Inflation, Oil Futures, Energy Stocks, Gold vs Real

Rates and U.S. Debt

By the

Curmudgeon

Introduction:

Consumer prices rose at the fastest pace in 30 years in

September while workers saw their biggest compensation boosts in at least 20

years, according to new government data released Friday.

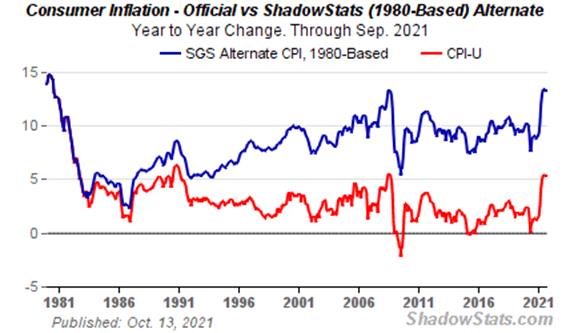

In this week’s column, we take a closer look at BLS reported

inflation vs an alternate inflation gauge.

Then we examine who’s buying oil futures and the much-improved energy

stock sector. Finally, we look at the

gold to U.S. government debt ratio to get a clue to the yellow metal’s future

prices.

WSJ - Price and Wages Increase at a Rapid Pace:

U.S. government reports on Friday point to an economic

recovery (?) caught between robust consumer demand and severe supply shortages,

leading to a rapid uptick in inflation.

Persistently high inflation could offset the increase in wages and make

households worse off.

It could also force the central bank to raise interest rates

to keep prices in check. Such a move also risks slowing the U.S. economic

recovery when the unemployment rate remains higher than it was before the

pandemic.

The Fed’s preferred inflation gauge, the

personal-consumption- expenditures price index, rose 4.4% in September from the

previous year, the fastest pace since 1991, the Commerce Department said

Friday. The index was up 0.3% in September from the previous month. Excluding food and energy categories, which

tend to be more volatile, the index rose 0.2% over the month and 3.6% over the

year.

An index of consumer sentiment also released Friday by

the University of Michigan showed Americans remain in a glum mood. The

index fell to 71.7 in October from 72.8 in September. It remains well below the

level of 101 registered in February 2020, before the pandemic hit. John Williams (see ShadowStats below) says,

“University of Michigan’s October Consumer Sentiment Continued to Hold Near Its

New Pandemic Trough.”

Consumers in October also anticipated the highest

year-ahead inflation rate since 2008 at 4.8%, according to the sentiment

survey. Higher consumer inflation expectations are a concern for policy makers

because they could prompt firms and workers to raise prices and salary demands

in the future, making the expectations self-fulfilling.

FT- Inflation pressure now ‘brutal’ because of supply

squeeze, US companies say

Shortages throughout the supply chains on which corporate

America depends are translating into widespread inflationary pressure, a string

of US companies revealed this week, disrupting their operations and forcing

them to raise prices for their customers.

Whirlpool on Friday blamed “inefficiencies across the supply chain” for “pretty

brutal” increases in prices for steel, resin and other

materials, saying these would add almost $1bn to the appliance manufacturer’s

costs this year.

“On any given day, something is out of stock in the store,”

said Vivek Sankaran, chief executive of Albertsons, likening the grocery

chain’s efforts to respond to successive challenges to a game of Whac-A-Mole.

Asked this week which ingredients and supplies Chipotle had

found difficulty securing, Jack Hartung, the restaurant chain’s chief financial

officer replied: “All of them.”

Pressure on every link in the supply chain, from factory

closures triggered by Covid-19 outbreaks to trouble finding enough staff to

unload trucks, is rippling across sectors, intensifying questions about the

threat that inflation poses to robust consumer spending and rebounding

corporate earnings. In recent days the

largest US airlines have all complained about the surging costs of jet fuel,

toy manufacturer Mattel has spelled out the challenge of higher resin prices

and Danaher has joined the list of manufacturers struggling to source electronic

components.

On Wednesday the Federal Reserve’s Beige Book summary of economic

conditions reported that supply chain bottlenecks and labor shortages had

slowed the pace of economic growth in much of the country. “Most districts

reported significantly elevated prices, fueled by rising demand for goods and

raw materials,” it noted.

NY Times - The Fed’s favorite inflation index remained at

30-year high as pay surged:

Annual inflation is climbing at the fastest pace in three

decades in the United States, keeping pressure on the Federal Reserve and the

White House as they try to calibrate policy during a tumultuous period marked

by widespread supply shortages, solid consumer demand and quickly rising wages.

Prices climbed by 4.4% in the year through September,

according to the Personal Consumption Expenditures price index data released

Friday. That beats out recent months to become the fastest pace of increase

since 1991.

The current pace of inflation has become an uncomfortable

political problem for President Biden and has created a delicate balancing act

for the Fed, which is still trying to coax the labor market back to full

strength. Employers may be struggling to fill jobs today and raising pay to

compete for workers, but that seemingly tight labor market belies a more

complicated reality. Many would-be employees remain on the labor market’s

sidelines, likely because of concerns about the virus and child-care issues,

and policymakers want to make sure that the economy is strong, and jobs are

available when they are ready to return.

“The big question for the Fed is: How much of this is really

transitory and how much of this is here to stay?” said Gennadiy Goldberg, a

senior U.S. rates strategist at TD Securities.

ShadowStats John William on Inflation and GDP Growth:

ShadowStats says actual

inflation is at 13% vs BLS reported “headline” CPI is 5.4% non-seasonally

adjusted Year over Year.

Irrespective of GDP Reporting Gimmicks, Real

Third-Quarter 2021 Economic Activity Is Turning Down Anew as the Inflation

Surge Continues. Third Quarter ShadowsStats Corrected GDP Contracted by

0.05% (-0.05%). Amidst surging

inflation, the “advance” estimate of Third-Quarter 2021 Gross Domestic Product

softened to an inflation-adjusted annualized “real” growth of 2.02%, down from

6.73% in Second-Quarter 2021, yet all that GDP “growth” was in inventory

buildup, not in sales (Bureau of Economic Analysis – BEA).

Headline Year-to-Year GDP Inflation Hit a 38-Plus Year

High of 4.53%. September 2021

Finished Goods Producer Price Inflation Hit a 41-Year High of 11.8%, with the

Final-Demand Producer Price Index (FD-PPI Series Created in 2009) at a Record

8.6%. Alternate-CPI Measure Suggested

a 13.9% year over year consumer price increase.

WSJ - Investors Buy Oil on Inflation Fears, Pushing Prices

Even Higher:

Fund managers like Luc Filip, head of investments at SYZ

Private Banking in Switzerland, are contributing to a rally that has pushed oil

prices to their highest level since the 2014 energy bust. While energy-futures

markets are more typically the province of producers and commodities-focused

hedge funds, an oil rally that shows no signs of slowing is now exerting a pull on traditional money managers who run portfolios of

stocks and bonds.

Because commodities prices tend to rise alongside inflation,

they can protect investment portfolios against its erosive effects. When

combined with other commodities like copper and gold, energy is “quite a decent

hedge,” said Mr. Filip, who has been buying energy futures and selling

longer-dated bonds that will lose value if inflation turns out to be high for

longer than expected.

Traders and analysts say that some of the recent oil gains

could be explained by inflation worries, especially on days with no news about

supply that might drive trading by the usual players such as commodities

brokers and oil producers.

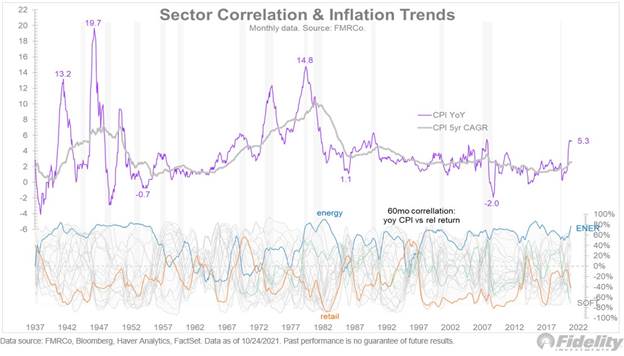

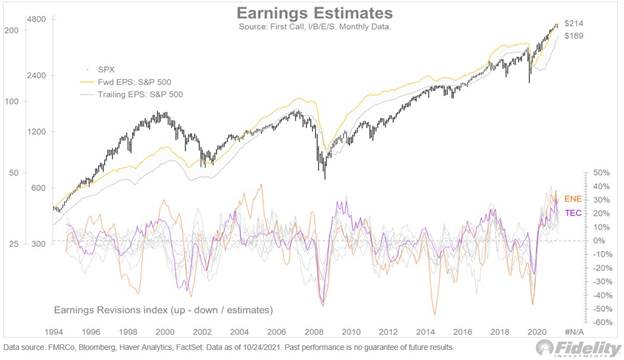

Tweet by @TimmerFidelity – Inflation and Energy Stocks:

Unlike other sectors, energy's correlation to inflation is consistent.

This shows the rolling five-year correlation between year-over-year sector

returns and the year-over-year change in the CPI. Energy is the winner in the

structural inflation-hedge department.

The energy sector is moving up! It’s remarkable how the energy earnings

estimates have been upgraded so dramatically.

Bloomberg - Peter Thiel says the high price of Bitcoin

indicates the economy is facing real inflation:

Peter Thiel said Sunday at the second National Conservatism

Conference that the high price of Bitcoin indicates the economy is facing

real inflation.

The tech billionaire said price rises aren’t transitory and

criticized the Federal Reserve for not addressing inflation and failing to

recognize its seriousness.

The Fed isn’t even acknowledging the problem, Thiel said, and

is guilty of embracing the theory that it could print money without triggering

inflation. He said the Fed is in a state of “epistemic closure,” a philosophical

term that means close-mindedness.

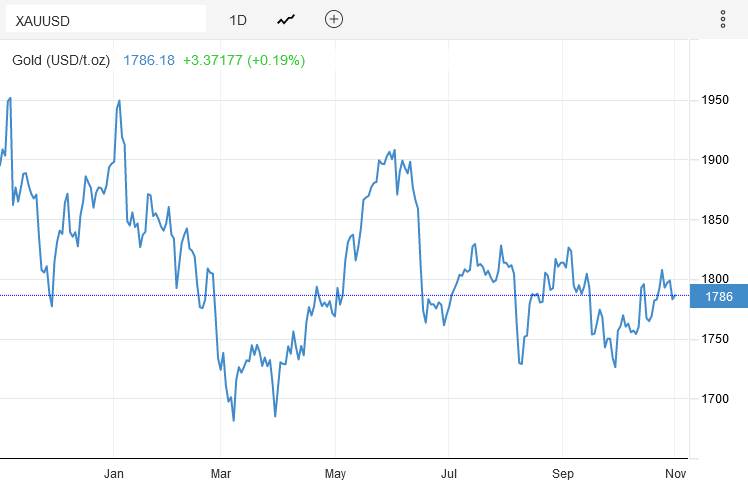

Trading Economics -

Gold Price Outlook:

Gold fell more than 1% toward the $1,775 a troy ounce level

on Friday, moving away from a 6-week high of $1,807 hit on October 25th, as the

U.S. dollar index rebounded from a 1-month low and Treasury yields

climbed higher. Among US data, personal spending beat market forecasts and core

PCE inflation came in in line with expectations while the employment cost

index rose at a record pace.

Elsewhere, the European Central Bank (ECB) pledged to

continue with the pandemic-era asset purchases program until at least March

2022 and left its rate hike outlook unchanged, even as the Eurozone economy

is faced with multi-year high inflation rates. Investors now look forward

to the Federal Reserve interest rate decision next week for further guidance on

policy outlook.

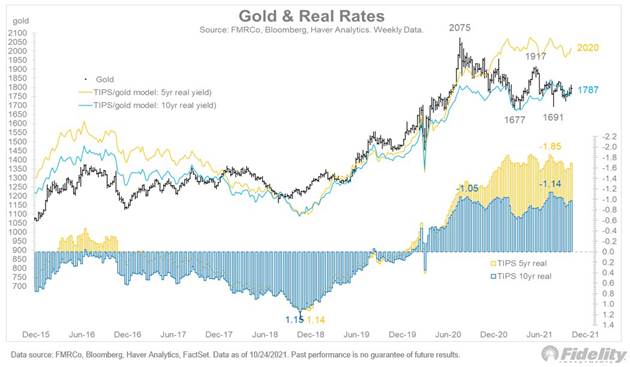

Jurrien Timmer of Fidelity – a Gold skeptic:

Where's

the glitter? If both nominal yields and inflation breaks their rise

from here, it may leave gold pretty much where it has been:

going nowhere. Gold follows real rates, and real rates haven’t budged in

over a year.

Curmudgeon: It’s been a huge

disappointment that despite negative real interest rates, negative real yields

on stocks and rising inflation Gold has gone nowhere.

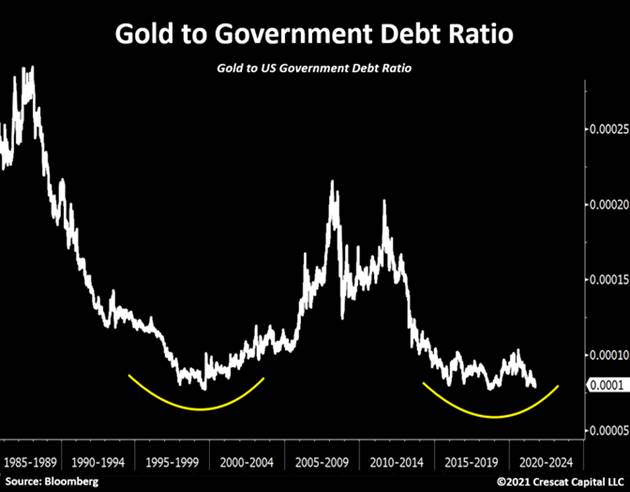

Tweet by @TaviCosta – Gold to

Government Debt Ratio:

Interestingly,

as the government has continued to pile on more and more debt, gold has

underperformed. Such a phenomenon is

unsustainable in our view.

Today, the

setup today looks just like it did in the early 2000s ahead of a 10-year

precious metals bull market.

…………………………………………………………………………………………………………………………..

End Quote (repeated from last week as it’s so apropos):

Money

printing is about redistribution - "Everyone wants to live at the expense

of the state. They forget that the state lives at the expense of

everyone."

Frederick Bastiat was a French economist, writer, and a prominent member of

the French Liberal School.

Stay healthy, enjoy life,

success, good luck and till next time….

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies

and government policies. Victor started

his Wall Street career in 1966 and began trading for a living in 1968. As

President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the

firm's research and development platform, which is used to create innovative

solutions for different futures markets, risk parameters and other factors.

Copyright © 2021 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).