“Goldilocks” Jobs Report Great For

Wall Street But Only So-So For Main Street

by The Curmudgeon

|

For the

second consecutive month, Wall Street cheered a mediocre employment report -

not too hot or not too cold (as in Goldilocks' porridge). The market rallied strongly on Friday to

celebrate "muddle through" jobs numbers, which participants believe

will keep the Fed's QE program going while preventing a consumer led

recession (due to concerns of high unemployment). More on the market's obsession with QE

later in this article. The Bureau of

Labor Statistics (BLS) report stated that a total of 175,000 nonfarm payroll

jobs were added in May.

But the net revisions for March and April were down 12,000. The May non- farm payrolls increase was in

line with the average of 172,000 jobs created per month over the last 12

months. A few other data points from

the May BLS report: ·

Unemployment

ticked up – from 7.5 percent to 7.6 percent.

·

The

number of long-term unemployed (those jobless for 27 weeks or more) was

unchanged at 4.4 million. These individuals accounted for 37.3 percent of the

unemployed. ·

The

average workweek for all employees on private nonfarm payrolls was unchanged

in May at 34.5 hours. ·

Hourly

earnings for all employees on private nonfarm payrolls were up a penny at

$23.89. ·

The

labor participation rate was little changed and remains near a 32 year low at

63.4 percent. ·

U-6,

the most comprehensive measure of unemployment, declined only 0.1 to 13.8

percent. [U-6 includes: total

unemployed, all persons marginally attached to the labor force, total

employed part time for economic reasons (as a percent of the civilian labor

force), plus all persons marginally attached to the labor force]. That's hardly

great news for main street to cheer about!

“The United States is way below where it should be,” said Lawrence F.

Katz, a Professor of Economics at Harvard. “We had a massive downturn and a

tepid recovery.” Indeed, the

U.S. is a full four years into an "economic recovery," yet overall

U.S. employment remains 2.1% below where it was at the end of 2007 (when the

"great recession" began). By comparison, over the same period,

between December 2007 and March 2013, the number of jobs was up 8.1 percent

in Australia; Germany, the biggest economy in the troubled euro zone, has

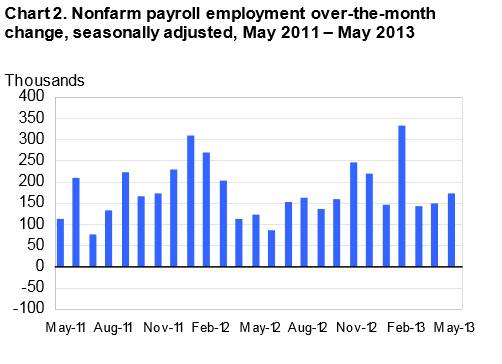

managed a 5.8 percent gain in employment, according to the NY Times. We can see

how little progress has been made over the past couple of years in creating

U.S. jobs in the chart below:

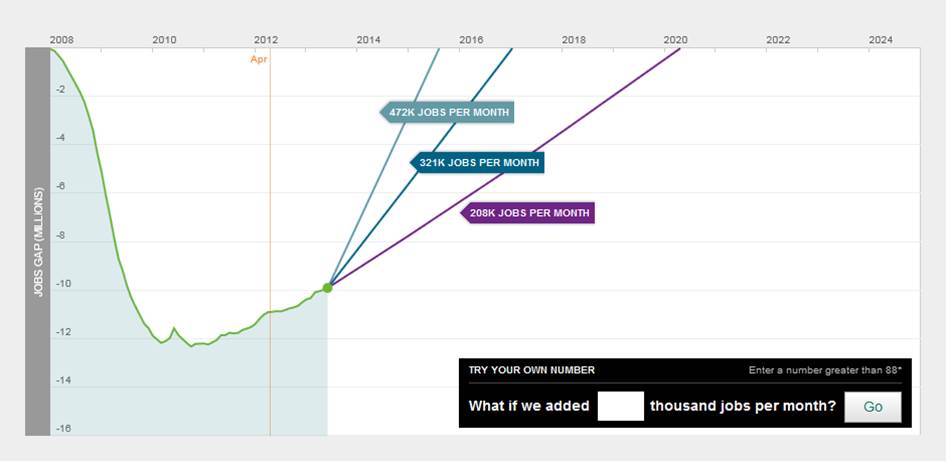

Each month,

The Hamilton

Project examines the

"jobs gap," which is the number of jobs that the U.S. economy needs

to create in order to return to pre-recession employment levels while also

absorbing the people who enter the labor force each month. Job creation would

have to average 208,000 per month to close the gap by 2020; 320,000 by 2017;

or 472,000 by mid-2015. This can be

clearly seen in this chart:

That is what

the Street calls "tapering."

Many market analysts have forecast that tapering would begin after the

Fed's September 2013 meeting, but the timing will likely depend on the Fed's

interpretation of future BLS employment reports. Evidently, the latest jobs report was strong enough to

reinforce the belief that tapering is coming, but the labor market is not

showing the kind of growth that would prompt the Fed to end its QE-debt

monetization programs in the next few months. That explains the market's strong rise on

Friday. But the situation could

quickly change. "Equity

markets are in a period of adjustment," said Anastasia Amoroso, global

market strategist at J.P. Morgan Funds in New York, which has about $400

billion in assets. "If there's an unannounced change in policy that

could be a shock to the downside." Closing

Thoughts & Viewpoint The

CURMUDGEON emphatically claims that the markets rally since the latest QE

program was announced (in September 2012) is based on a "house of

cards" that could collapse at any time.

Central banks have created the illusion of growth, based upon

re-inflating asset prices through artificially low interest rates and debt

monetization programs (AKA quantitative easing, or "creating money out

of thin air," or "printing money"). Michael Pento wrote: "In the

U.S., the publicly traded debt jumped by $7 trillion since the start of the

Great Recession. Our total debt hit a record $49 trillion (353% of GDP) at

the end of 2007—which precipitated a total economic collapse. But by the

start of 2013, total U.S. debt increased to $54 trillion, which was still

350% of our GDP. It is clear, once that interest rate “pin” is pulled, the

entire house of cards will collapse." Our view: At some point in time, the economy

will recover- unemployment will decrease below 7%, banks will start lending

again, money velocity will increase, and so will inflation. As inflation starts to pick up and long

term interest rates rise, the Fed will have to stop bond purchases and raise

short term rates. But we think the Fed

will ALSO have to "unwind" its massive balance sheet by

selling some of the $T's of bonds and mortgage securities it's purchased over

the last few years. Otherwise,

inflation will accelerate sharply and the US $ will collapse. That will be the day of reckoning for the

both the financial markets and the economy.

The long term outlook is NOT good. |

Till next time.....................................

The Curmudgeon

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.