New

Undisclosed Threats to the US Economy and Markets

By Victor Sperandeo with

the Curmudgeon

Introduction:

What happened to America? I could write a small book on so

many current topics: COVID-19, the killing of George Floyd and the riots in two

dozen cities, and of course the economy and the primary markets. However, the Curmudgeon and I will focus on

the latter as this is NOT a political blog.

Our new piece will be a surprise to many. It focuses on the

US economy, consequences of Fed debt monetization, bank lending, money velocity

and a possible new inflation flare up which few are anticipating and which the

Fed may not be able to contain.

US Economic Assessment:

What you see occurring in both the economy and the markets is

not capitalism. The government system we live in threw the US Constitution out

a long time ago, and the loss of liberty is declining materially on a monthly

basis. The U.S. Federal Reserve has used Central Planning (a.k.a. socialism)

in an attempt to stop most corporate failures and has flooded the markets with

newly created fiat money to save the system (and their jobs). That is the epitome of moral hazard.

Under capitalism, failure is a large part of the economic

system. However, in the current environment, the government - no matter who is

in power - bails out the people that contribute the largest amounts; they

always get saved in the end.

The banks were the beneficiaries in 2008/2009, but today it

is the large corporations. Meanwhile,

small business has been decimated with many mom and pop outfits not able to

survive. Yet the government bails out

large corporations instead?

The airlines bought $50 billion of their stock back in the

last several years, supporting prices so insiders could cash out. The

government just gave them $50 billion in grants and loans -because it wasnt

their fault that the virus came to America, according to President Trump.

In doing this bailout dance, the government creates massive

debts. This is especially true for the solution to the economic assault used

in defense against the pandemic, where governors shut down most businesses

(with the blessing of the President), under council of Dr. Fauci and Dr. Birx.

What is the economy supposed to look like in the 2nd, 3rd, and 4th quarters?

According to the Congressional Budget Office (CBO), the estimate for the

quarter ending June will show nominal GDP down -11.5% (or -38.7% annually). The

quarter ending September will be up 5.1% (or 22.2% annually), and the quarter

ending December will be up 2.6% (or 10.9% annualized).

The Fed Printing of US Dollars has yet to have a cost. Will that continue?

The Feds perception of ZIRP and multiple rounds of QE (not

to mention Operation Twist) is that, like MLB Hall of Famer Ted Williams (hit

.406 in 1941), they are great. Why? Because it worked to keep the markets up

and thereby preventing a recession. All

done like magic, with a zero cost.

QE was free of a price -for now. The history of printing

money has always had a cost, which became high when inflation accelerated. But

not this time?

The reason, which I have mentioned in many previous

Curmudgeon comments, is the change of the banking rules which allowed the Fed

to pay their member banks interest on free reserves (aka excess reserves) they

held. That gave the banks an

incentive to NOT loan money. Why

loan money and take a credit risk when you can get free interest + guaranteed

return of principal from the Fed?

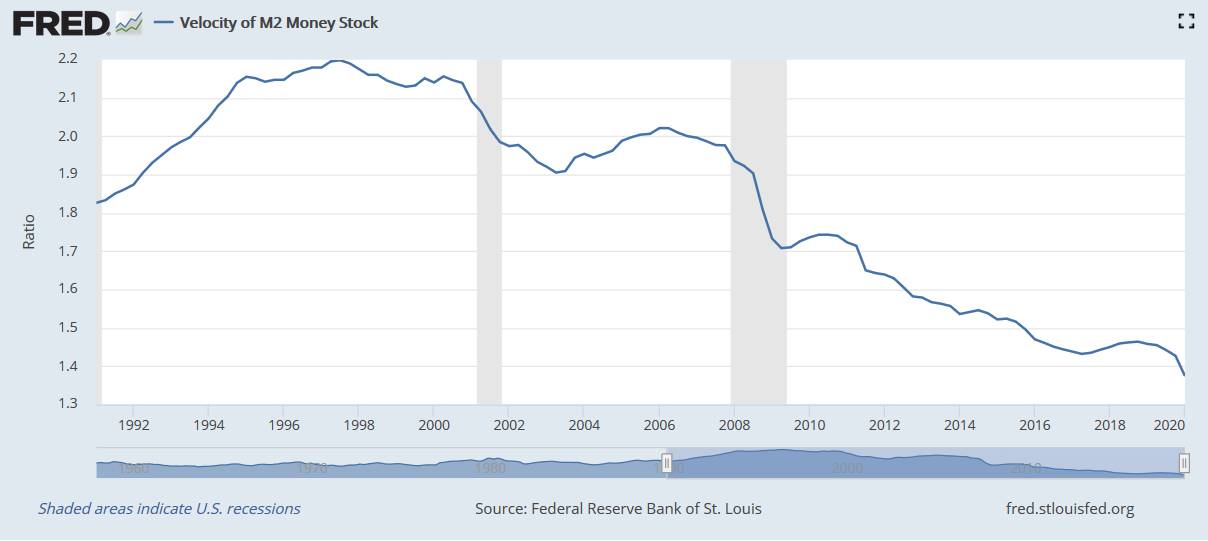

This lack of lending is why the velocity of money (M2) is at a 65 year

low of 1.37% as of April 29. 2020.

The effect was that the money the Fed created by buying fixed

income securities became free reserves at Federal Reserve member banks which

were then loaned back to the Fed. Hence,

the trillions of dollars created never made its way into the real economy! Weve previously called this

merry-go-round a PONZI SCHEME!

.

News Flash: On May 29, 2019, the Federal Reserves

balance sheet stood at $3.9 trillion. As of May 27, 2020, the Feds

balance sheet had skyrocketed to $7.145 trillion, an increase of 83

percent in one years time. The Fed is greatly increasing the amount of Treasurys

and other assets it owns in an effort to keep markets and the economy afloat

during the COVID-19 pandemic.

.

How does a bank make money?

It borrows short term and lends long term. Short rates are normally

lower in the short term, and higher as you extend the duration of the loan,

note or bond. [The exception is the inverted yield curve, where short term

securities like three-month T-bills yield more than longer term securities like

10-year T-notes.]

So, banks earn money on the spread, as they collect more in

long term interest (e.g. loans) than they pay in short term interest (e.g. on

savings accounts or CDs). If banks do not make loans, money is stagnant.

To create real economic growth (and later inflation), money

has to be turned over. That is, it has

to CIRCULATE in the real economy. The

latest 1.37 M2 velocity number means it has been turned over 1.37 times a

year.

For comparison, in 1922 Germany it turned over 12.0 times, or

once a month therefore the result was hyperinflation.

How will the Fed cope if inflation returns?

In an editorial in the WSJ ,on May 29th 2020 titled: Why the Fed May Not Duck Inflation This Time,

Phil Gramm and Mike Solon point out why low inflation might not continue. Here are a few excerpts:

When the Fed bought $3.7

trillion of presidency and personal debt in 2008-14 and, defying standard

financial knowledge, precipitated no inflation, a brand new phantasm took

maintain of the political left: Fashionable Financial Idea, which holds that

the Fed can present nearly limitless funding with little draw back.

The large quantity of

debt bought by the Fed didnt improve the cash provide and create

inflationary pressures, as a result of the Fed carried out a brand new

coverage the general public and plenty of educated commentators and economists

nonetheless dont totally perceive. For the primary time, Congress empowered

the Fed to pay curiosity on extra reserves, changing these reserves into an

investment asset for banks and making it attainable for the Fed to borrow large

quantities of cash from the banks.

Worst of all, public

lending to non-public enterprise might turn into everlasting. If the Fed cant

finish its $four trillion lending at sponsored charges and reverse its

financial enlargement without leaving the banking system and the financial

system crippled, will Congress prolong the Feds business-lending position past

the scheduled Dec. 31 finish date? Were perilously near discovering out

whether or not the Fed can create a nearly limitless provide of credit score

with no adversarial results, and whether or not credit score can lengthy be

allotted politically relatively than by market forces without threatening

Americas prosperity and freedom.

..

.

US companies must borrow; Banks need to lend money to make

money:

Corporate America needs money now as their earnings drop will

be HUGE. They will need to borrow money

to stay afloat. Also, the money supply

is now expanding at a 102% rate in the last two months and excess reserves have

doubled, according to Gramm and Solon. So, theres plenty of money available to

loan out and thereby increase money velocity which is a precursor to inflation.

The banks are not making profits now, because spreads have

collapsed, i.e. the yield curve is very flat (the 6-month T-Bill is 16 bps and

the 10-year T-Note is 66 bps).

Therefore, there is an incentive for banks to increase loans at the

prime rate or higher. If the banks

start lending again and money starts to turn over/ velocity increase, inflation

could result. What would the Fed do then?

Let us assume money velocity increases and inflation

returns. The federal deficit is going to

be at least 18% of GDP, but it would be higher if the Fed tightens credit. Raising rates at a time when the US Treasury

needs to borrow records amount of money would make debt service costs

increasingly high and thereby increase the budget deficit and national

debt. It might also tip the economy into

another recession before an economic recovery starts in earnest (the CBO said yesterday that it will take 10 years for

the U.S. economy to fully recovery).

Henry McVey, head of

global macro, asset allocation, and balance sheet investments at KKR warned in

a Bloomberg TV interview that governments will reach a tipping point next

year at which point they can no longer easily sell new debt. The now extinct bond vigilantes investors

who sell bonds to combat rising inflation could return in droves and further

complicate the government's bond-sale efforts.

McVey thinks they will object to additional borrowing when federal debt

reaches 150% of gross domestic product.

Most of the newly created government spending on COVID-19

relief has been financed by debt which has been purchased by central-bank which

have greatly expanded their balance sheets. But that buying cannot go on

indefinitely. At the same time debts

been increasing, the denominator in the debt-to-GDP equation is shrinking.

McVey expects a 10% drop in demand over time because of the pandemic, greater

than the 5% decline he figures is implicit in current stock prices. Therefore, the debt to GDP ratio is likely

to increase spectacularly. Such risks

will push the Fed to end its relief programs in a matter of months, McVey said.

So, raising rates to fight inflation, might not be possible.

That certainly poses a dilemma for the Fed.

Conclusions:

If inflation results, the Fed may not be able to stop it and

it would then accelerate. This then puts a whole new light on risk for stock

prices. Oaktree Capital co-chairman

Howard Marks warned earlier in May that current risk-asset prices (especially

US equities) are "artificially supported by Fed buying," and that he

didn't think such levels would hold "if the Fed were to recede."

I do not think many investors are aware of this potential

scenario and will be surprised at the sight of inflation. However, keeping

people in the dark is the Feds playbook.

Or maybe the Fed is also in the dark?

Closing Quote:

It is in the interest of tyrants to reduce the people to

ignorance and vice. For they cannot live in any country where virtue and

knowledge prevail. Samuel Adams, one of the Founding Fathers of the

United States.

..................

Stay healthy, be well, stay calm and till next

time

..

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2020 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).