Is

Risk a Thing of the Past? Markets Don't Grow Old if They're Manipulated!

By the Curmudgeon with Victor Sperandeo

Introduction:

Quick

takes this week followed by Victor's quotes from 1992 and November 19, 2021. Stay

tuned for a post expressing Victor's opinion on why gold and silver have lagged

surging inflation. Enjoy!

Again,

comments, concerns, opinions are welcome. Email the Curmudgeon at ajwdct@gmail.com. Thanks.

WSJ: How the

Fed Rigs the Bond Market

Inflation hasn’t been this high relative to

Treasury bond yields since the 1970s. Then as now, real bond yields—the gap

between the 10-year Treasury and inflation—signaled distress for policy makers

and market participants.

Since

1970, negative real Treasury bond yields typically have corresponded with a

plunging stock market. Example: Yields reached a low of negative 4.9%

in 1974. During that year, the S&P 500 fell 37%. Today, real yields of

negative 4.7% are the second-lowest since 1970, yet the S&P 500 has

risen nearly 30% over the past year. What

is different today?

First,

the U.S. Treasury bond market has been rigged and manipulated

(see End Quote below) since the Federal Reserve’s second

quantitative-easing program began in 2010. Since then, Fed purchases of

Treasury debt have funded as much as 60% to 80% of the entire government

borrowing requirement. In other words, Fed actions have crowded out

private-sector price discovery for more than 10 years, pushing yields to lows

and stock prices to record highs. The consequence of this blurred line between

Fed and Treasury responsibilities—“monetizing the debt”—is inflation.

Photo

Credit: David Klein

Second,

the infamous bond vigilantes, who sold

bonds to protest inflationary policies, are relics of the past.

They were driven by opportunity, not ideology. These investors voted on

government budget deficits and debt management by buying or selling bonds every

day. But active Fed intervention has silenced them. “Fighting the Fed” has

always been fraught with risk, but fighting a Fed operating with such force

will result only in big and consistent losses.

WSJ:

Tweedledum and Tweedledee at the Fed- Powell

and Brainard have both presided over the inflation breakout.

Neither

one deserves the job if you judge them by how well they have performed in their

main duty of maintaining price stability. The Powell Fed has presided over

inflation that it failed to predict and has been slow to address. The Fed’s

professed inflation target is 2%, but the consumer price index rose 6.2% in

October above a year earlier.

By

any measure this is an historic failure. Mr. Powell’s credibility has

been damaged with his persistent refrain, until recently, that inflation is

“transitory.” His new monetary policy framework of average-inflation targeting,

unveiled in August 2020, has been a bust.

If

Mr. Biden wants to distance himself from this inflation failure, he’d nominate

a critic of current Fed policy (Curmudgeon: that would be a smart choice).

If

the choice is Tweedledum or Tweedledee (Powell vs. Brainard), Mr. Biden should

understand that he is embracing their monetary policy as his own. He’ll own

inflation even more than he already does.

Goldman:

Market Greed Is Now Outpacing Fear

Goldman

CEO David Solomon, speaking at the Bloomberg New Economy Forum in

Singapore, said “greed has far outpaced fear” in markets and investors could

face a rocky period as the global economy emerges from the pandemic.

“When

I step back and think about my 40-year career, there have been periods of time

when greed has far outpaced fear -- we are in one of those periods,” Solomon

said in an interview at the Bloomberg New Economy Forum in Singapore. “My

experience says those periods aren’t long lived. Something will rebalance it

and bring a little bit more perspective.”

“Chances

are interest rates will move up, and if interest rates move up that in of

itself will take some of the exuberance out of certain markets,” Solomon said.

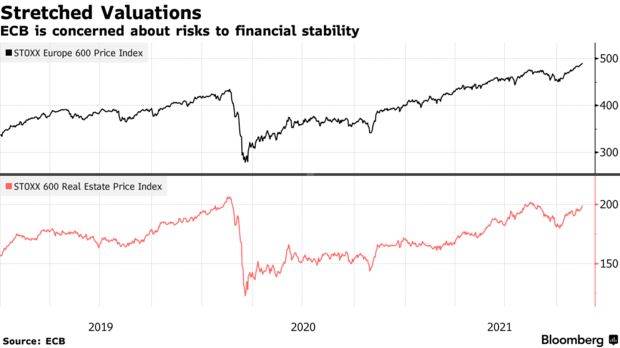

ECB Warns of

Investor exuberance threat to financial markets

Increasingly

stretched prices in property and financial markets, risk-taking by non-banks

and elevated borrowing pose a threat to euro-area stability, the European

Central Bank warned.

“Concerns

particularly relate to pockets of exuberance in credit, asset and housing markets,

as well as higher debt levels in the corporate and public sectors as a legacy

of the pandemic,” it said Wednesday in its Financial Stability Review, echoing

former Federal Reserve Chairman Alan Greenspan’s description of the dot-com

bubble in the 1990s.

The

ECB highlighted growing vulnerabilities in residential real estate --

especially for countries where pre-pandemic valuations were already elevated.

ECB

said that the real estate market is “more prone to a correction,” while also

warning that investment funds, insurers and pension funds could face

“substantial credit losses” if their exposure to lower-rated corporate debt

sours.

“The

markets for equity and risky assets have maintained their striking buoyancy,

making them more susceptible to corrections,” ECB Vice President Luis de

Guindos said in the report. “There have been examples of established market

players exploring more novel and more exotic investments. In parallel, euro-area

housing markets have expanded rapidly, with little indication that lending

standards are tightening in response.”

Pockets

of Exuberance- Here are some of the risks the ECB sees for

financial stability:

·

Supply disruptions and rising energy prices pose

risks to inflation and the economic recovery

·

Higher debt levels in the corporate and public

sectors are cause for concern

·

Vulnerabilities are growing in euro-area

property markets

·

Bank profitability is improving but structural

challenges remain

·

Non-banks’ vulnerability to duration risk builds

amid persistently high liquidity risk

Source:

ECB

“The

pandemic continues to be one of the main risks to economic growth,” the ECB

said. Beyond Europe, uncertainties

include a slowdown in China, even if problems experienced by indebted property

developer China Evergrande Group have only had limited effects on the outlook

so far, according to the report.

“If

persistent bottlenecks feed through into higher-than-anticipated wage rises or

the economy returns more quickly to full capacity, price pressures could become

stronger,” the ECB said. “A more-persistent high-inflation scenario could

translate into an untimely tightening of financial conditions, weighing on the

economic recovery.”

“A

correction in markets could be triggered by a weaker than expected economic

recovery, spillovers from adverse developments in emerging market economies, a

re-intensification of stress in the non-financial corporate sector or abrupt

adjustments in market expectations regarding the prospective path of monetary

policy normalisation,” it said. Eurozone inflation rose to a 13-year high of

4.1% in October, well above the ECB’s 2% target. The central bank, however, has

predicted inflation will fall back below its target in the next few years and

said it did not expect to raise rates next year.

Curmudgeon

Comment: It's somewhat disingenuous for the ECB to warn of asset bubbles it has

directly fueled with its egregious, easy monetary policy.

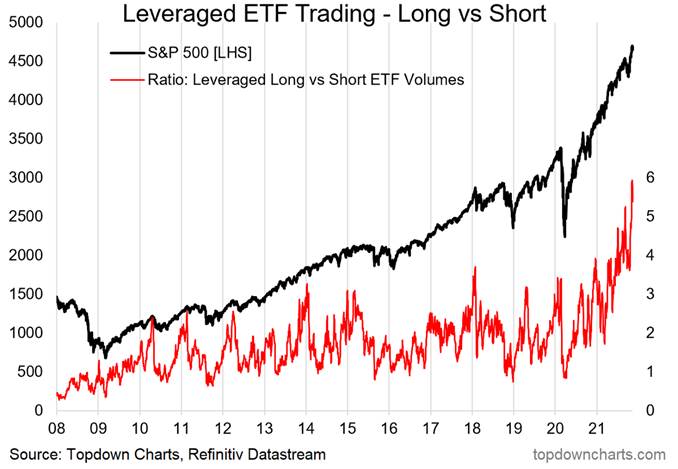

Tweet by

Topdown Charts @topdowncharts

The

chart below shows the ratio of trading volumes of leveraged long vs leveraged

short US equity ETFs. It’s basically a sentiment indicator where spikes

indicate excessive risk taking on the long side.

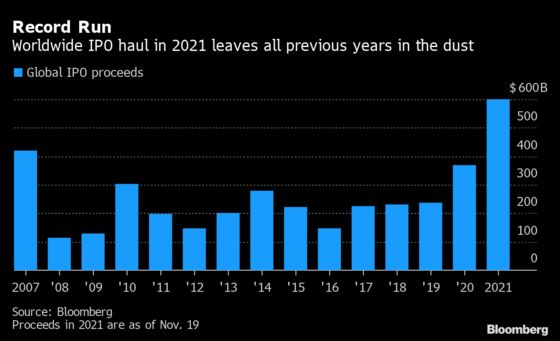

Bloomberg:

Global IPOs Blow Past $600 Billion Mark in Best Year on Record

Global

initial public offerings have smashed their previous record this year,

propelled by a blank-check boom and companies cashing in on high valuations.

With

six weeks to go, about 2,850 businesses and special purpose acquisition

companies (SPACs) have raised more than $600 billion in IPOs, leaving the

records for both deal count and proceeds reached in 2007 in the dust, according

to data compiled by Bloomberg.

Leading the pack is electric-truck startup Rivian

Automotive Inc., which raised nearly $12 billion in New York this month.

Asia’s biggest was China Telecom Corp.’s 54 billion-yuan ($8.4 billion) IPO in

August, while Polish parcel-locker provider InPost SA seized the top spot in

Europe with its 2.8 billion-euro ($3.2 billion) Amsterdam listing in January.

These companies took advantage of record-high stock prices, as

central bank support kept investors flush with cash. And the economic recovery

from the pandemic along with stimulus measures helped boost corporate earnings.

A retail-buying frenzy that sent stock markets on a

rollercoaster ride this year, along with investor appetite for hot sectors has

fueled some dizzying post-listing pops. Rivian, which has yet to

generate revenue, more than doubled in its first few sessions, briefly

surpassing Volkswagen AG in market value, while Korea’s SK Bioscience Co.

surged 160% in its debut.

These outsized gains have fanned worries of a bubble.

The S&P 500 Index is trading at more than 21 times projected earnings in

the next year (we don’t believe in forward earnings estimates because they are

almost always overstated), well above its 10-year average. Stocks are near

their most expensive level since the dot-com bubble of 2000 (by some measures

stocks are MORE expensive than the dot-com bubble peak).

“As monetary stimulus programs are scaled back, and if global

growth slows sharply, markets could be heading for a correction,” said Susannah

Streeter, senior analyst at Hargreaves Lansdown Plc. “Over-valued companies

will feel the pain much faster than others.”

Bloomberg:

‘Confusing

Time’ for Managers Weighing Stock Bubble

A

stellar year for the stock market is coming to a close and money-managers are

looking ahead to what 2022 might have in store. But worries persist, including

the perennially nagging question of whether the stock market is overvalued and

in a bubble.

Sébastien

Page, head of global multi-asset at T. Rowe Price

offers his opinion:

A

simple question right now that’s on everyone’s mind is: are stocks in a

bubble? And it’s really a complicated question. This is going to sound

unusual, but I can make the statement that at the same time, stocks are both as

expensive as they’ve ever been and as cheap as they’ve ever been. So how do I

get to that statement? If I look at the price-earnings ratio on the S&P

500, it’s in the 99th percentile compared to the last 30 years. But if you

think stocks are expensive, have you looked at bonds recently?

Curmudgeon

Comment: Comparing one bubble (stocks) to another (bonds) is a fools game. Why

not compare TSLA stock to bitcoin? Or

IPOs to SPACs? Or Meme Stocks to Home Flipping?

As

we've stated numerous times, we're in a liquidity fueled global bubble in many

asset classes - stocks, bonds, cryptos, real estate, art, etc.

End

Quotes:

"Market

price movements are like people – they have statistically significant life-expectancy

profiles. In a market that is in a stage of old age, it is

particularly important to be attuned to symptoms of a potential end to the

current trend."

"Trading

the market without knowing what stage it is in is like selling life insurance

to twenty-year-olds and eighty-year-olds at the same premium."

Above

quotes from "Victor Sperandeo: Markets Grow Old Too" interview

by Jack Schwager in New Market Wizards, orignially pulbished in 1992.

"There

are no markets (anymore); only manipulation." Email to Curmudgeon on 19 November 2021.

......................................................................................................

Stay healthy, enjoy life, success, good

luck and till next time….

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2021 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).