Analysis of

Profligate U.S. Government Spending and Guaranteed Income Experiments – Part I

By the

Curmudgeon

Introduction:

This is the first article of a

two-part series on excessive government spending, ballooning deficits/debt, and

guaranteed income aka “free handouts.”

The latter topic will be covered in tomorrow’s Curmudgeon post.

Analysis of $1.9 Trillion

Aid Bill:

On Friday, the U.S. Senate

passed the bipartisan debated $1.9 trillion COVID-19 aid bill. One of the biggest criticisms of the bill is

that it is too large overall at a time when the Congressional Budget Office

(CBO) projects the economy is running roughly $700 billion below potential.

“I don’t think there’s any

justification from an economic standpoint or a bottom-up standpoint for $1.9

trillion in further Covid relief. A package half that size would still be a

safe boost to the economy,” said Marc Goldwein, senior policy director for the Committee for a

Responsible Federal Budget who was quoted in the Washington Post.

“To me the part that’s the

hardest to justify is the $1,400 checks to everyone,” said Greg Mankiw, a

Harvard University professor who served as President George W. Bush’s chief

economist from 2003 to 2005. “They are making large payments to people who

don’t need them.”

Mankiw noted that two of his

adult children have not lost jobs have but have nonetheless been receiving

stimulus checks. A family of four who didn’t lose any

income in this coronavirus crisis would still receive an additional $5,600.

Many economists are also

concerned that the money, along with enhanced unemployment benefits until early

September, are discouraging some people from returning to work. Many are making as much now as they did when

they were employed. And there’s more government transfer payments to come!

“Many small businesses

complain they are not able to reconnect with employees because of these

benefits,” said Lindsey Piegza, chief economist at the investment firm Stifel.

“We want to be leery of getting a short-term boost that ends up creating

longer-term roadblocks.”

Another objection to the new

$1.9 trillion aid bill was the aid to state and local governments. The bill

would provide $350 billion to state and local governments which have

been hit by a loss of tax revenue during the pandemic, causing many to plan

cuts to services and warn of tax increases to allow them to balance their

budgets. Republicans have slammed the aid as “blue state bailouts,”

rewarding Democratic states for poor financial decisions that predated the

pandemic and note that many states’ tax revenues have exceeded expectations.

The new bill contains the

largest overhaul to the Affordable Care Act in years. It expands

eligibility for subsidies to purchase insurance to people of all incomes and

caps the maximum premium at 8.5% of a person’s income. It also takes steps to

lower, or even zero out, premiums for people making less than 150% of the

federal poverty line.

The bill also encourages

states to expand Medicaid (i.e., free health care) by having the federal

government pay for new recipients.

Summing up the COVID-19

Stimulus Aid Packages:

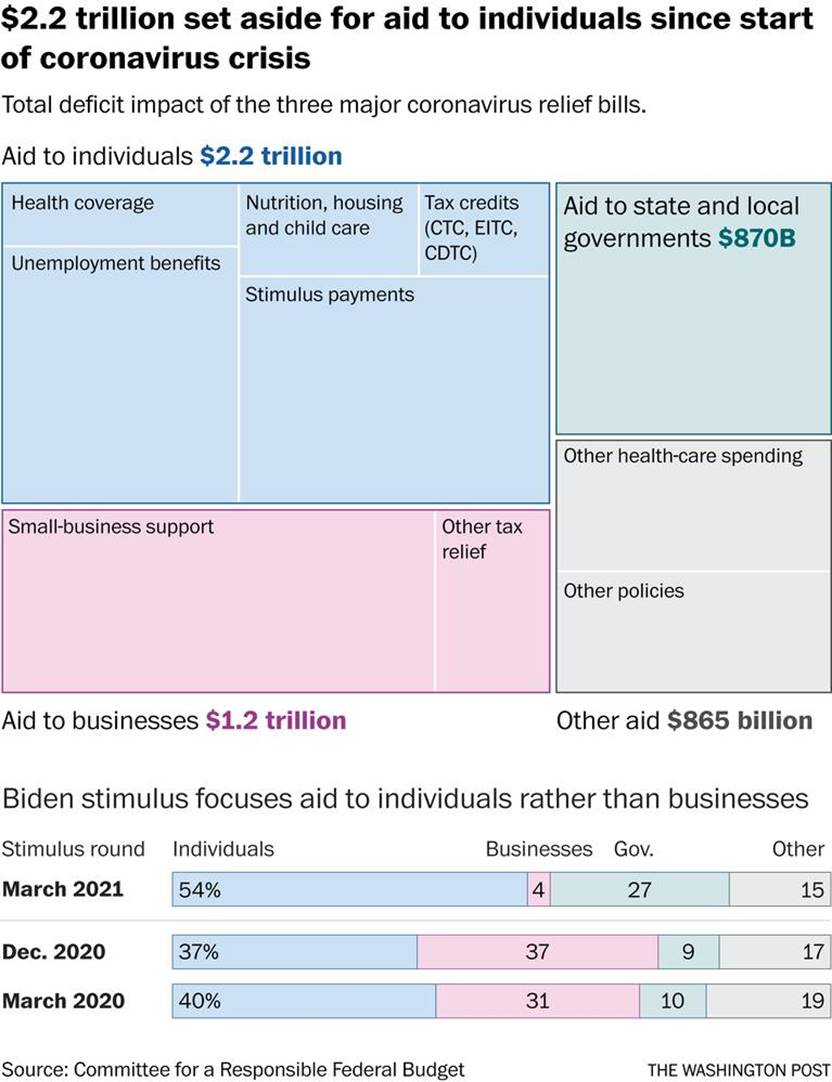

The total numbers are

staggering. Cumulatively, the government will hand out $2.2 trillion to

workers and families between the two relief bills passed last year and this

latest bill, according to the Committee for a Responsible Federal Budget, a nonpartisan group. That’s

equivalent to what the government spends annually on Social Security, Medicare

and Medicaid combined!

Here’s a breakdown of where that $2.2 trillion has and will

go to:

U.S. Government Debt and

Debt to GDP Ratio:

Do you actually

think that $1.9 trillion will increase the U.S. federal government

deficit? Or will it be funded by new tax revenues in 2021-2022?

Note that 57% of all federal

government spending over the last 12 months was unfunded, i.e., deficit

spending. That percentage is growing rapidly.

On the current trajectory it would be 80% in 5 years.

And let’s

not forget the U.S. debt to GDP ratio which seems to be spiraling out of

control. Gross federal debt in the U.S.

increased to 107.6% of GDP in 2020 – up from 106.9% in 2019, according

to estimates from the Office of Management and Budget.

U.S. debt will be equivalent

to 202% of gross domestic product by 2051 the nonpartisan

CBO said on Thursday in its long-term

budget outlook. The forecasts don’t take into account the $1.9 trillion in the new federal

spending bill. It’s

important to note that the U.S. debt to GDP ratio has only exceeded 100% twice

before in U.S. history. That was in 1945

and 1946, following a surge in federal spending as a result

of World War II.

The U.S. economy is projected

to grow 1.8% a year during the next three decades, according to the CBO. As usual the budget office forecasts NO

RECESSIONS over the next 30 years!

A New Era Arrives for

Budget Deficits and Debt to GDP Ratio:

“The risk of a fiscal crisis

appears to be low in the short run despite the higher deficits and debt

stemming from the pandemic,” the CBO said. “Nonetheless, the much higher debt

over time would raise the risk of a fiscal crisis in the years ahead.”

Budget deficits will widen to

13.3% of GDP in 2051, from 5.7% in 2031, driven largely by increasing costs of

servicing the debt, the CBO said. Net spending on interest will triple relative

to GDP in the two decades leading up to 2051, and spending on programs such as

Social Security and Medicare will also rise.

However, no Democratic

congress members listened to Victor, who in numerous posts cited the dangers

the U.S. Treasury would face in servicing the debt via higher interest payments

if rates were ever normalized to their multi-decade averages. Could that ever happen in our lifetimes?

Conclusions and Investment

Implications:

Michael Hartnett, Chief Investment

Strategist, BofA Global Research (UK), wrote in a research note to clients that

a one-percentage-point rise in Treasury yields would increase the U.S.

Treasury’s annual interest expense by the equivalent of double NASA’s

budget (which is $23.271 billion in fiscal 2021). Interest costs at one

percentage point above the CBO’s baseline estimate would add $9.7

trillion—more than 10 times the annual U.S. defense budget—to the budget

deficit from 2021 to 2030. Such worrisome possibilities, the BoA strategists

conclude, make some form of Fed yield curve control inevitable.

Hartnett further states that

the pervasive and addictive Wall Street-Fed dependency culture (everyone

bullish) is extending to a Main Street-U.S. Treasury dependency culture

which is increasing with a total of $8 trillion U.S. government spending for

stimulus checks, and welfare. It’s all financed by deficit spending courtesy of the

ballooning Fed balance sheet which will soon exceed $8 trillion. That means asset price inflation mutating

into Main Street inflation. This suggests rates are no longer

"anchored."

BoA’s conclusion is that the

Fed’s financial repression, with low and stable interest rates since the

September 2008 Lehman bankruptcy, is about to end. A new era of financial market volatility is

set to begin. Markets will now likely push the Fed via higher yields,

according to Harnett.

Here’s a very long-term chart of U.S. significant financial

events courtesy of BoA: 10 Year U.S. Treasury Inflation Premium %

Chart of the Day:

Stay calm, be well,

persevere, and till next time …………………...

The Curmudgeon

ajwdct@gmail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned

(since 1971) to profit in the ever changing and arcane world of markets,

economies and government policies.

Victor started his Wall Street career in 1966 and began trading for a

living in 1968. As President and CEO of Alpha Financial Technologies LLC,

Sperandeo oversees the firm's research and development platform, which is used

to create innovative solutions for different futures markets, risk parameters

and other factors.

Copyright © 2021 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).