Annualized

Global Bond Fund Inflows Hit a Record; Negative Yields; Profit Recession Dead

Ahead?

By the

Curmudgeon

Bond Inflows Hit New

Record:

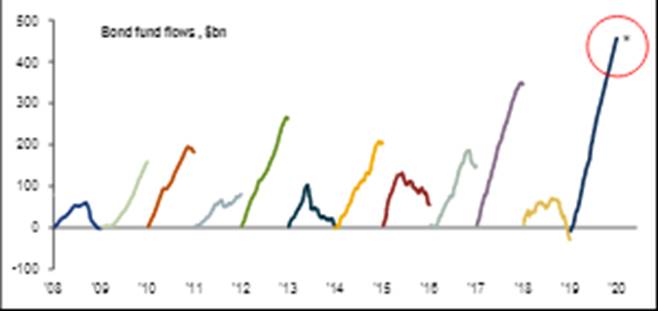

According to a recent BofA Merrill Lynch

(BoAML) Global Research report, annualized inflows to bond funds will reach

a staggering record of $455bn in 2019 (please see Chart 1. below). That is over 1/3 the $1.7tn inflows during

the past 10 years. As a result, BoAML says there is more danger (i.e.

downside risk) in bonds, rather than stocks or commodities.

Bubbly, frothy inflows to U.S. government bonds, Investment

Grade, High Yield and Emerging Market debt funds are coinciding with:

·

Renewed global monetary ease

(18 rate cuts past 6-mths & 720 cuts since Lehman);

·

A record $12.9tn of bonds in

developed markets with negative yield (25% of total);

·

A record 26% of Euro IG

corporate bonds with negative yield;

·

A record 56% share of global

equity market cap from tech-heavy US stock market;

·

Extreme relative valuation of

"growth" stocks versus "value" stocks, e.g. US growth &

EAFE value have price-to-book ratios of 7.7x and 1.1x, and dividend yields of

0.9% & 4.8% respectively.

The relative bull trend in assets which promise

"yield" and "growth" has become more extreme as central

bank capitulation to Wall St deepens in 2019, says BoAML. Randall Forsythe echoed that ultra-dovish

central bank (mostly the Fed) theme in his July 15, 2019 Barrons column: The Fed Is Spiking the Punch Bowl. It May Not End Pretty. Here is an excerpt:

Taking away the punch

bowl when the party gets going. Federal Reserve Chairman William McChesney

Martins famous description of what central bankers are supposed to do is so

last century. Now, the punch bowl gets

spiked if the party seems to slow down, not by the delinquents sneaking vodka

in water bottles, but by the supposedly sober chaperones.

Dιjΰ vu all over again?

Joe Carson, Alliance Bernsteins former chief economist and a longtime friend

of Barrons, writes that the Fed has never made a preemptive move to stave off

a slowdown while the economys performance has been so close to its

expectations or when the financial markets have been so robust.

Chart 1. Bond fund net inflows from 2008-2019. Source: BoAML

Incredibly, 2019 YTD has seen

$254bn into bonds, but $144bn NET REDEMPTIONS (outflows) from equities. So once

again, we attribute the sharp rise in the U.S. stock market rise to share

buybacks, which were aided and abetted by the 2017 GOP tax cut.

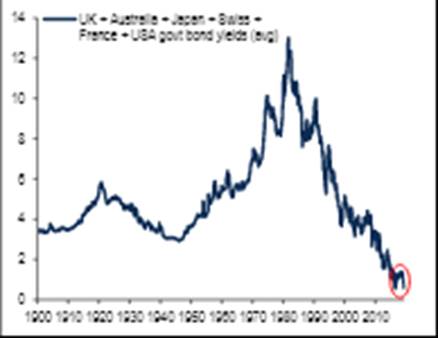

Meanwhile, global bond yields are trading at all-time low

(dating back 120 years) yields as per this BoAML

Chart:

Chart 2. Global bond yields at 120-year lows. Source:

BoAML

..

Fixed Income Flow

Highlights for various types of securities as per BoAML:

·

26th week of IG bond fund

inflows ($8.1bn)

·

6th week of HY bond inflows

($1.2bn)

·

6th week of EM debt inflows

($1.5bn)

·

28th week of Muni fund

inflows ($1.2bn)

·

27th week of MBS fund inflows

($1.0bn)

·

Small Government/U.S.

Treasury outflows ($43mn)

·

Small TIPS outflows ($0.2bn)

·

35th week of Bank loan

outflows ($0.7bn)

Negative Nominal and Real

Interest Rates on Global Government AND Junk Bonds:

Some $13 trillion in bonds are paying negative interest

rates, which means bondholders actually pay for the

privilege of holding an issuers bonds. That represents more than 20% of a

total global bond market value of $55 trillion, according to Bloomberg. Other

bonds are paying positive rates so low they carry a real (after inflation)

negative yield as well. If you go back even further, negative yields are

virtually unprecedented.

If a significant fraction of [the worlds bond market] has

negative interest rates, thats pretty unusual, said Richard Sylla, Professor Emeritus at NYUs Stern School of

Business. Even in recent history, he added, such occurrences are rare. In

1940-1941, he said, rates on short-term U.S. bonds went negative as the economy

still grappled with the fallout from the Great Depression.

Underlying this all is rapidly slowing growth in Europe: In

April the International Monetary Fund projected sub-2% growth in major European

countries. Lately there have been warnings about impending recession in

Germany, Europes largest economy, amid worries over BREXIT and slowing global

activity because of the U.S.-China trade war.

There is a slowdown going on in the world, and I think

thats one of the reasons why the biggest negative interest rates occurred just

in the last month or so, said Sylla.

Earlier this week, a Wall Street Journal article titled Oxymoron Alert, reported that there are

about 14 companies with junk bonds worth more than 3 billion ($3.38 billion)

that are trading with negative yields, according to BoAML. Thats about 2% of

European high-yield bonds are offering negative yields. They include telecom

giant Altice Europe NV and

tech-equipment company Nokia Corp. The Bank of America analysts, who monitor all

major corporate bonds in Europe, say they hadnt seen any negative-yielding

junk bonds until recently.

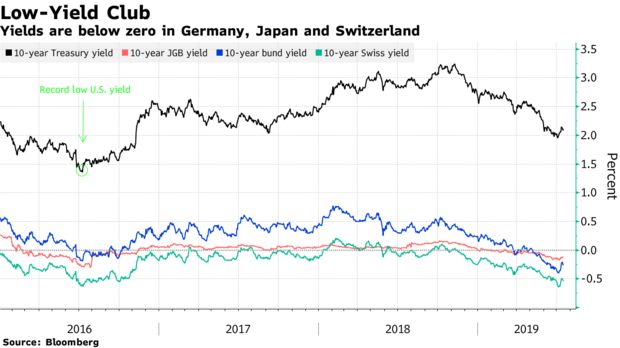

Pushing yields to record lows: The European Central Bank

(ECB) has hinted it will cut its already-negative policy rate in coming months

or unveil a restart to its bond-buying stimulus program. Meanwhile, a shortage

of high-quality government and corporate bonds has led investors to buy riskier

debt to find some income.

By definition,

junk bonds pose more risks, so why take a negative yield for a

risky asset when you can just keep that

money in cash? Risk is relative, however, and if you have lots of cash, like

many corporations do, having a vault of physical cash is not feasible. You must

invest it somewhere, and there are no low-risk options that offer a positive

return. The euro deposit rate is -0.4%, meaning depositing money in the bank

costs investors more than high-yield bonds, which are at about -0.2%.

Government and high-grade corporate bonds cost even more. Go figure?

The lesson of the past decade from Japan and Europe is that

the zero and negative-yielding world is like a sand trap. The quicksand

scenario is a process, not an event, a slow bleed that could take three or

four years, JPMorgan Chase & Co.s Jan Loeys

told Bloomberg in this article.

.

Moodys: Reduced Capital

Spending May Reduce Corporate Profits:

In the July 18, 2019 Moodys

Credit Markets Review and Outlook (subscribers only), John Lonski, Chief Economist, wrote: The Next Deeper Than 5% Drop in Yearlong Corporate Profits Will Sink

Equities and Swell Spreads:

Financial markets

reacted negatively to the profits recession. As measured by month-long

averages, the market value of U.S. common stock sank by 12.9% from a May 2015

high to a February 2016 bottom, a composite high-yield bond spread ballooned

from June 2014s current cycle bottom of 331 bps to a now 10-year high of 839

bps, while Moodys long-term Baa industrial company bond yield spread swelled

from May 2014s current cycle low of 144 bps to February 2016s now 10-year

high of 277 bps.

As of 2019s first

quarter, the yearlong average of core profits set a new record high. However,

the ability of core profits to avoid sinking under its current zenith has been

challenged by the latest deceleration of business sales. In terms of

year-over-year increases comparing 2018s second-quarter to 2019s second quarter,

the business sales proxy slowed from 7.4% to a prospective 1.9%, while core

business sales eased from 5.4% to a prospective 2.0%.

It is imperative that the slowdown by core business sales end

soon. Otherwise, another prolonged contraction by profits is likely to shrink business outlays on capital equipment and staff by

enough so that any recession will probably extend well beyond profits. The good

news is that the annualized sequential growth rate of core business sales

retail component accelerated from first-quarter 2019s 2.7% to the 6.9% of the

second quarter for the liveliest such increase since the 7.6% of 2017s final

quarter.

.

Curmudgeon Challenges

Ray Dalio book Quote:

In his very long, but excellent book Principles,

Ray Dalio states:

"To make money in the markets, one needs to be an independent

thinker who bets against the consensus and is right. That's because the consensus view is

(already) baked into the price. One is inevitably going to painfully wrong an

awful lot, so knowing how to do that well is critical to one's success."

Curmudgeon Rebuttal: Is the stock market

still a discounting mechanism, where the consensus view is (already) baked

into prices? If that were so then how

can one explain the U.S. stock market REPEATEDLY celebrating the same

forecasted event >10 times via daily price rises, e.g. tax cut deal in late

2017, US -China trade deal (which was never reached) in 2019; Fed rate cut talk

day after day after day (at July 31, 2019 FOMC meeting)?

We attribute the repeated stock market rises as the epitome

of a financial asset bubble which has gone on longer (due to central bank

largesse and share buybacks) than any we have ever seen or read about!

Good luck and till next time

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2019 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).