Why

are Gold and Silver Lagging Inflation?

By Victor Sperandeo with the Curmudgeon

Introduction:

For decades, gold and to a lesser extent silver, were seen as

the best inflation hedges. As inflation

has surged this year, the precious metals have not kept pace. Part of the reason is gold’s correlation with

stocks and interest rates which Victor explains in this article. The Curmudgeon

has a somewhat more sanguine outlook for the yellow metal.

Happy Thanksgiving to all U.S readers!

Discussion:

When stocks go up gold generally does not. Why? Stocks are now perceived to be a better

inflation hedge. Companies often raise

prices on goods and services they sell when inflation is increasing. Most stocks also pay a dividend, but gold

does not. Add manipulation by banks,

which have sold gold and bought stocks over the past ten or more years.

For the last 28 years, here is the correlation analysis for gold vs stocks [from Jan 1993 -Feb

2021]:

Gold vs

S&P 500

1-month 1.20%

1 year -17.09%

3 years

-51.37%

5 years

-62,23%

10 years -61.81%

This correlation clearly shows that investors have preferred

stocks to gold for the last 10 years- a period of ultra-low interest rates.

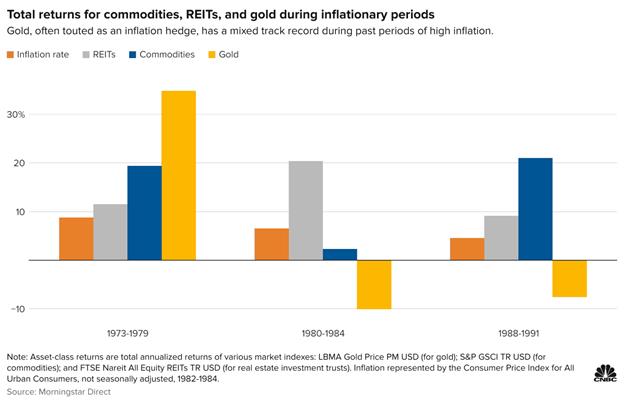

Of course, that was not the case from the 1973 to January

1980, as interest rates and inflation rose significantly. From 1973 to 1979, the annual inflation rate

averaged 8.8% and gold returned a whopping 35% per year.

However, gold lost 10% on average from 1980 to 1984, when the

annual inflation rate was about 6.5%, according to Morningstar’s Amy

Arnott.

“Gold is really not a perfect hedge,” said Arnott, who

analyzed the returns of various asset classes during periods of above-average

inflation.

Correlation of Gold vs Fed’s Discount Rate from 1973 to 1976:

From July 1973 to June 1976, the Federal Reserve Board’s

Discount Rate (widely followed at the time) went from 4.5% to 8%, then declined

to 5.25%. The U.S. dollar increased 15.5%

during that time. Gold’s price more than doubled from 1973 to 1976. It went from $106.48 at year end 1973 to

$287.05 at year end 1976.

Then from June 1976 to July 1980 the Discount Rate went from

5.25% to 14.0% and the U.S. dollar declined -20.9%. Yet the gold price increased to $595 at year

end 1980, while trading at $881 in January of that year.

If the 1973 -1976 period would repeat, then as inflation accelerates

interest rates would increase, the U.S. dollar would decline, and gold prices

would rise substantially.

Curmudgeon Comment:

As inflation accelerates, real interest rates (which the Fed

has kept at rock bottom) become even more negative, making gold more

attractive.

GraniteShares founder and CEO Will Rhind told CNBC

earlier this month: “We have real inflationary pressures that, the longer they

persist, the more of a problem that causes, and the more people will look for

inflation hedges. There just aren’t that

many places to hide and gold is one of those places that people have always

gone to in times of stress, and I think this data’s a reason for still

believing that gold is going to be there next year if there’s an official

acknowledgment that inflation is a (real) problem.”

Victor’s Conclusions:

Gold will continue to lag inflation until interest rates rise

significantly and the S&P 500 starts to decline. Note also that when the

Fed raises rates in small increments, stocks continue to advance.

The tipping point comes when both short- and long-term

interest rates rise enough to offer stiff competition for stocks. At that time,

money will move from stocks to gold and the yellow metal will once again be

deemed the best inflation hedge.

My opinion is that “until” the Fed raises interest rates

significantly, it is far better (all things being equal and relative) to own

stocks rather than gold.

Addendum: WSJ

Editorial- Biden Signs Up for Powell’s Inflation:

[Excerpts with emphasis added]

By keeping Jerome Powell as the Fed chairman, while elevating

progressive favorite Lael Brainard to vice chair, President Biden may think

he’s deftly straddled the Democratic politics. Instead, he is buying their

monetary policy and inflation.

Neither deserves reappointment on their record of the last four years (we completely

agree!), as inflation has risen three times above the Fed’s 2% mandate

to the highest rate in 30 years.

The Fed has maintained the loosest monetary policy in history

despite strong economic growth and a 4.6% jobless rate. Real interest rates are

still negative, and Mr. Powell has given no public indication of having second

thoughts.

In anointing the duo, Mr. Biden will now own future

inflation. Perhaps there’s rough justice to having Mr. Powell stick around to

fix the problem, but only if he does fix it. One lesson of the long fandango

over his reappointment is that Washington and Wall Street will apply intense

pressure to keep the easy money running as long as

possible.

A vote in the Senate to confirm Powell is also a vote for

the inflation status quo. Mr. Biden has concluded that this is a good political

gamble, but Republicans can take the opportunity to distance themselves from

the failing economic policies on which voters have soured so rapidly.

The current spike in inflation is no accident. It's the

result of reckless policies that squeeze the supply of goods and

services—notably energy.

......................................................................................................

Stay healthy, enjoy

life, success, good luck and till next time….

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2021 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).