Can

Central Banks Change the Stock Markets Primary Trend?

By the Curmudgeon

with Victor Sperandeo

Introduction:

According to Dow Theory, neither a

central bank nor any other entity can manipulate the stock market such as to

change the Primary Trend. The Primary trend

usually lasts more than one year and may last for several years. If the market

is making successive higher-highs and higher-lows the primary trend is up. If

the market is making successive lower-highs and lower-lows, the primary trend

is down. [There are also Secondary

trends, and Minor trends, but they are not the subject of this article.]

However, we currently are in the longest bull

market in history which will be 11 years old this March. During that time the Primary trend has been

up, despite three corrections that

mysteriously ended (October 4, 2011 intra-day, February 11, 2016, and December

24, 2018).

Could such a long uptrend in stock prices have

happened without the Fed and other global central banks manipulating the

market?

Dow Theory - No One Can Manipulate the Primary Trend:

In his iconic Dow Theory Letters, the late

Richard Russell unequivocally stated that the Fed could not change the markets

Primary trend. A

tenant of Dow Theory is that stock market manipulation is possible day-to-day but the Primary trend cannot be

manipulated. That hypothesis was

largely based on Robert Rheas interpretation of Dow Theory (Russell was so

enamored with him that he once wrote he was the reincarnation of Robert

Rhea).

The following text on stock market manipulation

was taken directly from Robert Rheas book, The Dow Theory:

Manipulation is possible in the day to day

movement of the averages, and secondary reactions are subject to such an

influence on a more limited degree, but, the primary trend can never be

manipulated.

Hamilton frequently discussed the subject of

stock market manipulation. There are many who will disagree with his belief

that manipulation is a negligible factor in primary movements, but it should

always be remembered that he had, as a background for his opinions, a most

intimate acquaintance with the veterans of Wall Street, and the advantage of

having spent his life in accumulating facts pertaining to financial

matters. Hamilton wrote:

'A limited number of stocks may be manipulated at

one time and may give an entirely false view of the situation. It is

impossible, however, to manipulate the whole list so that the average price of

20 active stocks will show changes sufficiently important to draw market

deductions from them. (Nov. 29, 1908)

'Anybody will admit that while manipulation is

possible in the day-to-day market movement, and the short swing is subject to

such an influence in a more limited degree, the great market movement must be

beyond the manipulation of the combined financial interests of the world.

(Feb.26, 1909)

'

the market itself is bigger than all the

'pools' and 'insiders' put together.' (May 8, 1922)

'One of the greatest of misconceptions, that

which has militated most against the usefulness of the stock market barometer,

is the belief that manipulation can falsify stock market movements otherwise

authoritative and instructive.

no power, not the U. S. Treasury and the

Federal Reserve System combined, could usefully manipulate forty active stocks

or deflect their record to any but a negligible extent.' (April 27, 1923)

'It is true that a flurry in the price of wheat

or cotton may influence the day to day movement of stock prices. Moreover,

sometimes newspaper headlines contain news which is construed as bullish or

bearish by market dabblers, who collectively rush in to buy or sell, thus

influencing or 'manipulating' the market for a short period. The professional

speculator is always ready to help the movement along by 'placing his line'

while the little fellow timidly 'lays out' a few shares; then, when the little

fellow decides to increase his commitments, the professional begins to unload

and the reaction ends, and the primary movement is again resumed. It is

doubtful if many of these reactions would ever be caused by newspaper headlines

alone unless the market was either overbought or oversold at the time---the

'technical situation' so dear to the hearts of financial news reporters.'

'Those who believe the primary trend can be manipulated could, no doubt, study the subject for a few

days and be convinced that such a thing is impossible. For instance, on

September 1, 1929, the total market value of all stocks listed on the New York

Stock Exchange was reported to have amounted to more than $89 billion. Imagine

the money which would have been involved in depressing such a mass of values

even 10 per cent!'

..

Opinion: Fed produced Stock Market Bubble will end BADLY:

John Hussman, PhD and x-Stanford Finance

Professor who runs several mutual funds, has long said that the Fed has created a huge

stock market bubble. In December 2018 he wrote:

In the Federal Reserves attempt to bring the

U.S. out of the crisis of its own making, the Fed has produced conditions that

make another collapse inevitable. Unfortunately, the scale of the present

bubble is far grander, and the consequences are likely to be more severe. By

the completion of this cycle, I continue to expect the S&P 500 to lose

roughly two-thirds of the market capitalization it reached at its September 20

peak. Mountains of covenant-lite debt and leveraged loans, this cycles version

of sub-prime mortgages, will go into default. Worse, covenant-lite means

that lenders have much less protection in the event of defaults, so recovery

rates will plunge to levels that investors have never experienced.

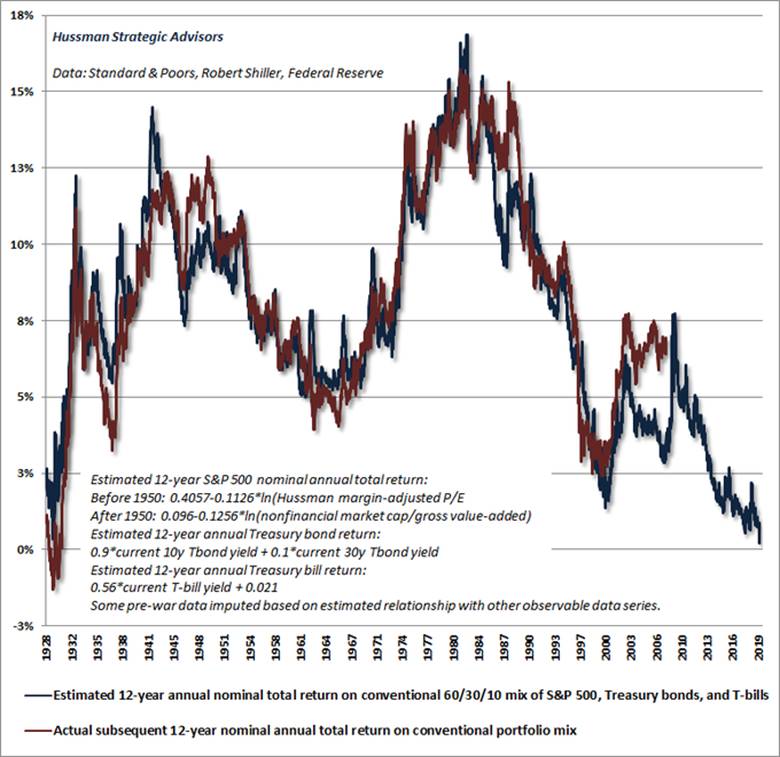

On January 3, 2019 Hussman tweeted

this ominous warning:

Yesterday, U.S. stock & bond market

valuations pushed to extremes that now imply total returns of just 0.25% on a

passive asset mix (60% stocks, 30% bonds, 10% T-bills), for over a decade. The

glorious "passive" returns you see in hindsight now rest on an

extreme worse than 1929.

Dow Theory is no more; Central Banks Rule (Victor):

Yes, Central banks have changed the markets

Primary trend. This has been

demonstrated since late 1987 - from the creation of the (former Fed Chair)

Greenspan put to the Feds rescuing the stock market repeatedly over the last

11 years. After Greenspan was knighted and called The Maestro, every large

global Central Bank began using the printing press [1] more and

more to beyond anything in the historical past to achieve Greenspan God-like

status.

Curmudgeon Note 1. The printing press in this context

refers to the Fed and other global central banks (ECB, Bank of Japan, Bank of

England, Swiss National Bank, etc.) buying securities (bonds and stocks) with

money created out of thin air. No new money is actually

printed as the transactions are done electronically.

When the Fed uses open market operations or

quantitative easing (QE) to purchase U.S. treasuries and/or mortgage securities

from banks or private bond dealers, people call this printing money, but the

Fed is instead creating funds electronically from its infinite credit account

to buy the aforementioned securities.

The proceeds are then deposited at Federal Reserve member banks and add

to their bank reserves. Such

reserves which are over and above the minimum requirement banks have to hold are called excess reserves.

..

The Fed propping up the stock market has been

done through ultra- easy monetary policy and moral suasion. By controlling

inflation, the Fed was able to keep interest rates very low (or zero). The result was negative real interest rates

across the yield curve (even before taxes). That provided investors a huge

incentive to go long stocks and led to the TINA mentality: There Is No

Alternative (to buying stocks when real yields are negative).

The magic of artificially low inflation was

primarily accomplished by the Federal Reserve enabling Fed member banks to not

loan money by paying them interest on excess reserves (see Note 1.

above) they held as a result of QE.

Therefore, most of the money created at the Fed stayed there, rather

than being used to grow the real economy which would have increased inflation

pressures.

Also, the U.S. Bureau of Labor Statistics

(BLS) changed the way inflation (i.e. Consumer Price Index or CPI) is

calculated so that it is understated and sure to stay low. Over the years, the methodology used to

calculate the CPI has undergone numerous revisions. According to the BLS, the

changes removed biases that caused the CPI to overstate the inflation

rate. However, critics view the

methodological changes and the switch from a cost of goods index (COGI) to a

cost of living index (COLI) as a purposeful

manipulation that allows the U.S. government to report a lower CPI.

An example of moral suasion was the July

26th 2012 declaration by Mario Draghi, President of the European Central

Bank (ECB) at the time:

Within our mandate, the ECB

is ready to do whatever it takes to preserve the euro. And believe me, it will

be enough.

The key to this statement is the implication that

the ECB will create an infinite amount of fiat currency and with that paper

currency, buy enough bonds to lower interest rates and flood the financial

system with liquidity to spur economic growth (instead it artificially inflated

stock and bond prices). And that would

be done on an unlimited basis, until the goal of keeping the financial system

afloat was accomplished.

Meanwhile, the U.S. Federal Reserve has shown

over the last 11 years that it can rule financial markets with the printing

press, ZIRP or negative real interest rates, and fix any domestic economic

problem with newly created fiat paper currency.

Therefore, the Fed has been able to control the

long-term trend of the financial markets.

That is, until an event occurs

(e.g. war) which the Fed cant control.

..

Closing Quote:

From Sir Josiah C. Stamp, a director of

the Bank of England from 1928-1941:

The modern banking system manufactures money out

of nothing. The process is perhaps the most astounding piece of sleight-of-hand

that was ever invented.

Bankers own the earth. Take it away from them,

but leave them the power to create money and control credit, and with a flick

of a pen they will create enough to buy it back...Take this great power away

from them and all the great fortunes like mine will disappear and they ought to

disappear, for then this would be a better and happier world to live in... But,

if you want to continue to be a slave of the bankers and pay the cost of your

own slavery, then let the bankers continue to create money and control credit.

AMEN!

Good luck and till next time

.

The Curmudgeon

ajwdct@gmail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2019 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).