China’s

Economy Now the World’s Largest; CCP 5 Year Plan Outlook

By the Curmudgeon

Introduction:

Earlier this month the IMF presented its 2020 World Economic Outlook, which

provides an overview of the global economy and the challenges ahead. Measured

by a metric that both the IMF and CIA now judge to be the single best metric

for comparing national economies, the IMF Report shows that China’s economy is now the world’s largest

– one-sixth larger than the U.S. economy ($24.2 trillion versus the U.S.’s

$20.8 trillion).

China's GDP grew by

4.9% in Q3-2020, the government reported on October 19th. While that

was one of the best rates of economic growth in the world, it disappointed

economists which had forecast China GDP of about 5.5%.

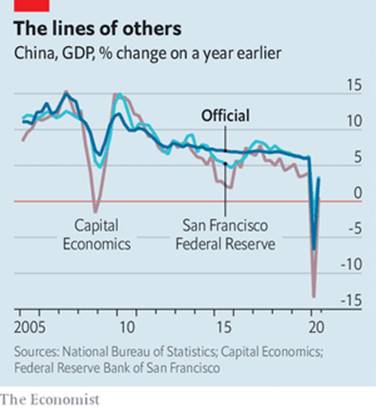

Of course, China government stated economic numbers have very

little credibility as the Economist magazine reports.

China’s Communist Party (CCP) meets this week to approve a new Five-Year Plan, and

with global trade tensions high, there will be particular focus on domestic

demand. This article looks at what we

might expect from the CCP’s new Plan and reviews the “Made in China 2025”

initiative.

Forecasts for China’s GDP in 2020:

The International Monetary Fund (IMF) forecasts China

GDP growth of 1.9% for this full year, with Oxford Economics suggesting

there could be some upside to 2020 growth with a 2.3% forecast. That's down

from 6.1% in pre-pandemic 2019.

The 2020 full-year figures would make China the only major

economy to increase its economy for this year, with the IMF predicting a 4.4%

contraction in the global economy. But China's numbers would also result in the

slowest pace of growth since 1976, when China was in the final throws of the

Cultural Revolution. Q1 resulted in a 6.8% shrinking in the economy, the first

contraction since China started keeping quarterly data in 1992.

Outlook for China’s 14th Five Year Plan:

Bank of America economist

Helen Qiao expects the China government to target

growth more than 5%, but well below the 6.5% in the last 5 Year Plan. She

believes China will emphasize global integration coupled with boosting domestic

demand, innovation, and urbanization.

Private consumption of goods represents less than 40% of GDP

as compared to 70% in the U.S. and the government is likely to encourage more

spending on services and higher quality domestic products.

The CCP will also likely speed up the opening of

China’s economy, especially financial market and service sectors, to

attract foreign investment. China is likely to focus on domestic sectors of its

economy largely because of its increasingly hostile relations with the U.S.

In addition to the ongoing tariff battle, the trade war

raised the probability that tighter U.S. technology sanctions may choke future

industrial development in China. It seems imperative for Chinese policy makers

to increase the country's self-dependence to continue its industrial

activities.

Among a wide range of potential macro policies, B of A thinks

the key drivers of domestic growth will be technology innovation, consumption

upgrade and further urbanization spurred by development of metropolitan areas.

Here’s how a command economy works:

The Chinese Communist Party ordered factories back

into operation before they were even willing to bring their workers into the

workshop - and before the factories had orders for goods to be produced.

The CCP is obsessed with keeping people in jobs, since

unemployment breeds discontent, and discontent breeds dissent against the

party, which retains staying in power as its primary goal. They also subsidize certain industries (see

below) by providing R & D spending as well as generous tax breaks.

“Made in China 2025” Progress Report:

The "Made in China 2025" program, released in 2015,

identified 10 industries in which China strives to become globally competitive

by 2025. The list included R&D

spending as % of revenue of above-scale manufacturers, number of patents per

RMB 100M of revenue, Competitiveness Quality Index of manufacturing sector, and

broadband Internet penetration (as a %).

China has already accomplished many of its “Made in China

2025 targets,” such as number of approved patents (1.1 vs 1.1 2025

goal) and broadband network coverage (86.1% vs 82% 2025 goal).

The government is shifting its focus to new infrastructure

like 5G cellular networks, an ultra-high voltage grid, software, biotech, semiconductors,

and higher-end components. Urbanization will remain a key focal point, but

the Plan will emphasize the development of the surrounding suburbs and

satellites of major cities rather than further densification of downtown

areas.

China has prioritized technology innovation in the

last decade, as it sought to upgrade the industrial sector and move up the

global value chain. But technology security and independence have become ever

more urgent, with the U.S. banning most component supplies (license now

required) to Chinese companies such as Huawei and ZTE. That

effective embargo threatens to choke the nation's technology supply-chain.

China’s economy must "make breakthroughs" and

"win the critical battle of" key technologies, President Xi stated in

August to a group of experts advising the new Plan. In September, the National

Development and Reform Commission (NDRC) issued guidelines on investing in

"strategic emerging industries" such as 5G, semiconductors and biotechnology. Tax breaks, state-led investment and research

funding will likely be offered to businesses in key sectors such as

semiconductors, especially considering the U.S. embargo against Huawei.

Unfavorable Views of China Reach New All Time High:

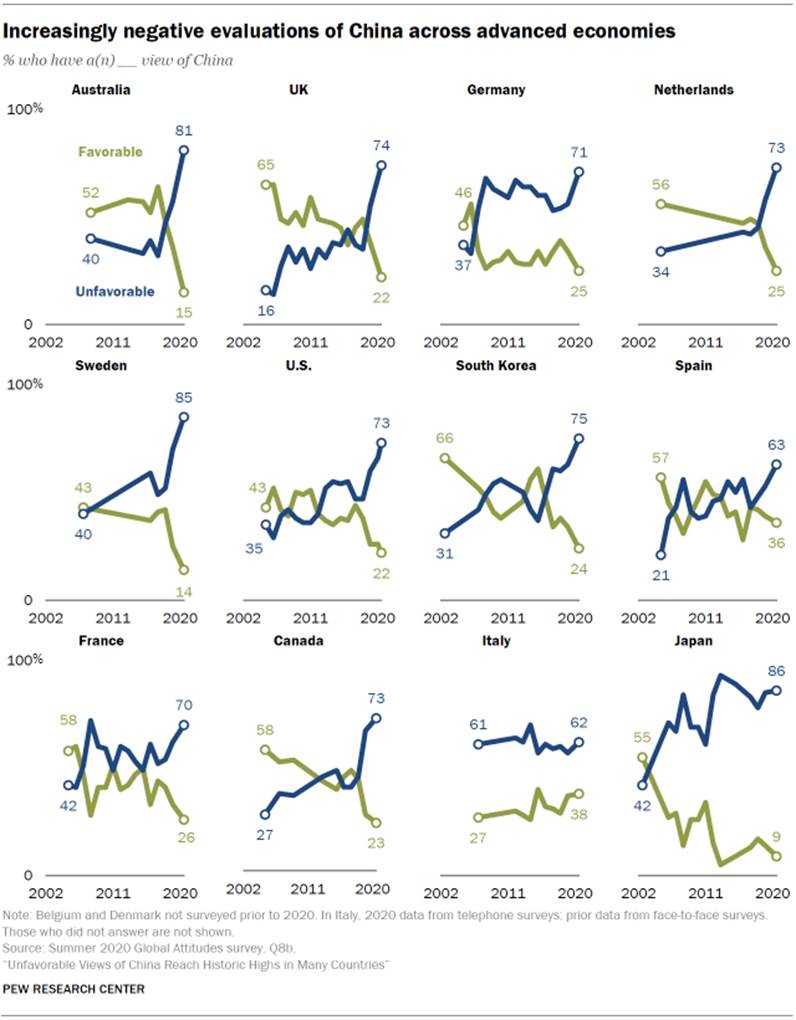

Views of China have grown more negative in recent years

across many advanced economies, and unfavorable opinion has soared over the

past year, a new 14-country Pew Research Center survey shows.

A majority in each of the surveyed countries has an

unfavorable opinion of China. And in Australia, the United Kingdom, Germany,

the Netherlands, Sweden, the United States, South Korea, Spain and Canada,

negative views have reached their highest points since the Center began polling

on this topic more than a decade ago.

Conclusions:

With another five months to go before its official release, it

is perhaps too early to compare the next Five-Year Plan with previous Plans.

However, the challenges China faces in the next five years have undoubtedly

grown much bigger than before. They

include: high leverage (China's total debt/GDP ratio will rise from 231% in

2015 to 284% this year), supply chain disruptions (largely due to U.S.

sanctions/tariffs and higher priced labor), and the global political

environment (especially the icy U.S.-China relationship)

China has yet to develop a coherent storyline to convince the

rest of the world of its peaceful ascendance, which could become more

problematic with its growing economic influence.

………………………………………………………………………………………………...

Be well, stay safe and calm, good luck and till next

time…….

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2020 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the original

posted article(s).