Analysis and

Implications of U.S. Budget Deficit at $1 Trillion

By the

Curmudgeon

Executive Summary:

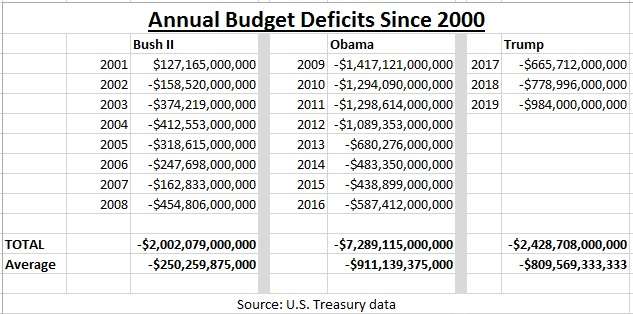

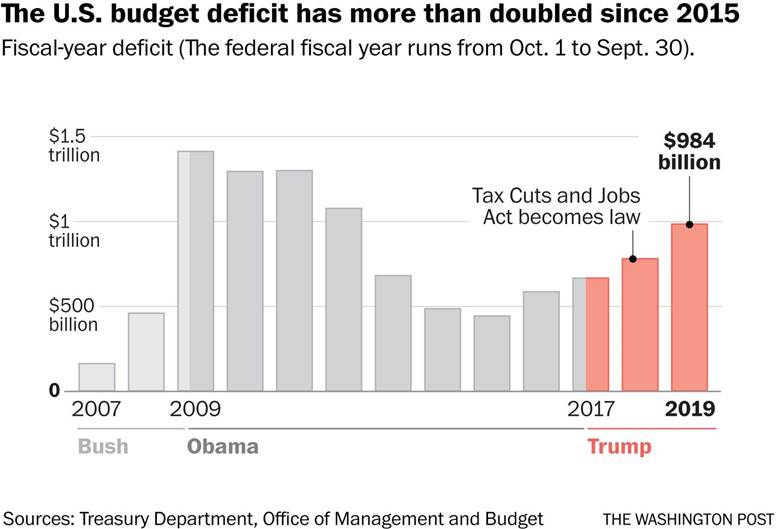

The U.S. government's budget deficit ballooned to nearly $1 trillion in fiscal year 2019, a $205

billion increase from a year earlier and its highest level in seven years. The

deficit grew $205 billion, or 26 percent, in the past year and is up nearly 50

percent since Trump took office.

The actual deficit number was $984 billion but wouldve been

OVER $1 trillion had it not been for the additional revenue from President

Trumps tariffs on trading partners like China, which brought in more than $70

billion into the government coffers. For

comparison, the U.S. budget deficit was $665 billion in fiscal 2017.

As a share of economic output, the budget deficit was 4.6% in

fiscal 2019, up from 3.8% in 2018, the U.S. Treasury said. Revenues as a share

of gross domestic product fell last year, to 16.3% from 16.4% in the previous

fiscal year, while federal outlays surged, to 20.9% of GDP from 20.2% the

previous year.

Years of sustained budget deficits have led the U.S. Treasury

to steeply increase borrowing in recent years. The government has said it

expects to borrow more than $1 trillion for the second year in a row in

2019. See below for the impact of U.S. interest payments on the exponentially

increasing national debt.

The annual federal budget shortfall is the largest since

2012, when the unemployment rate was twice as high - topping 7 percent - and

the economy was emerging from the worst financial crisis since the Great

Depression. America's fiscal imbalance

has increased for four consecutive years despite a sustained period of economic

growth during that time.

Analysis:

So how did the U.S. budget deficit increase so much with no

recession? Blame it on federal

government spending and, to a much lesser extent, the 2017 GOP tax bill!

President Trump has endorsed big spending increases and

steered most Republicans to abandon the deficit obsession they held during the

Obama administration. For example,

military spending has risen dramatically under Trump, from about $550 billion

annually to more than $700 billion in 2019, and Democrats successfully pushed

for increases to other parts of the budget in exchange for their support to

boost money for defense.

Victor and I touched upon this astonishing dynamic of the budget deficit increasing during an

economic expansion. In a post

titled, Bond Vigilantes

and Deficit Hawks are Extinct; Stocks love DEBT! we wrote: Deficit

hawks would not have tolerated the budget busting GOP tax bill in late 2017

that has produced a budget deficit this fiscal year that will approach or

slightly exceed $1 trillion!

Budget deficits typically decrease a lot during economic

expansions as tax revenue increased since households earn more money and

corporations make higher profits. Also,

fewer people use safety net programs like unemployment benefits and food stamps

so government welfare payments decrease. The United States entered its longest

expansion on record in July and the jobless rate is at a 50-year low, yet the budget deficit has continued to widen.

Republicans, who in years past have shut down the federal

government in their quest to cut spending, have enabled the increases that are

exacerbating the deficit. In August, the

Republican controlled Senate gave final approval to a two-year budget deal that

raised federal spending by hundreds of billions of dollars and allowed the

government to keep borrowing money. Democrats reluctantly agreed to President

Trumps demands on military spending in order to satisfy their desire to

bolster spending on social programs. Twenty-eight Republicans joined with

Democrats to send the bill to Trumps desk where he signed it into law.

Former fiscal policy/deficit hawks such as Mick Mulvaney, Mr.

Trumps acting chief of staff, quietly lamented that agreement as a fact of

life in a divided government. What a contrast! During the Obama administration

Mulvaney held Spending, Debt and Deficit town hall meetings and repeatedly

criticized lawmakers of both parties for increasing the deficit, including

through funding relief for Hurricane Sandy (the strongest, deadliest and most

destructive hurricane of the 2012 Atlantic hurricane season. Inflicting nearly

$70 billion of damages).

Since becoming President, Trump has endorsed big spending

increases and steered most Republicans to abandon the deficit obsession they

held during the Obama administration.

That is why we wrote (in the above referenced Curmudgeon post) that deficit

hawks are extinct!

Trump administration officials did not defend the steep

increase in the budget deficit. Instead,

they cast blame on Congress for not doing more to reduce expenditures. Treasury

Secretary Steven Mnuchin called on lawmakers to cut wasteful and irresponsible

spending. But neither Trump nor Congress has done much to cut spending in

recent years, with Trump repeatedly backing away from his own budget proposals.

Trump has also demanded new spending on the military and for a border wall. He

has recently told aides that he will focus on cutting spending if he is elected

to a second term next year.

Budget experts also say the 2017 GOP tax bill (a tax cut for business, but a huge tax increase

for people living in high tax states like CA or NY) has led revenue to come in

lower than they normally would during an economic expansion. Tax revenue remained roughly flat the first year

the law was in effect, despite economic growth of nearly 3 percent. Tax revenue

was modestly higher in fiscal 2019, aided in part by a 70 percent increase in

tariff revenue as noted above.

Most alarming is that non-controllable government outlays are

increasing at a relatively fast pace. Mandatory allocations, which include

Medicare and social security payments, are growing amid an aging population and

with one of the worlds least efficient health-care systems. Interest payments

are also adding up, now comprising about 8.4% of total outlays.

Americas expanding federal deficit is an anomaly among

developed nations around the world. Nearly all other advanced-economy countries

are on track to see their debt shrink as a share of their economy over the next

five years, according to the International Monetary Fund.

Other Voices:

The mounting red ink has raised a new round of alarm bells

from deficit watchdog groups and politicians, whose warnings have long gone

unheeded in Washington. Here are a few

quotes:

This administration came into office talking about reducing

deficits, and the results have been the exact opposite. The current levels of

debt are unprecedented in peacetime during a growing economy, and the

consequences of this irresponsible spending are unknown, said G. William

Hoagland, senior vice president at the Bipartisan Policy Center.

This is the first time in our history that we are seeing a

boom in the economy at the same time deficits are rapidly rising. Its

alarming, said Marc Goldwein, senior policy director of the Committee for a

Responsible Federal Budget, which supports reducing the deficit.

Our nations leaders are in debt denial, running up red ink

all while ignoring trillions of dollars in shortfalls for Social Security,

Medicare, and other programs that many millions of Americans rely upon,"

said Mitch Daniels, co-chairman of the Center for a Responsible Federal Budget.

We are at a turning point without action now to phase in reforms over the

coming years, Americans will face a much different future than the one that was

promised.

Leon Panetta, a former budget director under President Bill

Clinton and CIA Director under President Obama, said in a statement issued by

the Committee for a Responsible Federal Budget (where he is co-chair): Instead

of getting our fiscal house in order and preparing for the next downturn, our

leaders continue to binge on debt-fueled tax cuts and spending hikes rather

than showing the leadership necessary to set our fiscal path.

There is very little discussion among Republicans about the

deficit and virtually no serious outreach to Democrats for any sort of

bipartisan deal, said Brian Riedl, a budget expert at the Manhattan Institute,

a libertarian-leaning think tank, and former chief economist for Sen. Rob

Portman (R-Ohio). The parties are not talking on this issue.

Wyoming Senator Mike Enzi (a Republican) who leads the budget

committee, called the countrys fiscal path unsustainable and said spending

must come down. He said in a statement: While the federal governments revenue

continues to grow, spending is growing twice as fast. We simply cannot afford

to continue ignoring the fiscal challenges our nation faces.

In order to truly put America on a sustainable financial

path, we must enact proposalslike the presidents 2020 budget planto cut

wasteful and irresponsible spending, Mr. Mnuchin said in a statement. Does

anyone believe that will really happen?

Whats Next?

The 2017 tax legislation is projected to increase the annual

deficit by about $200 billion, or close to $2 trillion over 10 years when

factoring in interest payments, according to the nonpartisan Congressional

Budget Office. The GOP tax-cut package

is estimated to cost $1.5 trillion over a decade, with few economists outside the

administration expect it will continue to fuel growth. The budget deficit --

which has little precedent at these super high levels outside recessions or

wartime -- is set to widen further as spending increases for mandatory programs

and interest payments.

Overall spending is projected to rise by about 16 percent

between 2017 and 2020, largely because of bipartisan deals struck by Congress,

including a 2018 law that lifted spending limits and disaster relief funding,

according to the Committee for a Responsible Federal Budget.

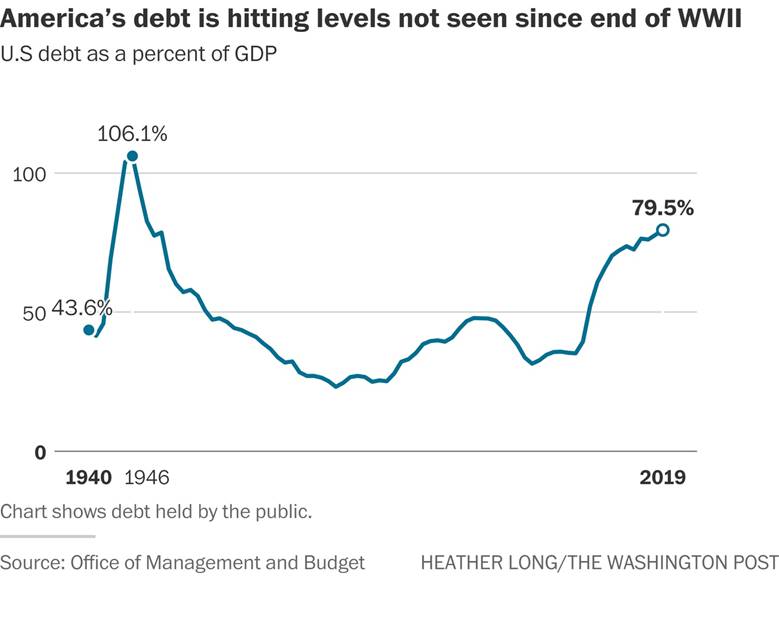

By 2029, the national

debt is projected to reach its highest level as a share of the economy since

the immediate aftermath of World War II.

.

Fears of trillion-dollar deficits could renew the desire of

Republicans in Congress to propose cuts to social programs, like food stamps,

Social Security and other safety net benefits. Republicans have long pointed to

swelling deficits as a reason to pursue their long-held vision of smaller

government, including undoing many of the programs ushered in during the New

Deal and Great Society to help the most disadvantaged Americans.

Budget experts have warned that a lack of focus on reducing

the budget deficit could make it much harder for the U.S. government to respond

to the next economic crisis. Thats because policymakers will have less

flexibility to enact new spending programs if they are devoting hundreds of billions

of dollars to interest payments on the

national debt. The federal

government spent approximately $380 billion in interest payments on its debt

last year, almost as much as the entire federal government contribution to

Medicaid. Interest payments on the debt will be much larger this year with

the higher deficit and will truly explode

higher if interest rates rise to just the average level of the past 50 years.

Federal Reserve Chairman

Jerome Powell is concerned about the

ballooning amount of U.S. debt. At a

January 2019 speech at The Economic Club of Washington, D.C. he said, Im very

worried about it. Its a long-run issue

that we definitely need to face, and ultimately, will have no choice but to

face.

Powell told the Senate Banking Committee in testimony this

February, "The U.S. federal government is on an unsustainable fiscal

path. He then noted that debt as a percentage of GDP is growing, and now

growing sharply... And that is unsustainable by definition. We need to

stabilize debt to GDP (ratio). The timing the doing that, the ways of doing it

through revenue, through spending all of those things are not for the Fed to

decide.

Conclusions:

At some point this author believes unchecked budget deficits

will become a big problem, because the national debt will reach a tipping point

where it cant be easily financed. That will cause much higher interest rates,

which will crowd out borrowing by consumers and businesses and that could lead

to a severe recession. At the same time,

foreigners will be wary of U.S. government debt and go on a buyers

strike. They could even sell their

massive holdings of U.S. debt which would cause a crash in the U.S. dollar and

potentially end its role as the worlds reserve currency.

Its hard to believe I still cling to this view which was

mainstream in 1981-1982 when budget deficits started to increase rapidly under

President Reagan. The day of reckoning

has not yet come yet, but it will sometime in the future.

Closing Quote:

In the previously referenced Curmudgeon post, Victor

concluded as follows:

All the empirical experience points to the long run (5-10

years) as the debt timeframe to worry about. In the short run, debt and

deficits apparently do not matter but it certainly looks like a ticking time

bomb!

..

Good luck and till

next time

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2019 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).