No V Recovery in US; Perspective on the Economy

and Bear Markets

By Victor

Sperandeo with the Curmudgeon

Introduction:

These are certainly interesting and unique times! In this post, Victor shares

his thoughts and opinions on a variety of topics, while the Curmudgeon provides

a historical perspective on previous bear markets, bear market rallies with

supporting tables courtesy of Goldman Sachs and Bloomberg.

Backgrounder (Victor):

Since 2008, the U.S. federal

government and the Federal Reserve Board have been operating under fiscal and

monetary models that are designed to avoid a recession at all costs, e.g. a

trillion dollar budget deficit accompanied by record low unemployment and ultra-loose

monetary policy. The problem with such a model is that it was not designed to

survive an unknown shock, such as a pandemic.

To clearly illustrate this

point, Janet Yellen, Former Chairperson of the U.S. Federal Reserve said (after

reviewing the results of a stress test in 2017):

Would

I say there will never, ever be another financial crisis? Probably that would

be going too far. But I do think we're much safer, and I hope that it will not

be in our lifetimes, and I don't believe it will be.

To be accurate, Ms. Yellen

said financial crisis rather than recession. Yet if the federal government and

the Federal Reserve had not thrown an atom bomb at the coronavirus it would

be a financial crisis, as well as an economic Armageddon.

Unprecedented Fiscal and

Monetary Stimulus (Victor):

To date, the U.S. government

has authorized the spending of $2.25 trillion in stimulus, a.k.a. bailouts

and giveaways, as well as $4 trillion in loans (which are really grants to

corporations on a need basis). That is

in addition to increasing the Federal Reserves balance sheet to perhaps $10

trillion with QE infinity. For sure,

this was only the first few salvos to be fired; there are other multi-trillion-dollar

spending proposals being discussed.

Deflation Ahead (Victor):

Its important to note that

this virus has caused a deflationary problem, which I expect to persist over an

intermediate time period. Although gold

was up 3.6% year-to-date as of March 31st (primarily as a risk off

or perceived safe haven trade), the CRB Commodity Index is now trading

at February 1999 levels! Trading at less

than 1% nominal yield, the 10- and 30-year U.S. treasuries are also discounting

deflation dead ahead.

For years equities have been

the darling of the rich, the government, and the Federal Reserve, while

commodities have been the black sheep of the financial community. Now theyre both in the tank!

Bear Market Intact

(Victor):

This is an equity bear market

in the classic sense, and it likely hasnt ended after 33 days. (See Curmudgeon comments on what type of bear

market it might be and a history of bear market rallies).

What would be typical is for

the popular stock market averages to make an intermediate low in mid-April,

into the poor earnings season and 2nd quarter guidance horror show. Then we

could see a rally of between 33% and 66% of the first leg down, before making

new lows or major bottom later in the year.

However, it is critical to

recognize that past performance is never necessarily indicative of future

results, especially as the current market is far from typical as are the

factors currently influencing it.

Perspective on the U.S.

Economy (Victor):

The 11 year economic

recovery, which has clearly just ended, will be classified to be at least 126

months long by the National

Bureau of Economic Research (NBER). Thats the longest recovery in

U.S. history.

After the virus pandemic

ends, many pundits are talking up a V Bottom type of economic recovery. In my opinion, that talk is very premature

and highly unlikely.

In March 1933, the highest

unemployment rate in U.S. history was recorded at 24.9%. Yet in December 1936 it was still

19.97%! FDR threw the kitchen sink at

the economy. In addition, prohibition ended, and with the passing of the 21st

Amendment in 1933 tens of thousands of bars and restaurants with hundreds of

thousands of new jobs were created, yet in 3Ύ years the unemployment rate

dropped only 5%.

I do not believe the U.S.

economy will experience a V bottom when so many bad experiences are taking

place. Human nature calls for fear and caution to very slowly move back to

normal spending. With 70% of the economy based on the consumer, does anyone

believe that people are going to go back to pre-pandemic spending ways in just

four months? I think not.

With respect to politics,

President Trump is letting his wishes dictate his statements. According to the Wall Street Journal, Washington Post, and NY Times Trump has ignored the advice of his

medical and health experts, which has considerably slowed the U.S. response to

the coronavirus. That will surely have a

negative economic impact.

Curmudgeon on Bear

Markets:

Every bear market has a

unique set of drivers, but throughout history most of them fall into one of

four categories:

·

Structural These are the result of financial bubbles, too much

leverage, credit market dislocations, and other structural imbalances. Examples are the February 2000 to March 2003

and early 2008 to March 2009 downturns, which each produced -50% declines in

popular stock market averages.

·

Cyclical Cyclical bear markets happen more as a function of

the business cycle, when growth leads to inflation, interest rates go up too

fast, the yield curve flattens or inverts, loan activity declines, demand

wanes, the economy is in recession.

·

Event-Driven These bear

markets are triggered by an exogenous event, like an energy crisis, political

instability, war, or in the case of the current bear market, a global pandemic.

·

Secular This type of bear market lasts for at least a decade

and is usually accompanied by one or more intermediate cyclical bull markets.

However, the major trend is one of wealth destruction as the real purchasing

power of stocks decline over many years. Dollar cost averaging doesnt work and time is your enemy for an equity investor that

wants to retain purchasing power (dont we all?).

The most recent secular bear

market was 1966 through 1982, which saw good rallies from December 1974

through 1978 and then again from March 1980 through the summer of 1981. It was a very painful and frustrating

period for the Curmudgeon.

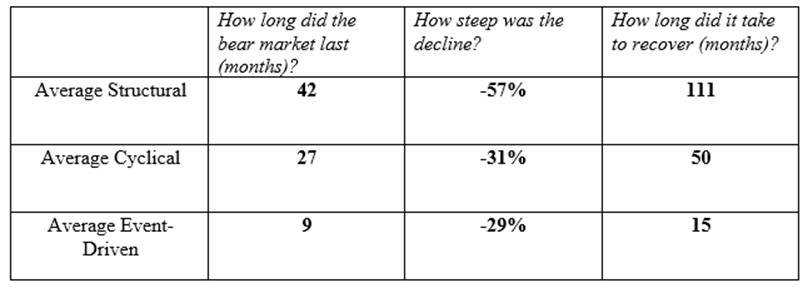

Looking back at data going

back to the 1800s, Table 1. shows the relative magnitude and duration for the

first three types of bear markets:

Table 1. Characteristics of three types of bear

markets:

Source: Goldman Sachs

.

.

.

.

.

..

.

.

.

.

.

.

..

.

.

.

.

.

.

.

.

Zacks Mitch on the

Markets wrote in an email to the

Curmudgeon:

Its

important to acknowledge that there has not been an event-driven bear market in

history that was triggered by a virus/disease outbreak. I think its important

to hold out the possibility that this event-driven bear could morph into a

structural (or even secular) bear market if the crisis is not contained by,

say, summer. In the meantime, however, I think the sheer size and speed of

fiscal ($2 trillion legislation) and monetary (virtually infinite liquidity)

stimulus should help keep this bear market in the event-driven category for a

few months.

Curmudgeon on Bear Market

Rallies:

Since the end of 1927, the

index that ultimately became the S&P 500 has experienced 14 separate bear

markets, according to Bloomberg calculations that define them as beginning any

time the index closes more than 20% below a record peak. Assuming a bear market

continues until the index either doubles from a post-peak low or climbs

above its pre-bear market high, the average bear market duration was 641

days.

Within those periods, the

S&P 500 has rallied more than 15% on 20 separate occasions (see Table 2.

below) before retracing those gains. Those advances lasted about 78 days each.

But even some of the retracements were marked with up moves in the market,

underscoring how hard it is to determine the MAJOR TREND in a typical bear

market.

Table 2. S&P 500 Advances of over 15% during Major

Bear Markets:

Source: Bloomberg

.

Conclusions (Curmudgeon

and Victor agree):

No one knows how long this

bear market will last. It all depends on

how effective the world is in containing the coronavirus and getting people

back to work. Therefore, dont believe

any of the forecasts you might read or hear about, especially the so called V

shaped economic bottom and recovery.

No end quotes today (weve

said enough already)!

Good luck, stay safe and healthy. Till next time

.

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been

involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2020 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating,

copying, or reproducing article(s) written by The

Curmudgeon and Victor Sperandeo without providing the URL of the original

posted article(s).