Cost of Money at 5,000 Year Lows Even as Inflation

Surges

By the

Curmudgeon

Introduction:

We provide another “food for thought” column which we

hope you find informative and useful.

Wish Victor good luck in his new apartment which he

moved into this past week!

Fed’s Kaplan, Rosengren to Sell All Stocks Amid Ethics

Concerns:

Boston Fed chief Eric Rosengren and Dallas

Fed’s Robert Kaplan were actively trading in a range of investments

during a year in which the central bank took sweeping policy actions to protect

the U.S. economy from Covid-19.

Rosengren and Kaplan’s trading activities – revealed

among the annual disclosures filed by all 12 regional Fed presidents last month

– drew sharp criticism at a time the Fed is already under fire from some

quarters for monetary policies that have elevated asset prices, which

disproportionately benefit wealthier Americans.

“At a time when they are being roundly criticized and

to the extent to which the policies have made the rich richer, you need to

question the optics of what these guys were doing,” said Mark Spindel, chief

investment officer of Potomac River Capital in Washington. “It doesn’t shed

positive light on them.”

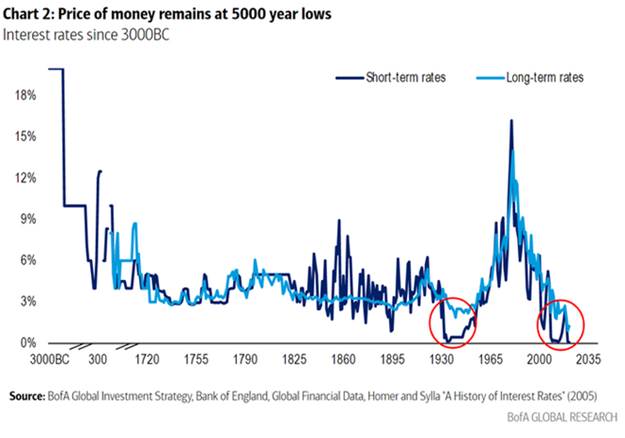

Bond Bubble- Biggest of All Time?

Being at a multi-millennia

low in rates means that bonds are also at a 5000-year peak in valuation. Now, I think that qualifies as a top

contender for the biggest bubble ever!

In many ways, conditions today seem the opposite of what they

were forty years ago as bond and stocks were poised to make their historic

runs. Yet, investors are positioned as if it’s 1982 all over again.

Atlanta Fed's GDP Forecast Cut by 41%:

The highly respected and closely watched Atlanta

Fed’s GDPNow forecast for the third quarter has been slashed by 41%

since August 2nd – from 6.3% (annual seasonally adjusted) GDP growth to a tepid

3.7% projected GDP growth as of September 10th.

The GDPNow forecast is constructed by

aggregating statistical model forecasts of 13 sub-components that comprise GDP.

Other private forecasters use similar approaches to “nowcast” GDP growth.

However, these forecasts are not updated more than once a month or quarter, are

not publicly available, or do not have forecasts of the sub-components of GDP

that add “color” to the top-line number. The Atlanta Fed GDPNow model fills

these three voids.

Absolutely Everyone is Buying Stocks, For Now:

On Tuesday I wrote about the spectacular surge of

investor flows, particularly retail investor flows, heading into

stocks. Here is yet another chart, this one from Strategas, that indicates

how extraordinary the trend is. It compares flows into equity exchange traded

funds for each of the past 15 years.

And this is happening at a time when equity mutual funds are

not losing assets to ETFs as quickly as in most years, making it even more

remarkable. Here is how Todd Sohn of Strategas described the phenomenon

to me: “It’s the persistency of the equity rally, up 100 per cent since last

March with barely a pullback. It’s everybody into the pool, it’s

everything, every region, every sector.”

Nikolaos Panigirtzoglou,

the JPMorgan strategist’s estimate of the composition of the global

portfolio, that is, all the stocks, relative to all the bonds and cash:

“If you look at this chart there have been diminishing peaks. Yes, there is a

lot of liquidity in the system, but relative to the size of the equity market,

it is pretty low, and that is a warning sign. [The

share of wealth in equities] can keep going up, but we are reaching territory

where if sentiment changes for retail investors the vulnerability is very

high.”

U.S. Stock Market Faces Risk of Bumpy Autumn:

Analysts at firms including Morgan Stanley,

Citigroup Inc., Deutsche Bank AG and Bank of America

Corp. each published notes this month cautioning about current risks in the

U.S. equity market. With the S&P 500 already hitting 54 records through

Thursday this year—the most during that period since 1995—several analysts said

that they believe there is a growing possibility of a pullback or, at the

least, flatter returns.

Behind that cautious outlook, the researchers said,

is a combination of things, including euphoric investment sentiment, extended valuations,

and anticipation that inflation and supply-chain disruptions will weigh on

corporate margins. In a Wednesday note, strategists at BofA Securities

said they saw little to be excited about, asking, “What good news is left?”

They added, “A lot of optimism is already priced in.”

Bank of America team

led by Savita Subramanian, head of U.S. equity and quantitative strategy, moved

its year-end price target for the S&P 500 price to 4250—a 4.7% reduction

from the 4458.58 level at which the benchmark index closed Friday. For 2022,

Bank of America set a 4600 price target for the end of

the year.

The analysts’ cautious outlook for U.S. stocks

presents a contrast to the so-called TINA—or “There Is No Alternative”—motto

that has dominated investors’ outlook for much of the past year. Because yields

on other assets such as bonds have been so low, many investors have justified

their continuous bullish positioning in stocks. Accommodative monetary policy

from the Federal Reserve has provided a continuous boost for equities this

year, too, as has the lure of big investment returns from a swath of companies,

ranging from meme stocks to Covid-19 beneficiaries.

In a note last week, Morgan Stanley strategists

wrote that they were downgrading their rating on U.S. equities to

“underweight,” saying they prefer stocks in Europe and Japan and view cash as

increasingly attractive to hold.

“We expect an understandable level of eye-rolling as

we move overweight cash,” the Morgan Stanley team including Andrew

Sheets wrote in the note, adding the caveat that select international equities

and other assets are attractive relative to cash. The note continued, “Morgan

Stanley strategists forecast cash to outperform U.S. equities,

government bonds and credit over the next 12 months.”

End Quotes:

“The trouble with the world today is that the

intelligent people are full of doubts while the stupid ones are full of

confidence.” – American poet Charles Bukowski

“In my 42 years of financial market experience,

anti-bubbles are where immense amount of wealth are made and bubbles are where

they are lost.” – Author David Hay

“The bull market is old, valuations are very high,

and massive inflows cannot last forever.” – Robert Armstrong, FT Unhedged

“Macro conditions are deteriorating, and Bear Market

Probability is rising. The trend of the dollar bears watching as it's in a poor

cyclical and seasonal window.” – Jason Goepfert, Sentiment Trader

……………………………………………………………………………………………….

Stay healthy, enjoy

life, success, good luck and till next time….

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies

and government policies. Victor started

his Wall Street career in 1966 and began trading for a living in 1968. As

President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the

firm's research and development platform, which is used to create innovative

solutions for different futures markets, risk parameters and other factors.

Copyright © 2021 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).