Mania in GameStop

and AMC the Most Irrational of Irrational Exuberance Seen So Far

By the Curmudgeon with

Victor Sperandeo

Introduction:

This will be a shorter post than usual as both Victor and I do not want to

rehash what we’ve repeatedly stated for years about

the Fed, ECB and irrational markets. We

are both worn out and fatigued by all the negatives we perceive in America

now. The homeless epidemic in the SF Bay

Area is particularly disturbing to the Curmudgeon.

We briefly comment on the BIG SHORT SQUEEZE before examining the

deteriorating fiscal health of state and local governments in the U.S.

The key question for the states is if any COVID-19 fiscal stimulus package

will provide sufficient aid. If not,

expect layoffs, spending cuts and (possibly) higher state income and/or sales

taxes.

Short Squeeze is Another Warning Sign:

The Fed meeting would normally have been the major focus of the markets

this week. Not even close! The only thing everyone in and out of the

market is talking about is the incredible short squeezes in stocks which have

very unfavorable earnings prospects.

Our take on young amateurs “sticking it to the hedge funds” is that it’s yet another sign of extreme bullishness.

“Rally the troops, my brothers, for the war could be over

very soon,” a commenter who goes by Gardeeon wrote on

Jan. 19th. “You control the power, GME is not going to the moon, but

to the edge of the [expletive] observable universe.”

“What d’ya mean you’re short?

Don’t you know stocks can only go up!!!”

We see this as a classic sign of incredible excess liquidity sloshing

around the markets. Victor describes the markets as being in “never-never

land.” Obviously, it is also a

quintessential display of retail herding behavior as per “Join the message

board crowd or lose out!”

Excess bullishness, excess liquidity and retail herding behavior are all

attributes of exuberance seen at historic stock market tops. For example, the 1929 shoeshine boy asking

for stock tips and the 1998-2000 infatuation with dot com/Internet and fiber

optic stocks.

While we are not calling a market top, we note that The DJI lost 1141

points during the week and that the DJI and S&P closed the first month of

the year lower, with declines of 2.04% and 1.11%, respectively. The NASDAQ

Composite ended the month higher by 1.42%.

State and Local Government Tax Revenues and Budget

Deficits:

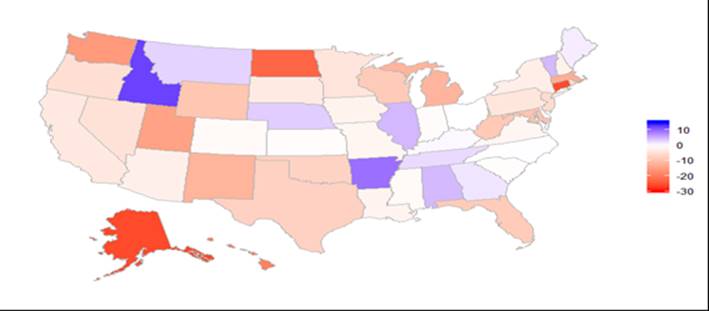

Overall state tax revenues in the U.S. declined 4.4% through the first 9

months of 2020. While state and local budget shortfalls weren’t

as bad as feared, economists are concerned many states will be forced to make

spending cuts or raise taxes.

Chart 1. State’s revenues decline

this year (Q1-Q3 of 2020 v Q1-Q3 2019 in %):

Source: Census Bureau

Tax revenue (income, property, sales tax, corporate) only makes up 56% of

state and local governments’ revenues.

The remainder comes from fees ranging from mining, airports,

recreational services, and mass transit—all areas hit hard by the pandemic.

Consequently, states that generate a significant portion of their revenues

from mining and drilling (e.g., Alaska, Texas, Oklahoma) and tourism (e.g.,

Florida, Nevada) have experienced a notable drop in total revenues through 3Q

2020.

The upshot here is that the coronavirus has spared the fiscal positions of

few, if any, states. Aid to state and local governments will be crucial to a

quick recovery.

State Spending Cuts Likely if no Federal Government Aid:

Bank of America economists predict that

without additional federal support, state and local spending could be a drag

on U.S. GDP well after the current COVID-19 induced recession has

ended. That was the case after both the

Dot-Com Boom and Great Financial Recession of 2008 -2009.

Spending cuts will likely concentrated in the local portion of government

for a couple of reasons: 1) states reduced transfers to localities and 2) local

governments tend to run primary and secondary public schools.

The cuts to public education jobs most likely will consist of workers who

have been furloughed, while schools practice more

online learning.

Brookings Institute's latest projections forecast from late-December of

next year shows tax revenues will be down roughly 3.25% from 2019 levels in

2020. If realized, this would imply 2021 state and local employment levels that

are 1.1% lower than equivalent 2019 levels. Hence, the jobs lost during

pandemic would not be recovered. U.S.

GDP will also be reduced unless there’s federal government aid to the states.

Chart 2. Contribution to GDP from State and local

consumption expenditures (%):

Source: BofA Global Research, U.S. BEA

……………………………………………………………………………..

NY Times Quotes on the Short Squeeze:

“Trading like we’re seeing in GameStop is humbling for those of us who hold

onto the quaint idea that capital markets channel investors’ money to its most

efficient and productive uses,” said Tyler Gellasch,

a former Securities and Exchange Commission official who now leads the Healthy

Markets Association, a nonprofit that promotes transparency in financial

markets.

Pablo Batista, 25, traded to

pass time during the lockdown, but has since become more serious as his $4,000

investment in stocks has swelled to more than $67,000. “At this point, I’m like overwhelmed,” he

said of the $11,440 he made trading shares of GameStop on Monday. “It’s

ridiculous. It’s crazy.”

“How does it end? Badly. Eventually, the bigger the balloon, the louder the

pop,” said Steve Sosnick, chief strategist at

Interactive Brokers in Greenwich, “When does it end? I don’t know.”

……………………………………………………………………………...

Good

health, stay calm and safe, try to think positive, and till next time….

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned

(since 1971) to profit in the ever changing and arcane world of markets,

economies and government policies.

Victor started his Wall Street career in 1966 and began trading for a

living in 1968. As President and CEO of Alpha Financial Technologies LLC,

Sperandeo oversees the firm's research and development platform, which is used

to create innovative solutions for different futures markets, risk parameters

and other factors.

Copyright © 2021 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).