Misleading

U.S Economic Data Obscures a Struggling Recovery

by The Curmudgeon

Executive

Summary:

We have three

crucial points to make in this very important article. All are related to what

we believe is flawed reporting of U.S. government economic data:

1. The U.S. Bureau of Economic Analysis (BEA)

initial GDP estimates since the September 2008 financial crash have

consistently been overstated. Later,

they were significantly revised downward, but the mainstream news media hasn't

paid much attention to that, even though the economy was shown to be weaker

than first reported.

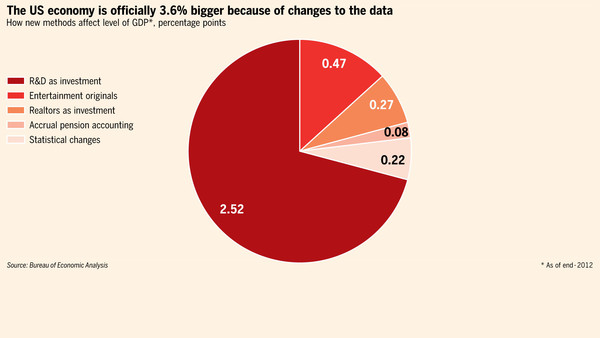

2. The BEAs comprehensive (or benchmark)

revision of U.S. national income and product accounts (NIPAs) series - from

1929 through the first quarter of 2013 - seem to be based on faulty assumptions

(described below). They make the recession that "ended" in June 2009

less severe and made the economy's 2012 output 3.6% larger or $559.8B greater

than previously reported (Source: Financial Times).

3. None of the key government released statistics

(e.g. CPI, GDP and unemployment numbers) can be trusted in the first

place. That's because the numbers are

biased and often-manipulated, especially understating inflation, which makes

real GDP better than it really is.

1. Markedly Different Pre and Post-Crash Revisions to GDP:

The BEA's

initial estimates of GDP have been mostly overstated since the summer of

2008. That is the exact opposite of what

occurred prior to that time! Here's the

background:

BEA reports

initial quarterly GDP estimates (known as the "advanced estimate"),

followed by two or three subsequent revisions as more thorough analysis of the

data takes place. The first estimates come out approximately one month after

the end of a particular quarter. The second and third revisions are made

several months thereafter. And now the

analysis:

From 2002 to

mid-summer 2008, the BEA revised initial GDP estimates a total of 25 times, 80%

(or 20 revisions) was higher than their initial estimate. As one might expect,

the average amplitude of the upward and downward revisions were equal at .5%.

In other words, the economy turned out to be stronger than expected, probably

due to the unsustainable real estate boom that went bust big time.

However, since

mid-2008 we have the opposite situation. 67% of the revisions (12 of 18) have

been downward, and those negative adjustments have been, on average, 50% larger

than the upward revisions (.75% vs. .5%).

Since mid-2008, revisions have subtracted a total of 6 % points of

growth off the initial estimates. This works out to an average of 1.3 % of

growth per year that was expected, but never actually happened.

This strongly

implies the post-crash "recovery" has been much weaker than initially

reported. Do you think that's just a

co-incidence or is there politic meddling involved?

Note: The chart above

depicts GDP revisions before and after the Sept 2008 financial crash--courtesy

of Peter Schiff

Peter Schiff

wrote, "The pattern of early optimism may stem from the lack of

understanding in Washington about how monetary stimulus actually retards

economic growth. But there can be little

doubt that these overly optimistic projections have worked wonders on the

public relations front. The big Wall Street firms and the talking heads on

financial TV set the tone by jumping on the new releases and ignoring the

revisions to prior releases. The lack of critical thinking and economic

understanding also play a role."

Indeed, the

main stream media, the public and the politicians seem to pay much more

attention to the initial estimate and mostly ignore the revisions. This creates a misleading situation where the

initial GDP estimates are both the most important and the least reliable.

As an example,

consider the July 31, 2013 GDP announcement.

The media cheered the better than expected 1.7% growth in 2nd quarter

GDP, but either ignored or downplayed the very significant 0.7% downward

revision to 1st quarter GDP - from 1.8% to 1.1%. It's actually worse, because the initial

estimate for 1st quarter GDP (released in April) was 2.5%. Yet the media celebrated the

"good" news of higher than expected 1st quarter GDP, while mostly

ignoring the huge downward revisions to the prior quarter.

2. New benchmark revisions make the last

recession milder and the economic "recovery" stronger than previously

thought. Corporate

"investment" takes on new meaning!

Revisions of

this scale occur only once every five years when the BEA not only updates its

data, but revises its methods as well and applies the new techniques all the

way back to 1929. The full report- COMPREHENSIVE

REVISION OF THE NATIONAL INCOME AND PRODUCT ACCOUNTS: 1929 THROUGH FIRST

QUARTER 2013 is available at: http://www.bea.gov/newsreleases/national/gdp/gdpnewsrelease.htm.

Articles on the

so called "improvements" incorporated in the revised estimates are

available at BEA’s website at www.bea.gov/gdp-revisions.

The key points

are as follows:

a] Great Recession

now milder by 0.3%: For the period of

contraction from the fourth quarter of 2007 to the second quarter of 2009, real

GDP decreased at an average annual rate of 2.9%. In the previously published estimates, it

decreased 3.2%.

b] Post

recession ("recovery") economy is 0.3% stronger: For 2009–2012, the average annual growth rate

of real GDP was 2.4% or 0.3% higher than in the previously published estimates. The percent change in real GDP was revised up

0.1% for 2010 (2.5%), unrevised for 2011 (1.8%), and up 0.6% for 2012 (2.8%).

c] New

definition of corporate investment: The biggest change in this benchmark

revision is an expanded definition of investment, to include intangible assets

such as research and development (R&D).

By itself that added 2.5 percentage points to the size of the economy,

according to the Financial Times.

“We’re all

about being relevant and that is what this comprehensive revision is about as

well,” Steve Landefeld, the director of the BEA, told

the Financial Times. The goal of the revisions is to better reflect the

changing pattern of the economy.

"Previously, companies invested in machinery. Now they are more

likely to invest in intangible assets such as research," he said.

Curmudgeon’s

Rebuttal: Who believes that? Companies don't invest

in machinery, because they've outsourced/off-shored manufacturing. And research spending, as a percent of

corporate revenues, has been declining for years!

Counting book,

movie and music copyrights as "investment" added another 0.5% to the

size of the economy. Transaction costs when somebody buys a house – such as the

estate agent’s commission – were also moved to investment and added another

0.3% to GDP.

3. The U.S. government is "fudging" the

economic numbers it releases.

Mr. Schiff goes

on to state that even if one focuses on the final GDP estimates, you still

aren't getting the truth. He says,

"All GDP estimates are based on imperfect inflation measurement tools,

which I believe are designed to under report inflation and over report growth.

The most recent GDP projection used an annualized .71% inflation deflator to

arrive at 1.7% growth for 2Q-2013."

Does anyone living in the U.S. believe that inflation is running at

<1% per year?

Note: Chart courtesy of ShadowStats

Mostly as a

result of sharply understated inflation, GDP has been much weaker than the BEA

reports, according to ShadowStats. This is clearly shown in the chart below:

ShadowStats

strongly asserts that unemployment is much, much higher than the government

reports as show in numerous charts on their website.

Their

seasonally-adjusted SGS Alternate Unemployment Rate reflects current

unemployment reporting methodology adjusted for SGS-estimated long-term

discouraged workers, who were defined out of official existence in 1994. That

estimate is added to the BLS estimate of U-6 unemployment, which includes

short-term discouraged workers. The U-6

unemployment rate is the Bureau of Labor Statistics’ (BLS) broadest

unemployment measure, including short-term discouraged and other marginally-attached

workers as well as those forced to work part-time because they cannot find

full-time employment.

Note that the ShadowStat's broad based Alternate Unemployment rate

CONTINUES to rise since the recession "ended" in June 2009, while the

BLS U-6 and U-3 (headline unemployment rate) continue to fall. The CURMUDGEON wonders: who's kidding whom?

Till next time.....................

The Curmudgeon

ajwdct@sbumail.com

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.