Picking

Up Nickels in Front of a Steam Roller

by The Curmudgeon

Introduction

Rob Arnott is one of the most respected names in global

investing. Founder & Chairman of

Research Affiliates, Rob’s firm manages and licenses over $150 billion,

including the PIMCO All Asset & All Authority Fund where he has 100%

of his retirement account invested. Mr. Arnott also sub advises mutual funds and ETFs for Schwab, Powershares and Nomura Securities.

In a July

15, 2013 PIMCO webcast for investment advisors, Rob shared his view on

various financial markets, said where the PIMCO All Asset & All Authority

fund was invested and why. This article

summarizes his key points, especially related to U.S. equities. We'll also review what Stephanie Pomboy of MacroMavens told Barron's

this past weekend.

Rob Arnott on the Current Market Environment

On the July

15th call, Rob described the current state of the U.S. stock market as "a

very late stage rally coming off already high valuations." He said he has an "aversion to U.S.

stocks" and has rebalanced his PIMCO All Asset & All Authority fund

(PAUDX or PAUIX) out of risk assets and into what he referred to as "cheap

assets," like emerging market equities and bonds. (The Curmudgeon notes

that "cheap assets" have a decided tendency to get cheaper when they

are in a strong downtrend).

The PAUDX/PAUIX

portfolio is currently 37% in "Risk Off" assets, 22% in Low Beta

assets, 16% in bonds and 21% SHORT U.S. equities (via PIMCO StocksPLUS AR Short Strategy Inst'l

shares). That U.S. stock short position is the fund's largest single holding!

On the webcast,

Mr. Arnott twice said that buying U.S. stocks now

is like "picking up nickels in front of a steam roller." It's simply not worth the risk at this

late stage of the Fed fueled bull market, which he said was not at all healthy

in terms of real economic growth.

PAUDX/PAUIX fund is keeping its "powder dry" by investing in

"market neutral alternative strategies" at this time. The fund "looks to acquire inflation

protection assets at cheaper prices, if they sell off due to talk of

deleveraging and the coming deflation."

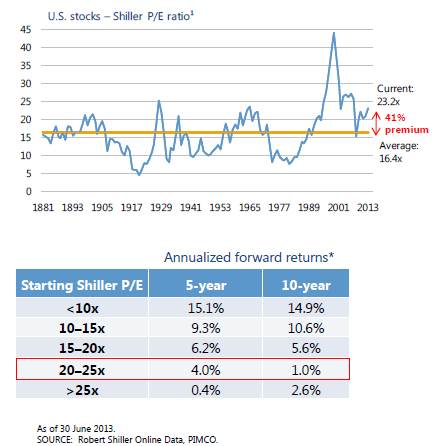

Are stocks

expensive? In the graph

below, U.S. equities, as measured by the S&P 500, are shown to have a Shiller

P/E1 of 23.2 (the latest Shiller P/E-as of July 15, 2016

- is actually 24.6 ). The 23.2 number represents a 43% premium to

its long term average of 16 (the current 24.6 Shiller P/E is 53.75%

premium!). That's also way above the

current S&P 500 P/E of 18.43 and the very controversial "forward

P/E" of 15.

When the Shiller

P/E is in the 20 to 25 range (it's now at the very upper end), U.S. stocks have

had an annualized 4% nominal 5 year return and a 1% annual 10 year return. That's a fact, not a prediction!

![]()

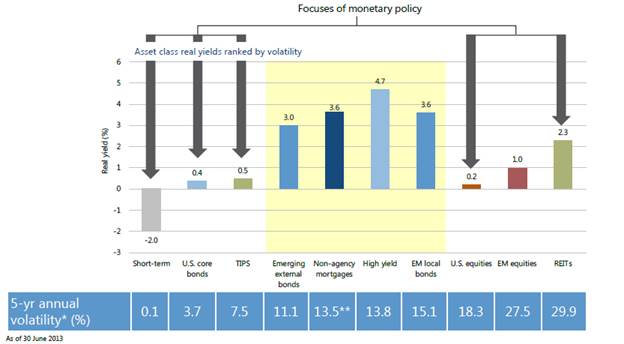

The downward

arrows in the figure below point to the asset classes that have been most

effected (distorted?) by the Fed's QE and Zero Interest Rate Policy

(ZIRP). Rob noted that short term

securities (e.g. 3 month T bills have a negative 2% forward real return - their

nominal interest rate is effectively 0 and there's a 2% annual inflation built

into the price of TIPS. Note also that

U.S. equities (S&P 500) are forecast to have only a 0.2% real yield2,

but have a 5 year annual volatility of 18.3% - not a very good risk/reward

ratio, especially at already expensive valuations as per the Shiller P/E Ratio

described above.

Barron's:

Mission Impossible Ahead- the Fed's job is to end the party, but how can it

do so without crashing the building?

"The credit

market has provided the funding for all the shareholder goodies that have been

holding stocks aloft,” Stephanie Pomboy of MacroMavens told

Barron's Kopin Tan on July 13, 2013.

Between January

and the start of the tapering talk in late May, the stock market added $2.8

trillion in market value. But the size of the U.S. economy expanded just $500

billion, according to Pomboy. Credit issuance during

this stretch totaled almost exactly $2.3 trillion (this is large companies

issuing debt). As rates jumped recently, the pace of monthly credit issuance

shriveled to $58 billion from $260 billion. "If growth - actual and

borrowed - dictates where stocks are headed, then the quartering of issuance in

the last six weeks portends ugly signs ahead," Pomboy

added.

Closing

Comment:

Indeed, second

quarter GDP forecasts have come down significantly and now look to be at or

below 1%. The U.S. stock market is expecting a significant pickup in growth in

the third quarter of 2.5%, and the fourth quarter of 3.0%. With continued

government spending cutbacks (sequester), higher crude oil and gas prices along

with the real estate market likely to slow (due to higher interest rates), it

is extremely difficult for the CURMUDGEON to see any acceleration in GDP or

corporate earnings growth.

But the market

really doesn't care about any of that now.

Only QE and ZIRP matter! We shudder to think what will happen when

"the jig is up?"

Till next time.....................

Notes:

1. The Shiller P/E (popularized by Prof. Robert Shiller and known

more formally as CAPE ratio or P/E-10) is the current price of the Standard

& Poor’s 500-stock index divided by the past decade’s average

inflation-adjusted earnings of the constituents of the index.

2.

The 0.2% real yield on the S&P 500 assumes NO PRICE CHANGE in

the coming year. It's not a total return

forecast, but rather the nominal yield minus the expected annual inflation

rate.

The Curmudgeon

ajwdct@sbumail.com

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.