U.S. Tech

Deal Resurgence Fueled by Expensive Stock

By the

Curmudgeon

Introduction:

U.S. technology deals have

boomed months into the COVID-19 pandemic. Tech merger and acquisition (M &A)

transaction volumes in 2020 increased by 72% (year over year) to $383 billion,

according to financial data provider Refinitiv. The first quarter of 2021 produced the highest

tech deal volume ever, with over 700 deals totaling $155 billion announced.

The technology sector

dominated global deal activity for the seventh month in a row, with $87

billion worth of deals struck in February 2021.

Reuters reports that close to half the

U.S. tech sector deals last year included stock compensation. That’s the highest

percentage since 2016, versus only 27% in 2019, Refinitiv said. In comparison, 39.5% of deals across all

sectors used corporate stock for financing in 2020.

The tech trend continued into

2021 as half of the deals in the sector announced in the first quarter also

used stock. Let’s

take a closer look at some tech sector M & A deals and how they were

financed.

Tech Deal Making Resurgence:

GlobalData’s latest report,

“M&A in TMT – 2020 Themes,”

notes that there were a total 702 M&A deals announced with a transaction

value greater than or equal to $50m in the global TMT

(technology-media-telecom) sector in 2020. The combined transaction value of

$903bn was a 25% increase on 2019, when there was $723bn worth of deals.

The market research firm

believes M&A activity will continue at a very high

level throughout 2021 as companies focus on their key technologies and adjust

to the realities of the COVID-19 pandemic.

Deloitte agrees: “Conditions are

ripe to support M&A activity into 2021, including low interest rates, middle

market resurgence, the need to deploy over $1.7 trillion in private equity dry

powder, and a growing sense of clarity around the path to pandemic and economic

recovery. The stronger

than anticipated rebound in

global TMT M&A since July 2020 looks primed to continue into 2021.”

As you might have expected,

acquisitions of the hottest (“on fire”) artificial intelligence (AI) startup

companies were dominated by U.S. tech giants, according to GlobalData.

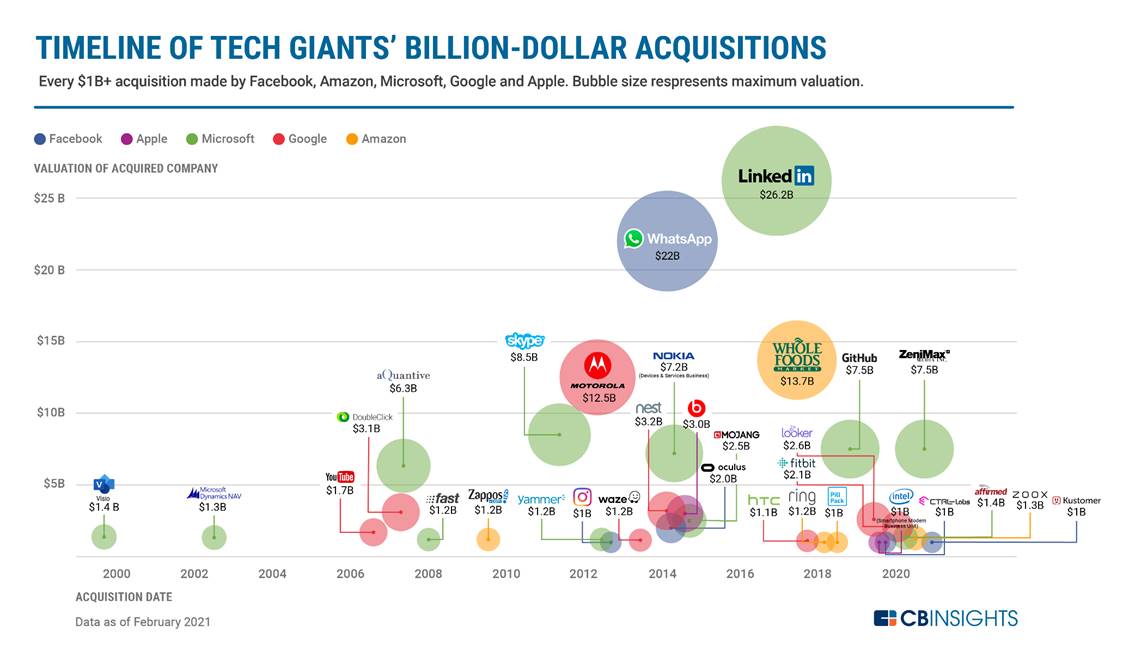

“Apple, Google, Microsoft and

Facebook collectively undertook 60 acquisitions in the AI tech space

during 2016–2020, while Apple led the race with 25 acquisitions. AI has

remained a key focus area for tech giants and growing competition to dominate

the space has resulted in an acquisition spree among these companies,” said Aurojyoti Bose, Lead Business Fundamentals Analyst at GlobalData.

Tech Deals Financed Mostly by

Stock:

The six largest technology

deals in 2020 all used stock, including semiconductor maker Advanced

Micro Devices (AMD)’s $35 billion acquisition of Xilinx and Salesforce.com’s agreement to buy messaging app Slack

Technologies Inc for $27.7 billion.

The popularity of stock as

currency for deals has been fueled by the soaring valuations in the tech sector,

deal makers said. The NASDAQ 100 Index trailing price-to-earnings (P/E) ratio

is 37.55 (according to the WSJ), the highest since

2000. Speculators and traders (there are

really no investors left) are throwing money at anything related to tech which

has caused a stupendous rise in tech stock prices and valuations.

This has made tech company

acquirers keen to use their highly valued shares, rather than cash, to pay the

frothy premiums that acquisition targets demand. While an all-stock or

cash-and-stock deal may dilute the shareholders of the acquirer through the

issuance of new shares, it reduces the risk of it overpaying because it hinges

more on the relative valuation of the two companies, rather than the absolute

valuation of the target, investment bankers said.

“It allows buyers and sellers

to participate equally in the upside or downside, as opposed to getting cashed

out,” said Mike Wyatt, Morgan Stanley’s global head of technology

M&A.

When identity management

company Okta

Inc clinched a $6.5 billion deal earlier this month for

rival Auth0,

it ONLY used its common shares to fund the purchase. The deal valued Auth0 at

about 26 times forward revenue multiple, compared to a forward revenue

multiple valuation of about 28 times revenue for Okta.

“Some people think the deal overvalued

Auth0, but it is actually lower than our multiple,” Okta CEO Todd McKinnon said

in an interview, adding Auth0 was also growing faster than Okta.

San Jose, CA laser maker Coherent

Inc. said Thursday morning that it has agreed to a cash-and-stock buyout

deal estimated to be worth about $7.01 billion from Pennsylvania-based

engineered materials and opto-electronic components maker II-VI.

Coherent common stockholders

will get for $220 in cash for each of their shares and 0.91 of a share of II-VI stock at the deal's completion, expected

in the fourth quarter of 2021. The deal must still get regulatory approval and

agreement by both companies' shareholders.

Tax Benefits Too:

Stock deals can also come with

tax benefits for the acquisition target. Deal proceeds are not taxable at the

corporate level in the United States as long as stock

makes up at least 40% of the purchase price consideration.

Hark Back to the Days of Yore-

the Dot Com/Fiber Optic Boom:

In the first quarter of 2000,

now bankrupt Nortel Networks acquired optical networking company Qtera, digital subscriber line (DSL) developer Promatory, and paid $3.25 billion in STOCK for photonic

switch start-up XROS. The latter company

did not even have a working prototype optical switch, let alone any sales or

earnings. Nortel at that time was

said to be: “accelerating its attempts to produce the world's first

all-optical wide area network.”

Guess what? Twenty-one years later, there is still no

all-optical network! [1.] As

a result, almost all of the optical networking

start-up companies acquired by Nortel, Lucent, Alcatel, and Cisco were shut

down and written off.

Could the same thing happen

with many of the corporate acquisitions now being made in AI & Machine

Learning, blockchain, fintech, biotech, greentech,

software, space exploration, satellite communications, etc. also go bust? What do you think?

Note 1. Even

though almost all global network operators use a fiber optic backbone (many

cellular networks use microwave transmission for backhaul), there are ZERO

photonic/ all optical switches deployed in commercial optical networks.

Instead, the actual switching of optical signals from input to output ports is

done via an electronic (NOT photonic) switching matrix in a O-E-O switch

(optical-to-electrical-to-optical).

…..………….……………………………………………………………….

Conclusions:

For 12 years now, central

banks have set short term interest rates below the rate of inflation (or even

negative nominal rates overseas). As a result, negative real interest rates on

safe assets, like CDs and savings accounts, have pushed large institutional

investors (and small specs) into riskier assets yielding higher potential

returns. But that is in large part based

on the “greater fool theory” --what is going up will continue to go up because there

will be a greater fool that will be buying that risky asset in coming days,

weeks, and months.

The motivation for many of

today’s tech stock deals is reminiscent of the late 1990s- early 2000 period,

just before the dot com bubble burst. Just

like 1999 and early 2000, expensive stock is being used as the capital to close

many tech acquisitions. That is yet

another warning sign, that this long, speculative bull market is coming to an

end.

Despite the stimulus inspired

pop expected for U.S. GDP, we urge readers to be cautious and careful with

their money. That’s

especially true with long and intermediate interest rates rising and in a

strong uptrend. Buyer beware.

……………………………………………………………….

Stay calm, be well, life will

get better, and till next time…...

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned

(since 1971) to profit in the ever changing and arcane world of markets,

economies and government policies.

Victor started his Wall Street career in 1966 and began trading for a

living in 1968. As President and CEO of Alpha Financial Technologies LLC,

Sperandeo oversees the firm's research and development platform, which is used

to create innovative solutions for different futures markets, risk parameters

and other factors.

Copyright © 2021 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).