Timid Incremental Fed Rate Hikes Won’t Tame

Growing Inflation Monster

By the

Curmudgeon

Introduction:

More news and views you might’ve missed this week. Please let us know what you think.

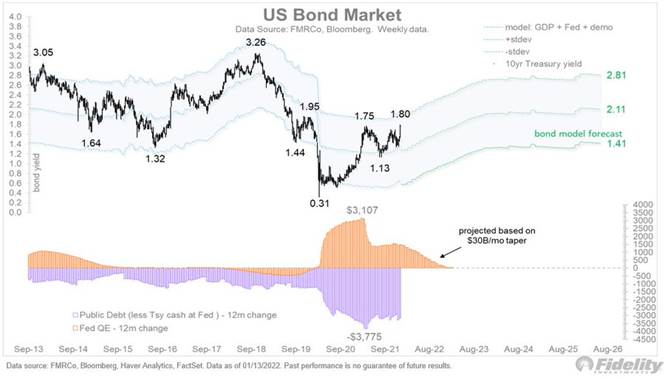

Neutral as the New Restrictive, by Jurrien Timmer, Director

of Global Macro at Fidelity:

Is neutral the new restrictive? The economy has become so

levered to low rates, perhaps a return to 2% is all that the Fed can do or

needs to do. Look at this chart, and I'll explain. (THREAD) /1

In the past, the monetary policy pendulum would swing all the way from 2-3%

below R-Star to 2-3% above. That was the full Fed cycle. But in 2018, it only

made it back to neutral, before the markets started to seize up. /2

So maybe neutral is the new-restrictive. Indeed, my bond

model above suggests as much, with 2% as the upper bound of a rising range. /3

And with the TIPS break-even stable at the 2-2.5% area, a

return to 2% on the 10-year will bring it almost back in line with where

nominals have traded in the past vis-à-vis inflation expectations. /4

So perhaps the bond market will find its footing soon. With

the 10-year now yielding 2.11% when hedged back into Euros and 1.50% when

hedged back into Yen, the non-US institutional bid is likely to get stronger

from here. /5

Perhaps German insurance companies and Japanese pension funds

will pick up some of the slack when the Fed stops buying US Treasuries. /END

Debt Bubble- What Can Central Banks Do Today?

This is the sixth chapter of the documentary. It studies what

the Central Banks can do today to solve our debt problems and looks at what

happened the last time it was attempted, which led to a crash in the

markets.

Highly recommended YouTube video is here.

Henry Kaufman, 1970s Wall Street Dr. Doom, Blasts Powell on

Inflation:

Henry Kaufman is one of the rare Wall Street veterans who can

authoritatively draw parallels between the inflation scare of the 1970s and

today’s alarming run-up in prices. And he has zero confidence Fed Chair Jerome Powell is

ready for the battle it now faces.

“I don’t think this Federal Reserve and this leadership has

the stamina to act decisively. They’ll act incrementally,” Kaufman, 94, said in

a phone interview. “In order to turn the market around to a more

non-inflationary attitude, you have to shock the market. You can’t raise

interest rates bit-by-bit.”

A more serious pledge to tame inflation would require the Fed going much

further, Kaufman said. Volcker’s 1979 decision to restrict the supply of

money drove short-term rates to excruciating levels but eventually, also

crushed inflation. Prices, rising at an annual 14.8% in March 1980, were

ticking up at just 2.5% a year by July 1983. Volcker emerged a hero.

If he were advising Powell, Kaufman said he’d urge the Fed

chair to be “draconian,” starting with an immediate 50-basis point increase in

short-term rates and explicitly signaling more to come. Plus, the central bank

would have to commit in writing to doing whatever is necessary to stop prices

from spiraling higher.

“The longer the Fed takes to tackle a high rate of inflation,

the more inflationary psychology is embedded in the private sector -- and the

more it will have to shock the system,” Kaufman said.

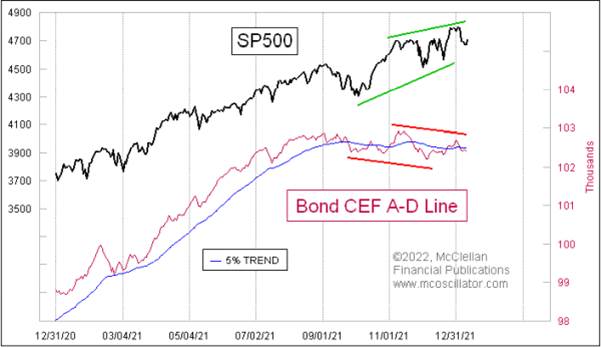

Tom McClellan - Bond CEF A-D Line Showing

Liquidity Problems:

Upon examination of the actual Advance/Decline line data, we

find that bond CEFs (Closed End Funds) give a good message about the health of

the liquidity stream that affects the entire stock market. So, if anything, they are making the

composite A-D data better by virtue of their inclusion in it. This week’s chart shows a big bearish

divergence versus the S&P 500 price trend.

The message of the current divergence shown above is that liquidity

has suddenly become a problem, and it is affecting the more

liquidity-sensitive issues first. That

can be a prelude to that same illiquidity coming around and biting the big cap

stocks that drive the major averages.

Most who hear this message about the current divergence

between the SP500 and the Bond CEF A-D Line won’t believe in it, because these

bond CEFs are interest rate sensitive contaminants to the proper A-D data. This is fine with me that they don’t believe

in it.

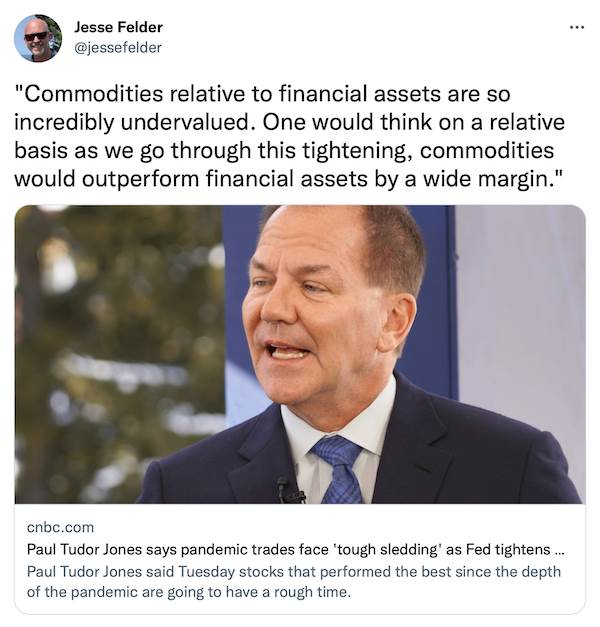

Billionaire Hedge Fund Manager Paul Tudor Jones

says Fed Must Catch-Up:

Jones (often referred to as “Tudor”), who won fame for

predicting the stock-market crash in October 1987, has been a sharp critic

of Powell and the Fed, previously complaining that policy makers were

“inflation creators not inflation fighters.”

Powell is “going to play catch-up. And he’s got a lot of

catching up to do, and I think that’s why you’re seeing them talk about

quantitative tightening, because I don’t think he can catch up fast enough to

try to deal with the inflation problem that he has right now,” Jones said.

Quantitative tightening refers to the Fed shrinking its balance sheet, which

has expanded sharply since the pandemic took hold because of the central bank’s

quantitative easing measures.

“I know that I think it’s going to be tough sledding for the

inflation trades, the pandemic going forward. So, the things that performed

the best since March of 2020 are going to probably perform the worst as we

go through this tight tightening cycle.”

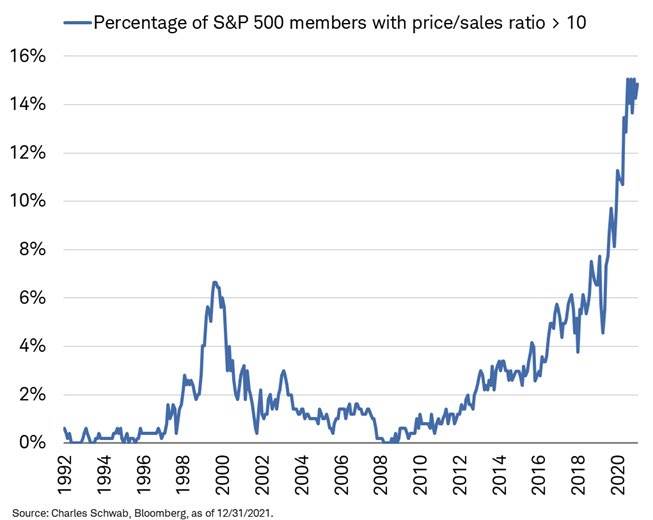

Tweet by Liz Ann Sonders, Chief Market

Strategist at Charles Schwab:

By end of 2021, 15% of S&P 500’s members had a price/sales

ratio > 10.

Curmudgeon Comment:

This shows how incredibly overvalued some S&P 500 stocks

are today.

S&P 500 Price to Sales Ratio (P/S or Price to Revenue) = Current price to sales ratio is estimated based on current

market price and 12-month sales ending June 2021 — the latest reported by

S&P.

S&P 500 Price to Sales Ratio:

Mean: 1.65

Median: 1.52

Min: 0.80 (Mar 2009)

Max: 3.26 (Dec 2021)

………………………………………………………………………………………………………………….

FT - Negative-yielding Debt Tumbles to $10T as

Bond Prices Drop:

The wind down of pandemic-era monetary policy has pushed

global levels of negative-yielding debt down to $10tn for the first time since

April 2020.

Government bond prices around the world have fallen since the start of this

year, as investors position for central banks to lift interest rates and end

large-scale asset purchases in a bid to contain surging inflation.

Bond yields — which rise as prices fall — have, in turn, jumped to their

highest level since before the coronavirus pandemic took hold in many

markets. In the eurozone and Japan,

swaths of government debt have traded at sub-zero yields in recent years — a

scenario that occurs when prices climb so high that investors are certain to

lose money if they hold their bonds to maturity. But a drop in bond prices has

led many such yields to move back into positive territory.

“This is a reflection of the changing times and the changing monetary policy

landscape,” said Kristina Hooper, chief global market strategist at Invesco US.

“A reduction in negative yielding debt is a symbol of that desire to return to

normal.”

FT Opinion – The Greatest Risk for Financial

Markets, by Peter Atwater

At lows in confidence, investors crave certainty. They buy

shares in the safest companies, those with tangible assets, “real” earnings,

and cash flow, if they buy equities at all. On the other hand, at peaks in

confidence, investors have an insatiable demand for possibility. They buy

dreams at the highest price.

Today, what is most expensive is what is the most extremely abstract — the

enterprises that have the greatest “hypotheticality”, the anti-real as it were.

The crowd adores everything that is at the far reaches of psychological

distance — in time, in place and in familiarity. We all but need binoculars to

see it out there on a far horizon. Futuristic investment themes like space

travel speak to our insatiable appetite for the psychologically distant

opportunity.

We’ve come a long way from the intense concreteness at the bottom of the 2008

financial crisis, when the greatest psychological distance investors were

willing to consider was about as far as the mattresses in which many were

intent on stuffing their physical cash and gold.

The net result of the high confidence is startling: investors are now

committing the most money to the most abstract opportunities in history while

paying the least amount of attention.

Blind investing is one thing, but the extreme approach by investors

cautions that we may have reached sentiment peak for the record books over

the past year.

As I look ahead, the greatest risk to the financial markets isn’t a decline in

corporate earnings or a policymaker misstep, but an abrupt change in investor

thinking. After years of devouring abstraction, does the crowd turn to more

substantive investment themes — a year of getting real? That process would be

far from smooth. Even if more solid ground is better for the long-term

direction of markets, those who rushed in when prices were “to the moon” will

be hurt as valuations return to earth.

“The markets have come to believe that if there’s a major

correction in the equity market, Powell will help them out,” said Komal

Sri-Kumar, president of Sri-Kumar Global Strategies. “The result is a seesaw

motion in which the market corrects in anticipation of tightening, then the Fed

eases and the market goes up.”

“The Fed has instilled a sense of complacency in the

markets. That’s going to make their job

a lot harder from here, said Rick Rieder, head of the global asset allocation

team at BlackRock. “If they waited too

long and have to brake hard on the other side, it will cause the markets to go

down hard.”

“There’s no place to hide,” Melda Mergen, global head of

equities at Columbia Threadneedle Investments, said during a presentation of

the firm’s 2022 outlook. “Most of the markets are at the top of the bar in

their current valuations.”

………………………………………………………………………………………………………...

Stay healthy, enjoy life, success, good luck and all the best

for 2022. Till next time.…

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2022 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).