Bear

Market, Global Recession, and the Fed’s Dilemma

By Victor

Sperandeo with the Curmudgeon

Introduction:

After President Biden signed an executive order banning

Russian oil imports (~10% of U.S. oil consumption) on March 8th

several important stock market lows were broken with volume increasing on

consecutive days. That confirmed a bear

market in U.S. equities, which I

thought would not occur this year.

Bear Market Analysis:

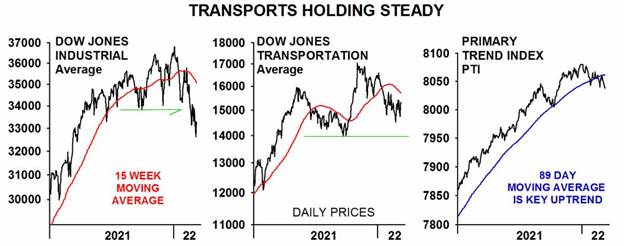

The Dow Transports (closed at 15,232.97 on Friday

March 11th) are still holding above their most recent major low (Sept 22, 2021,

of 14,000.78). Therefore, a Dow

Theory bear market signal has yet to be triggered, according to the Aden

sisters. Chart courtesy of the Aden Forecast:

I beg to differ. The Dow Theory does not have to confirm a

bear market on the SAME DAY BUT IN STAGES. The Dow Transports broke their

important December 1, 2021, lows in January 2022, which was unconfirmed by the

Dow Industrials. This past Friday March 11th, the Industrials closed

at 32,944.19, which was below their February 23, 2022, low of 33,131.76. The IMPORTANT fact is that the S&P, NDX

100, Wilshire 5000, and Nasdaq composite ALL made lows on March 8, 2022 (based

on critical fundamental changes in the world) is the significant feature

confirming my bear market call.

The fact that the Dow Transports are in a “minor” rally is

not significant at this time. The Russell 2000 did not

make a new low either, but that also means nothing as that index has already

established its downtrend.

The reading of Dow’s Theory is more an art of subjective

judgement than objective perfection. I suggest reading Robert Rhea’s letters

-every 10 days from 1932-to-1939 is the best education on Dow Theory.

Fundamentally Induced Bear Markets Cause Recessions:

My historical analysis of bear markets concludes that those

which are “fundamentally caused” result in a recession. The U.S.

ban on Russian oil is the intermediate cause that changed the

fundamentals. World oil is priced at the

margin so the U.S. sanctions on Russian

oil (see cartoons below) have and will raise prices for global oil as there

is less supply. Yes, Europe will continue to import Russian oil, but now the

price will be higher. That leaves less

money for consumer discretionary spending.

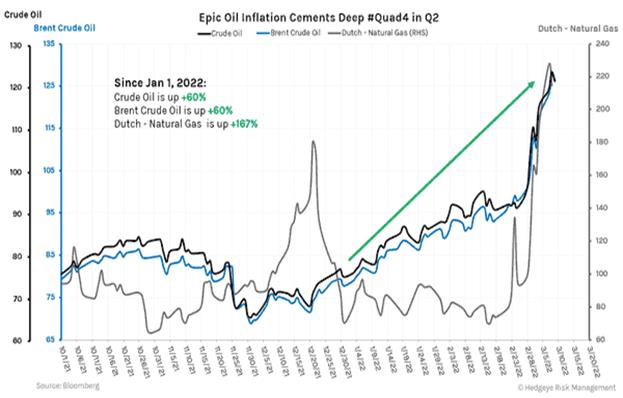

Energy inflation, as depicted in the chart below, will cause

price increases of most goods and services.

What’s Next for the Global Economy:

The CPI will increase into the teens, driven mainly by

increasing energy prices that will continue to rise. That leaves the consumer with much less discretionary

spending for other goods and services.

The gap the U.S. must fill by buying oil on the open market

will lift oil prices, thus increasing Russia reserves value and net worth. Russia can also borrow against those

increased reserves value and sell oil at a higher price in the future to repay

the loans. They can make Europe buy oil in Rubles as Europe has no

alternatives. China and Russia win- consumers lose!

China will buy Russian oil at a discount. They will sell part

of their $1.1 Trillion of U.S. Treasury’s (with the dollar at recent highs) and

paying only 1.5-2% interest. Most of the

proceeds might be used to buy Russian Rubles (now at their lows) paying over

20%.

McDonald’s suspended 850 franchises in Russia last week. If

you are a dictator, what would you do as Russian people run those

franchises? NATIONALIZE THEM!

The same is true with other American corporations that want

to stick it to Putin, but may hurt their shareholders? I believe such polices

are like the shutdown of businesses by U.S. state governors and health officers

during the Covid-19 pandemic which I previously wrote were like committing

economic suicide! Please refer to Perspective on U.S. Economy

and the Coronavirus – Suicide is NOT Painless!

Here are two cartoons which offer a light look at Russia

sanctions:

Fed Meeting Next Week:

On Thursday March 17, 2022, the Fed will BEGIN to “FIGHT

INFLATION” by raising the Fed Funds rate by 25 bps. To every professional this is a joke! The widely expected small rate rise is hardly

a mystery as the Fed pre-announced it several weeks ago. What Fed Chair Powell

will say about future rate increases will be what every savvy trader will be

watching.

“We know that high inflation exacts a toll, particularly for

those less able to meet the higher costs of essentials like food, housing, and

transportation,” Powell said in prepared testimony that was made public Monday.

Duh? We all know the problems inflation causes.

The key question is what will the Fed do about it?

It’s obvious to me that the goal of the Fed is to retain the

power they have by securing election victories of Senators that might confirm

the appointments of Fed governors [1.]. That is what they care about most! The people

are mere pawns.

Note 1. The Board of

Governors is the governing body of the Federal

Reserve System. It is run by seven members, or "Fed governors,"

who are nominated by the President of the United States and confirmed in their

positions by the U.S. Senate.

Mohamed El-Erian on the

Fed:

During an interview on Face the Nation, today (March 13,

2022), chief economic adviser to Allianz, Mohamed

El-Erian discussed “the Fed’s ongoing train of policy mistakes regarding

inflation.”

When asked what the Fed might do next, El-Erian replied: “Well, he (Fed Chair Jerome Powell) doesn't

have an easy decision, as you said. Inflation is high and will go higher

because of what's happening in Ukraine. And basically, he's got to make a

choice, hit the brakes, regain credibility, but risk a recession or tap the

brakes, and we have an inflation problem going into next year. We are here because the Fed is very late

and has no good policy options available anymore.”

Asked where does the responsibility for this lie exactly?

EL-ERIAN: “It lies in the circumstances, it lies in the Fed being

late, and mischaracterizing inflation. Until the end of November 2021, they

were calling it transitory, but also to be fair to the administration, there-

there will be a Putin inflation component. I estimate that at 7.9%, we will

probably get very close or above 10%

inflation before we come down. And

that difference will be all because of the disruption that Putin's war implies

for commodity prices, supply chains and shipments.”

Double digit inflation. When do you think we will see that?

EL-ERIAN: Yeah, if it happens, it will happen in the summer and people will feel it, the worst

thing for us would be not only do we feel the higher inflation, but we also

feel income losses. That's why it's critical to avoid a recession. We can't

avoid stagflation–lower growth, higher prices, but we certainly can avoid a

recession and we can bounce back quickly (but he never says how?).

Will the Fed Monetize

More U.S. Debt?

This year the CBO hasn’t yet published a budget report.

However, private forecasts say the U.S. federal government will spend $6.7 -$7

trillion which will create a $2.8 - $3 trillion budget deficit? My guess is that the $3 trillion will be

monetized by the Fed and banks, resulting in another huge increase in the money

supply and inflation.

Victor’s Conclusions:

Important fact: EVERYTHING we do NEEDS energy. Any

restriction on fossil fuels due to calls of climate change will raise

prices. Wind, solar, and batteries are a

fraction of world energy usage.

The way to attack Russia is not to decrease the supply of oil

and gas, but to increase it! That would lower prices and make Putin weaker.

Higher energy prices make him stronger.

The left and globalist elite are attempting to overturn

American capitalism. Until the people push back (like the Canadian truckers

protesting pandemic restrictions), the U.S. and rest of the world will continue

to lose its liberty and the abundance it creates.

That will decrease everyone’s standard of living. There is a

constant war on liberty, which creates wealth.

The endgame appears to be some form of Marxism and Fascism. As Klaus Schwab, head of the World Economic

Forum put it “You will own nothing and be happy.” Do you find that hard to believe?

We highly recommend this YouTube

video clip to learn more….

End Quote:

“The individual is handicapped by coming face-to-face with a

conspiracy so monstrous he cannot believe it exists. The American mind simply

has not come to a realization of the evil which has

been introduced into our midst. It rejects even the assumption that human

creatures could espouse a philosophy which must ultimately destroy all that is

good and decent.

…by J Edgar

Hoover FBI Director for almost 40

years

……………………………………………………………………………………….

Stay healthy, enjoy life, success, good luck, and best

wishes. Till next time....

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2022 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).