The Fed Pours Gasoline on an Already Red-Hot U.S. Real

Estate Market

By the Curmudgeon with Victor

Sperandeo

Introduction:

With all the noise about the

stock, bond, and crypto-currency manias, the residential real estate bubble (if

there is one?) has been mostly neglected by the mainstream media. That’s despite a red-hot U.S. housing market.

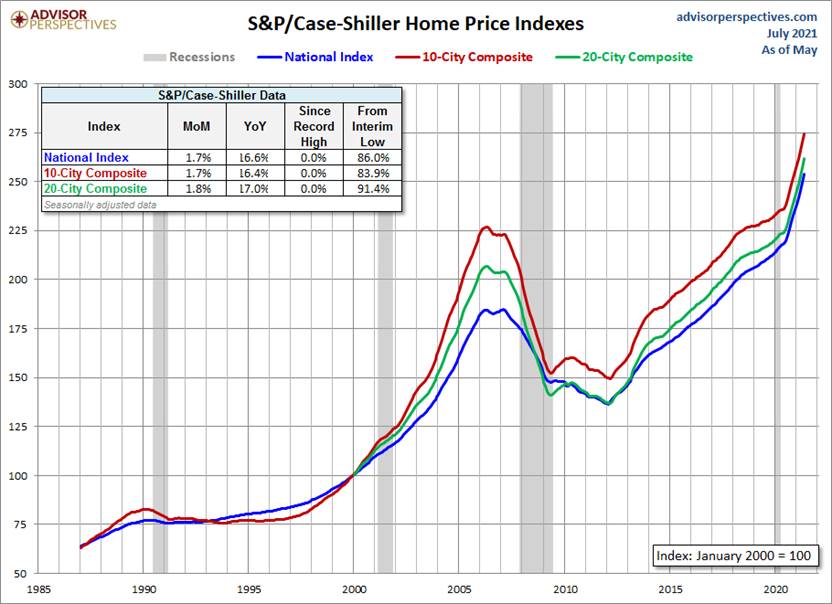

The S&P CoreLogic Case-Shiller Index,

the leading measure of U.S. home prices, posted a 16.6% annual gain in May, up

from 14.8% in April. That’s the highest

reading in more than 30 years of data and the 12th straight month of accelerating

prices. The 20-City Composite posted a 17% annual gain, up from 15% a month

earlier. The 20-City results surpassed analysts’ expectations of a 16.3% annual

gain, according to Bloomberg consensus estimates.

Low interest rates and

historically low inventory continued to fuel home buying. Last week, the National

Association of Realtors reported that the median existing-home price for

all housing types in June hit $363,300, the highest level recorded since

January 1999.

Home price increases were

recorded in all 20 cities, and the gains in the 12 months ended in May exceeded

the gains in the 12 months ended in April. Prices in 18 of the index's 20

cities now stand at all-time highs.

Is that a healthy price rise

based on fundamentals or is it yet another Fed created

bubble?

Let the reader decide, but you

already know our opinion.

Anecdotal Evidence:

It’s been reported that home

price bidding wars have become common, with many buyers forced to pay all

cash. Some bids are coming in $1 million

over the asking price. Stories abound of

buyers signing contracts on homes without even doing a walk through. Some real

estate agents are advising buyers to forgo inspections, saying they will just

slow the process.

“I witnessed the price rise firsthand.

I recently returned from a family vacation in the North Carolina mountains,

where many homes now sell for double or triple the price compared to just a

couple of years ago,” wrote Lisa Brown, CFP®, CIMA® in a Kiplinger article

titled, Red-Hot Housing Market Today Could Burn Real Estate

Professionals Tomorrow.

Industry executives and economists

agree this explosion in home values is unsustainable, as home prices can't go

up 20% year-over-year forever, especially with the below 3% trend GDP growth

the U.S. has experienced for many years.

Expert Opinions:

Here are a few selected quotes

from real estate market professionals:

“It’s an incredibly strong

housing market,” said Hilla Sferruzza, chief

financial officer at home builder Meritage Homes Corp.

“The market’s strength

continues to be broadly-based. Housing

price growth set a record for the second consecutive month,” said Craig J.

Lazzara, managing director and global head of index investment strategy at S&P

Dow Jones Indices, in a press statement. “A month ago, I described April’s

performance as 'truly extraordinary,' and this month I find myself running out

of superlatives."

“This month's S&P Case

Shiller Index highlighted a housing market in full swing during May 2021, when

strong demand and insufficient supply pushed home prices up at a

record-breaking pace,” said Realtor.com Senior Economist George Ratiu in

a statement prior to the results. “The combination of historically-low mortgage

rates, business re-openings and the lifting of pandemic restrictions fueled a

buying frenzy with multiple bids, price escalation clauses and contingency

waivers. The summer buying season is fully underway, with many families seeking

to take advantage of the current market and favorable financing to find their

next home before the start of the school year.”

“Despite home prices

skyrocketing, the acceleration in home price growth has not deterred

prospective buyers’ desire for ownership,” CoreLogic Deputy Chief

Economist Selma Hepp said in a press statement prior to the results. “In fact,

the number of homes selling over the asking price continues to rise with more

than half of homes sold now closing above the original listing price.”

“I expect that home price

growth will continue to inch upwards until more existing homeowners choose to

sell their homes and more new homes come on the market,” said Bill Dallas,

President of Finance of America Mortgage, in a statement prior to the

results.

"We have a housing

shortage. In shortages, prices don't decline," said Lawrence Yun, chief

economist at the National Association of Realtors. "Some buyers are

simply being priced out," he added.

“It’s making me nervous that

you’ve got this incipient housing bubble, with anecdotal reports backed up by a

lot of the data,” James Bullard, the president of the Federal Reserve Bank

of St. Louis, said during a call with reporters Friday. He doesn’t think

things are at crisis levels yet, but he believes the Fed should avoid fueling

the situation further. “We got in so much trouble with the housing bubble

in the mid-2000s.”

"In some ways this is an

even hotter housing market than before the Great Recession," said Aneta

Markowska, chief economist at Jefferies. "But the risk of this turning

into a bubble is much lower."

[Curmudgeon asks: Really?]

U.S. Home Price Index Charts:

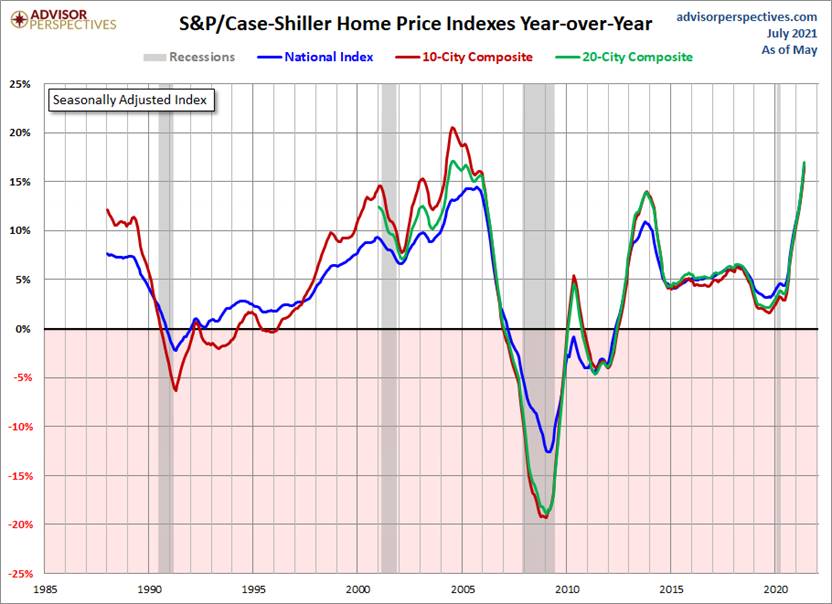

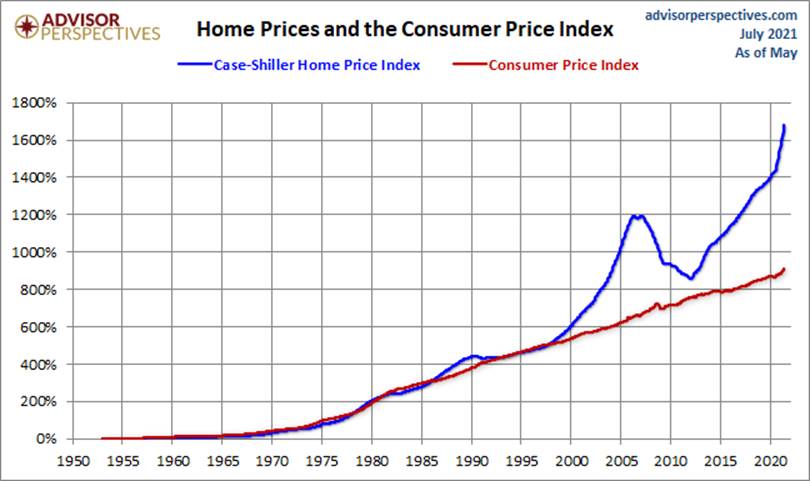

The graphs below tell the

story better than words:

Image

Credit: Advisor Perspectives

.….…......…......…....….…......…....….…......…....…....….…....….…....…....….…

Image

Credit: Advisor Perspectives

...….…....….….…......…....….…....….........….…...….….......…...…...…....…….

Image

Credit: Advisor Perspectives

...….…....….….…......…....….…....….........….…...….….......…...…...…....…….

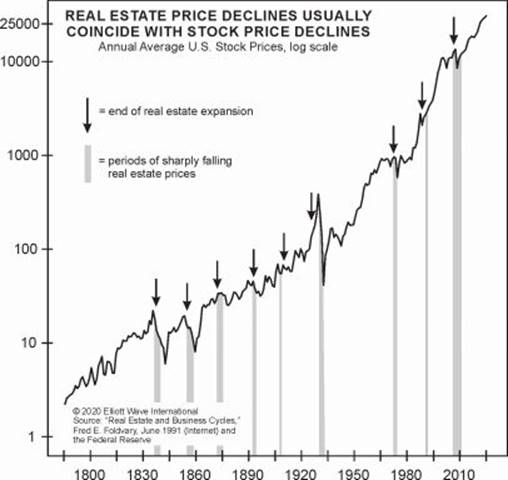

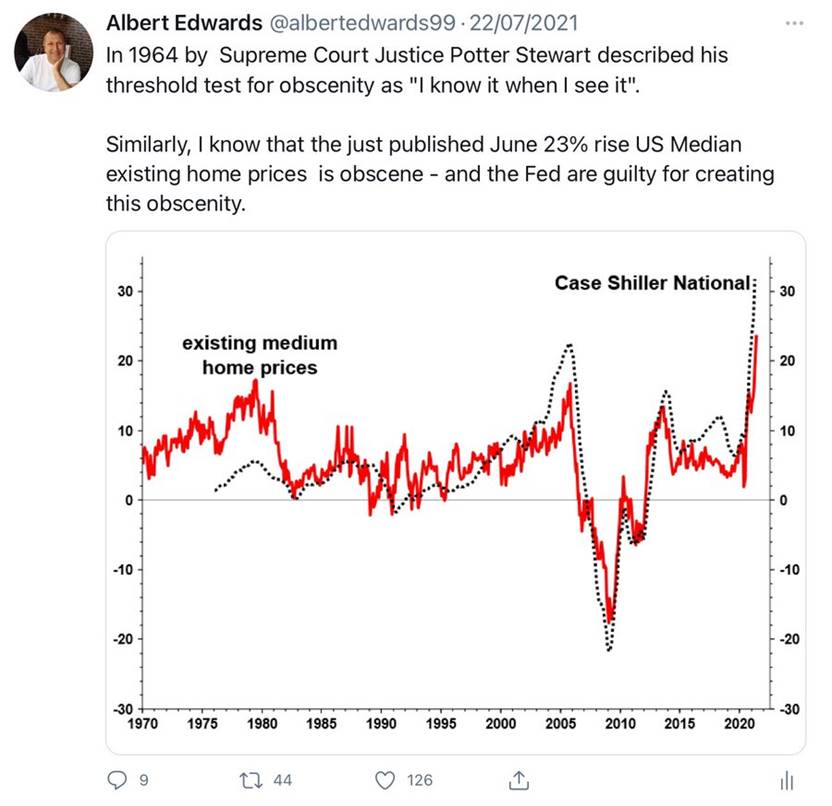

Elliott Wave’s Robert Prechter says the trends of the real

estate and stock markets tend to be strongly correlated. That’s shown in this

chart:

Source:

Albert Edwards, SOGEN via Twitter

.......…...…...….…...….......…...…...…...….….…...….....….…...….…...….…...…..

Victor’s Comments:

The alternative for companies

to effectively raise prices is to shrink the size of what’s in the bag. So, the price stays the same, but you have to buy more in order to get the same quantity. The same

is true for real estate, as per the real-life problem I’m now dealing with.

26 years ago, I moved to

Dallas, TX from New York City and New Jersey. I rented a two-bedroom 1,950

square feet apartment for $2,100. The gas and electric utilities bill were

about $65.00. Today, the rent is $3,450.00 +171.53 for utilities.

[The Fiend first moved to a

small town in California 15 years ago and rented a small one-bedroom apartment

for $600 a month. The same apartment today (if you are lucky to find one

available) is going for $1,550 a month. Of course, wages are higher, but I don’t

believe they have matched the increase. People don’t seem to understand that it

isn’t how much money you have but what you can buy with it.]

Due to a fire in my apartment

building, I have to move out and am now urgently

searching for a new place to live. I can rent a two-bedroom apartment for

$3,350 without utilities, but I’d only get a “whopping” 1,330 square feet! To

get the 1,980 square feet I’ve had for years, it would cost me $6,900 a month

WITHOUT utilities.

This is a classical “get

less for more money” situation. Do

you get the picture?

Watching

Fed Chair Jay Powell explain inflation was hilarious. It was like an

Abbott and Costello “Who’s on First” baseball routine. Powell says inflation can run over their

arbitrary 2% target, because it was lower than 2% before? I wonder if Powell ever thought of starting

his base from 1970, when inflation was 3.92%?

Better yet, from 1913 at 3.09% inflation?

The Fed’s goal is apparently

to move the middle class into higher tax brackets via inflation, so that they

pay higher taxes which would partially reduce future budget deficits. In 24 years at the current 5% (and heading

higher) inflation rate, combined income tax rates of 50% (including Federal,

State and City taxes) would be common.

Assuming ONLY a 5% compounded

inflation based wage increase, an individual making an income today of $65,000

(Median household income was $68,703 in 2019

– the latest number available), would be making over $200,000. That would put that individual in today’s 37%

federal income tax bracket. But it’s

worse than that, because income tax rates will surely increase with massive

government spending needing to be offset by additional tax revenues.

[The Curmudgeon believes the

Fed’s hidden agenda for continued QE is to monetize the huge federal government

budget deficit].

Conclusions:

About half of small bankers

in a recent industry survey said the current state of the housing market poses

“a serious risk” to

the United States economy.

For sure, Fed monetary policy

has helped fuel the demand for residential real estate. Mortgage bond buying

and zero (Fed funds) interest rates make mortgages cheap, inspiring people to

borrow more and buy bigger homes.

“Interest rates are one factor

that’s supporting (real estate) demand, but we really can’t do much about the

supply side,” Jerome H. Powell, the Fed chair, explained during recent

congressional testimony.

The Fed’s policy-setting

committee voted Wednesday to keep monetary policy set to full-support mode,

which includes buying AT LEAST $40B of mortgage-backed securities each month.

To the Curmudgeon, the Fed is

like the guy who poured gasoline on an out of control

blazing fire, as it continues to buy mortgage bonds while the residential real

estate market is soaring.

Bank of America

acknowledged that "bubbles are notoriously difficult to identify in real

time." They only become obvious in hindsight, or so it seems?

Closing Quote:

“We felt a little bit more

comfortable paying more for the house to lock in low interest rates. Interest

rates are so low, and money is cheap. Why not do it?” David Pomeroy as reported in the NY Times.

Stay healthy, enjoy life,

success, good luck and till next time….

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies

and government policies. Victor started

his Wall Street career in 1966 and began trading for a living in 1968. As

President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the

firm's research and development platform, which is used to create innovative

solutions for different futures markets, risk parameters and other factors.

Copyright © 2021 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).