A Most Difficult Year for Investors and

Traders May Get Worse

By the Curmudgeon with

Victor Sperandeo

Introduction:

This has been an incredibly difficult year for stock market

investors and traders. Both inflation

and disinflation/deflation assets have lost ground, while almost every asset

class declined. The only assets that rose were ETFs or futures contracts based

on the U.S. dollar, oil and the grains (agricultural

commodities). The price swings have been

very sharp and swift, which made trading very difficult and frustrating for

many professionals.

Money is continuing to leave every asset class and the exodus

is deepening as investors rush out of names like Apple Inc., according to Bank

of America.

According to Bloomberg,

2022 has seen an $11 trillion wipeout for global stocks, which is the worst

losing streak since the 2008 financial crisis. The MSCI ACWI has fallen for six

straight weeks, the Stoxx Europe 600 is down 6% since late March, while the

S&P 500 has dropped more than 13% since its March 29 recovery high.

Accelerating inflation, and the interest rate increases meant

to contain it, will make life harder for consumers. A severe COVID-19 lock-down

in China and Russia’s unprovoked invasion of Ukraine are worsening disruptions

in the flow of goods across borders, contributing to rising food and energy

prices, and threatening corporate profits.

Victor comments on recent Fed market spooking talk which

indicates the U.S. central bank wants to keep a lid on the equity markets. Perhaps a decline in stocks will cause a

‘reverse wealth effect” which the Fed believes may reduce inflation but might

cause a recession.

Roller Coaster Moves for

Stock Indexes with a Downward Bias:

·

After peaking on January 3,

2022 (the first trading day of the year) the S&P 500 sold off till January

27.

·

Then a rally started which

culminated in a double top at 4587 in early February.

·

That was followed by a

decline with a double bottom on March 8 and 14 at 4173.

·

From there, stocks embarked

on a strong rally. The S&P rose to 4631.6 on March 29, easily taking out

its 4587 recovery high set on February 9.

·

In late March, the S&P

500 rose more than 10% over 11 trading sessions, which caused hedge funds and

institutional traders to cover shorts and add to long positions.

·

From the March-April highs,

the S&P Composite has fallen 778 points, the DJIA 4264 points and the

NASDAQ 3538 points.

·

The recovery in the Dow Jones

Industrial Average lasted exactly 8 weeks, from Thursday, February 24 until

Thursday, April 21. The recovery in the weaker NASDAQ indexes lasted only 2

weeks plus 1 day, from March 14 until March 29.

·

The recovery in the S&P

took a middle duration, lasting 2 days less than 5 weeks, from February 24

until March 29.

·

Since their early January 2022

highs, all stock indexes have fallen to new lows for the year.

Here’s a one year chart of

the cash S&P 500 index:

Unprecedented Stock

Market Volatility:

In last

week’s column, we noted the never-before-seen reversal from the May 4th

pop till the May 5th drop, especially the flip in the

Advance/Decline ratio. But there’s more,

much more …….

On May 4, the S&P 500 shot up 154 points in 78

minutes to hit a high for the day four minutes before the close. It was the biggest stock market rally in two

years. Yet the very next day, the

S&P 500 tumbled -3.6% after a gap down open, with more than 95% of its

companies moving lower. Despite that May 5 heavy selling, the S&P futures

shot up 36 points in a single minute only to reverse again to the downside.

The NASDAQ 100 suffered one of its sharpest U-turns

ever. The tech benchmark plunged ~ -5%, wiping out its post-Fed meeting gains

of the previous day.

In a sign of just how volatile markets have been amid the

Fed’s tightening campaign, the rout was only the worst since the previous

Friday.

What’s Next for the

Markets?

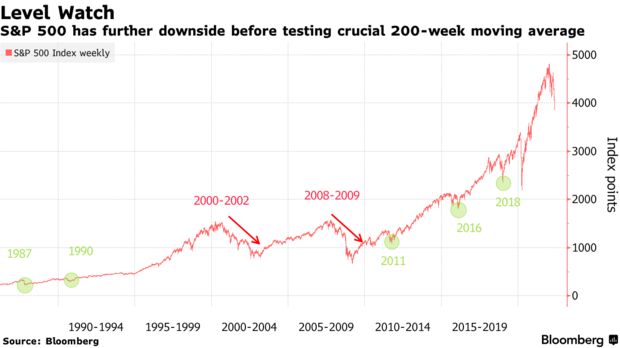

The S&P 500 is still about 14% above its 200-week moving

average, a level that’s previously been a floor during all major bear markets,

except for the tech bubble and the global financial crisis.

Goldman's equity strategy team cut its end-2022 target for the S&P 500 to

4300 from 4700, noting investors have been "mauled" since the January

3rd peak for the index. But

if there is a recession, it would push the S&P down to 3600, which would be

an 11% drop from current levels.

"Our economists assign a 35% probability of recession in

the next two years," strategist David Kostin wrote in a note.

"However, if by year-end the economy is poised to enter a recession in

2023, a combination of reduced EPS estimates and a wider yield gap would drive

a lower index level."

If the economy avoids recession, but real rates keep rising,

that will take the S&P down to 3800.

"If the Fed is forced to hike by more than our economists

expect and real rates rise to 1%, similar to the peak reached during the last

cycle in 2018, our macro model suggests that higher rates will more than offset

the lower yield gap," Kostin said. "In this scenario, the forward P/E

would equal 16x, the lowest level since 2020."

Meanwhile, tech stocks just suffered their biggest weekly

outflows of the year, according to Bank of America. Yet even after

crushing price drops, Valerie Gastaldy, a technical

analyst at Day By Day SAS, says the sector is at risk

of losing another 10% before finding a floor.

“I don’t think we have seen capitulation just yet,” said Dan

Boardman-Weston, chief executive of BRI Wealth Management. “This week has been pretty brutal, and investor sentiment, especially in the

technology area, is shot to pieces. We’re going to have a tricky few weeks and

months ahead.”

If a picture is worth a thousand words, feast your eyes on

this:

Consumer Confidence Drops 9.4% to 59.1:

U.S. consumer sentiment slumped to its lowest level in nearly

11 years in early May as worries about inflation persisted. The University of Michigan's preliminary consumer sentiment index tumbled 9.4% to

59.1 early this month, the lowest reading since August 2011. Economists polled

by Reuters had forecast the index dipping to 64. The sharp decline is in stark

contrast with the Conference Board's consumer confidence survey, whose index

remains well above the COVID-19 pandemic lows.

The deterioration in sentiment, which some economists said

pushed it into recessionary territory, was across all demographics, as well as

geographical and political affiliation. Gasoline prices and the stock market

have a heavy weighting in the survey.

Consumer confidence greatly influences consumer spending

which accounts for ~ 70% of U.S. GDP.

Hence, the May drop to 11-year lows does not augur well for U.S.

economic growth or corporate profits.

Economists expect demand to slow as people face high prices

and rising borrowing costs at the same time.

“The consumer is the main driver of the U.S. economy,” said

Kathy Bostjancic, chief U.S. financial economist at Oxford Economics. “So how

the consumer goes, so goes the economy.” Ms. Bostjancic said that as the Fed

continues to raise rates this year and into next year, “we see more

vulnerability for the consumer and risks of a consumer pullback rise.”

Victor’s Comments:

Apparently, the Fed wants to keep the equity markets down

with more talk about rate hikes and the increasing possibility of a recession.

On Thursday, after six consecutive down days, Federal Reserve

Board Chairman Powell reiterated that raising interest rates by half

percentage-point increments at the next two meetings is likely to be

appropriate. And San Francisco Fed President Mary Daly also reinforced

expectations for half-point hikes in June and July. You can watch a Bloomberg Day Break video

of that here.

Powell also noted that with a tight labor market pushing up

wages, avoiding a recession that often follows aggressive policy tightening

will be a challenge. “So, it (a soft

landing) will be challenging, it won’t be easy. No one here thinks that it will

be easy,” he said.

Those remarks likely

caused bonds to get sold in force and yields rising 9 bps on the 10-year T-

Notes.

When the Fed doesn’t

allow one up day in stocks and bonds without negative jawboning the markets we

are in for more losses.

Here’s more market spooking talk by a regional Federal

Reserve Bank President:

The Fed will have to raise interest rates more aggressively

and risk a recession if supply chain issues don't begin to ebb soon,

Minneapolis Fed President Neel Kashkari

said on Friday, as he reiterated that policymakers are keenly watching how far

rates will have to rise above the neutral level.

"We know we have to bring inflation back down to 2%. If

the job market softened a little bit, that's not much of a trade-off,"

Kashkari said during an event at the University of Minnesota in Minneapolis.

"The challenge is going to be if the supply chain issues

don't help us, if they don't unwind a little bit on their own ... and we have

to use aggressive monetary policy to bring inflation back down then that could

lead to a higher unemployment rate, that could lead to a recession," he

said.

“Every time the Fed has spoken, markets have taken it fairly

negatively,” said Saira Malik, chief investment officer at Nuveen, a global

investment manager. “Investors are concerned that with these multiple rate

hikes, the Fed is going to cause a recession rather than a soft landing.”

Victor’s Conclusions:

A recession hits the economy in so many negative ways it’s

hard to understand Fed Chair Powell and his gang talking like they have

recently. Inflation will come down with

a recession, but will Americans be happy and better off when unemployment

soars? Will that leave more people homeless? And will the budget deficit and

national debt increase to unsustainable levels?

We’ll see before the end of this year!

If there is a recession, Inflation will surely increase as

the federal government will return to stimulating the economy to make it look

good for the 2024 elections.

In conclusion:

·

This looks like a no-win

scenario with a soft landing highly improbable.

·

Being a stock market

bull today is like playing Russian Roulette with a semi auto pistol.

Closing Quote:

“Sometimes I wonder whether the world is being run by smart

people who are putting us on or by imbeciles who really mean it.”

Lawrence J. Peter, The Peter Principle

Be well, try to find diversions to uplift your spirits,

wishing you peace of mind, and till next time…………………………………………………………...

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2022 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).