in the next 10 years ending in 2032, the CBO does

not forecast any recessions! In

other words, the CBO believes the business cycle is dead. So, this alone

implies the CBO report is nothing more than a for show document.

For what its worth here are some interesting CBO statistical

forecasts:

- GDP

will compound annually at 4.04% (this is Gross not Real).

- Debt

held by the public as a percentage of GDP (see chart

below) goes from $97.9% to 109.6% in 10 years (the CBO excludes funds held

for the Social Security Old-Age and Survivors Insurance Trust Fund, which

is on track to be depleted by 2034 according to an official report.

At that time, the fund's reserves will become depleted and continuing

taxed income will be sufficient to pay 77% of scheduled benefits).

- U.S.

debt will increase by $11.7 trillion. (If a recession occurs expect

$6-10 trillion in deficits in that period alone).

- Interest

rates: 3-month T-Bills = 2.0%; 10-year T Notes from May of 2022 =3.2%.

- Domestic

Corporate Profits =+8.5%.

- Unemployment

rate = 4.2% [overall average from 2021-2031].

- Inflation:

CPI average =+2.3% from 2023. PCE average =+2.1%.

- GDP:

+ 2022 +3.1%; 2023 +2.2%; from 2024 +1.6 % average.

Charts of the Week:

1. From the CBO report:

Federal Debt Held by the Public, 1900 to 2052 as a % of GDP:

....

.

..

..

..

..

..

.

..

..

..

..

..

..

.

.

Inflation and Interest Rates

Percent

2. From Bianco

Research:

-->Average price of

unleaded gas in SF Bay Area is > $6.35/gallon!

3. From BoA Global

Research:

In an interesting divergence, investors have been buying

bonds and selling financial stocks (like JPM) for many consecutive weeks.

Inflows to Bonds Continue for 14th Straight Week!

BofA Private Client Debt Flows (4-week MA as % of AUM):

Source: BofA Global Investment Strategy

......

........

....

......

......

........

......

....

........

......

........

..

..

Outflows from Financial Stocks for 10th

Consecutive Week. Financial Flows Weekly

and 4-Week MA:

Source: BofA Global Investment Strategy

.

End Quotes:

When people are least sure (of what they are doing) they are

often most dogmatic.

John Kenneth Galbraith, The

Great Crash of 1929

There can be few fields of human endeavor in which history

counts for so little as in the world of finance.

― John Kenneth Galbraith, A Short History of Financial

Euphoria

.

..

.

Be well, stay healthy, try to find diversions to uplift your

spirits, wishing you peace of mind, and till next time

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2022 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).