Valuations Explode with Investors Confident Its

Different This Time

By the

Curmudgeon

Introduction:

More quick takes and graphs this week. Please let us know what you think.

Victor is still unpacking in his new apartment. Please send him your best wishes! He is researching a significant topic that

well reveal if you email the Curmudgeon (ajwdct@gmail.com).

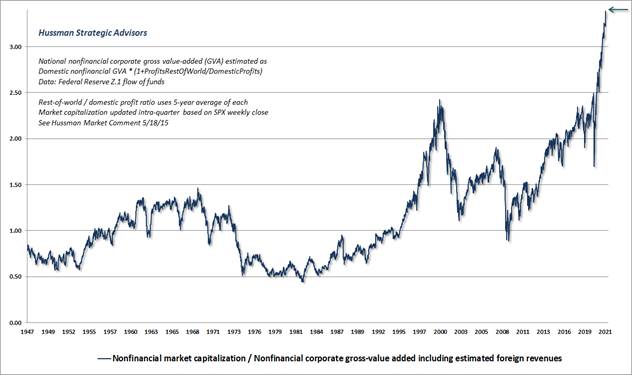

John Hussman - Valuation Update:

Its critical to understand just how extreme

valuations have become. The chart below shows the valuation measure that we

find best correlated with actual subsequent S&P 500 total returns over a

century of market cycles: the ratio of nonfinancial market capitalization to

corporate gross-value added, including estimated foreign revenues.

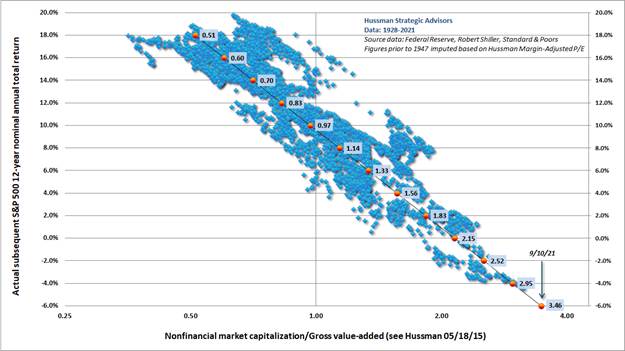

The plot below shows the log of MarketCap/GVA

versus actual subsequent 12-year S&P 500 total returns across

history. We dont yet know the actual subsequent 12-year return, but given the

current extreme, investors would require a rather large positive error simply

for that total return to be zero.

An investment security is nothing more than a claim to some

expected stream of future cash flows. Elevated valuations do two things: they

reduce the long-term return that one can expect from a given stream of future

cash flows, and they increase investment duration the sensitivity of prices

to small changes in expected return. Depressed valuations create a margin of

safety in the form of higher expected return and lower duration. Extremely

elevated valuations do exactly the opposite.

BofA - S&P 500 up 100% from COVID trough, EPS up

50%:

The S&P 500 has risen 19% YTD, led by

stronger-than-expected EPS (fwd EPS +29% YTD).

However, we see both cyclical and secular risks ahead for earnings: (1) margin

pressure from inflation (see our report entitled When good inflation goes bad),

(2) peak globalization, where globalization has been a big driver of margin

expansion over the last few decades, and (3) potential for corporate tax hikes,

which could wipe out much of earnings growth next year.

The market is statistically overvalued vs. history

on 15 out of the 20 metrics we track, and our long-term valuation model (r-sq:

80%) is suggesting negative 10-yr returns for the S&P 500 for the first

time since 1999. The only valuation reads that favor stocks are relative to

bonds, and relative to long-term growth expectations (which are at risk). TINA

("there is no alternative") remains a compelling argument for

income-investors to buy stocks, especially amid rising inflation where bonds

offer no inflation protection.

BofA - Monster Reallocation Cash-to-Stocks- Equities

flows (weekly and 4-week MA, $bn). Weekly Flows: $51.2bn to stocks (largest inflow since March

2021):

Chart courtesy of BoA Global

Research

BofA - It's different this time:

4.7 million pandemic deaths, $32 trillion policy

stimulus, $840 million per hour central bank asset purchases, lowest rates in

5000 years, global stock market cap up $60 trillion in 18 months, GDP >10%,

CPI>5%, house prices >20%, largest worker shortages in 50 years; most

unconventional cycle highly unlikely to follow conventional path.

..

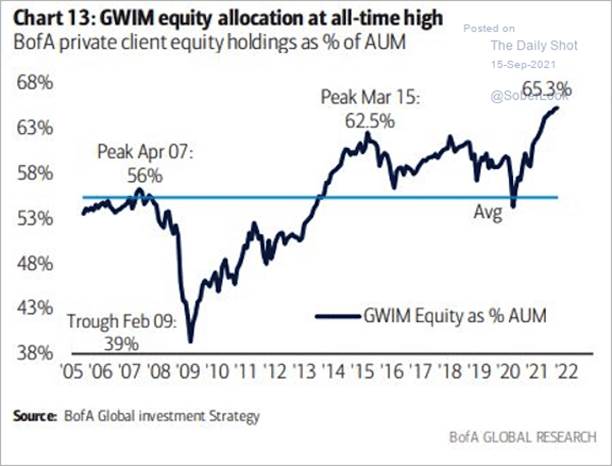

Lev Borodovsky, PhD - The

Daily Shot:

"BofAs private

clients have never had this much exposure to stocks." Thats shown in

this graph:

WSJ - Junk-Debt Sales Soar Toward Record Year:

The $3 trillion market for low-rated companies debt

is having its best year ever, powered by a rebounding economy and investors

demand for any extra yield.

Low rated U.S. companies have sold more than $786

billion of junk-rated bonds and loans so far in 2021, according to S&P

Global Market Intelligences S&P. That tops the previous high for a full

year in data going back to 2008.

The record issuance marks a notable rebound from

March 2020, when investors worries about widespread bankruptcies and defaults

sent prices for low-rated debt slumping. Now, low interest rates and a

stimulus-fueled economic rebound that has supported companies with weaker

credit ratings have boosted the appeal of riskier debt.

Junk bonds and so-called leveraged loans are

typically issued by companies with significant debt relative to their earnings,

making them more sensitive to the economys trajectory. Economists surveyed by

The Wall Street Journal expect the U.S. to grow around 6% this year and

3% in 2022.

In the junk-bond market alone, U.S. companies have

issued more than $361 billion of bonds with speculative-grade credit ratings

through Sept. 14, according to S&P Global Market Intelligences LCD. That

is the second-most junk bonds ever sold in a single year and on pace to surpass

2020s $435 billion record, analysts say.

This is still likely to be one of the lowest

periods for spread volatility on record and will continue to help support

the relative appeal of high yield to investors, Deutsch Bank analysts wrote.

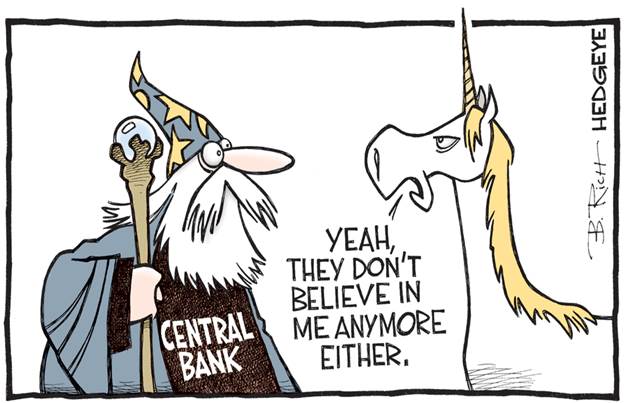

HedgeEyes Keith McCullough the Nefarious ECB:

Earlier this week we learned that the European

Central Bank (ECB) has been hiding its long-term inflation forecasts.

Yes, you read that righthiding. Their forecasts

completely contradicted their nonsensical transitory inflation lie.

Were caught in a nefarious news cycle of monetary

and fiscal officials acting against the public good. Theyre selling snake

oil to the people as inflation poisons the well.

Narratives and stories abound, numbers and data be

damned. The Fed and ECB deliberately turn a blind eye to the data. The Old Wall

is clueless on how to interpret it.

Meanwhile, narrative-sellers spin data in whatever

way generates the most clicks. Heres

an illustration of that:

Doomberg - We Are Running Out of Some Stuff:

Sometimes I think Im taking crazy pills. In my real

life, everywhere I look I see less choice and higher prices.

Everybody I talk to has a story about something they need to buy but cant.

Many big-ticket items have unprecedented lead times, assuming you can get them

at all. My friends in the corporate world are focused on raising prices ahead

of their increasing input costs. They are also staying up at night worried

about accessing supply altogether be it parts, materials, or even labor. I

see shrinkflation, both in the size of the consumer goods I buy and in

the level of service provided, compared to the pre-Covid period.

Get ready to keep paying more for less during the

Thanksgiving/ Christmas shopping season. These shipping costs will be passed on

to the consumer. How long before Biden shakes his angry fist at pandemic

profiteering by the dirty shipping cartel?

The One Thing That Matters Is Inflation, Gavin Baker:

Gavin Baker thinks that inflation will become the key

factor determining the direction in financial markets.

If you go back to 2010-11, the last time there was

significant quantitative easing, there were two remarkable open letters to Fed

Chairman Ben Bernanke in the Wall Street Journal, signed by the worlds

greatest macro investors and economists. Both said basically the same thing: QE

is a terrible risk, youre going to unleash hyper-inflation, and you have to stop. These op-eds were written with a lot of

conviction, and they were dead wrong. I think because of that, almost no one is

really pushing back on what the Fed is doing today. At the same time, unlike in

2010-11, very few people in the United States Congress are pushing back against

stimulus programs, and today the stimulus is a lot bigger. To me, that lack of

real pushback is concerning, just because inflation and deflation are the

two things that financial markets cannot abide.

End Quote:

When the public woke up to the historical merits of

common stocks as long-term investments, they soon ceased to have any such

merit, because the publics enthusiasm created price levels which deprived them

of their built-in margin of safety, and thus drove them out of the investment

class.

Then, of course, the pendulum swing to the other

extreme, and we soon saw one of the most respected authorities declaring (in

1931) that no common stock could ever be an investment. Precisely because the

old-time investor did not concentrate on future capital appreciation, he was

virtually guaranteeing to himself that he would have it.

And, conversely, todays investor is so concerned

with anticipating the future that he is already paying handsomely for it in

advance. Thus, what he has projected with so much study and care may happen and

still not bring him any profit.

If it should fail to materialize to the degree

expected he may in fact be faced with a serious temporary and perhaps even

permanent loss.

Benjamin Graham, The New Speculation in Common

Stocks

.

Stay healthy,

enjoy life, success, good luck and till next time

.

The Curmudgeon

ajwdct@gmail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been

involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies

and government policies. Victor started

his Wall Street career in 1966 and began trading for a living in 1968. As

President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the

firm's research and development platform, which is used to create innovative

solutions for different futures markets, risk parameters and other factors.

Copyright © 2021 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating,

copying, or reproducing article(s) written by The

Curmudgeon and Victor Sperandeo without providing the URL of the original

posted article(s).