Sept 2020

U.S. Jobs Report; Recent Layoffs; Labor Participation Rate Decline; GDP

Forecasts

By the Curmudgeon

Executive Summary:

Total U.S. nonfarm payroll

employment rose by 661,000 in September, and the unemployment rate declined to

7.9%, the U.S. Bureau of Labor Statistics (BLS) reported on

Friday. In September, notable job gains

occurred in leisure and hospitality, retail trade, health care, social

assistance, and in professional and business services. Employment in government

declined over the month, mainly in state and local government education. In

September, nonfarm employment was below its February 2020 level by 10.7

million, or 7.0%.

In

the BLS’ Household Survey for September, the unemployment rate declined by 0.5%

to 7.9%, and the number of unemployed persons fell by 1.0 million to 12.6

million. Both measures have declined for five consecutive months but are higher

than in February, by 4.4% and 6.8 million, respectively.

Similar patterns in industry

payrolls ranging from Retail Sales and Construction to Manufacturing show a

sharply slowing pace of economic improvement, but no economic

recovery close to pre-pandemic levels. That is in

contrast to both the headline real Retail Sales and Construction

Spending series having recovered pre-Pandemic levels fully.

Other signs of a slowing U.S.

recovery include a drop in household income at the end of the summer and

smaller gains in consumer spending, the economy’s main driver.

ShadowStats’ John

Williams continues to characterize recent U.S. economic performance

as an “unfolding L-shaped economic recovery.

Other economists realize the economy has slowed and the recovery will be

bumpy.

“The pace of jobs recovery

apparent in today’s report suggests that we will be counting the employment

recovery in years, not months or quarters,” said Marianne Wanamaker, a

labor economist at the University of Tennessee, Knoxville. “We’re not going to

gain jobs as rapidly as we did in May and June.”

“It’s disturbing that we’re

seeing such a dramatic slowdown in employment gains as we head into the

fall,” said Diane Swonk, chief economist for the accounting firm Grant

Thornton. “This is a red flag. We need aid now.”

Huge Layoffs Not Reported

in Jobs Numbers:

Large corporate layoffs are

sweeping across the U.S. Walt Disney Co. earlier this week announced

permanent layoffs for 28,000 theme park workers who were previously on

temporary furlough. CNBC reported in

August that park shutdowns cost the company $3.5 billion.

Ralph Lauren said it would cut its global workforce by about 15%

on September 22nd, ultimately saving the retailer $180 million

annually. Department store Kohl's is

cutting 15% of its corporate workforce. The unspecified cuts will save the

company $65 million annually, according to a September 15th

SEC filing.

American Airlines Group

Inc. and United Airlines Holdings

Inc. will proceed for now with a total of more than 32,000 job cuts after

lawmakers were unable to agree on a broad coronavirus-relief package. That was after German airline Lufthansa

announced on September 21st that it is further shrinking its global

fleet and workforce. The airline did not announce how many job cuts to expect

but hinted it might be a bit more than 22,000 positions that were said to be

“surplus personnel.”

Defense and aerospace giant Raytheon

Technologies (Curmudgeon’s first job after

graduating from college was with Raytheon Digital Systems Lab in May 1968)

announced it will cut 15,000 jobs on September 17th.

On September 30th,

the following layoffs were announced by major U.S. corporations:

·

Shell (oil and gas) is cutting up to 9,000 jobs, or roughly

10% of its workforce. The layoffs are meant to cut costs amid the pandemic, as

well as position the company to move away from fossil fuels.

·

Allstate (home and auto insurer) said it would lay off 3,800

employees — or 8% of its workforce.

·

Goldman Sachs (investment bank) is cutting 400 jobs, or 1% of its

workforce, after briefly pausing job cuts amid the pandemic.

These recent layoff

announcements aren’t reflected in the September jobs

report, which includes data gathered in the first half of the month. Yet they are a definite indication that

economic growth will slow in the months ahead.

Labor Participation Rate Decline is Worrisome:

The labor force participation

rate decreased by 0.3% to 61.4% in September and is 2.0% lower than in February

2020. In particular, the September Labor

Force has collapsed by (-4.463) Million Since Pre-Pandemic level at the end of

January 2020. The employment-population ratio, at 56.6%, changed little over

the month but is 4.5% lower than in February 2020.

Williams thinks the drop in

the Labor Force reflects lost unemployed who have just dropped out of the

system or are being missed in government surveying. Fully accounted for,

those missing unemployed people would push headline September unemployment up

to 10.6%, versus the headline 7.9% number reported Friday by the BLS.

Separately, for the seventh

straight month, the BLS acknowledged continued misclassification of some

“unemployed” persons as “employed,” in the Household Survey. An estimated

“upside limit” of 773,000 persons were indicated as “employed,” who more

properly should have been counted as “unemployed,” reducing a potential

September 2020 U.3 headline unemployment rate of 8.3% to the published 7.9%

(7.86%). That was down from a similarly distorted headline U-3

unemployment rate of 8.42% in August. Headline September U-6 declined to

12.84% from 14.24%, with the headline September ShadowStats Alternate

Measure -- moving on top of U.6 -- at 26.9%, down from 28.0% in August.

Editor’s Note:

The U-3 unemployment rate

represents the number of people actively seeking a job in the U.S. The U-6

unemployment rate also includes discouraged, underemployed, and unemployed

workers in the country.

…………………………………………………………………………………………………….

Declining Federal Stimulus

Payments & Reduced 4th Quarter GDP Forecast:

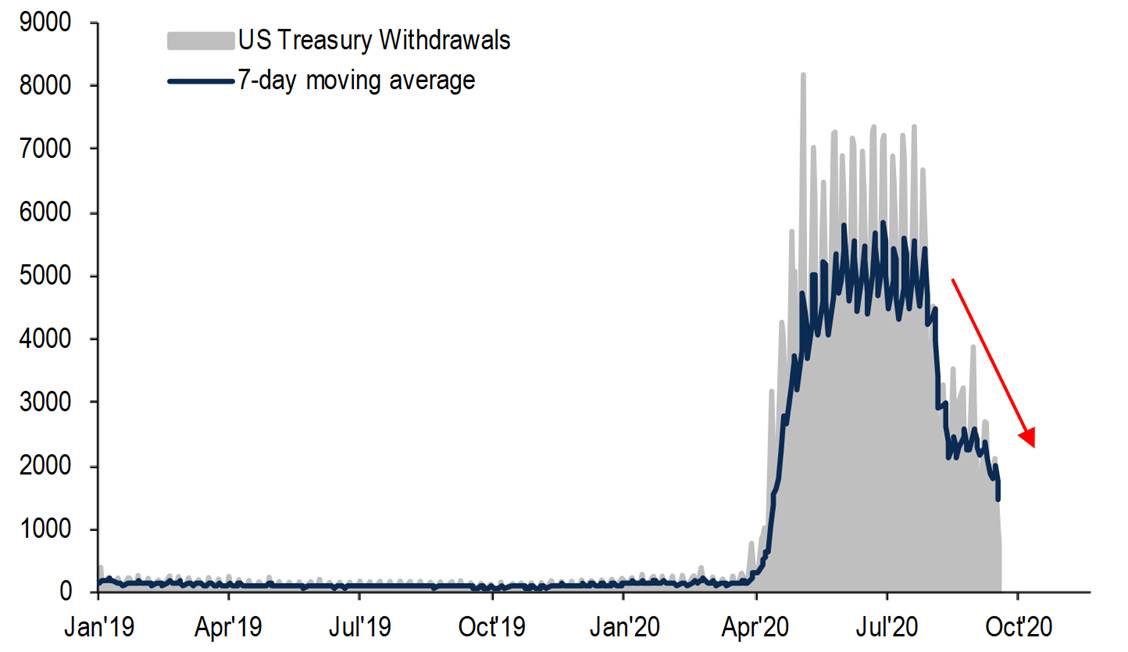

Bank of America Research notes that U.S. Stimulus Payments are the lowest

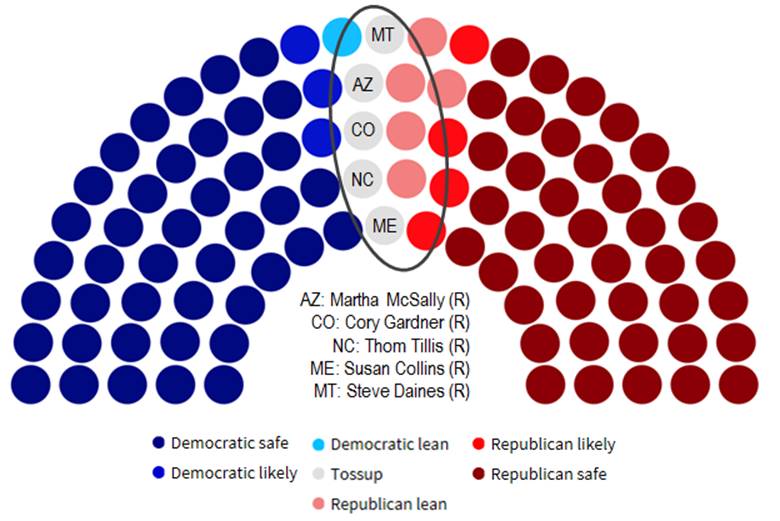

since April. The investment bank

identifies five state elections which they believe will determine the majority

in the Senate in 2021. This is show in

the following two charts.

Chart 1. Federal stimulus payments are the lowest

since April - Treasury withdrawals for unemployment insurance payments, $mn

SOURCE: BofA Research Investment

Committee, Bloomberg

……..………..………..…..…..…..………..…..……….…..…..….…..…..………..……………..…..…..

\

Chart 2. 5 races

will decide control of the Senate and the future of fiscal policy - 2020 Senate

election consensus forecasts

SOURCE: BofA Research Investment Committee, Cook Political

Report, Sabato's Crystal Ball, Inside Elections

.….…….…………….…….….…….……….…….……….…...….….….….…….…..

Separately, Morgan Stanley

slashed its forecast for US gross domestic product growth in the 4th

quarter to 3.5% from 9.3%, citing "diminishing fiscal support" in a

Sunday note to clients. A team of Morgan

Stanley economists said that a second stimulus package is "unlikely to be

delivered this year." They also noted that a divided government after the

election means more "fiscal gridlock" is ahead for the U.S.

economy.

Conclusions:

Friday’s employment report

was the last set of monthly jobs numbers - and one of the last major pieces of

economic data - before the presidential election on Nov. 3rd. There’s tremendous uncertainty for the

remainder of the election campaign due to President Trump suffering from

COVID-19. Also, the uncertainty of GOP

Senate leaders trying to gain confirmation of the Amy Coney Barrett Supreme

Court nomination despite the news that at least three Republican Senators have

tested positive for the coronavirus and more are quarantining after likely

exposure.

Meanwhile, the BEA will

publish its initial estimate of third-quarter GDP on Oct. 29th. No

matter how large the number is (annualized or not), it won’t

tell us much about the sustainability of the economic recovery or the amount of

time it will take to return to pre-pandemic levels. That will largely depend on containing the

virus, having a vaccine that has been thoroughly tested as safe and effective,

and the U.S. election results.

Classic Quote:

When pondering the uncertain

economic and coronavirus outlook for the 4th Quarter and all of

2021, keep in mind what Brooklyn Dodgers fans of the early 1950s and New York

Met fans of the 1960’s said after the end of each baseball season:

“Wait till

next year...”

Good health, good luck and

till next time…

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been

involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned

(since 1971) to profit in the ever changing and arcane world of markets,

economies and government policies.

Victor started his Wall Street career in 1966 and began trading for a

living in 1968. As President and CEO of Alpha Financial Technologies LLC,

Sperandeo oversees the firm's research and development platform, which is used

to create innovative solutions for different futures markets, risk parameters

and other factors.

Copyright © 2020 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).