Investment

Pros: Clock Ticking on Bubble Markets

By the Curmudgeon with Victor

Sperandeo

Introduction:

For this Memorial Day weekend,

we forego our unique comment and analysis save for Victors Conclusions. Instead, we include excerpts of recent

reports which I hope youll find valuable and of

special interest. The major theme throughout is how unusual the last 14 months

have been for both pandemic policy responses (Fed and U.S. government) and the

frothy financial markets.

Readers are urged to consider

if this is the new normal and all of financial history

has been repealed? If not, caution and risk control are now more important than

ever.

Excerpts from Noted

Professionals:

Steven Roach, The Ghost of Arthur Burns

The Fed poured fuel on the

Great Inflation by allowing real interest rates to plunge into negative

territory in the 1970s. Today, the federal funds rate is currently more than

2.5 percentage points below the inflation rate (i.e., negative real

interest rate). Now, add open-ended quantitative easing some $120 billion per

month injected into frothy financial markets and the largest

fiscal stimulus in post-World War II history. All of this is occurring

precisely when a post-pandemic boom is absorbing slack capacity at an

unprecedented rate. This policy gambit is in a league of its own.

.

Sentiment Trader (via email):

Now that there has been a

spike in inflation gauges, the earnings yield on the S&P 500 has turned

negative. This is not a condition that investors have had to tackle much

over the past 70 years.

When an investor in the

S&P adds up his or her dividend check and share of earnings, then subtracts

the loss of purchasing power from inflation, he or she is barely coming out

even. This is a record low, dating back to 1970, just eclipsing the prior low

from March 2000.

If we ignore dividends, then

there have been five other times when the S&P 500's inflation-adjusted

earnings yield turned negative. The S&P failed to rally more than 7%

at its best point within the next two years after all but one signal.

.

Steve Blumenthal of CMG

Capital Management Group (via email):

If valuations were better and

interest rates higher today, wed have less reason for

concern (think 2009). Of course, that is not the case at this particular moment in time.

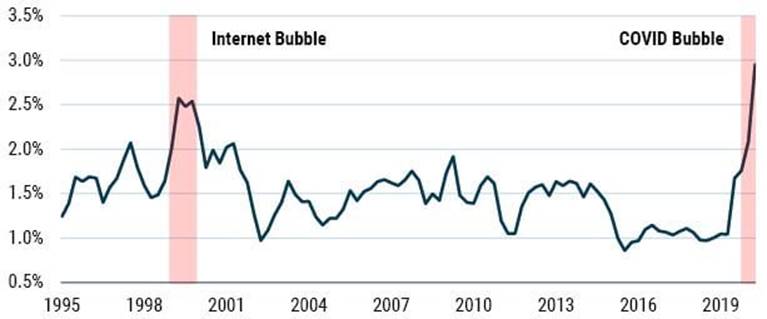

Note the spike in valuations over the last year in this graph:

.

Keith McCullough of Hedgeye (via email):

In case

you didnt already know, being permanently bullish (or

bearish) on Stocks, Gold, Bitcoin, etc. is how many (if not most) fund

managers get paid. They have no repeatable investing process. Its all about asset gathering and marketing. Gather assets

or fade away into the sunset

.

Allianz Global Investors' Head

of Global Strategy Stefan Hofrichter: "As we have seen, most but not all

of the criteria required for bubbles are waving red flags, and there are many

similarities between the current period and the tech bubble of the late

1990s."

Investor psychology at the moment leads Hofrichter to believe stocks are in a

bubble right now. He said there is too much optimism around the degree of

economic growth in the years ahead, evidenced by the bullish earnings

expectation revisions for some tech firms over the next three-to-five years.

"All financial bubbles in

history took place against the backdrop of 'easy' financing conditions provided

by central banks. In that respect, this bubble indicator is clearly present

today. Central banks have not only cut rates close to zero or even lower

but they have flooded the system with levels of liquidity that are

unprecedented in peacetime."

.

Stanley Druckenmiller, USC Student

Investment Fund Annual Meeting Keynote: Why do I say this period is so unique?

Well first

of all, the COVID-induced decline that we experienced last spring was

both violent and abrupt, and, to put it into math terms, we had five times the

decline in the average recession in 25% of the time. Think about that.

Monetary and fiscal policy

response to that was equally unprecedented. It's

not pleasant to remember back last spring, but if you think about that period,

I think we were all terrified that we were experiencing a potential black hole,

not only in our lives, but the but the in the economy itself with potentially

catastrophic circumstances consequences.

If you look at the policy

response it was extremely aggressive, led by the Cares Act. In three months, we

increased the government deficit more than the last five recessions combined.

If you added up all those

recessions effect on our budget, and the size of the budget deficit, combined,

they do not equal how much the budget deficit increased in three months last

spring.

The Fed response was equally

aggressive and unprecedented, they did more QE in six weeks last spring, than

they did in the entire period from 2009 to 2018. Which was unprecedented in and

of itself, and a lot of people were questioning the size of that.

The peak month during that

nine-year period was when then Fed Chairman Ben Bernanke did $85 billion in QE,

we're still buying $120 billion (per month) in

securities well after the six weeks that I talked about.

The final thing that happened

last spring was the Fed crossed a lot of red lines in terms of what they

would backstop in terms of the corporate debt. Also in

the municipal market.

The results were very

emphatic: corporations increased their debt in a recession by over a

trillion dollars in response to the Fed backstopping that debt. I dont believe its ever happened before.

Just to put that into

perspective in the great financial crisis, they shrunk their balance sheets

$500 billion, which is much more consistent with historical activity.

The good news is this resulted

(I'd say pleasantly surprisingly) in a very abrupt and

strong recovery. And in that context, it was a good risk reward to enact policy

expecting a deep and protracted recession in the spring of 2020. It worked. It

was dynamic, it was bold.

However, a lot has changed

since then. By the fall, the outlook had already brightened considerably, and

policy makers continue to accelerate fiscal deficits; they are going to reach

30% of GDP and just under two years.

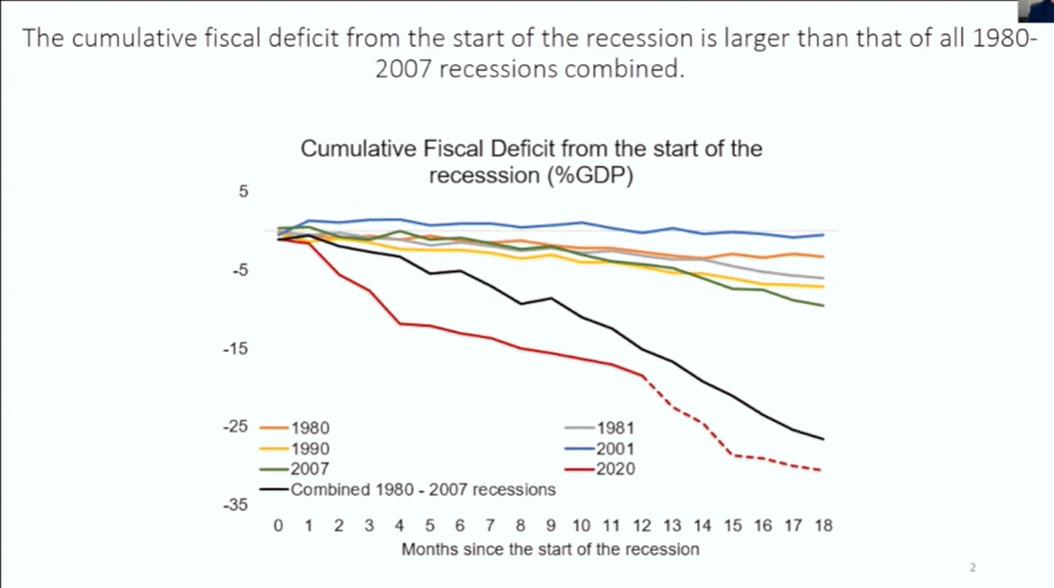

This is a chart of the

cumulative fiscal deficit from the start of the recession, of all the

recessions mentioned earlier, since 1980:

The top five lines are the

four recessions that preceded this one.

The black line represents all those added up together. Remarkably, the

red line is what we're doing in 2020 and 2021.

Again, the boldness of what

they did and the beginning of that chart when you'd

say first five or six or seven months, makes a lot of sense. But what's very surprising, is we're continuing to

double down on these policies, even after it's quite apparent, you've had a

very strong recovery in the economy.

The Feds easy money printing

is almost two times all previous fed incursions into money printing.

The Fed is constantly

reminding us of monetary policy ads with long and variable lags.

· Why,

then, is the Fed still providing emergency financial conditions when their

recoveryas I've shownis in full acceleration?

· Why is

the Fed buying $40 billion in mortgages a month, when we are clearly running

out of housing supply?

· Not

only is the Fed still providing record amounts of accommodation; it is

promising not to raise rates until after 2023. Even when the recession is

already over.

· If the

Fed raised rates in the first quarter of 2024, as indicated, it will be 41

months after recovering 70% of the drawdown and unemployment. That was the

chart I showed with the red line earlier.

· What do

you think the average number of months is before the Feds first hike after a

70% employment recovery in the post-war period? Chairman Powell is predicting

41 months before Feds first rate hike.

· What do

you think the average after that kind of recovery has been since World War Two?

Four months. Four!

· And

according to the Chair, they are not even thinking about ending $120 billion a

month in bond purchases. Simply put, the fastest and strongest recovery from

any post-war recession is being met with the Feds easiest response on record

by a mile. Policymakers say, We need to go big to avoid downside risks and

avoid this stagnation experienced after the great financial crisis.

· But as

I have shown, comparisons with the great financial crisis are completely

inappropriate.

What about the risks of

financial stability? The worst economic periods of the last century have

followed the bursting of asset bubblesthink the 1930s after the 1929 bubble

burst and think about the great financial crisis after the housing bubble

burst.

With Dogecoin, which

was started as a joke, with a $60 billion market cap, and they have NFTs

(non-fungible tokens) on everything you can spell out there, is there any doubt

in anybody's mind that we are in a bubblenot to mention the stock market, and

the GDP is well above any level that we've seen in the

past century?

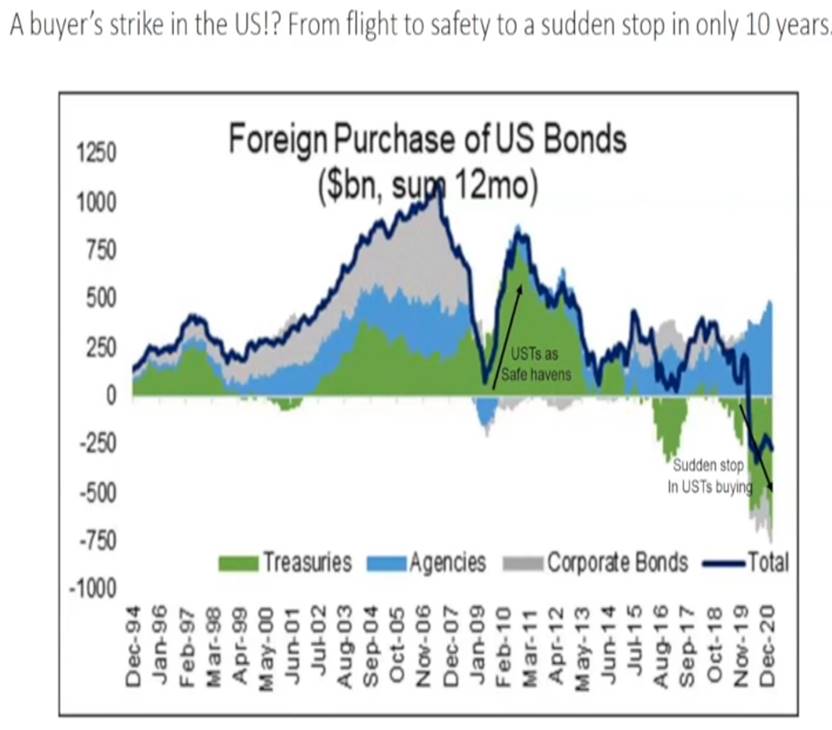

What about the risk of fiscal

dominance and loss of our reserve currency status? Foreigners have started to lose confidence in

the U.S. dollar as theyve aggressively sold U.S.

Treasuries in the last year. Thats reflected in this

chart:

Asians and others have been

purchasing Chinese assets. China has not done QE and provided much less fiscal

stimulus in response to COVID. Yet

Chinas economy and markets are doing just fine while

the Yuan has appreciated.

China represents 20% of world

GDP, but only 1.6% of global portfolios.

The U.S. represents 25% of GDP, but 28% of world portfolios. Do you think those ratios will now change?

.

GMO Quarterly Letter: Speculation and Investment,

by Ben Inker:

Speculative booms provide both

entertainment and outsized profits while they are happening, but they do

generally burst painfully. This is particularly true in equity markets, where

the demand growth is ordinarily met with increased supply from savvy

capitalists. Maintaining excess demand in the face of growing supply becomes

ever more difficult and eventually proves impossible.

In this cycle, the supply

growth (see chart below of U.S. equity issuance) is particularly impressive

in both its scale and the flexibility it has to

migrate wherever speculation is most rampant. That does not seem like a good

sign for an extended continuation of this boom. Whether the end means a fall

for just the more speculative end of the market, or the market as a whole is harder to predict at this point, although even

if the rest of the market holds up for now it will require a difficult economic

balancing act to keep it aloft indefinitely.

U.S. EQUITY ISSUANCE AS

PERCENT OF U.S. GDP:

Issuance doubled as a percent

of U.S. GDP at the height of the internet bubble, but the recent burst has been

even more impressive. Not only has the last year seen the highest level of

issuance since the data Im using began, it did so

from what had been desultory levels over the previous half decade.

The U.S. stock market of

2017-2019 may well have been quite expensive relative to history, but it didnt show many of the other classic symptoms of a

speculative bubble. That has now changed.

As striking as this burst of

issuance is, Id argue that the form of the issuance

this time is particularly laser-focused on giving speculators what they hunger

for. SPACs, among their other interesting features, give their promoters the

ability to create more of whatever type of stock is coveted in the market with

impressive speed. And while it is easy to say that the burst in SPAC issuance

in recent months is unprecedented, lots of things are unprecedented.

What makes speculative

bubbles distinct is that the investment side of the equation becomes an

insignificant driver of transactions, with both the rationale for trades and participants

expectations for returns from them driven overwhelmingly by speculation.

Victors Conclusions:

Well have

rising consumer prices in the U.S. through at least the end of July. The market

knows that and that real interest rates are deeply negative (as per Steven

Roachs comments above). While the Fed

is concerned that tapering or raising rates might cause a market crash, it has

recently been draining extra cash in the repo market.

Reuters reports that the amount of money

flowing into the Feds reverse repurchase (RRP) facility [1.] hit an

all-time high of $485 billion on Thursday, further repressing key short-term

interest rates, which risk falling below zero. Cash-heavy financial

institutions have been loaning money to the U.S. central bank overnight at 0%

interest in increasing amounts since March.

Note 1. The

Fed launched its reverse repo program in 2013 to soak up extra cash in

the repo market and create a strict floor under market rates, especially its

Fed Funds policy rate.

This move by the Fed is to

show the world that yes, they do care about too much money printing! But this

is just a signal. If they keep rolling

the reverse repos theyll be draining liquidity, which

will have economic effects. The Fed can

end this drain anytime so the markets will be watching! Beware of the Fed trying to look good to its

critics.

End Quote:

A market does not culminate

in one grand blaze of glory. Neither does it end with a sudden reversal of

form. A market can and does often cease to be a bull market long before prices

generally begin to break.

Jesse Lauriston Livermore

...

Stay safe, be healthy, take

care of yourself and each other, and till next time

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned

(since 1971) to profit in the ever changing and arcane world of markets,

economies and government policies.

Victor started his Wall Street career in 1966 and began trading for a

living in 1968. As President and CEO of Alpha Financial Technologies LLC,

Sperandeo oversees the firm's research and development platform, which is used

to create innovative solutions for different futures markets, risk parameters

and other factors.

Copyright © 2021 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).