Will

Geopolitical Tensions Effect Oil and Stock Markets?

By the

Curmudgeon

Introduction:

Investors and speculators appear to be stuck in a perennially bullish

posture that treats every stock market decline, potential selloff, or risk

factor as an opportunity to buy fear and prepare for stocks to rally

higher. The mentality continues to be buy the dip and sell puts whenever volatility spikes.

"Welcome to the brave new world where it appears that little short of

full-fledged world war between nuclear-armed powers would be required to have a

durable impact on financial markets. And even then, some begin to wonder,"

Reuters' Sujata Rao and Dhara Ranasinghe wrote. Lets examine, whether that opinion is valid.

..

Geopolitical Risk Events and the Stock Market:

No doubt worries over Iran have investors on edge, said LPL Financial

senior market strategist Ryan Detrick. Stocks could be volatile for a while,

but the impact to stocks from geopolitical events historically has tended to be

short-lived, he added.

Mr. Detrick is correct most of the time.

A recent Schroders report identified the 1990 Gulf War, the 2001 9/11

attacks on New York and the 2003 Iraq invasion as the most monumental

geopolitical risk events here of the past 30 years.

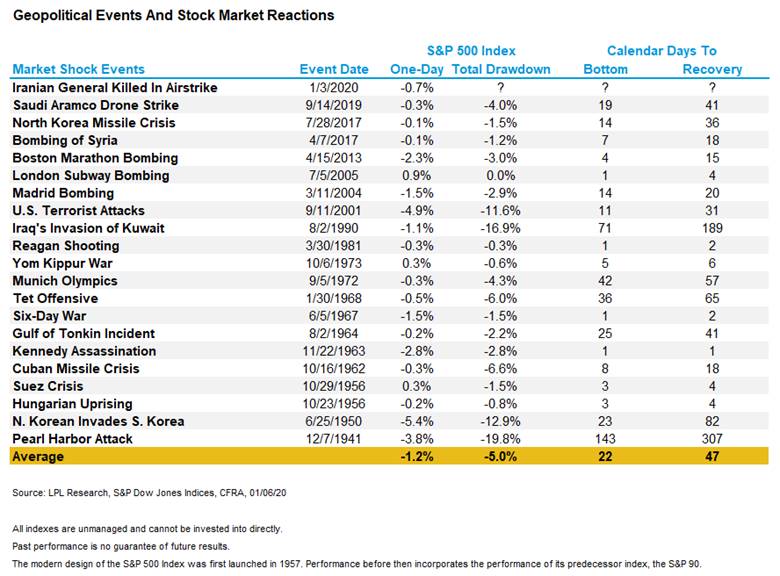

As we can see from the table below, courtesy of LPL Research (via Sam

Stovall of CFRA), there have been only two double digit S&P 500 drawdowns

due to geopolitical events since North Korea invaded South Korea in 1950.

Heres a graphic which charts the world uncertainty index vs global stocks

since the 2008 financial crisis:

The market has taken a view based on a decades worth of experience that

this (Iran-U.S. conflict this month) is not going to escalate out of control,

said Societe Generale strategist Kit Juckes.

Geopolitical Events, Oil Price Spikes, and Market Impact:

For decades, the energy price impact of major geopolitical conflicts has

been the main concern to the wider economy and world markets. The threat of oil

supply disruption has been a shadow on the global economy ever since a

quadrupling of oil prices during the 1973 OPEC oil embargo and a 30% jump in

1990.

Indeed, a recent Schroders report identified the 1990 Gulf War, the

9/11/2001 attacks on New York and the 2003 Iraq invasion as the most serious

geopolitical risk events here of the past 30 years. Those all had the potential to curtail middle

East oil supplies, especially since most of the 9/11 suicide terrorists were

from Saudi Arabia and presumably received financial aid from that country (of

course, the U.S. never retaliated).

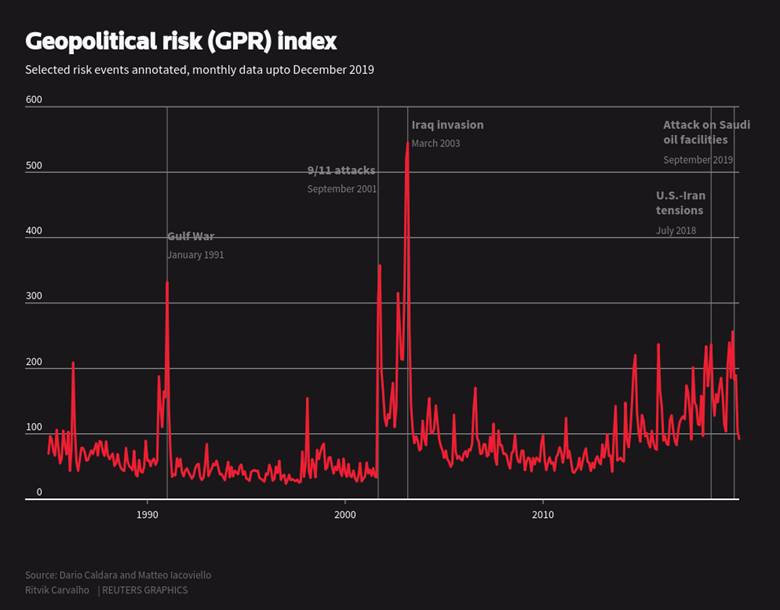

A geopolitical risk index compiled by U.S. Federal Reserve Board researchers

Dario Caldara and Matteo Iacoviello rates the

September 14, 2019 Saudi oil field attacks at a relatively high 185 points, but

well below the 2003 U.S. invasion of Iraq that scored 545 points.

How could that be when Saudi

Arabia is still the worlds largest oil exporter and its oil production is

threatened?

Its because oil price rises these days tend to be briefer than in the

past. Witness last week when oil prices

spiked the day after the U.S. killed Irans top general but gave up all their

gains by the end of the week.

This tepid crude oil price rise (and short-lived stock market decline)

response to potential oil supply disruptions, reflects the changing nature of

energy usage and geographical sources of supplies.

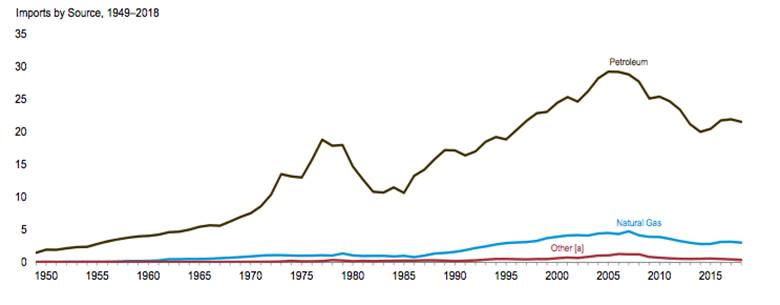

When Iraq invaded Kuwait in 1990, oil was a key factor and rising crude

prices put pressure on an already weak U.S. economy. But it is important to

remember that in 1990, the U.S. was a major oil importer, and we were not a

dominant energy producer on the global stage. Today, the U.S. is the worlds

largest oil producer and our reliance on imports has been in decline for years

as per this graph:

U.S. shale oil producers can now step up to offset price spikes stemming

from Gulf supply disruptions, regardless of local politics or OPEC action,

while the rise of renewable energy sources amid fears of climate change is

happening at a rapid pace.

Also, technology advancements and new efficiencies means that far less oil

is needed to produce a dollar of global GDP today than was the case during the

Arab oil embargo of 1973, which was largely responsible for the 1973-74

recession. U.S. energy consumption has

been relatively flat over the past decade. Fewer imports, more production, and

level consumption mean less reliance on middle east oil.

..

Iran and Iraq Instability vs the Oil Market:

Will Iran retaliate further (after their drone strikes on U.S. military

bases in Iraq as a response to the U.S. killing of Iran Revolutionary Guards

#1 commander Soleimani)?

Will Iraq oil supplies be disrupted due to the worsening conflict there

with U.S. troops ordered to leave by Iraqs parliament?

Iran has been blamed for attacks on Saudi oil facilities and oil tankers in

the Strait of Hormuzthe thoroughfare for about a third of the worlds seaborne

oilover the past year, including attacks on Abqaiq and Khurais

in September 2019 that rocked global oil markets. Iran has denied

responsibility.

An ongoing concern is that a conflict in the region could result in Iran

closing off the Strait of Hormuz, a potential oil chokepoint. The strait, which

links the Persian Gulf and Asian markets, and through which an estimated 40% of

the world's crude passes every day, is bordered on one side by Iran and on the

other by Oman. Iran has pledged to close

the strait in the past if war breaks out.

Could that really happen?

BCA (formerly known as Bank Credit Analyst) Research provides some insight and clarity:

1. Iran is not yet likely to court a full-scale American attack by shutting

down the Strait of Hormuz. It is more likely to retaliate

via regional proxy attacks, including cutting off oil production, pipelines,

and shipping at a time of its choosing. If Trumps pressure tactics succeed,

it will advance Irans nuclear program rather than staging large-scale attacks.

However, Iran would have to create and maintain an oil supply shock the

size of the September 2019 attack in Saudi Arabia for four months in order to

ensure that American voters would feel the negative impact at the gas station

before the November 2020 Presidential election.

The underlying US-Iran conflict will persist and create volatility in oil

markets in 2020 and beyond. We also remain on guard for ways in which the Iran

dynamic could affect Trumps re-election odds and hence US policy and the

markets over the coming year.

2. Iraqi instability will worsen as a result of the past months events, bringing 3.5 million barrels of

daily oil production under a higher probability of disruption than when we

first flagged this risk. Supply disruptions there or elsewhere in the region

would hasten the drawdown in global inventories and backwardation of prices

occurring due to the revival in global demand on China stimulus and OPEC 2.0

production cuts.

3. Continued oil volatility, as in 2018-19, should be expected, but the risk for now lies to the

upside as Middle East tensions could cause an overshoot. We remain long Brent

crude and overweight energy sector equities.

..

More fallout in the U.S.-Iran standoff (from Geopolitical Futures):

Unidentified aircraft targeted arms depots and vehicles carrying ballistic

missiles of the Iran-backed Popular Mobilization Forces in Abu Kamal, Iraq,

near the Syrian border. The attack killed eight Iraqi fighters. The Iraqi and

Syrian governments have not commented, and no one has claimed responsibility

for the attack. Though the U.S. said it would sustain its maximum pressure

campaign against Iran, its U.N. ambassador said the U.S. was ready to

negotiate without preconditions.

Other interested parties are preparing their own responses. The European

Unions Foreign Affairs Council has convened an emergency meeting on the

situation in Iran (and Libya).

Japanese Prime Minister Shinzo Abe will visit the Middle East to speak with

leaders of the United Arab Emirates, Saudi Arabia and Oman about cooperation

with the Japanese Self-Defense Forces in the Strait of Hormuz. Japan intends to

deploy a destroyer and two P-3C patrol planes to escort oil tankers through the

strait and gather intelligence.

.

Late Breaking News from Iran and Iraq:

Could a civil war be in the making in Iran?

On Saturday, protesters in Tehran (Iran's capital) demanded the resignation

of senior leaders following the admission by authorities - after days of

denials - that Iranian forces accidentally downed a Ukrainian passenger plane,

killing all 176 people on board. Ukraine International Airlines flight PS752

bound for Kyiv, Ukraine, crashed minutes after take-off from the Imam Khomeini

International Airport in Tehran on Wednesday.

That happened hours after Iran launched missile attacks on U.S. armed

forces in Iraq in retaliation for the U.S. assassination of top Iranian

commander Qassem Soleimani. Yet in the days after PS752 crashed, Iran

stated they had no role in downing the Ukrainian civil aircraft. Iranian officials said it was due to a

mechanical failure.

On Sunday, more protesters gathered in Tehran and other cities (including

Kermanshah, Ahvaz, Rasht, Yazd, Semnan and Mashhad) to denounce what they

called lying and incompetence by the countrys leadership, as additional

security forces were deployed outside a university where hundreds of protesters

had assembled.

The public rebuke reflects the challenges Iran faces in trying to keep a

lid on months of unrest fomented by various social classes and ethnic

backgrounds as the economy reels and foreign pressure mounts.

The states legitimacy is severely challenged by people, regardless of

their background, said Alam Saleh, an Iran expert

and lecturer in Middle East politics at Lancaster University in England. He

said Tehran would need to enact reforms to show it is listening. If not,

[Iran] will have prolonged protests.

A security crackdown in NovemberIrans deadliest in decadeskilled

hundreds, rights groups said, after protesters objected to austerity measures

that raised fuel prices.

Iran has reinforced links with armed militias in the region, including

Lebanons Hezbollah and Shiite militias in Iraq, some of which

have recently attacked U.S. positions.

.

Attack on an Iraqi Airbase hosting U.S. Military and Contractors:

A volley of rockets slammed into the Al-Balad [1]

Iraqi airbase north of Baghdad, where U.S. forces have been stationed. The attack wounded at least four Iraqi

servicemen. The base had held a small U.S. Air Force contingent as well as

American contractors, but a majority had been evacuated following tensions

between the U.S. and Iran over the past two weeks, military sources told AFP

news agency.

Note 1. Al-Balad is the main airbase

for Iraqs F-16s, which it bought from the U.S. to upgrade its air capacities.

In a statement, the Iraqi military said eight Katyusha-type rockets landed

on Al-Balad airbase - 80 kilometers (~50 miles) north

of the capital - wounding two Iraqi officers and two airmen.

The U.S. has blamed Iran-backed militias for the attack, but no one

have taken responsibility for it.

Iraq military bases hosting U.S. troops have been subject to volleys of

rocket and mortar attacks in recent months that have mostly wounded Iraqi

forces, but also killed one American contractor last month. That death set off a series of dramatic

developments, with the US carrying out strikes against a pro-Iran paramilitary

group in Iraq as well as a convoy carrying top Iranian and Iraqi commanders

outside Baghdad airport.

Pro-Iran factions in Iraq have vowed revenge for those raids, even as Iran

said it had already responded in proportion by striking another western

airbase where US soldiers are located.

Rocket attacks against Baghdads high-security Green Zone, where the U.S.

and other embassies are based alongside international troops, are still taking

place.

So after almost 17 years of U.S.

military presence, Iraq seems to be more unstable than ever, largely due to

Iran backed militias trying to gain political influence in the country by

their repeated attacks.

The upshot is that turmoil in Iraq would severely diminished Iraqi oil

output which has the potential to significantly alter the global supply

picture. Iraq is the second-largest oil

producer in the Organization of the Petroleum Exporting Countries. Excluding

exports from the Kurdish Regional Government, Iraq exported around 3.3 million

barrels a day in December, according to shipping tracker Kpler.

The biggest risk is that

Iraq increasingly sides even more with Iran and

that Iraq is hit by sanctions from the U.S., said Bjarne Schieldrop,

chief commodities analyst at SEB Markets.

Conclusion:

While we urge investors to not dismiss geopolitical crisis as irrelevant,

one or more of them could end the oil and stock market complacency of the last

several years. In

particular, an event which the Fed (and other Central Banks) cant

control could cause economic weakness and trigger a serious correction or bear

market in global equities.

Today, tweets seem to have more impact than geopolitical events as per

Closing Quote:

Todays markets are whipsawed by political slings and arrows, often in the

form of tweets or breaking news reports. And investors increasingly are

reacting impulsively to a reality thats shifting minute-by-minute, said Brent

Schutte, chief investment strategist at Northwestern Mutual Wealth Management

Company, in a Monday note. Put differently, broad swaths of equities can flip

from winners to losers in an incredibly short time period perhaps in the wake

of a single tweet.

Good luck and till next time

.

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2019 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).