NBER Declares COVID-19 Recession Over - Shortest on

Record!

By the Curmudgeon with Victor

Sperandeo

Introduction:

According to the National Bureau of Economic Research (NBER),

the "official" arbiter of U.S. business cycles, the coronavirus

induced recession ended last April, ending the shortest economic downturn in

U.S. history at only two months. What most analysts missed is that the

recession was over two months BEFORE the NBER said on June 8, 2020, that the

U.S. economy had peaked in February, marking the recession’s onset.

Isn’t a recession defined as 2 consecutive quarters

of declining GDP? Evidently NOT!

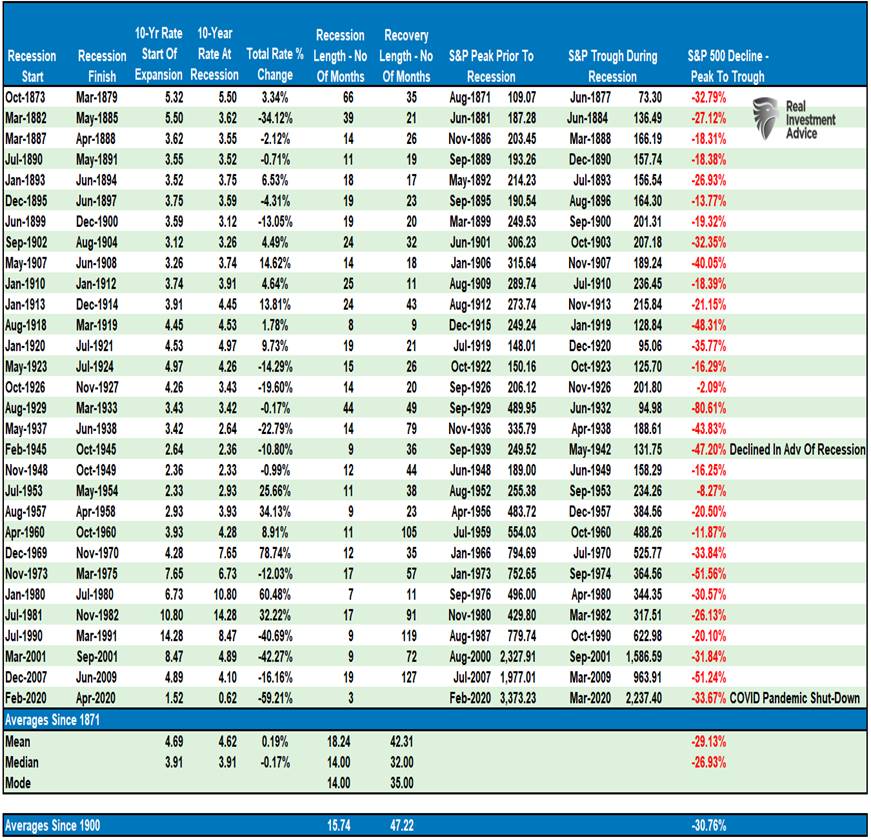

From February 2020 to April 2020, the U.S. economy

fell by 31.4% (as measured by real GDP), while U.S. stock markets plunged by

33%. Both of those declines are within

historical norms as you can see from Table in the next section of this article.

The NBER stated:

The

NBER chronology does not identify the precise moment that the economy entered a

recession or expansion. In the NBER’s convention for measuring the duration of

a recession, the first month of the recession is the month following the peak

and the last month is the month of the trough. Because the most recent trough

was in April 2020, the last month of the recession was April 2020, and May 2020

was the first month of the subsequent expansion.

In

determining that a trough occurred in April 2020, the committee DID NOT

conclude that the economy has returned to operating at normal capacity. The

committee decided that any future downturn of the economy would be a new

recession and not a continuation of the recession associated with the February

2020 peak. The basis for this decision was the length and strength of the

recovery to date.

In case you’re puzzled (as we are), have a look at NBER’s FAQ’s. Notably, the NBER stated that any subsequent

downturn would get labeled as a “new” recession.

That begs the question is the economic growth we’ve

seen in 2021 sustainable? John Williams

weighs in with his opinion, while Victor’s hard-hitting comments should shake

you out of the complacency that’s so prevalent today.

Recession Tables and Charts with Commentary:

The table below shows previous U.S. recessions dating

back to 1873 (we don’t have data from 1854 till then). As you can see, the median is 18.24 months vs

only two months in 2020.

Table courtesy of Real Investment Advice

...........................................................................................…

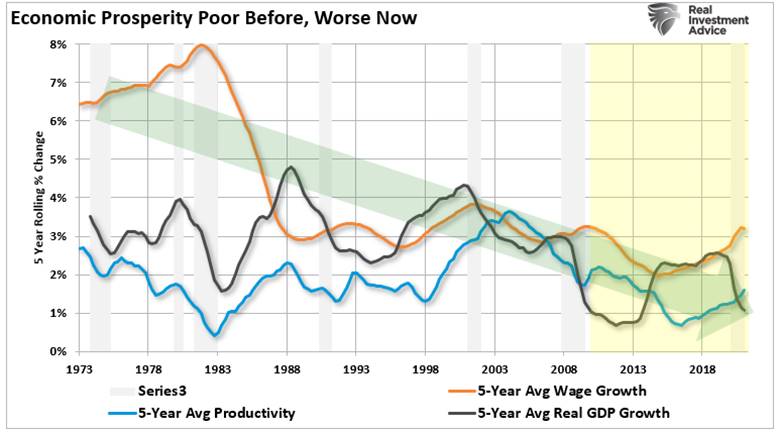

Below is a terrific chart showing how horrible the

5-year average real GDP has been since the 2008 great recession. It’s still declining with a current reading

of only 1%.

Chart courtesy of Real Investment Advice

...........................................................................…..........….

Curmudgeon Comment and Analysis:

To be sure, the U.S. is the world’s largest economy.

Yet, in the last two decades, its growth rates have been decreasing. In the

1950’s and 1960’s the average growth rate was above 4%, in the 70’s and 80’s

dropped to around 3%. In the last ten years, the average rate has been below

2%. Yet that hasn’t stopped the U.S.

stock market from exponential rising prices (especially since the March 2009

bear market bottom).

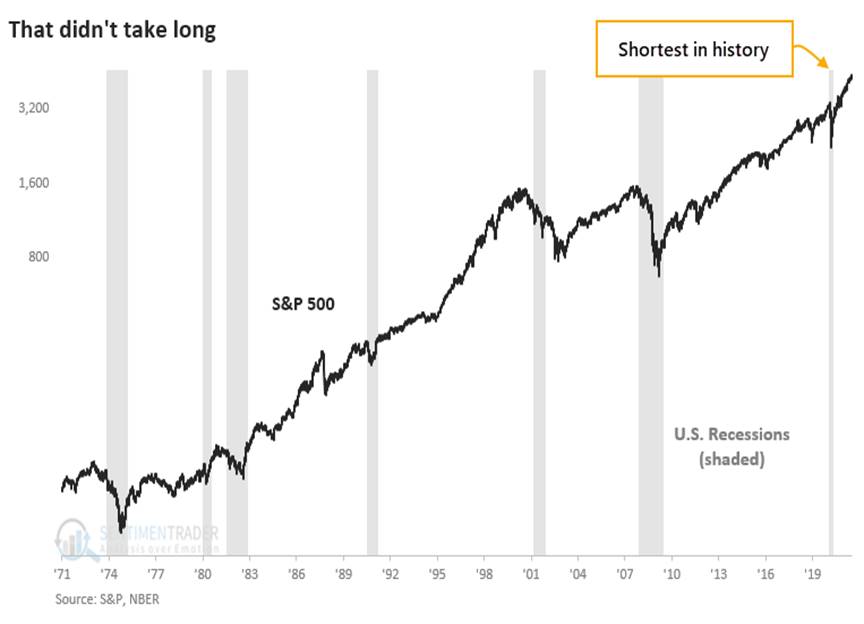

In the last year, the NASDAQ 100 (dominated by big tech

stocks) was up an incredible 43.2%.

Since the March 6, 2009 low of 666, the S&P 500 has compounded in

the high double digits, closing at 4,411.79 on Friday, July 22nd. That’s a bull market gain of 662.5% not

including dividends.

Isn’t it ironic that as economic growth has slowed

precipitously, stock prices have increased at a rate so much higher than when

economic growth was much better? We’ve

explained this conundrum many times, but the Curmudgeon is still in disbelief.

...…....…....…....…..…....…....…....…..…....…....…....…....…..…....…..….

Graph of S&P 500 with Recessions Shaded:

Chart courtesy of Sentiment Trader

.....…......….…....…......….…......…....…......….…....…......…............…

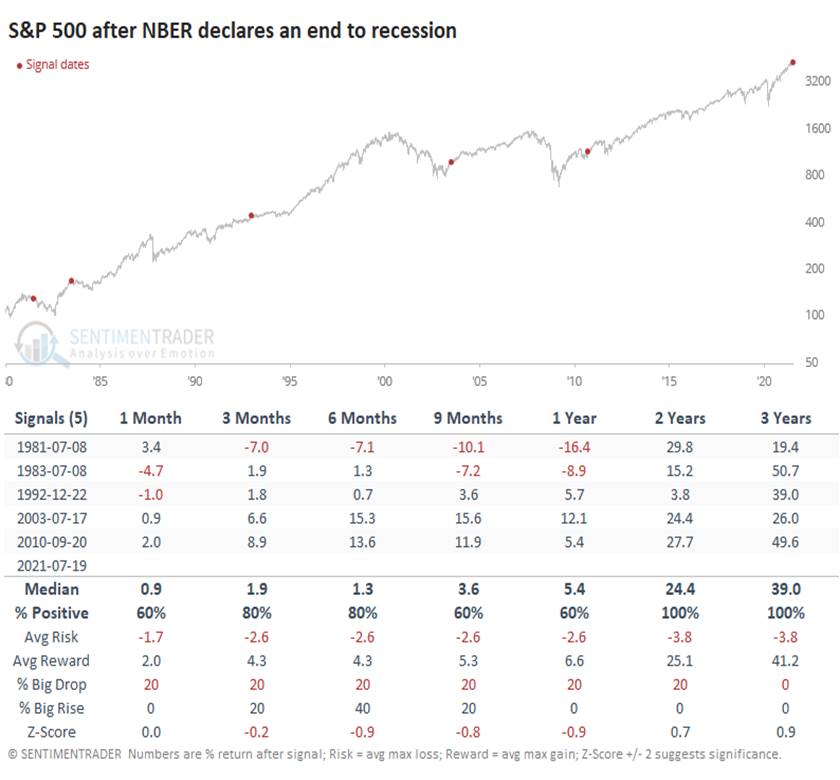

What Happens After the Recession Ends:

To see if there is any potential use in becoming more

optimistic once a recession is officially declared to be over, Sentiment Trader looked at how various asset

classes performed following a publicly declared end to a recession by the NBER.

In the very short-term of a couple of weeks, the S&P

500 dropped after each of the last five end of recession declarations. However, stocks were mixed up to a year

later, yields typically rose, and Growth stocks struggled. Only over the next 2-3 years did the S&P

show above-average performance, with low risk and high reward.

Chart and Table courtesy of Sentiment Trader

...............................................................................................

In a note to subscribers, Sentiment Trader’s Jason

Goepfert wrote: “Now that headlines will be trumpeting an end to the shortest

recession on record, we should be on guard that it doesn't necessarily mean

clear sailing, especially for Growth stocks.”

...…....….….….….…....….…......….…....….…....….….…....…..…....….….…

Shadowstats (John Williams) Outlook:

“A Recession is just the first leg of a Depression.

Recessions are measured only from Peak-to-Trough, while Recoveries are measured

from Trough-to-Regaining-the-Pre-Recession-Peak, which is not at hand and never

has been recognized formally by the NBER. Thereafter, an Expansion is in Place

until the next formal Peak, which, again the NBER does time.

The timing of the release of NBER’s announcement is

curious, just 9 days before the July FOMC announcement and 10 days before

likely major downside GDP benchmark revisions. It shall be interesting to see

how the NBER handles the lowered GDP circumstance.”

Williams also notes that the U.S. monetary base (“high

powered money” that is now mostly used to fuel speculation and gambling in various

asset classes and other things) has hit an all-time high.

“Based on Three Weeks of Reporting Through July 21st,

Late-July 2021 Monetary Base Has Continued to Surge on Top of Extreme Levels

that Had Stabilized in May and June 2021 (FRB). Broadly moving on a parallel

basis with the Money Supply, although not hitting the record annual growth

levels of the 2007-2008 Banking System Collapse, which exploded Reserve

Balances at the time, growth in the Monetary Base expanded in April 2021, up by

74.9%, from its February 2020 Pre-Pandemic Trough (PPT). Where May 2021 held at

74.9%, and June eased to 74.5%, late-July surged to a current-cycle peak pace

of 77.2%. Those patterns of change in the aggregate Monetary Base reflected

parallel changes in the Reserve Balances at Federal Reserve Banks component

surging from 124.6% in March 2021 to 134.6% in April 2021, easing/ flattening

out to 133.7% in May 2021 and 132.2% in June 2021, and now jumping to

cycle-high 137.4% in late-July 2021.

The Currency in Circulation component continued hitting

successive, historic all-time high dollar levels and record-high growth rates

(against the PPT) of 17.8%, 19.9%, 20.7%, 21.2% and 21.6% in March, April, May,

June, and late-July 2021. The June 2021 and Late-July data were estimated from

the weekly reporting of the related series by the Federal Reserve Board.”

....….….….…..…....…....….…......…....….…....…..…....…..…....….…….

Victor’s Comments:

The NBER says the last U.S. recession was only two

months. What does that tell you?

I’m a complex, but very logical thinker. To discuss

this or any other topic one must know what you’re talking about and therefore

we must define our terms. Without definitions we do not have concepts. Without

concepts we are without identifying words. Without concepts or definitive words

“anything can mean anything,” which means nothing! Let’s have a closer look.

The NBER was founded in 1920 and has classified

recessions and recoveries from 1854. This is their policy statement:

The

National Bureau of Economic Research (NBER) is a private, nonprofit,

nonpartisan research organization dedicated to undertaking and disseminating

unbiased economic research to public policymakers, business professionals, and

the academic community. The NBER's greatest asset is its reputation for

scholarly integrity. Affiliated researchers are expected to conduct their

research in ways that adhere to the highest standards of scientific conduct and

that will not reflect adversely on the integrity of the NBER. The NBER has

established policies that cover research conduct, participation in NBER

conferences, employment-related interactions, and the professional conduct of

NBER affiliates more generally.

Here’s what they say about recessions (emphasis

added):

“A recession is a period of falling economic activity

spread across the economy, lasting more than a few months (?), normally

visible in real GDP, real income, employment, industrial production, and

wholesale-retail sales. The trough marks the end of the declining phase and the

start of the rising phase of the business cycle."

As the Curmudgeon points out, a recession had been

typically recognized as two consecutive quarters of economic decline, as

reflected by GDP in conjunction with monthly indicators such as a rise in

unemployment.

However, the NBER now says that two consecutive

quarters of a decline in real GDP is NOT how a recession is defined

anymore. Also, does two months meet

the criteria of “more than a few months?”

In other words, there is NO clear definition of a

recession anymore. This lack of clarity also extends to U.S. laws. For example, the Fed is prohibited from purchasing

Corporate Debt as per the 1913 “Federal Reserve Act.” But in the past year,

the Fed has bought corporate bonds as well as junk bond ETFs. No amendment was passed to allow that. Yet no one seems to care? Why not?

-->One must conclude that U.S. laws have become

meaningless!

The NBER, which has defined recessions for 166 years

(from December 1854) now identifies a recession as whatever seems to fit its

agenda or narrative.

That certainly causes many questions to arise. What it shows to me is that several state

Governors ordered pandemic closures of businesses and severe restrictions that

caused a steep U.S. economic decline, while the Fed went way beyond its twin mandates (stable inflation and maximum

employment) to prop up bond and stock markets.

In addition to Fed “printing” trillions of dollars,

there was also several rounds of stimulus checks from the U.S. Treasury Dept.

All that enabled those who have substantial financial assets (the

rulers/controllers of our society) to double or even triple their net worth

since markets bottomed in March 2020!

Yet none of

the Fed’s recent actions are permitted by the U.S. Constitution. Here’s why:

Article One, Section 8 and Section 10 of the U.S.

Constitution does not allow printing fiat paper money (aka “Bills of

Credit”). [Reference: Juilliard vs

Greenman -1884].

Moreover, the Federal Reserve Board and its banks are

not a part of the federal government. They exist because of an act of

Congress. In reality, they are a bunch

of self-interested bankers. It appears

the FED wants to serve the interests of the wealthy and politicians desiring to

be re-elected, rather than the man on the street.

Also, State Constitutions only give the Governors

emergency powers for a short period of time (usually 30 days). After that they would need to pass a law

through the state legislature on shutdowns. Astonishingly, they never did that!

Victor’s Conclusions:

The obvious conclusion of all of this is that at

least since 1982, the U.S. economic system is NO LONGER based on

capitalism! If not capitalism, what then

is the U.S. system of government today?

I submit that it’s Fascism with a twist, in

which Multi-National Corporations dictate the terms, because they have “bought”

our elected officials (who our citizens voted to represent them).

·

Fascism in economic terms (as Mussolini created it) is when the

title of the property still belongs to its owners, but the government can

dictate what they can do with it.

·

Socialism is where the government has the title of the Property.

·

Corporativism is the dominant structure of who controls what today, i.e.,

the wealthiest, who buy the lawmakers to get what they want! This is the system

and the NBER has evidently adopted it.

Sadly, laws mean nothing anymore and the power has

moved from the individual to the government, the Fed, and the biggest

multi-national corporations.

I defer to the reader to picture the end game, but it

won’t be pretty.

End Quotes:

For those confused by why the markets are making new

highs:

“Economic history is a never-ending series of episodes

based on falsehoods and LIES -not truths. It represents the path of big

profits! The object is to recognize the trend, whose premise is false, ride

that trend, and step off before it is discredited.” George Soros.

“I believe the Federal Reserve has already made a

significant policy error that can lead directly to recession. Even more

egregious is the Fed seems to have assumed a third mandate: keeping the stock

market rising. Not only does this exacerbate wealth disparity, but it also

borders on malpractice because, at some point, the Fed will have to take its

foot off the accelerator. When that happens the potential for another “taper

tantrum” is significant. The Fed absolutely should not think the stock market

is its responsibility. To do so (as I believe they are) sets up all of us for

extreme future volatility.”

“Now, you might say Fed officials surely know this. Why

are they still pumping? An excellent question. We may get an answer someday,

years from now, when the people making those calls are able to talk more

freely. For now, we can only guess, and my best guess is that the Fed is

effectively monetizing the giant and fast-growing government debt. They aren’t

technically monetizing because they don’t have that authority, but it amounts

to the same thing.”

John Maudlin on Federal Reserve Folly

Stay healthy, enjoy life, success, good luck and till

next time….

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been

involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2021 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).