To Restore Credibility, the Fed Must Explain

Epic Inflation Misread

By the

Curmudgeon

Introduction:

More

quick takes this week. Enjoy and let us

know what you think!

Tweet by Eric Balchunas, Sr ETF Analyst at Bloomberg:

What selloff?

Vanguard ETFs have taken in $14B this year, which is 72% of the net total

(BlackRock is -$11B, SPDR -$1B) with over 50 ETFs seeing inflows. Chart shows VTI (Vanguard Total Stock Market

ETF) is -8.5% YTD but had +$2.258B in inflows!

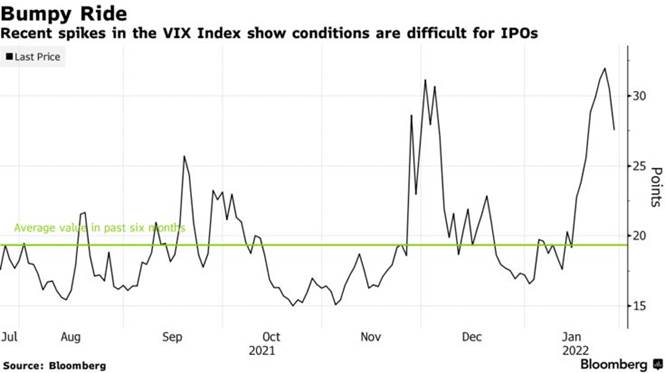

Bloomberg - IPOs Run Out of Steam as Selloff Rattles

Global Equity Markets: Deal volume is down by 60% versus a

record start in 2021

Initial public offerings have

gotten off to a rough start of the year.

Globally, $26.7 billion worth of IPOs have priced, marking a 60% drop

from the same period a year earlier. Now, pulled deals are piling up under

pressure from roiling markets.

The prospect of interest rate

hikes combined with slowing economic growth and geopolitical tensions have set

global equities on course for their worst month since the pandemic started.

Frothier technology and growth shares, including recent IPOs, have been

particularly vulnerable to the selloff as investors flock to cheaper stocks.

“It’s a really tough

environment for new listings right now,” said Andreas Bernstorff, head of

European equity capital markets at BNP Paribas SA. “Many investors are

grappling with their portfolios turning negative and the rotation into value is

depressing appetite for the growth stocks that dominated the IPO market last

year.”

The CBOE Volatility Index (the

VIX) has surged 60% this month, a red flag for new share sales.

Falling investor demand and

rocky markets have caused the value of scrapped IPOs to almost double worldwide

from a year ago, hitting $6.2 billion so far. Another recent casualty was South

Korea’s Hyundai Engineering Co., which pulled its $1 billion listing on Friday

after failing to draw demand at the valuation it wanted.

Bloomberg - Bloated Central Bank Balance Sheets Are

the Real Risk:

What would you pay for

fixed-income assets now if you knew that the biggest holders would become

forced sellers later?

Some central banks say that

rate hikes are coming, but their extraordinary reluctance to deal with actual

inflation means it will become entrenched. Not only will policy makers have to

raise rates more than they envision, but they will have to cut the size of

their massive balance-sheet assets, too. Don’t expect that the process will be

anything other than awful for risky assets of all stripes.

Short rates will of course

need to rise. That is problem enough for markets, but the bigger problem comes

from the trillions of dollars of assets that central banks have accumulated on

their balance sheets. Taken together, the Fed, ECB, Bank of Japan, Bank of England,

and Swiss National Bank have some $27 trillion of assets. In 2007, before the

global financial crisis, the combined total was a little more than $4 trillion.

Central bank assets will stop growing this year, undermining a major source of

support for all types of bonds. But if inflation remains persistently high,

central banks won’t simply be able to let their assets roll off as they mature,

as most assume. They will have to start selling them. That is the big

problem.

Michael Strain, director of

economic policy studies, American Enterprise Institute:

“Is the Fed worried about the impact of quantitative tightening on the budget

deficit? The Fed has become a major player in the Treasury

market, and if the Fed is reducing its balance sheet, then Treasury will need

to find new buyers for its debt. Is the Fed worried about the level of investor

demand for Treasuries, and will that factor into its decisions?”

Chris Whalen, chair at Whalen Global Advisors asks:

“Why do Fed officials think that they can shrink their portfolio without

triggering another liquidity crisis?”

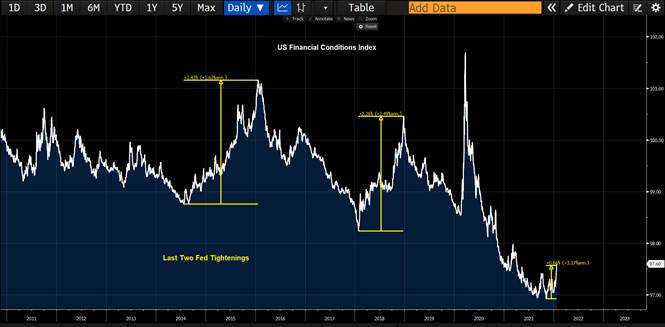

Tweet by Julian Brigden of Macro Intelligence:

Fed rate hikes work via bonds,

credit, FX, and equity markets to tighten financial conditions and slow growth.

Bulls need to understand that if markets don't respond or rally back to highs =

NO tightening. In the last two cycles FC have tightened over 2%. We haven't

even started (tightening) yet!

The Fed Is Playing with Fire, by Stephen S. Roach:

By now, it is passé to warn

that the Federal Reserve is “behind the curve” in fighting inflation. In fact, the

Fed is so far behind that it can’t even see the curve and may have to slam

on the policy brakes to regain control before it is too late. The problem, of course, is inflation.

The inflation rate as measured

by the Consumer Price Index reached 7% in December 2021. With the nominal

federal funds rate effectively at zero, that translates into a real funds rate

(the preferred metric for assessing the efficacy of monetary policy) of

-7%. That is a record low.

Only twice before in modern

history, in early 1975 and again in mid-1980, did the Fed allow the real funds

rate to plunge to -5%. Those two instances bookended the Great Inflation, when,

over a five-year-plus period, the CPI rose at an 8.6% average annual rate.

Today’s Fed is playing with

fire. The -3.1% real federal funds rate of the current

über-accommodation is more than double the -1.4% average of those three

earlier periods. And yet today’s inflation problem is far more serious, with

CPI increases likely to average 5% from March 2021 through December 2022,

compared with the 2.1% average that prevailed under the earlier regimes of

negative real funds rates.

All this underscores what could

well be the riskiest policy bet the Fed has ever made. It has injected record

stimulus into the economy during a period when inflation is running at well

over twice the pace it did during its three previous experiments with negative

real funds rates.

The Fed’s dot plots, not only

for this year but also for 2023 and 2024, don’t do justice to the extent of

monetary tightening that most likely will be required as the Fed scrambles to

bring inflation back under control. In the meantime, financial markets are

in for a very rude awakening.

Mohammed El-Erian’s advice to the Fed (who did not

take it):

More bluntly, the Fed needs

immediately to stop its asset-purchase program, guide markets towards expecting

three and possibly more interest rises this year and bring forward to March the

announcement of plans to reduce its balance sheet. It also needs to explain how

it has managed to get its inflation call so wrong and why it is so late in

reacting properly. Without that, it will struggle to regain the policy

narrative and restore its credibility.

To make all this credible, Fed

officials must also come clean on why they so badly misread inflation for so long

(as noted before, I believe this will go down in history as one of the central

bank’s worst inflation calls) and explain how they are now better at

incorporating a broader set of bottom-up indicators into its macro modelling

and forecasts. This is what I believe the Fed should do. I worry that it won’t,

however. (THEY DIDN’T!)

Judged in terms of risk

scenarios, the threat to society is one of a persistently slow Fed being

forced later this year into an even bigger bunching of contractionary monetary

measures. The result would be otherwise avoidable harm to livelihoods, greater

financial instability, a higher risk of domestic stagflation and a greater

threat to global economic and financial wellbeing.

A market crash will depend on which bit of the

equation investors got wrong, by Merryn Somerset Webb:

Proper bubbles

involve people convincing themselves that a high-profit, low-inflation

environment will be permanent. Such a

bubble can only develop if investors do not assume cyclical normality but

instead manage to convince themselves (against all historical experience) that

it is possible for a high-profit, low-inflation environment to be permanent. This

always ends badly. Think 1901, 1921, 1929, 1966, 2000, 2007, briefly 2020

and possibly right now. The only question is how fast it ends badly.

Image

Credit: Financial Times (Miss Peach)

The Federal Reserve, under

pressure from the inflation itself and possibly also from polls suggesting that

said inflation is not helping President Joe Biden, is now changing tune (no

more “transitory”). Nick Chatters, investment manager at Aegon Asset Management

said “there is a reasonable probability of seven rate hikes this

year, one at each meeting. That could cause investors to fall off chairs.”

Illusion-shattering stuff.

It also leaves investors with little choice: if the Fed holds this line, they

should surely not buy dips but sell rallies — at least when it comes to

their most expensive holdings.

Robert Prechter’s

Elliott Wave Theorist--February 2022:

The stock market is

spectacularly overvalued. Stock ownership is the broadest in the history of

humanity, both in the U.S. and abroad. Research is derided, while passive

investing is lauded as the road to riches: Just buy funds comprising indexes

and ignore the relative health of component companies.

A hundred years ago there were

only two stock indexes, one for every 1000 stocks. Now there are 70,000 indexes

for every 1000 stocks.

In 2009, there was one crypto

coin. Now there are thousands of them, mostly just clones of the original.

Finance has intoxicated the

public. The number of types of vehicles with which to speculate is

unprecedented. The number of derivatives is unprecedented, and the aggregate

value of those derivatives is unprecedented.

The complexity of the

investment marketplace is unprecedented. The number of investment manias in the

past quarter century is unprecedented.

Credit

spreads are the lowest in history, and in some cases negative. European junk

bonds recently had lower yields than U.S. Treasuries.

Similar

conditions have appeared in a few rare instances in history and — although past

episodes have been far smaller in scope than at present — they have always led

to a substantial crisis in the financial system.

…………………………………………………………………………………………………………

Closing Cartoon:

Stay healthy, enjoy life, success, good luck, and

best wishes. Till next time....

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2022 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).