DOW THEORY

BULL MARKET Confirmed; Disconnect and Economic Weakness Worries Persist

By the

Curmudgeon

Dow Theory Bull Signal

Triggered:

The U.S. stock market surged Monday with all popular averages

up over 1%. Importantly, the Dow Jones

Industrials and the Dow Jones Transportations both closed above their February

highs at 26091.95 and 10632.49, respectively.

That triggered a Dow Theory bull

market confirmation, because the Dow Theory Sell Signal that's been in

force since December has now been reversed.

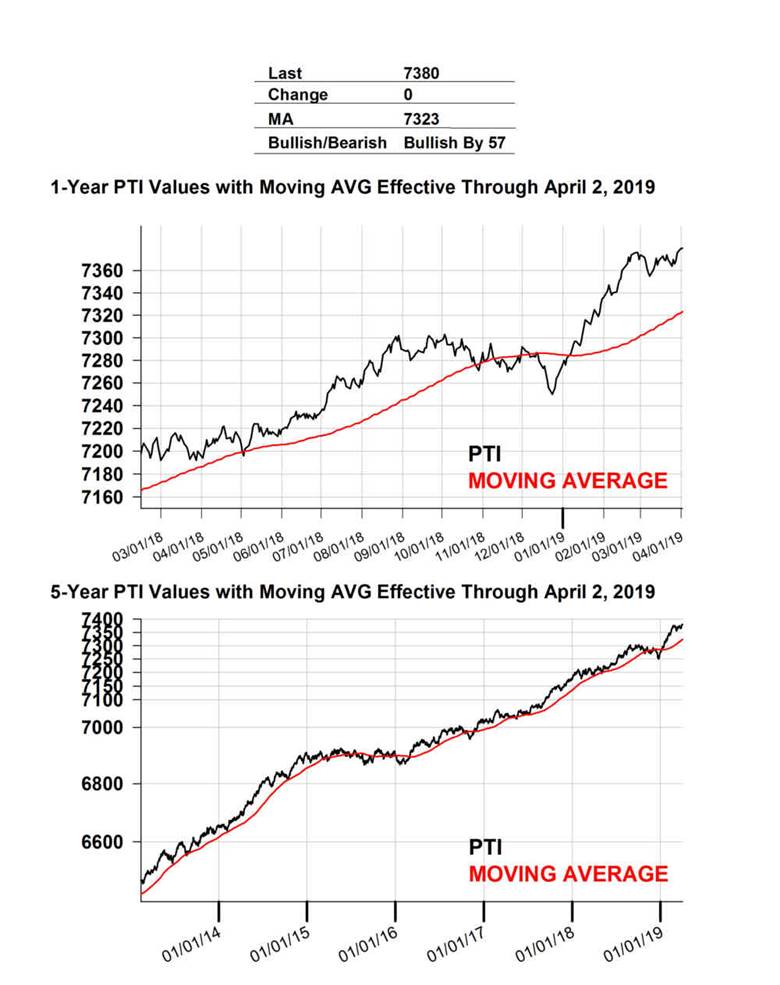

The late Richard Russells PTI (Primary Trend Index) is hitting new highs, which reinforces

the bullish case. Also, most U.S. stock

indexes are above their respective 65-day MAs while the cumulative

advance/decline lines for the All Exchange, NYSE and Nasdaq are now all

positive and above their 50-day MAs.

Below is the PTI chart as of April 2, 2019. The PTI continues to be at a new all-time

high:

..

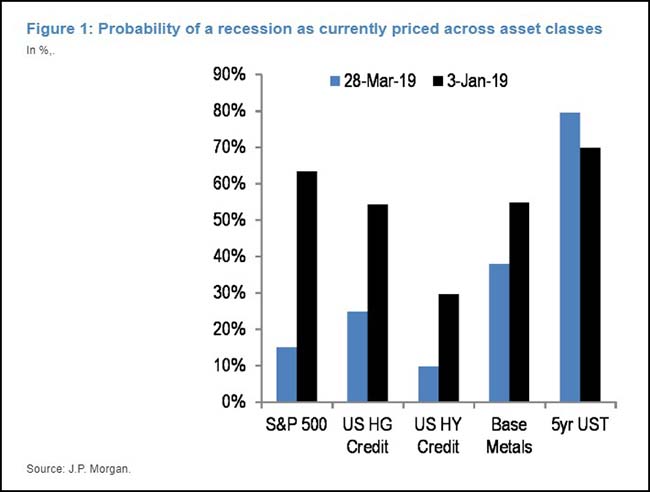

Disconnect says JP

Morgan Research Note to Clients:

U.S. equities rally over the past quarter is showing a huge disconnect with the downside risks

according to a JP Morgan note. Markets appearing to price in only a 15% chance

of a U.S. recession, a sharp reduction from 66% at the start of the year. Similarly, U.S. credit markets appear to be

currently pricing between 10% and 25% chance of a US recession. In contrast,

the 85bp fall in 5-year U.S. Treasury yields from their early November peak

points to 80% chance of a U.S. recession on our calculations.

.

Bloomberg - Many Reasons

to Fret About the Global Economy:

According to Michelle Jamrisko of Bloomberg, the global economy is wobbling in

2019, giving rise to recession fears and forcing the worlds central banks to

consider renewed easing of monetary policies.

There have been repeated economic forecast downgrades by

governments and other authorities this year. On Tuesday, the World Trade

Organization slashed its 2019 trade projection to the weakest in three years (Tariff War Will Hammer Global Trade Growth This Year, WTO

Says). The Organization

for Economic Cooperation and Development (OECD) cut

its economic forecast last month and warned of downside risks that

could lead to an even worse outcome.

The global expansion continues to lose momentum, the Paris-based

Organization for Economic Cooperation and Development said as it downgraded

almost every Group of 20 nations economy. Growth outcomes could be weaker

still if downside risks materialize or interact.

Despite all the hoopla, there is still no trade deal with

China and tariffs are hurting global growth.

Yet the U.S. stock market has repeatedly celebrated such a trade deal

for months- as if it was a done deal. Bloomberg notes that Chinas policy

uncertainty has been especially pronounced as analysts try to pick apart how

officials will manage the slowdown there.

Across the U.S., Europe and Asia-Pacific, economic data released

this year have been surprising on the negative (down) side more often than

normal. And thats especially disturbing

considering economists poor record of predicting recessions.

Finally, BREXIT has become the weight that wont go away in

the U.K., still holding back capital spending and broader economic growth. The

British Chambers of Commerce said this week that investment intentions are at

the lowest in eight years as firms refuse to commit to projects in such an

uncertain backdrop.

..

Has the Fed Eased Enough

in 2019? Apparently NOT!

With additional fiscal stimulus on hold due to massive budget

deficits, the Fed has eased financial conditions as reflected by this Bloomberg

chart:

Despite President Trump saying the U.S. economy is super

strong and the stock market is rallying, the administration seems to be worried

about an incipient recession later this year or early in 2020.

U.S. National Economic Council Director Lawrence Kudlow told The Wall Street Journal (WSJ) in an

interview the administration would like to see the Fed lower its benchmark federal-funds rate by half a percentage point

(50 bps), which would put it in a range between 1.75% and 2.00%. Kudlow

said he believed rates needed to be cut as a precaution. Kudlow noted the inverted yield curve which

has preceded past recessions and added: I dont want any threats to the

(economic) recovery. Im aware of the inversion of the yield curve, and Im

aware of the rest of the worlds weak economy, he said. Apparently, Kudlow still believes the U.S.

economy is in recovery mode almost 10 years since the last recession ended in

June 2009.

Meanwhile, the Fed Funds futures market, which had forecast

no chance of a rate cut this year prior to the March 2019 Fed meeting, now

predicts a 40.6% probability of a 25 bps cut and a

15.7% chance of a 50 bps cut by the December 2019. That can be seen from this chart:

..

Leutholds MTI Still

Neutral:

As of April 2, 2019, Leutholds Major Trend Index (MTI) was

at 0.99 with 0.95 to 1.05 considered to be Neutral. Leuthold CIO Doug Ramsey provided this

commentary today:

Theres still the

possibility that the move off the late-December lows is a bear market rally,

but obviously those odds diminish as the S&P 500 closes in on its September

2018 all-time high. Still, its worth remembering that the bear markets of

2000-2002 and 2007-2009 produced a total of five bear market rallies in the

+18-24% range.

The upswing in the

Russell 2000, however, might be more confidently called a bear market rally;

that index is still below the rally peak established five weeks ago, and 11%

below its August 2018 bull market high. We view the Russells

non-confirmation of the new rally highs in the S&P 500 and DJIA as only a

minor negative and would give the junior index some time to catch up. However,

the weakness in both Small and Mid-Caps during the last six weeks points to

underlying weakness in breadth thats not being captured by the various

advance/decline lines.

The Intrinsic Value

category remains a drag on the MTI at -380 but is well below the cycle extremes

seen in January 2018 (-621), and again in September 2018 (-629). Remember, at

both of those peaks the bulls were crowing that valuation is not a timing tool. Now, despite only modest

improvement in most valuation metrics (especially on those using normalized

fundamentals), cheaper valuations has emerged as a key pillar in the bullish

line of reasoning. However, there are many examples in which the markets

valuation peak occurred months before the final price peak (1989-1990 and 2007

to name a couple), and 2018-2019 might well be such a cycle peak.

.

In the 40 years I've been working as an economist and

investor, I have never seen such a disconnect between the asset market and the

economic reality... Asset markets are in the sky, and the economy of the

ordinary people is in the dumps, where their real incomes adjusted for

inflation are going down and asset markets are going up.

When you print money, the money does not flow evenly into

the economic system. It stays essentially in the financial service industry and

among people that have access to these funds, mostly well-to-do people. It does

not go to the worker.

Market forces will one day crush the Federal Reserve. One

day, the market forces will reverse.

Readers are invited to

vote for their favorite quote by emailing the Curmudgeon: ajwdct@gmail.com

.

Good luck and till next time

..

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2019 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).