U.S.

Unemployment Situation Much Worse than April BLS Report

By the Curmudgeon

Introduction:

Below were the headline stories

in the NY Times, WSJ, and SF Chronicle, respectively in Saturday’s print

editions:

· U.S. UNEMPLOYMENT IS WORST SINCE DEPRESSION

· Decade of Job Gains Erased in April

· Jobless rate rises to highest since 1939

Not really a surprise, but scary nonetheless. We analyze the BLS report with strong

supporting commentary from ShadowStats’ John Williams revealing the true

jobs picture.

This month’s jobs collapse has

occurred with unprecedented speed. In February, the unemployment rate was at a

more than 50-year low of 3.5%, and employers had added jobs for a record 9½

years. In March, the unemployment rate was just 4.4% vs. an actual rate of

somewhere between 20% and 30% at the end of April.

Summary of Bureau of

Labor Statistics (BLS) April 2020 Unemployment Report:

On Friday, the BLS reported that 20.5 million jobs vanished in April, the

worst monthly loss on record, while the unemployment rate rose to 14.7

percent. Unemployment is now at its

highest point since 1939. That is the

highest rate and the largest over-the-month increase in the history of the

series (seasonally adjusted data are available back to January 1948). The

number of unemployed persons rose by 15.9 million to 23.1 million in April. The

sharp increases in these measures reflect the effects of the coronavirus

pandemic and efforts to contain it.

As noted in previous Curmudgeon

posts related to unemployment reports, BLS presents statistics from two

monthly surveys. The household survey measures labor force status,

including unemployment, by demographic characteristics. The establishment

survey measures non-farm employment, hours, and earnings by industry.

BLS said that employment fell

sharply in all major industry sectors, with particularly heavy job losses in

leisure and hospitality. Of course, this was due to the nationwide shutdowns of

factories, stores, offices, and other businesses.

Minorities and poor people

have suffered the most from the economic shutdown. Job losses were especially

severe among Latinos, whose unemployment rate leaped to 18.9% from 6% in March.

The African American rate jumped to 16.7%, while for whites it rose to 14.2%.

Almost half the 14 million

U.S. hotel and restaurant workers lost their jobs last month. But losses have

spread to nearly every industry, with even health care shedding 1.4 million

jobs, nearly all of them from doctors’ and dentists’ offices, as Americans have

cut back on all but necessary visits.

In addition to the millions of

newly unemployed, 5.1 million others had their hours reduced in April.

The BLS statement included

this very relevant, significant paragraph which most

reporters missed:

The labor

force participation rate decreased by 2.5 percentage points over the month

to 60.2 percent, the lowest rate since January 1973 (when it was 60.0

percent). Total employment, as measured by the household survey, fell by 22.4

million to 133.4 million. The employment-population ratio, at 51.3 percent,

dropped by 8.7 percentage points over the month. This is the lowest rate and

largest over-the-month decline in the history of the series (seasonally

adjusted data are available back to January 1948).

Comment and Analysis:

“The jobs report from hell is

here,” said Sal Guatieri, senior economist at BMO

Capital Markets, “one never seen before and unlikely to be seen again

barring another pandemic or meteor hitting the Earth.”

“In just two months the

unemployment rate has gone from the lowest rate in 50 years to the highest rate

in almost 90 years,” said Gus Faucher, chief

economist at PNC Financial.

“It’s literally off the

charts,” said Michelle Meyer, head of U.S. economics at Bank of America.

“What would typically take months or quarters to play out in a recession

happened in a matter of weeks this time.”

The scale of the job losses

last month alone far exceeds the 8.7 million lost in the last recession, when

unemployment peaked at 10 percent in October 2009.

“I thought the Great Recession

was once in a lifetime, but this is much worse,” said Beth Ann Bovino, chief U.S. economist at S&P Global.

Nearly all the job growth achieved

during the 11-year recovery from the financial meltdown has now been lost in

one month. The last time unemployment

was this high was at the tail end of the Depression, just before the U.S.

entered World War II. Unemployment peaked at 25% during the decade-long slump.

Joblessness, by any measure,

could be even higher in the May BLS report, which will reflect many new initial

unemployment claims this month.

Temporary or Permanent

Job Losses?

The unemployment report

indicated that the vast majority of April’s job losses

— roughly 75% — are considered temporary, a result of businesses that were

forced to suddenly close but hope to reopen and recall their laid-off

workers. Whether most of those workers

can return anytime soon, though, will be determined by how well policymakers,

businesses and the public manage their response to the health crisis. The Curmudgeon believes the key will be to

greatly increase testing and contract tracing.

Economists worry it will take years to recover all the jobs lost.

“What I can do is I’ll bring

it back. Those jobs will all be back,

and they’ll be back very soon. And next year we’ll have a phenomenal year,” President Trump said in an

interview with Fox News.

Diane Swonk,

chief economist at Grant Thornton said such optimism was misplaced. She countered with this statement: “This is

going to be a hard reality. These furloughs are permanent, not temporary.”

“There is no safe place in the

labor market right now,” said Martha Gimbel, an economist and labor market

expert at Schmidt Futures, a philanthropic initiative. “Once people are

unemployed, once they’ve lost their jobs, once their spending has been sucked

out of the economy, it takes so long to come back from that.”

Meanwhile, the nonpartisan

Congressional Budget Office (CBO) has projected that the jobless rate

will be 9.5% by the end of 2021. Victor and I think it will be much higher

than that.

Harvard economist Raj Chetty said the economy’s health

will hinge on when the outbreak has subsided enough that most Americans will

feel comfortable returning to restaurants, bars, movie theaters and shops.

Unemployment Rate

Greatly Understated by BLS:

Sadly, the unemployment

numbers are actually quite a bit worse than BLS

reported. Government errors and the incongruous way it measures the job market,

makes the real unemployment situation.

The BLS admitted the

mistake but won’t fix it! BLS said its survey takers erroneously

classified millions of Americans as employed in April even though their

employers had closed down.

Betsey Stevenson, who was a

member of the Council of Economic Advisers as well as the Chief

Economist of the U.S. Department of Labor, highlighted, there was

incorrect classification of many individuals in April. “Interviewers were told

to classify people who were employed [but] absent from work due to

COVID-related reasons as temporarily unemployed. Many did this incorrectly

—correcting for this error raises the unemployment rate to nearly 20%,” she tweeted. “The BLS

doesn't do "ad hoc" corrections,” she added. (For more on this BLS

faux pas, please see John Williams’ analysis and comments below).

Also, millions more Americans

have filed unemployment claims since the data was collected in mid-April.

Finally, people who are out of

work but aren’t actually looking for a new job are not

officially counted as unemployed. An estimated 6.4 million people lost jobs

last month but did not search for new ones, most likely because they saw little

prospect of finding work with the economy shut down. Classifying those people as unemployed would

push the rate to 24%, according to calculations by Heidi Shierholz, an economist at the Economic Policy

Institute.

In note to subscribers (we

recommend you subscribe!), ShadowStats John Williams wrote:

The BLS

will not correct its headline numbers formally, because they state: “...

according to usual practice, the data from the household survey are accepted as

recorded. To maintain data integrity, no ad hoc actions are taken to reclassify

survey responses.”

That’s nice.

Look at Graph 1. below. It plots the full history of the headline Unemployment

Rate from 1948, up to the April 2020 14.7% headline reading. The diamond marker

reflects the more-accurate 19.5% headline level, as suggested by the BLS

corrective analysis. Consider that the headline April U.3 is the highest-ever

reading for the series, by about five percentage points, except for the

“corrected” number, which would be the highest ever by about ten percentage

points. This is not a minor error. If I were the head of the BLS, not

only would I find a way of correcting the meaningfully bad headline numbers,

but also make sure that current surveying techniques were fully understood by

the people in the field, before next week’s surveying of May unemployment

begins. A headline or “corrected” May 2020 unemployment rate of about 30% lies

in the balance.

….………………………………………………...

John’s other key comments and

opinions on this BLS report:

·

Headline April U.3 Unemployment

at 14.7%, Should Have Been 19.5%

·

The BLS Had Disclosed

the Same Surveying Error Last Month;

·

Where Headline March

2020 U.3 Was 4.4%, It Should Have Been 5.3%

·

Headline April

Unemployment Soared to Historic Highs from March:

·

U.3 from 4.4% to 14.7%,

U.6 from 8.7% to 22.8% and ShadowStats from 22.9% to 35.4%

·

More Realistic, Those

Same Unemployment Numbers, Corrected:

·

U.3 from 5.3 % to 19.5%,

U.6 from 9.6% to 27.7% and ShadowStats from 23.7% to 39.6%

·

April 2020 Payrolls

Collapsed by an Unprecedented 20.5 Million Jobs

·

Annual Growth in April

2020 Money Supply Measures Soared to Historic Highs

·

U.S. Economic Activity

Has Collapsed to Great Depression Levels

·

Federal Reserve is

Creating Unlimited Money [1.]

Note 1. (John Williams): Systemic

turmoil is just beginning as the Fed and U.S. Government continue to drive

uncontrolled U.S. dollar creation. The April 29th FOMC Statement confirmed, as

did Fed Chairman Powell at his April 29th FOMC Press Conference, that current

polices will continue, “... until we’re confident the economy is solidly on the

road to recovery.” Such is in the context of exploding, record annual growth in

April 2020 Money Supply (M1 at 27%, M2 at 18% and ShadowStats M3 at 20%),

unlimited liquidity creation and a Fed Funds range of 0.00% to 0.25%.

Here’s a 1-year chart from the St. Louis Fed showing the

sharp increase in M1 starting in March of this year:

…………………………………………………………………………

Financial Market Impact:

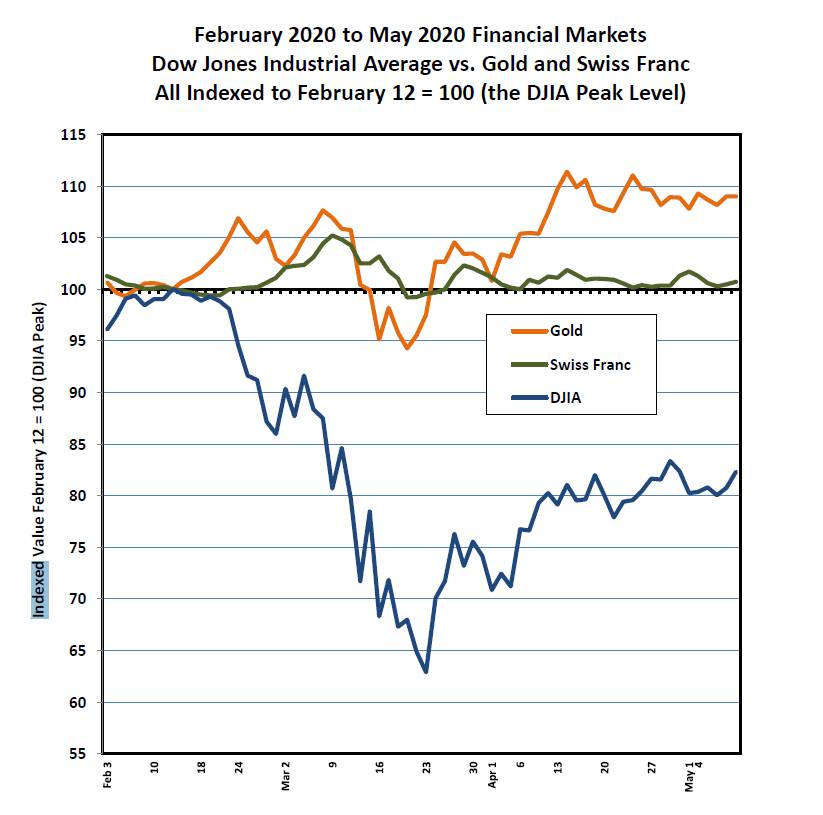

With respect to financial

markets, Williams says that physical Gold and the Swiss Franc [2.]

continue to protect U.S. Dollar purchasing power, especially vs. large cap

stocks. This is clearly depicted in

Graph 18:

……………………………………………..

Note 2. Swiss

Francs are extremely difficult to hold for a U.S. based investor. Even if one were to open a Swiss bank or money

market account, you’d have to pay fees and a negative

interest rate to buy and hold Swiss Franc’s in your account. You’d also have to

fill out special tax forms for foreign holdings. Hence, we don’t

recommend Swiss Francs for U.S. residents.

"One can buy physical

Swiss Francs (hard currency) at most major U.S. banks. I would no more hold

electronic CHF at this point in time than I would electronic or paper

gold."

……………………………………………………………...

Worldwide Economic

Contraction:

This week, the Bank of

England projected that Britain would see its biggest annual economic

decline since 1706, when the European powers were embroiled in the War of the

Spanish Succession.

Unemployment in the 19-country

euro-zone is expected to surpass 10% in coming months as more people are laid

off. That figure is expected to remain lower than the U.S. unemployment rate,

in part because millions of workers in places such as France and Germany are staying

on the payrolls with the help of (socialist) government aid that covers a large

portion of their salaries.

While no one knows the real

unemployment rate in China (government statistics cannot be trusted and the

unemployment numbers only include full time urban residents- not migrant

workers), we can say with confidence that its export led economy will get hit

especially hard by the global pandemic.

The sharp contraction in global demand poses considerable risks for

prolonging labor market weakness, which will hold back China’s economic

recovery in the second half of the year.

Economists from UBS and

Société Générale think that as many as 80 million China residents might

have been out of work in March (and more in April). That is nearly 20% of the

urban workforce. Few of the unemployed receive any help from the government,

which greatly exacerbates the plight of those without a job in China. That implies domestic demand will crater, if it hasn’t done so already?

……………………………………………………………………………...

Closing Quotes:

“You take my life when you

take the means whereby I live.” WILLIAM SHAKESPEARE,

The Merchant of Venice

“Of all the aspects of social

misery nothing is so heartbreaking as unemployment.” JANE ADDAMS, Twenty Years at Hull-House

“A man willing to work, and

unable to find work, is perhaps the saddest sight that fortune's inequality

exhibits under this sun.” THOMAS

CARLYLE, Chartism

……………………………………………………………………………

Good health, good luck, be well and have compassion for

your fellow man. Till next time…...

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2020 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).