Coronavirus Update: U.S.

Economy Hit Hard; IMF Forecasts Worse Downturn; Disconnect Danger Ahead?

By the Curmudgeon

Introduction:

Today

was truly momentous regarding the many coronavirus related announcements that

show the U.S. and the global economy will be hit much harder than previously

thought. The IMF once again downgraded its global growth forecast.

Latest

Coronavirus Stats:

ท There have been just under 9.5 million COVID-19

cases worldwide, with more than 483,000 deaths. More than 4.7 million people

have recovered.

ท More than 2.3 million COVID-19 cases in the U.S.,

including 121,979 deaths. The five states with the highest death tolls are New

York with 32,257; New Jersey with 13,076; Massachusetts with 7,937; Illinois

with 6,770; and Pennsylvania with 6,518.

ท 38,115 new

infections were reported by U.S. state health departments on Wednesday, June 24th

surpassing the previous single-day record of 34,203 set on April 25. Texas, Florida,

and California led the way, with all three states reporting more than 5,000 new

cases apiece.

ท Three states California, Florida, and Oklahoma

reported record highs in new single-day coronavirus cases, while

hospitalizations hit a new peak in Arizona, where intensive care units have

quickly filled.

ท At last count, there were 196,030 COVID-19 cases in

California, including 5,724 deaths. CA infections are speeding up: more than 190,000 people in CA have tested

positive for the coronavirus, with nearly 28% of the total cases reported in

the last 14 days. John Swartzberg, an infectious

disease expert at UC Berkeley, said increased testing accounts for part of it,

but that testing alone is insufficient to account for the increase in the

number of cases.

Click here to see a U.S. map

with state-by-state death tolls and coronavirus case counts.

...

Dead

people received $1.4 billion in coronavirus stimulus payments:

Let us

start out with U.S. government negligence, which seems pervasive. Nearly 1.1

million coronavirus stimulus payments totaling nearly $1.4 billion were

sent to dead people, according to a congressional independent report released Thursday June 25th. The U.S. Government Accountability

Office (GAO) said that U.S. Treasury and IRS officials did not use death

records to stop payments to deceased individuals for the first three batches of

payments because of the legal interpretation under which IRS was operating.

The

report also stated: The Internal Revenue Service (IRS) and the Treasury moved

quickly to disburse 160.4 million payments worth $269.3 billion. The agencies

faced difficulties delivering payments to some individuals, and faced

additional risks related to making improper payments to ineligible individuals,

such as decedents, and fraud. According to the Treasury Inspector General for

Tax Administration, as of April 30, 2020, almost 1.1 million payments totaling

nearly $1.4 billion had gone to decedents. GAO recommends that IRS

should consider cost-effective options for notifying ineligible recipients how

to return payments. IRS agreed.

When

the U.S. Treasury learned that payments had been made to dead people, Treasury

and the IRS determined that people are not entitled to a payment if they are

dead at the time the payment is made, and Treasury instructed the IRS to stop

issuing payments to deceased individuals, according to the GAO report. The report

says that the stimulus payments to dead people could be considered

improper payments under a 2019 law.

U.S.

Economy Hit Hard by Coronavirus:

1. US GDP fell at 5.0% rate in Q1-2020; much

worse declines expected

The

U.S. economy shrank at a 5.0% rate in the first quarter with a much worse

decline expected in the current three-month economic period, which will

show what happened when the pandemic began spread across the U.S. A revised

government estimate found that consumer spending in the first quarter was

weaker than previously thought.

The

Commerce Department reported Thursday that the decline in the gross domestic

product, the total output of goods and services, in the January-March quarter

was unchanged from the estimate made a month ago. The 5% drop was the sharpest quarterly

decline since an 8.4% fall in the fourth quarter of 2008 during the depths of

the worst financial crisis since the Great Depression.

Federal

Reserve officials and private-sector economists believe that GDP plunged around

30% from April through the June (2nd quarter). Economists surveyed

by MarketWatch expect a decline at a 29.5% annual rate. The data will be

released on July 30th.

That

would be the biggest quarterly decline on record, three times bigger than the

current record-holder, a 10% drop in the first quarter of 1958.

2.

California unemployment claims on the rise:

New

claims for unemployment benefits in California (CA) rose sharply last week

compared to the week before, the latest Department of Labor figures show.

Continued high job losses suggest the damage from the coronavirus is spreading

into more sectors, economists said.

3. CA

Governor Newsom declares budget emergency to support states virus response:

CA Gov.

Gavin Newsom on Wednesday. June 24th declared a budget emergency to

ensure the availability of funding for personal protective equipment, medical

equipment and other expenses as the state continues grappling with the

coronavirus. The proclamation clears the way for the Legislature to pass

legislation allowing the (largest populated U.S.) state to draw from the CAs

rainy day fund to help California continue to meet the COVID-19 crisis,

Newsoms office said in a statement. The proclamation is needed so California

can tap its contingency reserve funds, a key component of the state budget deal

that Newsom and legislative leaders agreed to this week.

4. Texas pauses reopening plan as coronavirus

cases surge and hospitalizations rise:

Texas

Gov. Greg Abbott announced Thursday that the state will pause any further

reopening as it continues to report record increases in Covid-19 cases and

hospitalizations.

Businesses

that were permitted to open under the previous phases can continue to operate

at the designated occupancy outlined by the Texas Department of State Health

Services, according to statement from Abbotts office.

Texas

is one of the states in the American West and South experiencing a recent surge

in Covid-19 cases. On Wednesday, the state reported more than 5,500 additional

Covid-19 cases.

5. ShadowStats John Williams latest comments on

U.S. Economy:

- U.S.

Economic Activity Was Faltering Before the Pandemic-Driven Collapse

- Pre-Pandemic

Economic Troubles Were Driven Primarily by Intensifying Federal Reserve

Policy Malfeasance

- March

2020 Economic Numbers Took the Initial Hit of the Pandemic Shutdown,

Pulling First-Quarter 2020 GDP into an Annualized 5.0% (-5.0%) Contraction

- April

2020 Saw the Worst-Ever Monthly Collapses in Industrial Production,

Nonresidential Construction, Payrolls and Retail Sales

- May

2020 Saw Dead-Cat Bounces in Monthly Production and Construction, Some

Bottom-Bouncing in Payrolls and Rebounding Retail Sales; the Latter Two

Series of Questionable Reporting Quality

- In

Its 18th Straight Month of Annual Decline, the May 2020 Cass Freight

Indexฎ Notched Lower, Closing in on Its Record Trough of the Great

Recession (2008-2009)

- Second

Year of Federal Reserve Reporting Delays Look to Exclude Long Overdue,

Pre-Pandemic Downside Revisions to Industrial Production from the July

30th Second-Quarter 2020 GDP Estimate and Annual Benchmark Revisions

- All

Considered, Initial Second-Quarter 2020 Real GDP Holds on Track for the

Deepest-Ever Annualized Quarterly Contraction, Down by Roughly 50% (-50%)

- No

amount of Government Spending or Federal Reserve accommodation and money creation will turn this

economy around, although the authorities may be well along the way of

hyper-inflating the economic collapse. Nonetheless, restoration of stable

social, economic and employment circumstances depends on the control and

containment of the massive issues arising from the handling of the Coronavirus

Pandemic shutdown of society and the economy.

- The

virus has not been broadly contained, yet. There is no vaccine, yet. High

risks to older individuals continue.

- There

have been elements of permanent destruction of or massive disruptions to

the small businesses that drive and enable so many key elements of

society.

- Protracted

Recovery Likely Will Be L-Shaped, Not V-Shaped: A full economic

recoveryregaining pre-Pandemic levels of economic activitylikely remains

some years off, in an eventually up-sloping L-shaped curve.

IMF

(yet again) Lowers Global Growth Forecast:

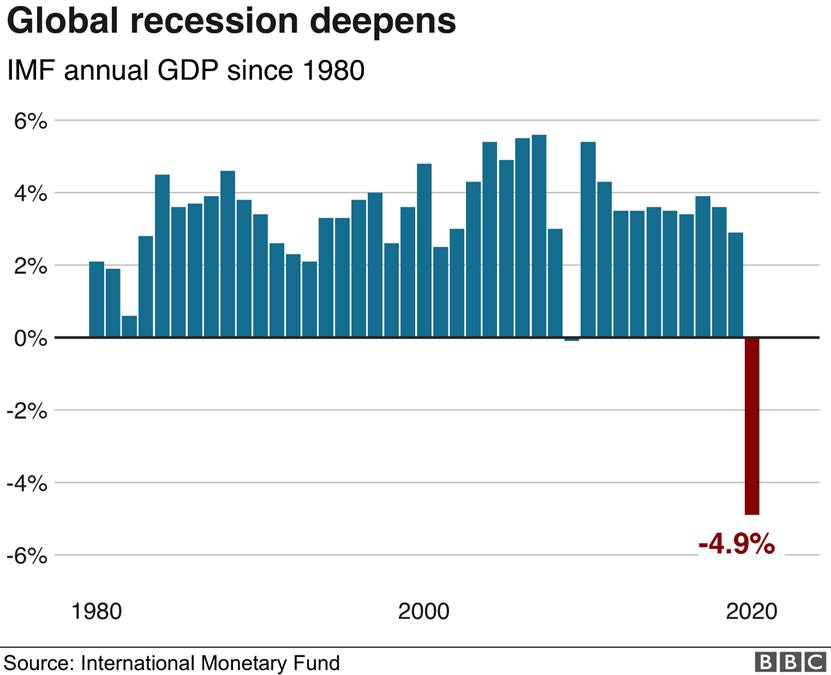

The

International Monetary Fund (IMF) has once again lowered its global growth

forecast for this year and next in the wake of the coronavirus pandemic. It now predicts a decline of almost 5% in

2020, substantially worse than its forecast only 10 weeks ago in April.

The

recession caused by the pandemic - globally and in many individual countries -

is likely to be deeper than the IMF previously thought.

The

IMFs gloomier outlook partly reflects the fact that data since April have

pointed to a sharper downturn than its earlier forecast envisioned. The global central bank now expects a larger

hit to consumer spending which is somewhat unusual. Consumer spending usually

takes a much smaller hit in a downturn than business investment. But this time, lockdowns and voluntary social

distancing by people who are wary of exposing themselves to infection risks

have hit demand.

The IMF

also expects people to do more "precautionary saving," which will

reduce their consumption because of the uncertain outlook ahead, especially for

jobs and business re-openings and staying open.

More

firms going out of business and people being unemployed for longer may mean

that it is harder for economic activity to bounce back as quickly as many

optimists had hoped.

There

is also a danger that, the efficiency of surviving businesses is likely to be undermined

by the steps they must take to improve safety and hygiene - to reduce the risk

of workplace transition of the coronavirus.

(Restaurants implementing social distancing protocols and extra cleaning

is the best example we can think of for such coronavirus impacted firms.)

..

The Fed

on U.S. Economic Risks:

Esther

George, President and Chief Executive Officer, Federal Reserve Bank of Kansas

City in a June 25th speech to the

Economic Club of Kansas City:

One

risk is that consumers and businesses react to the new uncertainty introduced

by the virus by pulling back on consumption and investment with the goal of

building precautionary buffers against future disruptions. While rational at

the individual level, such a pullback can hamper growth across the wider

economy.

Another

risk comes from the global economy. Foreign demand for U.S. exports had already

been weak for some time before the crisis. Now, with the virus rolling across

foreign economies at varying times and intensities, it seems unlikely that we

should expect much support from overseas as our economy picks back up.

Finally,

while fiscal policy is currently providing substantial support for growth,

there is a risk that the impetus from fiscal policy will turn negative before

the recovery has been fully realized. The coronavirus pandemic has created

serious financial consequences for state and local governments, which unlike

the federal government, must balance their budgets. In the near term,

governments are facing liquidity challenges, as many tax deadlines have been

postponed, leading to massive drops in income tax collections this spring.

Also, shelter-in-place orders have sharply reduced consumer spending, thereby

lowering sales tax collections. While state revenues are under pressure, the

demand for state services, including spending on medical supplies and temporary

health facilities, is growing.

...

Fiendbears Comments:

While

significant, all of what was reported today is just a drop in the bucket. The

real concern is that this does not seem to be going away. My conference in San

Diego is now virtual. We will be working remote until at least September.

Travel is going to remain restricted so no vacationing.

I

really do not think people realize how serious this virus is going to be once

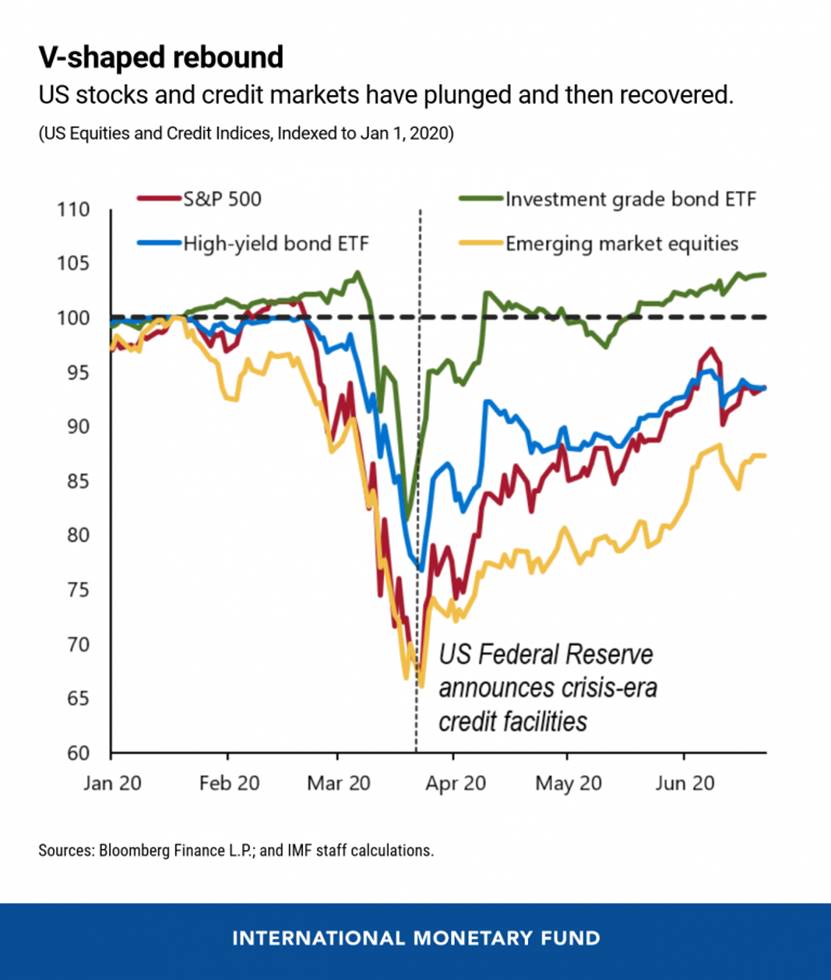

it really gets going (i.e. 2nd wave of cases). The Fed has done a

great job propping up the stock and credit markets (see chart below), but the

economy may be in trouble for years.

...

Curmudgeons

Closing Comment:

The

disconnect between financial markets and the real economy can be illustrated by

the recent decoupling between the soaring U.S. equity markets and plunging

consumer confidence (two indicators that have historically trended together),

raising questions about the rallys sustainability if not for the boost

provided by the Fed and other central banks.

.

This

divergence increases the probability of another MAJOR correction in risk asset

prices should investors bullish and complacent attitudes change. Such a

negative wealth effect would pose a very real threat to any economic

recovery. As weve

noted in many previous Curmudgeon posts (with tables) bear equity market

rallies have occurred in the past during periods of significant economic

pressures, only to unwind quickly and sharply (like a falling knife or

waterfall decline).

Be

well, safe, and healthy. Success and

good luck. Till next time

...

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been

involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since

1971) to profit in the ever changing and arcane world of markets, economies and

government policies. Victor started his

Wall Street career in 1966 and began trading for a living in 1968. As President

and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's

research and development platform, which is used to create innovative solutions

for different futures markets, risk parameters and other factors.

Copyright ฉ 2020 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).