Buy,

Buy, Buy; Melt-Up Talk Proliferates

By the

Curmudgeon

In todays financial markets, risk is now a thing of the past. Rather than

buy cheap and sell what is dear, analysts today only know one word: BUY. Lets look at a few examples.

Chris Rupkey, chief financial economist at MUFG

Union Bank, sent a spirited note to clients which was partially quoted in a

December 14th MarketWatch

column.

All over the world, markets are falling in love. Buy it. Buy it all,

reads the headline of his note.

Stimulated by the never-ending hype of the U.S.-China trade deal and Boris

Johnsons election victory in the U.K. (which presupposes that Brexit will get

done by January 31st EU extension deadline), Rupkey

wrote:

There is some smoke and mirrors here, but it looks like this is the time

for investors around the world to throw months of caution to the winds and take

risk off the table, and they are, buying stocks and selling bonds with abandon,

as the economic outlook brightens and central banks shelve their plans to cut

interest rates further.

Rupkey says investors piling

into stocks will be armed with a 2020 outlook that looks better than it has in

months, as he thinks the U.S. manufacturing recession possibly closer to

ending that beginning. Equally, he thinks the world economic outlook looks good

for next year and beyond. Take risk off

the table as a concern to be hedged. There is no risk. Bet on it, he wrote.

This weekends Barrons (online subscription required) featured a story

titled Forget Buy Low, Sell High. How to Buy High and Sell Higher.

The author of that piece, Jack Hough, wrote: The broader record suggests

that when it comes to price action alone, buy high, sell higher is probably

better advice

.. So dont

feel the need to ignore a vast universe of rising stocks now, and focus bargain

hunts on a small bunch of stinkers.

He goes on to list seven stocks that gained significantly more than the

S&P 500s median advance of 4.3% over the past three months and have

free-cash-flow yields safely above the indexs median of 3.7%. (We dont recommend buying any individual

stocks so are not listing the names).

.

This afternoons MarketWatch lead story is titled: Why

Wall Street sees the stock market on the verge of a melt-up.

Analysts at Bank of America Merrill Lynch, led by chief strategist Michael

Hartnett, described the market as primed for Q1 2020 risk asset melt-up, with

the Federal Reserve and the European Central Bank still providing ample support

to portions of the market and economy that have shown some signs of softness.

Hartnett expects that the S&P 500 will hit a target of 3,333 by March 3,

2020 in what he calls a front-loaded 2020.

UBS Global Wealth Management Chief Investment Officer Mark Haefele said that a partial Sino-American trade resolution

contributes mightily to the bullish thesis that a number of

strategists have adopted. This could unlock further upside for equity markets,

driven by an improvement in business confidence and a recovery in investment, Haefele wrote.

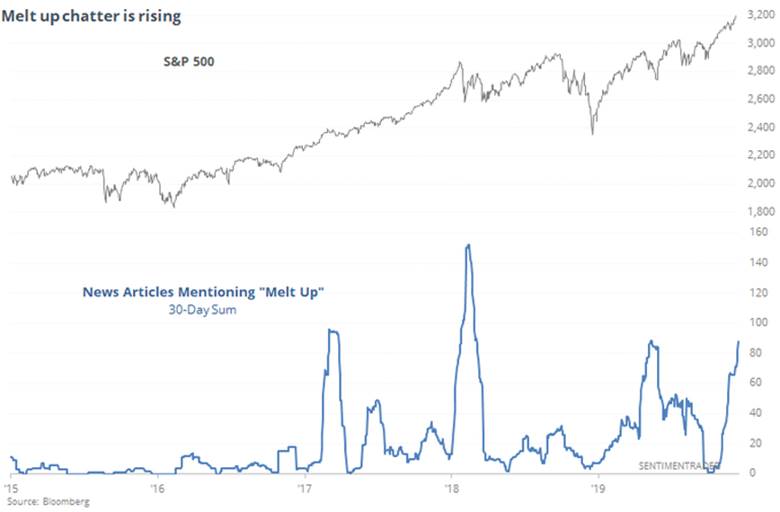

Tweet from SentimenTrader:

The "melt up" chatter is ramping up. A few more days like this

and we could challenge the early '18 euphoria.

.

.

A call by some market participants and strategists/analysts for further

gains for equity indexes comes as the S&P 500 has gained nearly 27.3% in

the year to date, the Dow has returned about 21% so far this year and the

Nasdaq has produced a year-to-date return thus far of about 33%, according to FactSet

data.

A so-called melt-up is considered by market pundits as the end phase of an

asset bubble and is usually, but not always, followed by a significant downturn

in stock values. Strategists have predicted melt-ups a number

of times over the past 18 months, despite concerns growing about slowing

U.S. economic growth in its record-setting 11th year of expansion and weak

corporate profits (see below).

Big investor complacency is clearly illustrated by the huge fall in the VIX

this year. The CBOE Volatility Index

(VIX) is on track for a 54% decline in 2019, which would mark the gauge of

coming volatilitys worst yearly drop on record. The index tracks bullish and

bearish options on the S&P 500 for the coming 30-day period and has tumbled

below a reading of 12, well below its historical average of about 19. The index

tends to rise when stocks fall and vice versa.

The VIX closed today at 12.14 which is close to a multi-year low.

Conversely, the S&P 500 and Nasdaq closed at yet another all- time high

today. They are on track to notch their best annual gains since 2013, despite the fact that YoY profits are down for both

indexes!

However, the percentage of S&P 1500 (large-, mid- and small-cap)

companies with positive forward EPS growth has deteriorated meaningfully since

2018, Morgan Stanley analysts wrote.

Further, the current level of this measure is worse than it was during the

20152016 manufacturing recession, a trend driven mainly by

smaller-capitalization companies which are struggling with higher labor costs,

the investment bank said.

We could go on and on about the disconnect between earnings (and other

economic fundamentals) vs stock prices, but weve already pounded the table so

much on that topic it is about to break.

.

End Quote:

"It's fair to say that [the rally] may be more due to the balance

sheet reversal [i.e. "NOT QE"] than fundamentals since the real signs

of bottoming have come from international PMIs (Purchase Manager Index) rather

than the US."

- Michael Wilson, Morgan Stanley

..

.

Good luck and till

next time

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2019 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).