1987

Stock Market Crash Versus Today’s Market

by The Curmudgeon

Introduction:

In a long

forgotten (or never read) April 13, 1987 Barron's article, When

Stocks Trade Like Commodities, Anthony Delis warned of "big trouble

ahead" for the U.S. stock market based on a powerful advance in prices

that seemed to defy economic fundamentals.

Delis called

attention to the exponentially rising stock prices from 1986 through April 1987

and compared that with similar price patterns in commodities. He wrote: "It's quite clear that these

ascending curve (=exponential) patterns climb vertically, exhaust themselves,

and then drop just as quickly."

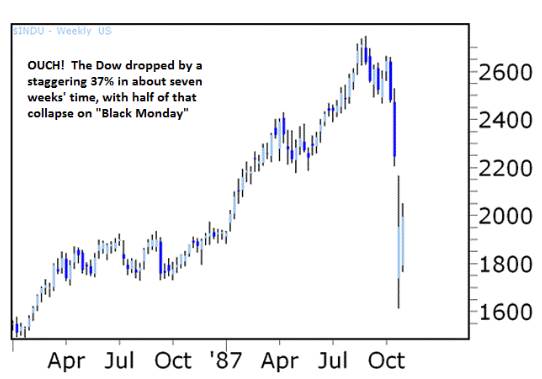

Of course, we

all know what happened in Oct 1987 as depicted by the chart below:

Is the stock

market headed for a 1987-like CRASH?

Recently, there

have been several on-line articles, blog posts, and archived interviews questioning

whether another 1987 like crash might occur soon (perhaps this October).

1. In an intriguing Zero Hedge blog post titled

1987 And

Market 'Accidents' Waiting to Happen, Tyler Durden wrote: "given

the current uncertainty of macro-economic data, high-leverage, fear of rising

interest rates, and instability of currency markets, all of the same conditions

that led to the 1987 crash are now present in financial markets. Does this mean

the markets are going to crash? Certainly not; but the conditions may be right

for another 'market accident' to happen."

The following

quotes from the Fed's research paper - "A Brief History of the 1987

Stock Market Crash With a Discussion of the Federal

Reserve Response" - were suggested as the primary causes of the 1987

stock market crash...

"During

the years prior to the crash, equity markets had been posting strong gains.

Price increases outpaced earnings growth and lifted price-earnings ratios; some

commentators warned that the market had become overvalued"

"Importantly,

financial markets had seen an increase in the use of “program trading”

strategies, where computers were set up to quickly trade particular amounts of

a large number of stocks, such as those in a particular stock index, when

certain conditions were met."

"The

macroeconomic outlook during the months leading up to the crash had become

somewhat less certain. Interest rates were rising globally."

Durden

concludes by asking the readers if the above commentary "Ring(s) any

bells?"

2. In a Yahoo Finance interview with Heritage

Capital's Paul Schatz on July 29th, Yahoo Breakout host Matt Nesto asks: Are

Stocks Heading for a 1987-Style Crash?

Schatz doesn't

think so, but believes we could experience a 10 to 20% correction very

soon. He said the drivers for the '87

crash -sharply rising (long term) interest rates, misplaced confidence in

portfolio insurance, and ill-advised remarks on the U.S. $ exchange rate by

Treasury Secretary James Baker- were not now present.

Schatz thinks a

new market top could be set in August or September, which would play into a

number of seasonal factors that have made the tenth month a tricky one, albeit

one that the Stock Trader's Almanac shows has averaged a 0.4% gains for the Dow

since 1950, which is better than five other months.

3. In a July 26th blog post on his Street

Smart Report website market timer Sy Harding

asserts that Stock

Market Bubbles Cannot Be Timed.

Harding opens

with several examples of "speculative bubbles, which burst with

devastating results for investors who believed there would be no end to their

rising prices." He continues:

"There are

several characteristics in the current market that were characteristics in

previous bubbles. In prior bubbles

prices were rising, as they seem to be now, based more on the excitement of the

price action itself (the continuing rising prices) and the surrounding hype,

with little thought given to the fundamentals. That is a worry."

"Then

there is the evidence that even as public investors are pouring money into the

market at a near record pace, institutional investors have been pulling money

out at a near record pace. That has also been evident near prior bubble

tops."

"A

convincing argument can also be made from the surge in investor confidence that

has margin debt (buying stocks with 50% discounts) at record levels last seen

at the 2000 and 2007 tops."

Harding offers

some very sound advice with this suggestion:

"By dialing back risk and preparing for the prospect of an

intermediate-term correction, one will also be on the right side of the market

if it turns out to be one of those fairly rare instances when it was not only

an overbought market, but a bubble market due for a sudden bursting of the

bubble."

Analysis and

Opinion:

While the

CURMUDGEON won't comment on whether another 1987-like crash is in the cards,

we'd like to point out some of the key differences between now and then.

·

In

percentage terms, to match the 508-point calamity that cracked the Dow (DJI) on

October 19, 1987, the blue chip benchmark would now have to shed more than

3,400 points in a single session. There

are circuit breakers in place now that would prevent that from re-occurring. However, there is the distinct possibility of

several "limit down" days, which were typical of commodity markets

(e.g. Gold and Silver) in early 1980.

·

Most

experts agree that the mistaken belief that "portfolio insurance"

would protect a stock portfolio played a huge role in the '87 crash. While that strategy is now passé, we strongly

believe that a combination of factors will cause liquidity to totally

evaporate. Those include: discounted

ETFs with APs failing to properly create/destroy ETF shares, various derivative strategies, unwinding of

leveraged stock positions (margin debt is at an all-time high), a buyers strike by HFTs and "dark

pools," etc. Few have called

attention to these dangers that will surely exacerbate any sharp stock market

downturn! We assert that trading will be

suspended when there are no bids, as market makers and HFTs won't take the buy

side in a sharply falling market.

·

With

the Funds rate at ZERO (as it has been for 4 1/2 years) and QE infinity in

place, the Fed has no real room to ease.

On Oct 19, 1987, the Fed Funds rate was 7.25% and was gradually lowered

by then new Fed Chairman Alan Greenspan to a cycle low of 6 1/2% in early

1988. Greenspan said immediately

following the '87 crash that the Fed "affirmed today its readiness to serve

as a source of liquidity to support the economic and financial

system." Current Fed head

Bernanke has been making that same statement for the past 4 1/2 years! But wait.... Maybe, he will have the Fed

buy all the Treasury securities at auction and on the open market. Wouldn't that be the ultimate test for

"Helicopter Ben" or his successor?

·

The

economic fundamentals are much different.

In the Fall of 1987, unemployment was lower,

the labor participation rate was significantly higher, wages were growing, and

U.S. manufacturing was still creating many factory jobs. Most importantly that 1987-88 economy was

very resilient. It did NOT enter

recession after the stock market crash, as many pundits predicted. [The CURMUDGEON had one of his best income producing years in 1988!]

·

Fast

forward to today and one can see the economy is considerably weaker. There's fiscal tightening through the U.S.

federal government sequester and tax increases (higher payroll tax &

increased income tax on the wealthy).

There's total gridlock/paralysis in Congress to pass any economic

stimulus legislation. Manufacturing and

much high tech engineering design and development have been outsourced and

offshored. Consumers are reluctant to

spend, as they are afraid of being laid off and becoming part of the "long

term unemployed."

·

In

short, there aren’t any "organic" drivers that could help the Main

Street economy in the event of another financial meltdown, even if Bernanke

does at some point temporarily stop a potential sharp market decline with more

QE and loans to the butcher, baker and candlestick maker. :-))

And on that

note, we ask readers to carefully consider the risk - reward tradeoff for any

new or existing investment(s), especially in light of the lurking dangers

described above.

Till next time.....................

The Curmudgeon

ajwdct@sbumail.com

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.