Lessons in

Dishonesty - from U.S. Government Agencies and the Banking System

By Victor

Sperandeo with the Curmudgeon

Introduction

(Curmudgeon):

The United States scored 71 points out of 100 on Transparency

Internationals 2018 Corruption Perceptions Index. That number ties the

all-time low set in 2010. The Corruption

Perceptions Index ranks countries and territories based on how corrupt their

public sector is perceived to be. A country or territorys score indicates the

perceived level of public sector corruption on a scale of 0 (highly corrupt) to

100 (very clean).

However, many people (including these two authors) believe

that U.S. corruption is much worse than reported, due to so many secret deals

and tactics that get exposed almost daily (most recently concerning the

FBI). As the U.S. is still the worlds

#1 economy, measured by nominal gross domestic product, massive corruption here

has a global economic and political impact.

Lets look at an example of stock market corruption weve

written about several times before - HFT and front running orders:

Wall Street banks and high frequency traders (HFT) at hedge

funds are buying high speed access to trading data from the New York Stock

Exchange (NYSE) at a cost of tens of thousands of dollars a month. The NYSE is

allowing these firms to co-locate, i.e., to locate their computers next to

those of the inter-connected computers at the stock exchange. That results in a

much lower delay (aka latency) when placing HFT orders. The Exchange is also

selling a faster data feed to these high frequency traders.

Combined, these practices effectively enable high frequency

traders to manipulate stock prices and front-run orders from the public. That is, their ultra-fast computers detect

incoming large buy/sell orders and they put in their orders ahead of those to

scalp quick profits.

Reference: Assessment and Perspective of

High Frequency Trading (HFT) by

Victor Sperandeo with the Curmudgeon

Victor expands on this broad topic in his essay below.

.

.

U.S. Corruption is off

the Charts (Victor):

For a person that reads the national (and international) news

avidly, what stands out to me is the grandiose

corruption by those in the highest political offices, and those who hold

the greatest influence in power. For

example, the FBI, DOJ, CIA, and State Department all participated, to varying

degrees in a fabricated scheme to frame the latest Presidential candidate, and

current President of the U.S., for Collusion (Conspiracy), and Obstruction of

Justice aka the Mueller Probe.

The former President of the NY Federal Reserve Bank and

constant voting member (the second most powerful FOMC member) from 2009-2018

and former Goldman Sachs chief economist wrote an editorial published by

Bloomberg News on July 30, 2019 which is truly shocking. Heres the beginning of an article by Kristinn Taylor in The

Gateway Pundit which references that editorial

Former New York Fed President Bill Dudley on Tuesday called

on the Federal Reserve to manipulate the economy to stymie President Trumps

reelection. Dudley made the plea in an op-ed

published by Bloomberg News. Dudley argued that Trumps effort to reset

trade with China is hurting the economy and that the Fed should enact policies

that hinder Trump and hurt his reelection chances.

The article contains an excerpt from Dudleys op-ed published

by Bloomberg News:

U.S. President Donald Trumps trade war with

China keeps undermining the confidence of businesses and consumers, worsening

the economic outlook. This manufactured disaster-in-the-making presents the

Federal Reserve with a dilemma: Should it mitigate the damage by providing

offsetting stimulus, or refuse to play along?

I understand and

support Fed officials desire to remain apolitical. But Trumps ongoing attacks

on Powell and on the institution have made that untenable. Central bank

officials face a choice: enable the Trump administration to continue down a

disastrous path of trade war escalation, or send a clear signal that if the

administration does so, the president, not the Fed, will bear the risks

including the risk of losing the next election.

Theres even an argument

that the election itself falls within the Feds purview. After all, Trumps

reelection arguably presents a threat to the U.S. and global economy, to the

Feds independence and its ability to achieve its employment and inflation

objectives. If the goal of monetary policy is to achieve the best long-term

economic outcome, then Fed officials

should consider how their decisions will affect the political outcome in 2020.

[1]

Curmudgeon Note 1. Yet the Fed is

supposed to be independent of political parties and politics? Is this a new Fed

mandate- to conduct monetary policy based on political outcome?

.

So, the most prestigious institutions along with U.S.

government are all doing the most egregious things that never have been known

to be done before- both illegal, corrupt seditious and treasonous. The mainstream

media press has been very subdued in reporting on any of this skullduggery.

Also, the U.S. government has not prosecuted any of its own

yet. The FBI under Chris Wray is stonewalling any and all requests for

documents, as if x-FBI Director Jim Comey was still in charge?

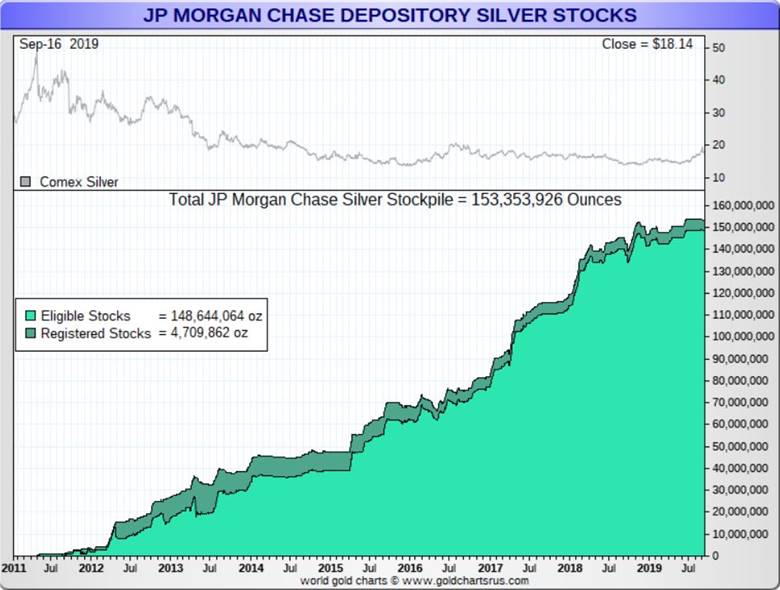

Moreover, JP Morgan

Chase, the biggest bank in the U.S. and by many measures the largest bank

in the world ($2.5 trillion in assets) has just been indicted for precious metals manipulation. U.S. prosecutors have

charged a group of bigwigs at JPMorgans precious metals desk with conspiracy

to conduct the affairs of an enterprise involved in interstate or foreign

commerce through a pattern of- racketeering- activity.

The traders allegedly manipulated prices of metals like gold,

silver, platinum, and palladium from 20082016 using a technique called spoofing. Whats spoofing? Its when

traders make (show/expose) buy and sell orders for precious metals futures

contracts with zero intention of actually executing

the bogus orders...but with every intention of influencing prices in their

favor.

A headline you dont see every day:

JP Morgans Metals Desk Was a Criminal

Enterprise, U.S. Says, by Tom Schoenberg and David Voreacos September 16, 2019, 11:25 AM CDT Updated on

September 16, 2019, 12:47 PM CDT.

U.S. invokes racketeering law in charging three metals

traders. RICO [2] statute is rarely (If not uniquely) used in cases involving

big banks

Curmudgeon Note 2. Racketeer Influenced and Corrupt Organizations Act (RICO) is a

United States federal law that provides for extended criminal penalties and a

civil cause of action for acts performed as part of an ongoing criminal

organization. RICO is a criminal

violation, which is much more than the usual fines banks get, which their

shareholders ultimately pay for.

Based on the fact that it was conduct that was widespread on

the desk, it was engaged in in thousands of episodes over an eight-year period

-- that it is precisely the kind of conduct that the RICO statute is meant to

punish, Assistant Attorney General Brian Benczkowski

told journalists.

..

All this chicanery despite the fact that

JPMorgan has one of the largest long positions in Silver ever accumulated of

more than 153,353,926 million oz. worth $2.7 billion dollars (almost 31,000

futures contracts worth).

The bottom line suggests that the mega bank was shorting

silver futures to knock down the price to buy the physical spot silver.

Reference: Who Owns the Most Silver Bullion Today?

Notwithstanding DoJ's success here,

private actions brought in the civil courts are more likely to hold crooked

bankers fully accountable than the regulators who have been tasked with that

job. The CFTC (Commodity Futures

Trading Commission) has yet to take responsibility for JP Morgans silver price

fixing actions. As thats a complete and

utter failure, it is safe to assume that the agency remains beholden by Wall

Street.

This is a common disease as the U.S. regulators are, in

general, owned by those they regulate -see the Pharmaceutical industry and the

FDA for example. Thats an inherent conflict of interest!

It is telling that CFTC investigators spent five years

investigating silver market manipulation, four of them during the time that Mr.

Edmonds and his accomplices were operating with impunity at JPMorgan Chase. Yet

that investigation was closed without a single banker ever being charged with

wrongdoing! That was to the dismay of

silver and gold market whistle-blowers everywhere.

->Gold and silver investors are being swindled

and the so-called press is silent. The so-called free press sells influence not

the news these days.

I think you get the picture.

No matter where you look within government and powerful institutions you

can see corruption and no one seems to care or is

embarrassed anymore.

The DOJ and FBI are so corrupt it makes the mafia look like

the epitome of integrity? The great economist Allen Meltzer (Professor of Political Economy Carnegie Mellon, who

died two years ago at age 89, strongly stated the only two rules in the political

economy that are universal and always apply:

1.

No nation ever became rich

without the rule of law;

2.

No nation that was rich, ever

remained rich, without the rule of law.

America is in decline. You can see it daily -just look around

you. The reason is that those in power

do not want to risk losing their power.

Thereby, these leaders care more about getting around the U.S.

Constitution, and the statues that are in sync with it (in order to retain and

get power and money), than be concerned with the rule of law.

Not only money is being lost by favoritism, but the cost of

liberty and freedom are part of the package deal and are being lost every day.

Closing Quotes:

As Russian dissident Aleksandr

Solzhenitzen learned the hard way: We didnt

love freedom enough to fight.

And from courageous author Salman Rushdie: Two things form the bedrock of any open society

freedom of expression(speech) and rule of law. If you dont have those things,

you dont have a free country."

..

Good luck and till next time

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative (non-correlated)

investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2019 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).