95% of

Financial Media Content is Either Wrong or Irrelevant

By the Curmudgeon

Introduction:

Victor and I are taking it easy on Father’s Day (June

20, 2021), so today’s post will be shorter than usual and without our comments

and incisive analysis. The title of this

post is from a quote by Prof. Steve Hanke (see below).

We hope you enjoy the quick takes on the markets via

quotes and charts from this week. Vote

for the chart or quote you like best by sending email to the Curmudgeon: ajwdct@gmail.com

Quotes of the Week:

1. Paul Tudor Jones (aka “Tudor”), billionaire

hedge fund manager:

The Federal Reserve is risking its credibility by

keeping monetary policy so loose and allowing inflation to grow in a way that

may not be temporary, Paul Tudor Jones told CNBC on Monday.

“It’s the craziest mix of fiscal and monetary policy

since the Federal Reserve Board was created.” And what we like best:

“Why are

so many media outlets (i.e., the mainstream media) promoting narratives they

know are false, because it plays to their audience?”

2. Steve

Hanke, Johns Hopkins Professor, advisor to sovereign nations in an Interview with Keith McCullough, CEO of Hedgeye:

“The bond market has bought into this Fed narrative

hook, line, and sinker. The bond market is not showing up with inflation

signals whatsoever. All I can say is

that these people are really going to get their fingers burnt badly unless they

are fast on their feet. You don't want to be long

bonds now. This is almost insanity now, I would say. Because

of the fact that inflation is baked into the cake, we know that

if you know anything about monetary economics.”

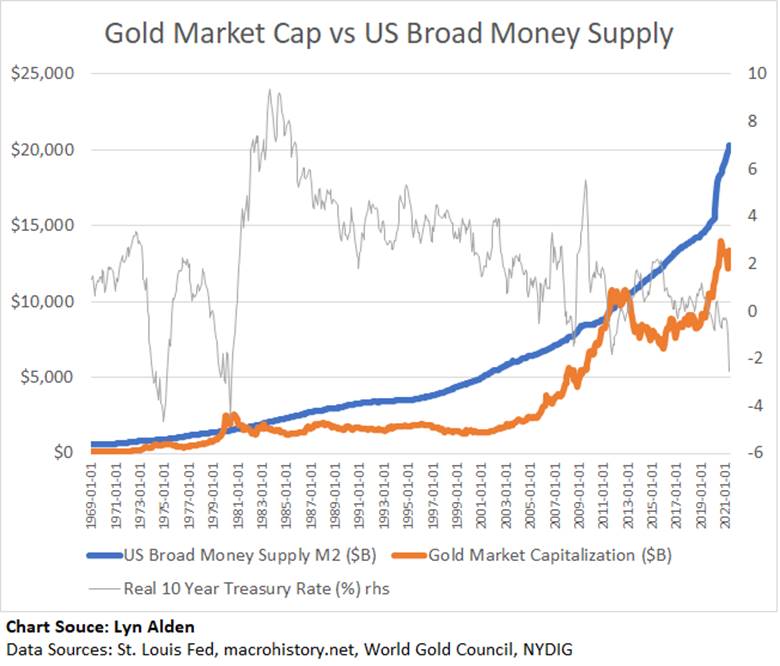

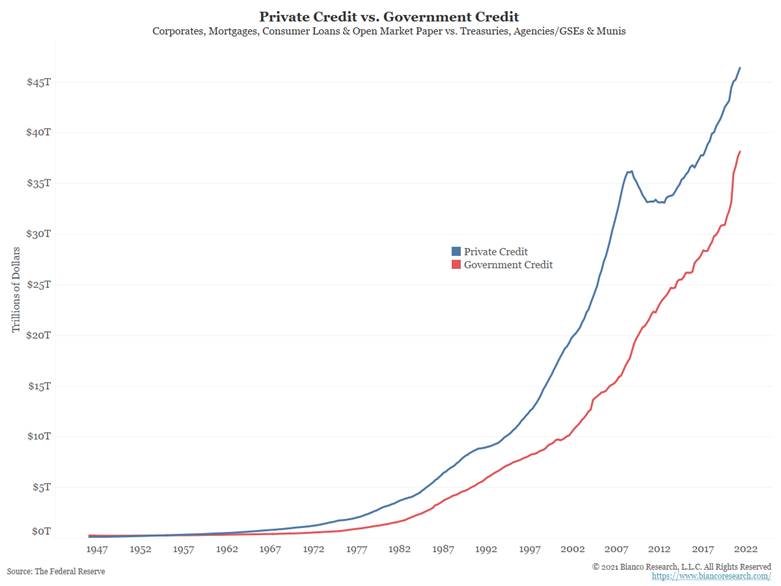

Image courtesy of Bianco Research

“The problem is that part of it is institutional

memory. You have a lot of young folks who are trading that have

no memory of anything and they never learned monetary economics.

95% of what you read or watch in the financial media

is either wrong or irrelevant. The media talks about

everything under the sun that's temporary, including

the fiscal spending, etc. etc. But they never talk about the money supply.

Money is what matters - money dominates!"

3. John

Hussman, PhD and President, Hussman

Investment Trust

“Coherent thinking is interested in how things

are related; where they come from, where they go, and the mechanisms by which

they affect each other. Incoherent thinking is a world of magic, loose theory,

and superstition; where things pop into existence, vanish without a trace, and

are somehow related without any need to carefully describe cause and effect.

Much of what passes for economic and financial

analysis is incoherent. I’ve

chosen that word carefully. The problem is not that the beliefs of investors

are “less true” than they think. It’s that many of the

most commonly repeated phrases don’t mean anything close to what investors

think they mean. It’s that many of these belief

systems are inconsistent, confused, or rooted in false premises. They are

incoherent in the same way that it’s incoherent to debate how many pine trees

are planted at the edge of the earth, how many aardvarks you need to start a

thunderstorm, or how the gold coins in the pot at the end of the rainbow are

invested.”

“The second lowest 10yr Treasury bond yield recorded

with a core inflation level of 3.8% YoY is around 5.6% - the lowest is

obviously the current observation around 1.5% (1.45% as of Friday June 18th,

using data since 1962).”

“Bringing truckloads of fiscal fuel (U.S. federal

government’s $5T COVID-19 stimulus packages) to the fire during a supply shock

(COVID-19 pandemic) risks creating bizarre bottlenecks such as the ones

we are experiencing right now.”

5. Fed Chair Jerome Powell Press Conference-June 16, 2021:

“Inflation has increased notably in recent

months. The 12-month change in PCE prices was 3.6 percent in April and will

likely remain elevated in coming months before moderating. Part of the increase

reflects the very low readings from early in the

pandemic falling out of the calculation as well as the pass-through of past

increases in oil prices to consumer energy prices.

Beyond these effects, we are also seeing upward

pressure on prices from the rebound in spending as the economy continues to

reopen, particularly as supply bottlenecks have limited how quickly production

in some sectors can respond in the near term. These bottleneck effects have

been larger than anticipated, and FOMC participants have revised up their

projections for inflation notably for this year.”

With that acknowledgement of rising prices, Powell

later said:

“We are continuing to increase our holdings of

Treasury securities by at least $80 billion per month and of agency mortgage-backed

securities by at least $40 billion per month until substantial further

progress has been made toward our maximum-employment and price-stability goals.

The increase in our balance sheet since March 2020 has materially eased

financial conditions and is providing substantial support to the

economy.”

Does anyone seriously believe that later statement?

Or should it be changed to “providing substantial liquidity for financial

bubble markets”??? Who’s kidding whom?

6. James Mackintosh article in the Wall Street Journal:

“Is the dot-com bust happening again right under our

noses? It might seem an odd claim, but there is a remarkable resemblance

between the speculative boom-to-bust of late 1999 and the first half of 2000

and what’s happened over the past nine months in the

fashionable areas of clean energy, electric cars, cannabis stocks and SPACs.

If the parallel continues it bodes ill for investors

who joined the excesses late. The trendy stocks—led by Tesla—are already down a

quarter to a third from this year’s highs.”

Charts of the Week:

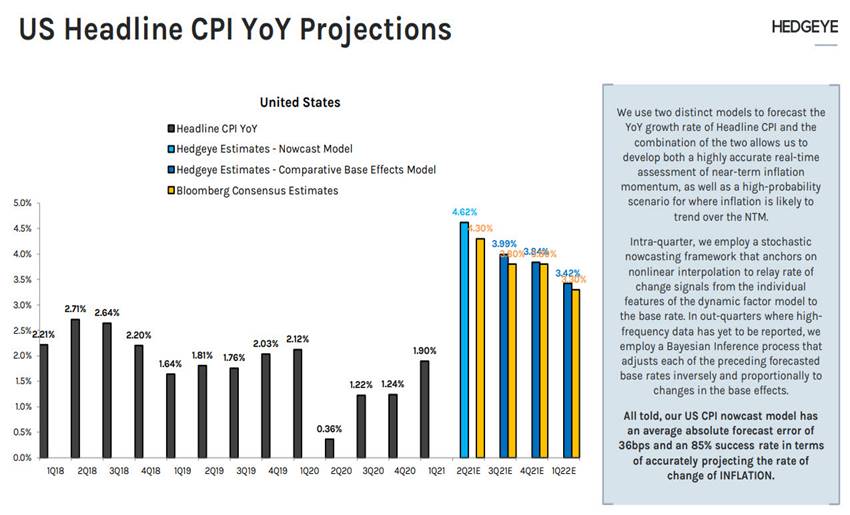

Chart courtesy of Hedgeye

Chart courtesy of Bianco Research

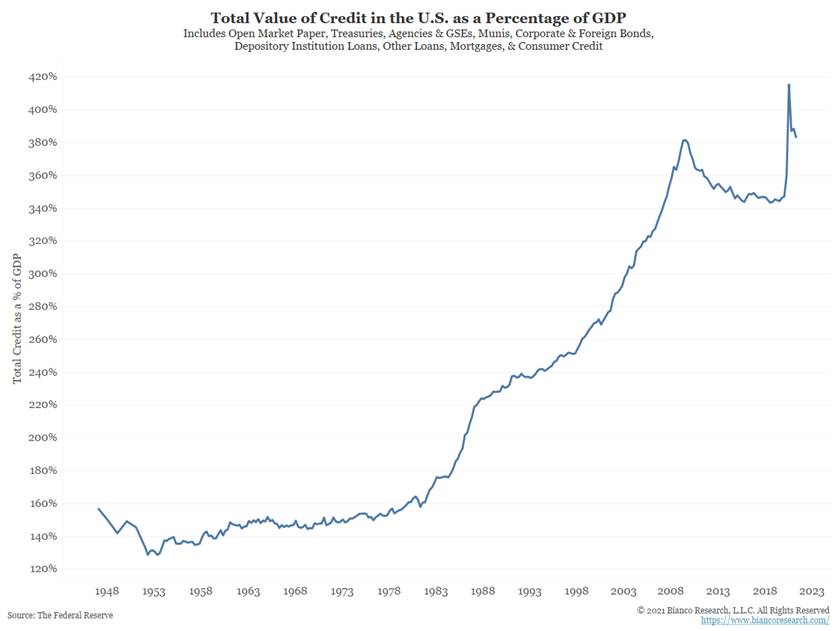

Chart courtesy of Bianco Research

……………………………………………………………………………………………….

End Quote:

"Bottoms in the investment world don't end with

four-year lows; they end with 10- or 15-year lows." — Jim Rogers

………………………………………………………………………………………………..

Celebrate the end of pandemic lockdowns, be healthy,

take care of yourself and each other, and till next time……

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned

(since 1971) to profit in the ever changing and arcane world of markets,

economies and government policies.

Victor started his Wall Street career in 1966 and began trading for a

living in 1968. As President and CEO of Alpha Financial Technologies LLC,

Sperandeo oversees the firm's research and development platform, which is used

to create innovative solutions for different futures markets, risk parameters

and other factors.

Copyright © 2021 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).