Why No

Commodity Inflation? The Government

Changed the Laws

By Victor

Sperandeo with the Curmudgeon

Introduction:

One has to wonder why commodities

have been depressed for such a long time, especially in light of all the “free

money” the Fed created through its multiple QE rounds and “operation

twist.” Victor provides an answer in his

comments below.

Commodity Cut Back at

Goldman:

In a sign of the times, the WSJ reported (on line subscription required) this week that Goldman Sachs is planning to scale back its

commodities-trading division, once a huge moneymaker and training ground

for a generation of executives including former CEO Lloyd Blankfein. “The

retreat follows a month’s long review under new CEO David Solomon that showed

the commodities business’s dwindling profits don’t justify its costs, according

to people familiar with the matter. Executives are discussing pulling back from

trading iron ore, platinum and other metals, and are ordering cost cuts to the

sprawling logistics network that handles the transport and storage of physical

commodities,” according to the Journal article.

Just two weeks prior, Goldman's global head of Commodities

Research - Jeff Currie told CNBC:

"We're bullish on commodities….One,

because you don't have the rising (interest) rates anymore and in fact, they've

come off and they're on pause. Two, the dollar is really strong and likely to

weaken from here as opposed to strengthen like it did last year." A weaker

dollar makes oil (and other commodities) more attractive as commodities are

priced in U.S. dollars.

Global Growth

Deteriorates:

Meanwhile, global growth is rapidly decelerating which is

very bearish for commodities (and corporate profits). Last week, the European Commission lowered

its estimate of 2019 GDP growth for the euro zone by nearly a third, to 1.3%

from 1.9%. Italy is already in recession, while German growth is faltering as

its export-dependent economy is being hampered by a slowing China, which in

turn is a result of increased trade frictions and its domestic deceleration.

Australia’s central bank lowered its outlook for growth, while India’s central

bank cut interest rates in a surprise move.

Barron’s reported in its February 11th print edition that

last week, nearly $9 trillion of global debt securities had negative yields, according to Bloomberg

data charted by Deutsche Bank. The yield on the 10-year German Bund, the

European benchmark, sank below nine basis points, or 0.09%, from over 50 basis

points last October. The 10-year Japanese government bond yield sank a couple

of basis points below zero. “Such yields

indicate an extreme desire by investors to stash their cash in havens (it helps

that global government bond markets have greater capacity than mattresses) amid

increased signs of (economic) deceleration abroad.”

It’s certainly

astonishing to this old timer that negative yields can compete with gold and

silver as a store of value. Yet both

those precious metals are well below their 2011 highs.

Victor’s Comments:

The Dodd-Frank bill was passed in 2010, but unlike the

typical way laws are passed, the details of the law had not been completed or

understood at that time. It would take

over 18 months before the interpretation of the regulations began to have a

little clarity, following a long period of industry input to the CFTC. Senator Carl Levin (D, Michigan) was

prominent in his suggestions to the CFTC that “excessive speculation in the

commodity markets” should be curbed, in theory to promote “fairer prices.” In his letter, which was one of other 5,000

the CFTC received, Sen. Levin demanded more position limits in all commodities,

including oil.

“Until this proposed rule is adopted, and effective position

limits are put in place, the American economy will continue to be vulnerable to

excessive speculation and the violent price swings it can cause,” Mr. Levin

wrote.

The CFTC also eventually curbed buying in commodities by

changing the swap rules for pension plans.

Although generally not recognized, QE2 was primarily

responsible for curbing commodity investment (and thereby keeping prices and

interest in commodities very low).

Former Fed Chairman Ben Bernanke’s QE2 resulted in the Fed buying $600

billion in Treasury and Mortgage-Backed securities. That drove interest rates

down which in turn boosted equities, gold and commodities.

From August 2010 through April 2011 the S&P 500 Index

rallied more than 29% and the NDX moved up nearly 35%. In the same period, Gold rallied over 25%,

our Commodity Trends Indicator® ETN went up over 40%, and The Consumer Price

Index increased to a 4.67% compounded annual rate. Despite the Federal Reserve keeping the Fed

Funds rate at zero, yields on U.S. Government Notes and Bonds increased. These higher yields affected home and auto loans

and threatened to put a halt to the already slow economic recovery.

The legislative reduction in commodity investment was then

coupled with the policy of paying banks interest on their free reserves. This gave banks an incentive not to loan out

their reserves, which curbed the money supply and greatly decreased the

multiplier effect. We wrote about this

in our last Curmudgeon

post, saying: “We claim this is a circular loop of deception whereby

the banks make free money, but the economy doesn’t benefit much, if at all.”

Combined with the expiration of the Bush tax cuts, this

allowed QE3 to take place with a much less noticeable effect on inflation. The Fed had found their “magic formula” to

keep rates and inflation low at the same time.

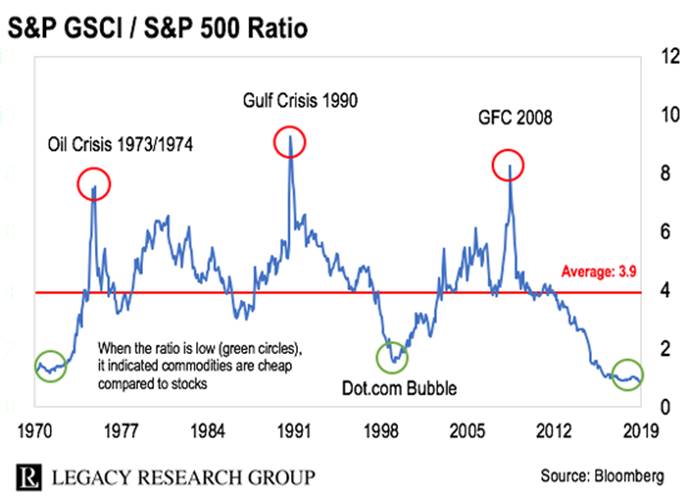

Lastly, the Obama administration proceeded to promote their

policies of globalism under the banner of “Free Trade” which encouraged

consumption (through purchases at credit card interest rates), moved

manufacturing jobs overseas to keep prices low, and exacerbated the stagnation

of middle-class wages. The low-cost debt

service for corporations and rallying stock prices multiplied the “wealth

effect,” leaving the ratio between equity prices and commodity prices at

historic levels (see chart below).

……………………………………………………………………………..

Conclusion:

In my opinion, U.S. government corruption has nullified free

markets and led to huge distortions in the price of most financial and hard

assets. The quotes below may help you better

understand what I refer to as “legal crony corruption.”

End Quotes:

“As long as government

has the power to regulate business, business will control government by funding

the candidate that legislates in their favor. A free-market thwarts lobbying by

taking the power that corporations seek away from government! The only sure way

to prevent the rich from buying unfair government influence is to stop allowing

government to use physical force against peaceful people. Whenever government is allowed to favor one group over another, the rich will

always win, since they can "buy" more favors, overtly or covertly,

than the poor.” Mary J. Ruwart,

author of Healing Our World.

A confirmation by “The Maestro,” who initiated the Fed PUT to

keep stock owners fat, dumb and happy:

”Crony

capitalism is essentially a condition in which... public officials are giving

favors to people in the private sector in payment of political favors,“ Alan Greenspan, former Fed Chairman.

Good luck and till next time…………………………………………………..

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2019 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).