Is the Fed a No Risk Hedge Fund or a Ponzi Scheme?

By the Curmudgeon with Victor Sperandeo

Introduction:

Quick takes this week. The Curmudgeon is too flummoxed, overwhelmed and stunned to write any original commentary. However, Victor weighs in with his thoughts on the Fed’s left hand vs right hand actions this week.

Friday’s Market Action:

U.S. stocks pushed further into record territory on Friday following an encouraging report on hiring across the country. Trading was shaky as the bond market was hit with another day of sharp swings.

The S&P 500 rose 17.47, or 0.4%, to 4,697.53 and clinched an all-time high for the seventh straight day. The Dow Jones Industrial Average gained 203.72, or 0.6%, to 36,327.95, and the Nasdaq composite added 31.28, or 0.2%, to 15,971.59. The Dow (DJI) and Nasdaq joined the S&P 500 in setting all-time highs. Russell 2000 rose 1.4% and finally broke out to a new high, ending 161 days without one.

The 10-year yield, which tends to move with expectations for the economy and inflation, dropped to 1.45% and is near its lowest level since September. It was at 1.58% just two days earlier. Analysts had varying explanations for that and other sharp moves in the bond market, which some called counterintuitive or a conundrum.

Selected quotes and article highlights:

"The most bullish thing a (market) can do is get overbought and stay that way." - Alan Shaw, CMT

Curmudgeon: Indeed, the current market trend is extremely bullish, despite valuations, sentiment, and fundamentals being bearish.

..........................................................................................................

Is the Market Still Overvalued?

NASDAQ 100’s forward price/sales ratio has notched a new all-time high (Curmudgeon: Market cap of 6 stocks is ~50% of NASDAQ 100)

Shiller PE Ratio for S&P 500

is now 40:

Friday’s S&P close=4697.53. Shiller PE Mean=16.88 Median=15.86.

If the S&P declined 60.4% to 1862.57 it would only reach fair value according to the Shiller PE Median of 15.86.

Shiller PE for S&P 500 over all of history:

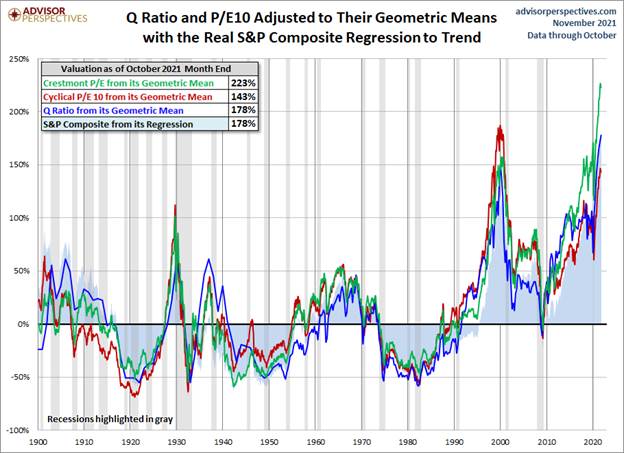

The chart below shows the P/E and Q ratios adjusted

to their geometric mean rather than their arithmetic mean.

Jeremy

Grantham recently told CNBC that equities in the U.S. are in a “magnificent

bubble,” larger even than those in 1929 and 2000, which kicked off

the Great Depression and signaled the end of the dotcom bubble,

respectively.

Grantham is worth listening to. He predicted the dotcom collapse and the 2008 meltdown of the real estate market. He’s also in charge of about $60 billion as the investment chief at asset management firm Grantham, Mayo, & Otterloo.

Video: Why Grantham Says the Next Crash Will Rival 1929, 2000.

Analyst Stephanie Pomboy explains why she predicts higher interest rates going to crash the market by 60%+, no matter what the Fed does. Check out her interview with Adam Taggart here.

…………………………………………………………………………………………………...

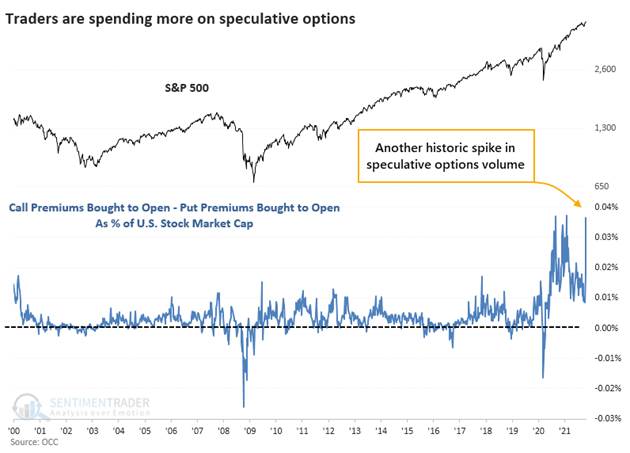

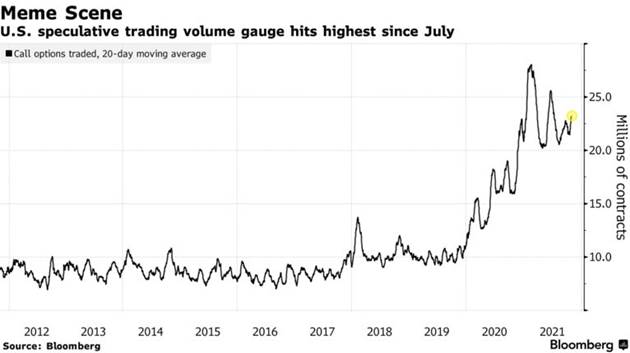

Speculative Retail Options Traders Back in Droves, Sundial Says:

Speculative call buying rose to one of the highest levels on record, as a percentage of both volume and market capitalization, President Jason Goepfert said in a note Monday. Net call buying to open -- a gauge of bullish bets -- was in the top 2% of all weeks since the year 2000 and not solely thanks to demand for Tesla Inc. options, he said.

Jason added: "It wasn't just about Tesla. There were about 8,000,000 options traded on that stock. There were over 100,000,000 call options traded last week on all stocks across all U.S. exchanges."

Tweet by Julian Brigden: 11:53 AM · Nov 3, 2021

Compare and contrast. Tuesday, ISM Manufacturing Chairman i.e., a man on the ground, "it's not clear when this (wage) spiral stops." To Fed Chair Jerome Powell, a man in the clouds, “We don’t see troubling increases in wages. We don’t expect those to occur."

Tweet by ZeroHedge: 5:31 AM · Nov 3, 2021

Treasury cuts debt auction sizes hours before Fed announces it will buy fewer Treasurys. Good coordination between the JV (Junior Varsity) partners. Please see Victor's comments below for Fed contradictions.

Is Inflation starting to decline?

Not based on commodities! YTD best year for commodities since 1973.

CRB Commodity Index Total Return (annual returns):

Source: BofA Global Investment Strategy, Datastream, Bloomberg, *2021 YTD annualized BofA GLOBAL RESEARCH

Counterpoint: The Baltic Dry Index (see graph below)– which measures the average prices paid for the transport of dry bulk materials across more than 20 routes – has collapsed 48.81% since October 7th. The average sale price of a 40-foot container in China plunged by 22.5% in the first two weeks of October alone.

..............................................................................................................

Victor's Comments – Tapering vs Reverse Repos:

The FED finally says they will “taper” the buying of $120 billion a month of fixed income securities by $15 billion per month. Tapering will continue till June 2022 when it reaches zero.

While the Fed’s announcement that it would begin tapering was widely expected, its continued dovish take on inflation was not. On Wednesday, the Fed said inflation reflected “factors that are expected to be transitory”—only a slight qualification. By way of explanation, it added a new sentence: “Supply and demand imbalances related to the pandemic and the reopening of the economy have contributed to sizable price increases in some sectors.”

Not at all publicized is the fact that the Fed allowed reverse repo’s (RRPs) [1.] to mature to the tune of $250 billion from the peak on September 30th of $1.600 trillion. As of November 5th, there's a total of $1.354 trillion parked in RRPs, according to the St. Louis Fed.

Head scratcher: As the Fed tapers its bond purchases, they inject cash into the banking system by unwinding reverse repo’s? Markets love it!

The public and mainstream media only talk about the taper, while they ignore the Fed putting more money into the system than it takes out net. Willie Sutton and Charles Ponzi would be jealous?

Again, we ask: Is the Fed a No Risk Hedge Fund or a Ponzi Scheme?

Note 1. We provided a tutorial on Reverse Repos in this post.

..............................................................................................

B of A Global Research:

1. Winners and Losers in 2021:

- Winners

(inflation/reopening/Fed) …bitcoin 111%, oil

71%, energy stocks 35%, US REITs 31%, banks 29%, FAANG 28%.

- Losers

(inflation/China) … China HY -32%, China tech

-19%, Brazil -18%, 30-year UST -7%, EM bonds -5%.

2. Weekly Flows:

$26.1bn to stocks, $14.7bn to cash, $8.0bn to bonds, $0.5bn from gold.

3. Summing it all up:

$32tn of policy stimulus, $840 million per hour central bank asset purchases, global stock market cap up $60 trillion in 18 months, CPI>5%, house prices >20%, and lowest interest rates in 5000 years…

-->You do the math: can't blame investors for "irrational exuberance" when central bank policy makers are paralyzed by framework that regards Wall Street as "too big to fail."

4. Heard on the Street:

"Falling unemployment and bubbly stocks please a minority of voters; higher inflation and goods shortages annoy everyone."

"The only thing to fear is greed itself: inflows galore, earnings galore, liquidity galore…little wonder zeitgeist is "bubble."

Source: BoA Global Research

.............................................................................................................

End Quote:

Albert Einstein said it best: “Only two things are infinite, the universe and human stupidity, and I'm not sure about the former.”

Stay healthy, enjoy life, success, good luck and till next time….

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2021 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).