Fedís QE Fattens Financial Markets, but the Economy Still

Starves

by The Curmudgeon

|

At the

conclusion of its 2 day meeting next week, the Fed is likely to reassure the

markets that it won't slow down it's buying of $85B per month of U.S. debt securities

in the near future.† The U.S. central

bank has noticed the market turbulence since Chairman Ben Bernanke's May 22nd

comment that it might begin tapering its quantitative easing (AKA debt

monetization) program even if the unemployment rate hasn't dipped below

6.5%.† That would

pose a major threat to the mortgage market, which the Fed wants to juice to

keep the housing recovery going.†

According to the Mortgage Bankers Association, the average rate

on a 30 year mortgage rose to 4.15% last week.† That's a 14 month high and up sharply from

3.59% in early May.† Freddie Mac's survey

pegged that rate at 3.98% this week, compared to 3.35% last month.† And refinancing applications were down 36%

from the first week in May, according to the Mortgage Bankers Association.† Rising

mortgage rates are a consequence of the swift rise in Treasury yields, as the

bond market sold off in anticipation of Fed "tapering," based on

Bernanke's May 22nd remarks.† Another Fed

concern is that inflation expectations are decreasing. The Fed has a 2%

inflation goal and doesn't want consumer prices to veer too much above or too

much below that number over time. Some inflation measures have dropped below

that level recently, but Fed officials haven't been too worried because

expectations of future inflation were stable.†

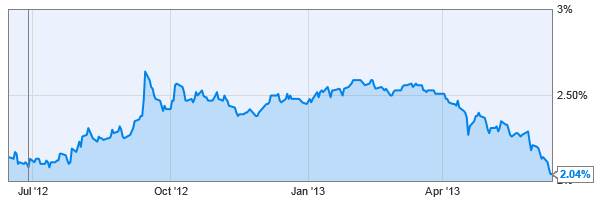

But those expectations are falling fast. The yield

spread between TIPS and same maturity Treasury notes provides a good measure

of inflation expectations.† The

difference between comparable maturity Treasury and TIPs yields reflects the

inflation compensation over that given timeframe.† For more information see this article. The TIPs

spread or "breakeven" rate (vs

Treasuries) has been falling, indicating a lower inflation outlook.† The current 10 Year TIPS/Treasury Breakeven

Rate is at 2.04%, compared to 2.51% on April 1, 2013.† The recent decline in this gauge is shown

in the chart below:

When faced

with frantic speculation over its motives, weakening markets, and diminished

inflation expectations, the Fed may be tempted to say things to calm everyone

down.† We expect Helicopter Ben to

continue putting the "pedal to the meddle." Yet we have

strongly argued that the Fed's QE programs and zero interest rate policy havenít

worked and are incredibly reckless.† It

has NOT stimulated the real economy, but has instead created many overvalued

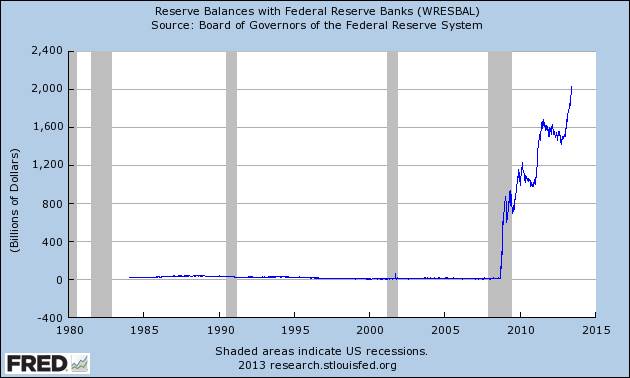

financial markets (which some call "bubbles").† We can see

how ineffective the Fed's policies have been by noting the bulge in Bank

Reserves (commercial banks deposits at the Fed, where banks earn 0.25%

interest) at the expense of commercial and industrial loans.† Reserves were up 25% (or $200B) in the 1st

Quarter of 2013 and have been growing exponentially for several years.† As the chart below indicates, bank reserves

have grown from practically zero in early 2009 to over $2 trillion now!

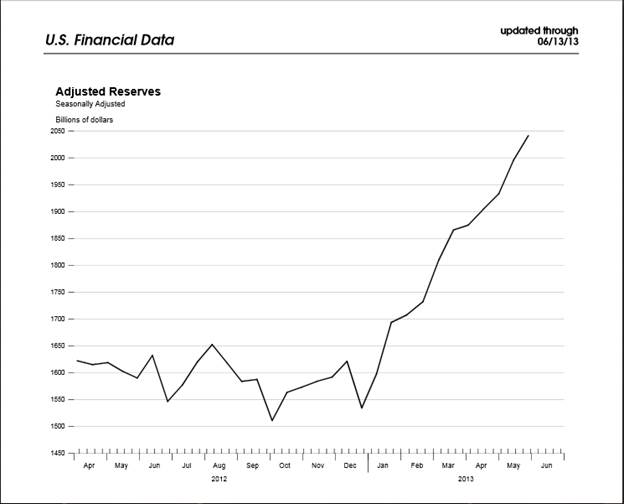

Adjusted

Reserves have recently

grown even faster, having spiked by 80% or $510B from the end of 2012 till

May 29th (latest posting).† This eye

popping expansion of seasonally Adjusted Reserves can be seen in the chart

below: The key point

is that instead of lending the cash they've obtained from the Fed's QE

programs, banks continue to deposit the money back at the Fed instead of

making loans. The banks' ongoing reluctance to lend (along with plunging

money velocity as we've shown in two previous Curmudgeon posts) totally

stymies the Fed's efforts to boost real economic activity.† Instead, it has resulted in overvalued

financial markets (especially U.S. stocks and junk bonds), which have become

almost totally disconnected from the real economy. Michael Pento

of Pento Portfolio Strategies LLC, told the

Curmudgeon that the Bernanke-led Fed has created "the biggest bubble in

the history of U.S. economics."†

In our next article, we'll cover the scenarios Mr. Pento has sketched

out when (and if) the Fed and the Bank of Japan (BoJ)

reach their inflation targets.† It is

not pretty! |

Till next time.....................................

The Curmudgeon

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.