Markets

Collapse Before Staging Historic Rebound

By the

Curmudgeon

Market Overview:

U.S. equities staged a massive

comeback rally today after reaching rarely seen oversold levels in early

trading. The Dow Jones Industrials (DJI) erased a 1,000+ point decline to

close higher on the day for the first time ever.

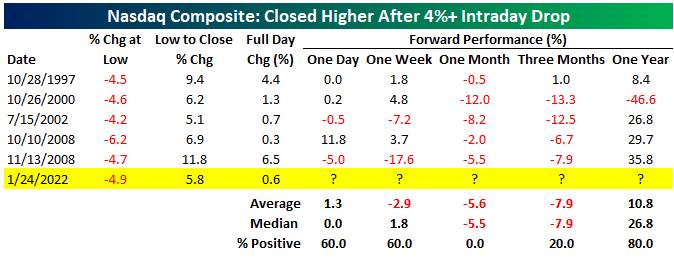

Not to be outdone, the Nasdaq erased a 4%+ intraday decline to

close higher on the day. That was just

the sixth time (since 1988 when open/high/low/close data begins) that the

Nasdaq has done that.

Below is a table showing

the prior occurrences along with the NASDAQ index's performance in the days and

weeks that followed:

Last week's selling pressure caused 42% of Nasdaq stocks to decline 50% or more

from their 52-week highs. Half the stocks that make up the Nasdaq 100, an index

closely aligned with the largest technology companies, have dropped more than

20 percent from their 52-week highs and so are in bear market territory.

Also, more than a quarter

of Nasdaq stocks are now at 52-week lows. Among sectors, Healthcare stocks have

been hit even harder than Technology shares.

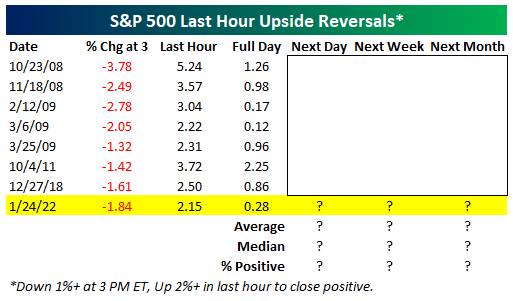

At 3 PM ET today, the S&P 500 was down 1.84%, but the

index rallied 2.15% in the final hour of trading to close higher by 0.28% on

the day. Since 1983 there have only been

seven other days that have seen similar 2%+ last hour moves after a 1%+ drop as

of 3 PM ET.

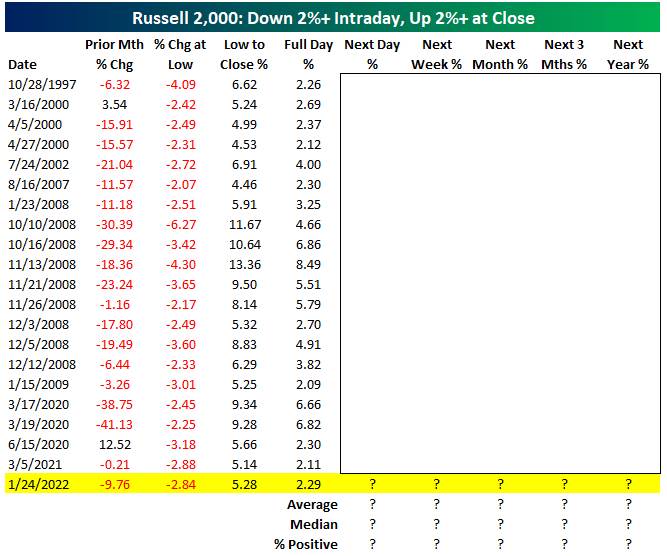

The small-cap Russell 2,000, which has been the

weakest index for months, out-gained all the major U.S. stock indices today

with a 2.29% move higher. At its low for

the day, the Russell was down only 2.84%.

This was just the 21st time that the Russell has erased a 2%+ intraday

decline to close higher by more than 2% on the day, according to Bespoke.

Options activity hit the highest level ever on Friday, with more than 62

million contracts changing hands, according to CBOE Global Markets data, and

volumes remained elevated on Monday.

Thats creating this very

high intraday volatility that were seeing, said Peter van Dooijeweert, a

managing director at Man Solutions, a unit of investment firm Man Group of

London. Weve seen plenty of buy the

dip type activity, Mr. van Dooijeweert said. But for the most part, the buy

the dip crowd is starting to get overrun by the sell the rally crowd.

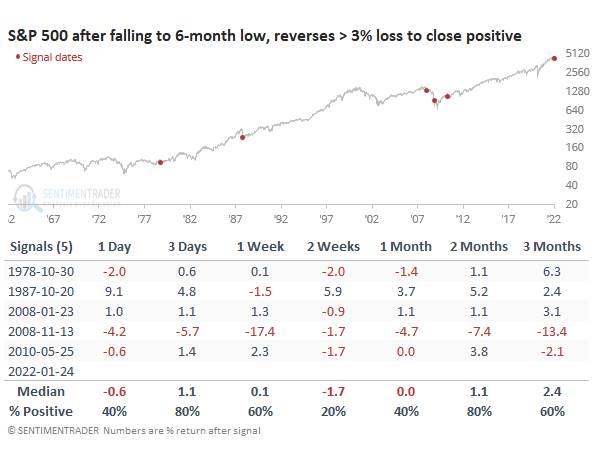

In a note to subscribers,

Jason Goepfert of Sentimentrader wrote:

A historic reversal:

Stocks enjoyed one of the best reversals in history on Monday, especially the

Nasdaq. But the S&P 500, the most benchmarked index in the world, enjoyed a

notable reversal of its own. The S&P was off by more than 3% and traded to

a 6-month low, before reversing all of its losses.

We've highlighted the

danger of relying on single-day price patterns many times, and this is no

different. The sample size is tiny, but all equivalent reversals saw losses

either 1 or 2 weeks later.

Curmudgeon Comment:

Victor and I have seen

these huge, bungee jump rebounds in the last 60 to 90 minutes of trading many

times before. They almost always come when the market averages are all down

intra-day by 10% or more.

The most notable upside

reversal was on October 4, 2011, when U.S. stocks closed significantly higher,

despite the large losses going into the last half hour of trading. At the close

of trading that day, investors ignored the S&P 500's early slide into bear

territory (-20% decline) and furiously bought back into stocks.

Heres the October 4, 2011,

daily chart of the S&P 500:

That day, the NYSE reported very large last hour volume in the three U.S. stock

index ETFs: SPY, QQQ, and IWM.

There is similar anecdotal

evidence of reversal days in 2015 and 2019 such that there is a mysterious and

invisible last hour buyer that supports the market to prevent a serious

decline.

Conclusions:

Personally, I believe the

invisible hand belongs to global investment banks, who are encouraged to buy

stock index ETFs and stock index futures by the Plunge Protection Team or PPT

(officially known as The

President's Working Group on Financial Markets). Its because the U.S. government and the Fed

want to avoid a bear market for fear it would cause a recession.

Victor explained how markets are manipulated to the extreme of history in

this post.

End Quote:

The return to normalization

that we will see this year will include more moderate growth and higher

interest rates. Thats a difficult environment for large-cap tech. Ryan

Jacob, the portfolio manager of the Jacob

Internet Fund.

.

Stay healthy, enjoy life, success, good luck, and best

wishes. Till next time.

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2022 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).