Has the U.S.

Economy Really Comeback or Weakened? What’s the Outlook for 2020?

By the Curmudgeon

with Victor Sperandeo

Introduction:

President Donald Trump will use next week’s State of the

Union to promote what he calls the “Great

American comeback,” according to a senior administration official. The

Curmudgeon asks: What comeback?

President Trump has maintained an enthusiastic bullishness

even though the annual GDP growth rate has fallen decidedly short of his

promises of 3 or 4 percent. In January,

at the World Economic Forum in Davos, Switzerland, Trump declared that “the

United States is in the midst of an economic boom the likes of which the world has

never seen before.” Really?

Overview of U.S.

Economy:

Let’s look at a few data points which conclusively show the

U.S. economy has been slowing and that is likely to continue:

·

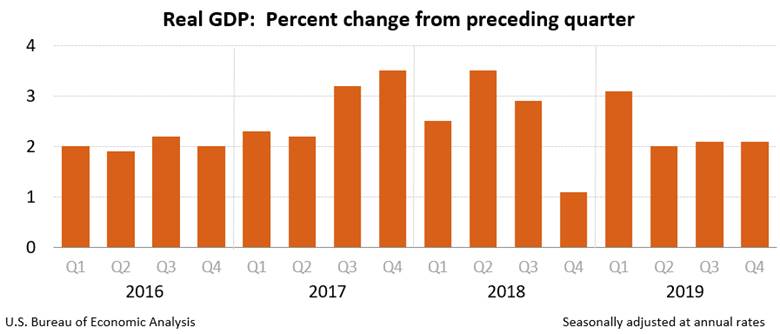

BEA reported this Thursday, January 30th

that U.S. GDP grew only 2.33% in 2019, which was down from 2.93% in 2018 and

the same as in 2017. The U.S. economy

has not expanded by 3 percent or more in a full calendar year since 2005.

·

GDP growth during the fourth

quarter of 2019 was 2.05849% (continuously compounded annual rate), slightly

lower than the (revised) 2.08169% during Q3-2019.

·

Gross private domestic

investment fell 6.1% in the quarter, the third straight decline and

significantly worse than the 1% dip in the previous period.

·

Investment in structures

slumped 10.1% and equipment, particularly on the industrial side, declined

2.9%.

·

The major contributor to Q4

GDP "growth" was the unusually large decline in imports (GDP

accounting subtracts spending on anything coming from overseas). While exports

were marginally higher (1.4%), the BEA figures that the total dollar value of

imported goods and services, adjusted for inflation, fell by an annual rate of

near 9%.

·

Imports were down sharply

because of trade wars and the domestic part of the supply chain is near its

breaking point.

·

Inventories have been

increasing (see chart below). If retailers and wholesalers are thinking of

economic weakness and then see it confirmed by inventory piling up, they're

going to begin cutting back on production and materials they order, which

results in lower demand for imported goods as well as those produced

domestically.

·

The yield curve has inverted

again. The spread between 3-month U.S. Treasury

bill and 10-year U.S. Treasury note inverted on Thursday for the first time

since October 2019. As of Friday, the 3

month T bill yielded 1.57% while the 10 year T note yield was at 1.51%

according to a U.S. Treasury web site.

·

The yield curve has flattened

toward zero all month: Short-term rates have stayed steady with the Federal

Reserve’s “on hold” monetary policy (and buying T bills to liquefy the repo

market), while longer-term yields have tumbled amid mounting evidence that the

deadly coronavirus is harming the outlook for global economic growth. Why is that significant? Because the yield curve inverted prior to

each of the past seven recessions. It’s

such a reliable indicator, that both the New York Fed and the Cleveland Fed

calculate the probability of a downturn in the coming 12 months based on the

slope of the yield curve!

·

Similar concerns about the

global economy’s health have also showed up in commodity markets, including industrial metals. This month, March

futures for copper have fallen nearly 10% to $2.527 a pound, and March West

Texas Intermediate crude futures are down more than 14% to $52.11 a barrel on

the New York Mercantile Exchange.

·

Finally, no new legislation

has or will come out of the U.S. Congress as a result of the impeachment

proceedings and bipartisan deadlock.

That means the U.S. government hasn’t and will not likely do anything to

stimulate economic growth.

……………………………………………………………………………………………

Comments from Economists

and Business Professionals:

“Underneath what you’re seeing is slower domestic activity,”

said Kathy Bostjancic, chief United States financial

economist at Oxford Economics. “It’s just the natural state of things.” Thursday’s GDP report shows that trend is

continuing. “We’re seeing some loss of

economic momentum as we exit 2019 and come into this year,” Ms. Bostjancic added.

“There is no evidence of broader positive developments

(related to the decline in U.S. imports),” said Brad W. Setser,

a senior fellow in international economics at the Council on Foreign Relations.

“To the extent that tariffs have succeeded in bringing the trade deficit down,

they have done so largely by reducing U.S. demand, not by raising U.S.

production.”

Ben Herzon, executive director of

United States economics at Macroeconomic Advisers, a forecasting firm said that

research shows that the “level of investment spending recently has been about

$100 billion lower than it would have had there been no uncertainty about trade

policy.” That uncertainty is likely to

continue – not only with China, but with Europe too.

"The behavior of the U.S. Treasury yield curve since

September is a little bit disturbing in that we've had monetary stimulus come

in," said Ed Al-Hussainy, senior interest rate

and currency analyst for Columbia Threadneedle Investments. "Despite all

of this, 10-year yields basically never got above 2% since September.”

“The flattening of the curve is an indication that the growth

concerns are greater now,” said Marvin Loh, senior

global macro strategist for State Street bank. “Everything is just a bit more

fragile, and we’re all wondering what the next headline is around the

coronavirus.”

"Consumer sentiment is terrific and the market is

terrific, but all the surveys of CEOs

say they expect a decline in the economy and I think, 'Who's got a better

feel for that?'" said Peter Ricchiuti, a

business professor at Tulane University who regularly speaks with small- to

medium-cap company CEOs.

“The coronavirus certainly presents a headwind to the

reflation of global growth story, which investors were anticipating into this

year,” Charlie Ripley, senior investment strategist at Allianz Investment

Management, told MarketWatch.

John Williams of ShadowStats wrote in a note to clients:

As Headline Economic

Reporting Increasingly Shows Slowing Economic Growth in Key Data, Looming

Benchmark Revisions Promise Downside Revisions to Recent Economic History.

Discussed in Special Commentary No. 985, headline economic reporting of the

last year was skewed heavily, likely to the upside, as a result of incomplete

and distorted reporting that resulted from the government shutdown.

Despite headline

December 2019 U.3 unemployment hitting a 50-year low of 3.50% at the second

decimal point, annual payroll growth slowed to a two-year low at the same time,

in advance of what should be negative annual benchmark revisions to payroll

employment on February 7th [see Flash Update No. 18]. In terms of harder

economic numbers, consider that Fourth-Quarter 2019 Real Retail Sales and Real

Earnings, Industrial Production, Real New Orders for Durable Goods and the

smoothed CASSTM Freight Index all contracted quarter-to-quarter, with total

full-year annual activity in Manufacturing, Real Orders and Freight actually

declining from the levels of full-year annual activity in 2018. December 2019

domestic freight activity plunged year-to-year in a manner and by an amount not

seen since the onset of the Great Recession.

Victor’s Comments on the Markets:

The financial and commodity markets were

greatly affected by the unexpected corona virus. Stocks, till the last day of

January, pretty much ignored the virus because it is weighted towards the tech

stocks which everyone loves. When the World Health Organization (WHO) declared

“a public health emergency of international concern,” the stock market started

to take notice.

Commodities perceived the virus as a “black

swan” killer event. The decline was particularly devastating due to the

tremendous hype surrounding the U.S. - China trade deal. The markets were led

to believe that China would be a buyer of U.S. grains, (perhaps) oil, copper,

and many other world commodities. As China buys a huge percentage of most

commodities, the country being closed for business (to prevent this virus from

spreading) caused across the board declines in commodities, even as most trends

were up in January.

Whenever you have a transition in trends

across the board it is always bad. The fear surrounding the corona virus also

caused downtrends to reverse, e.g. U.S. bonds/note prices were heading lower

then rallied. To a lesser degree, the Japanese Yen also reversed to the upside

as a “safe haven” currency.

This virus is extremely contagious so until

the number of people start to be infected less, “risk-on” markets should be

down to flat. It should be noted that June Gold closed at a 5 year high on a so

called “flight to safety.”

The Democratic primaries will be important

to watch. By March 3rd (Super Tuesday) the remaining candidates

should be Sanders, Biden, and Bloomberg (the Curmudgeon’s favorite). Should

Sanders or Warren be Presidential contenders the markets will be very nervous.

As much as many people don’t like Trump most like his polices. The same cannot

be said for Sanders or Warren who are perceived by many as Socialists.

Some final thoughts:

- The

U.S. dollar should decline as the rout in commodities will cause inflation

to decline. As disinflation or deflation occurs in the U.S. the Fed will

lower rates which will lower the dollar on world currency markets.

- The

whole world will follow the Fed as without China buying goods and

commodities, deflation is in the cards.

- Debt

instruments should continue to rally in price, while yields decline.

- More

stimulus will be forthcoming by global central banks. This in part as

Brexit finally happened to a degree. It's not official in my world for

another 11 months till its final.

Victor’s Conclusions:

1. The Fed reducing its balance sheet too

fast is totally responsible for the U.S. economic slowdown, in my opinion.

That’s even though the Fed started to greatly increase its balance sheet last

September to add liquidity to the repo market [1.].

Note 1. The

repo market is where high-quality securities are swapped daily for trillions of

dollars of cash, making a wide range of transactions easier.

2. President Donald Trump exaggerates

almost everything so the economy will never grow at 3% as

long as Jay Powell is head of the Fed. I have to say that Trump needs to

return to school as he has no idea who he is hiring and what they stand for?

His “ HR” instinct gets a grade of F- for what he

wishes his agenda to be.

Closing Quotes:

As

we enter the important U.S. presidential election season in March, perhaps the

words of some former leaders are apropos.

Otto Von Bismarck (1815-1898) said: “People

never lie so much as before an election, during a war, or after a hunt.”

Or as observed by Deng Xiaoping: “The

United States brags about its political system, but the President says one

thing during the election, something else when he takes office, something else

at midterm, and something else when he leaves.”

……………………………………………………………………………………………………………………………….

Good luck and till next time….

The Curmudgeon

ajwdct@gmail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been

involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2020 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).