Fed

Has Difficult Task to Contain Inflation Without Crashing Markets

By the

Curmudgeon

Introduction:

News and views you mightve

missed this week, which the mainstream media tends to downplay or ignore. Please let us know what you think.

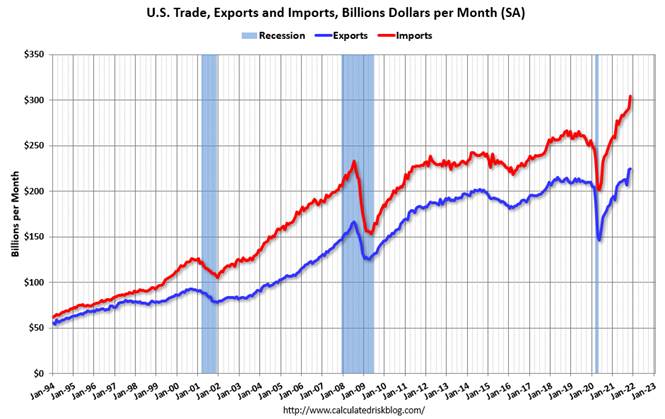

U.S. Trade Deficit at Record

High:

The U.S. Census Bureau and the

U.S. Bureau of Economic Analysis announced on Thursday that the U.S. goods

and services trade deficit was $80.2 billion in November, up $13.0

billion from $67.2 billion in October, revised.

November exports were $224.2

billion, $0.4 billion more than October exports. November imports were $304.4

billion, $13.4 billion more than October imports.

The trade deficit with

China increased to $32.3 billion in November, from $30.6 billion in

November 2020. So much for Trumps

China deal.

Curmudgeon Comment: A

trade deficit, in theory, should weaken the U.S. currency due to net dollar

outflows as imports exceed exports. Yet

the U.S. dollar hasnt weakened (yet) because its the worlds reserve

currency. However, when the DXY index

declines, we expect it to decisively take out the June 2021 low of 81. The DXY closed Friday at 95.74 which was -0.6%

lower than Thursdays close.

.

WSJ - Fed Run-Off Would Shrink its Balance Sheet:

Once the Federal Reserve stops

buying assets, it could keep the holdings steady by reinvesting the proceeds of

maturing securities into new ones, which should have an economically neutral

effect. Alternatively, the Fed could allow its holdings to shrink by allowing

bonds to mature or run off. [The

Fed would remit the proceeds of maturing bonds to the U.S. Treasury, thereby

shrinking its balance sheet]

If the Fed allowed the

securities in its $8.76 trillion asset portfolio to mature without

reinvesting the proceeds, its holdings of Treasury securities would shrink

relatively quicklyby about $2.5 trillion over three years.

When the Fed began the run-off

process in late 2017, the economy was weaker than it is now: Inflation was

below the Feds 2% target, and the unemployment rate was higher.

The economy is so much

stronger now, so much closer to full employment, Mr. Powell said at a Dec. 15

news conference. This is just a

different situation, and those differences should inform the decisions we make

about the balance sheet at this time.

[Note that at the current 3.9% unemployment rate, the U.S. economy has

reached full employment.]

Curmudgeon Comment: Shrinking the Feds bond portfolio faster or

sooner could come as a surprise to most investors and speculators. It represents a huge market risk that has yet

to be discounted.

The Fed will say they are

worried about inflation, but deep down, all the policy settings were put in

place to get this result.

If the Fed tightens too much,

they will end up with an equity market and a real estate crash. I think

the Fed will try to continue on the side of always being late. And this is

based on my core belief that todays inflation rate is not a bug. Its a

feature. Its what they want. Its how you deal with an excessive amount of

debt. So, they will say they are worried about inflation, but deep down, all the

policy settings were put in place to get this result. Its just like the 1950s

and 1960s: You know, we came out of World War II with very high levels of debt

to GDP, and we took care of it through 15 years of negative real rates. Its

the same plan this time around.

B of A Research Comment (via

email):

Ethan Harris continues to

believe the Fed is behind the curve and expects a total of eight rate

hikes over the next two years. The Fed has taken notice and FOMC minutes

revealed some members thought Quantitative Tightening (QT) could start

soon after hikes. Our rates strategists expect QT to be announced at the

September FOMC, though they suggest there is a chance it could happen by early

summer.

WSJ: Bond Selloff Rattles Markets:

A year-opening bond rout has

pushed longer-term interest rates to new pandemic-era highs, sending shock

waves across financial markets.

The yield on the benchmark

10-year Treasury note, which rises when bond prices fall, jumped in just one

day from its year-end close of 1.496% to 1.628%. By Friday, it had settled at

1.769%, smashing through its 2021 closing high of 1.749% to reach its highest

level since January 2020, before officials reported the first Covid-19 case in

the U.S. The average 30-year mortgage

rate reaching a nearly two-year high at 3.22%.

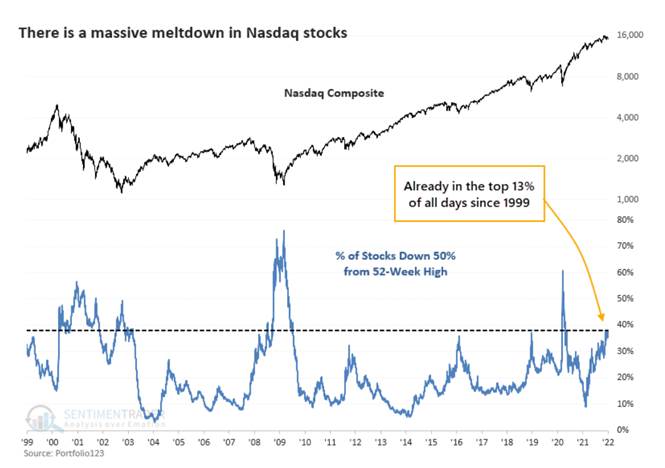

The Nasdaq Composite lost 4.5%

in its worst week in more than 10 months, as rising yields hit shares of

technology companies and other businesses that derive much of their value from

profits expected further in the future. The tech heavy ARK Innovation ETF lost

11%.

Number of Nasdaq Stocks Down 50% or More Is Almost at

a Record

A near-record number of tech

stocks have plunged by some 50% in an echo of the dot-com crash.

Roughly four in every 10

companies on the Nasdaq Composite Index have seen their market values cut in

half from their 52-week highs, while the majority of gauge members are mired in

bear markets, according to Jason Goepfert, chief research officer at Sundial

Capital Research (which publishes the excellent SentimenTrader

newsletter.

Whatever the fundamental and

macro considerations, there is no doubt that investors have been selling first

and trying to figure out the rest later, Goepfert said in a note to

subscribers.

At no other point since the

bursting of the dot-com bubble have so many companies fallen like this while

the index itself was so close to a peak.

Valuations are at historical

highs, companies are raising billions based on fairy dust, and the Fed is

signaling a tightening cycle, Goepfert said. All of these are scaring

investors that were on the cusp of a repeat of 1999-2000.

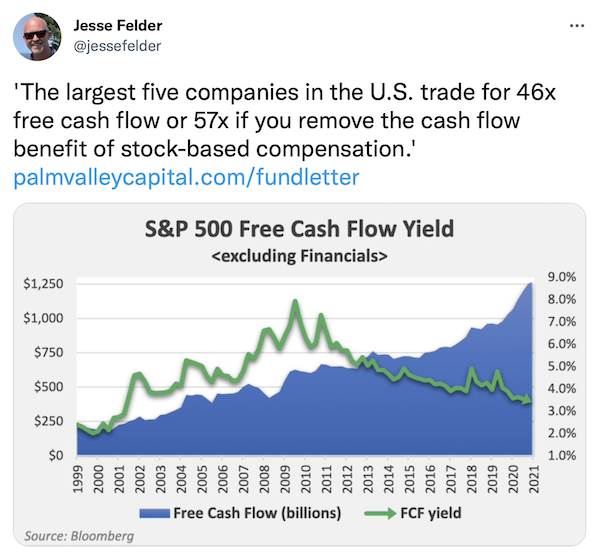

Palm Valley Capital Quarterly Letter: Negative Real Free Cash Flow Yields

For investors looking back on

the long bull market that commenced in March 2009, it may now feel like

research is unnecessary, unrewarded, and more likely to reduce than enhance

returns. The free cash flow yield of the

S&P 500 excluding financials is 3.4%the lowest level since

2002.Considering inflation, real free cash flow yields are negative and

have never been lower.

.............

Vox: Money Has Never Felt More Fake

The market feels like a

bubble. Does it matter? Evidently

not, to new investors. Between

NFTs, crypto, and GameStop, AMC, and other meme stocks, money has rarely felt

more fake. Or, at the very least, value has rarely felt so disconnected from

reality.

Rich

Uncle Pennybags, the Monopoly game figure,

shows some of his funny money as he prepares to strike the opening bell at

the American Stock Exchange in New York in February 1995. Bob Stron/AFP via Getty Images

The concept of value is a

fuzzy one, and valuation is often more art than it is science. Psychology has

always played a role in money and investing and there have always been

bubbles, too, where the price of an asset takes off at a rapid pace and

disconnects from the fundamental value. As Jacob Goldstein wrote in Money: The

True Story of a Made-Up Thing, all money is sort of a collective myth. Money

feels cold and mathematical and outside the realm of fuzzy human relationships.

It isnt, he wrote. Money is a made-up thing, a shared fiction. Money is

fundamentally, unalterably social.

If and when the bubble around

some of these hyped investments bursts, a lot of people are going to get hurt

and lose money. In NFTs, evidence suggests those who are already wealthy and

powerful are the ones ruling the roost, just like in the stock market.

While there are true believers

in crypto projects, so much of it is just speculation, and venture capitalists

and hedge funds are more likely to win the speculation game than the little

guys caught up in the mania.

Robert Prechters

Elliott Wave Theorist--January 5, 2022, Update:

Blue chip indexes appear to

have topped in the first three trading days of January 2022. The Dow Jones

Industrial Average and the NYSE Composite index each made a daily closing high

on January 4 and an intra-day high on January 5 (at 36,952.65).

For cyclical reasons detailed

in the June 2021 issue, I think 2022-2024 will witness the biggest bear

market ever recorded.

...

Stay healthy, enjoy life,

success, good luck and all the best for 2022.

Till next time....

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2022 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).