Middle

Class and Small Business are Victims of Fed Monetary Policy

by The Curmudgeon

Introduction:

In an earlier post this year, the

CURMUDGEON opined that most of America was still in a bear market. Recent evidence seems to corroborate that

assertion and conclusively proves that the Fed's reckless monetary policy (QE

and ZERO interest rates) is destroying the middle class.

Analysis of

Economic Data:

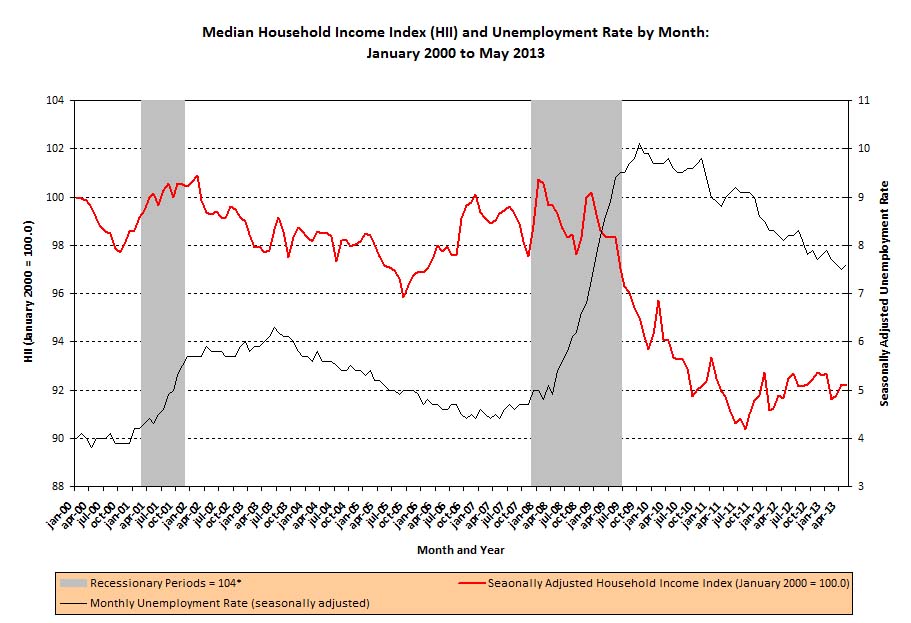

1. Let's start by updating disposable income. The chart below from Sentier

Research plots the median household income index vs. the seasonally adjusted

unemployment rate. As you can clearly

see, household income is way below its level in June 2009 when the recession

officially ended. It's now lower than in

September 2012, when the Fed started its massive $85B per month debt purchases

in Sept 2012. According to Sentier Research, "Real Median Income" has

dropped 8.5% from early 2008 to date.

2. The unemployment rate has NOT significantly

improved. Note that the unemployment

rate was 7.8% in September 2012 and is now only 0.2% lower at 7.6%. And today's 7.6% unemployment rate is

much higher than it was five years ago, as can be seen from the BLS chart and table.

3. What about the labor participation rate,

which continues to hover around 32-year lows?

The NY Times says

it's NOT coming back!

Binyamin Applebaum of the NY Times wrote:

"Lots of

people lost jobs during the Great Recession. In the aftermath, the great

surprise has been how few are looking for new jobs. Labor force participation,

the share of adults working or trying to find work, has stagnated at about 63.5

percent, almost three percentage points below the pre-recession level. The unemployment rate has dropped almost

entirely because of this decline in labor force participation. In other words, it

has not fallen because people are finding jobs. It has fallen because fewer

people are looking for jobs."

Comment: So even the incrementally small drop in

unemployment during the Fed's QE and ZERO interest rate policy is a

fake-out! Less people are actually

employed now and many of those are in low paying jobs or working part-time.

4. The following analysis was provided by Victor

Sperandeo to illustrate today's lower standard of living for America's

middle class:

"Using the

government's own CPI data from 1971 to date, the compounded rate of inflation

was 4.25%. The median income of

$7,734.00 in 1971 translates to $45,366.04 through June 2013 using that

rate. Nominal median income in 2011 was

$50,054. That's an annual increase of

only 0.23% of real wage growth! However,

when you factor in "progressive income taxes,"

and the additional government user taxes that did not exist in 1971, you can

easily see why the middle class has a lower standard of living today than 42

years ago."

5. Sperandeo believes that "massive

future inflation will be spawned from policies of Obama and Bernanke over

the last 4 1/2 years. Their actions make

clear that they have no concern for the potential (and actual current)

collateral damage being done with QE and 0% interest rates. Fed Chair Ben Bernanke has stated that the

amount of QE could increase further if economic conditions deteriorated. That would add to a never-ending binge of

paper money in an attempt to keep the economy from recession, while destroying

the nation in the process."

6. Victor believes the Obama administration and

Fed policies are impeding GDP growth by making it much more difficult for

small business' to be formed and survive.

He wrote, "Anything that is an obstacle to creating new businesses

is harming the common people. This means

whatever raises the costs -primarily taxes, inflation and regulations of

business - or lowers the incentives to go into business - are a detriment to US

workers jobs and income."

Conclusions:

In the last 4

1/2 years GDP is growing at real rates

of less than 2%, but the S&P 500 and other popular stock market averages

have compounded at double digit rates and are now at (or close to) all-time

highs. During the same time period, real

median income is down 8.5%, fewer people are working, and those that are have

not had wage increases that have kept up with inflation. The Fed continues to maintain a policy

that has greatly harmed the middle class, but has been a huge benefit to large

corporations and wealthy stockholders.

Sperandeo fears

the U.S. will eventually become one big Detroit. "One day America's debt, plus the

obligatory interest payments, will catch up with reality. Sadly, the nation at large will suffer a

terrible ending as a result."

The CURMUDGEON

is not as pessimistic as Victor. We are

hopeful that government policies will change for the greater good and stimulate

real economic growth. That would create higher

paying jobs and raise the standard of living for many Americans. However, we think that some unexpected crisis

will be needed to trigger such a policy rethink and bold action plan. Let's hope that it won't be too painful.

Till next time.....................

The Curmudgeon

ajwdct@sbumail.com

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.