Thoughts on the Decline in U.S. Productivity and

Standard of Living

by Victor Sperandeo with the Curmudgeon

Introduction:

We take a break from our market analysis, comments and

historical perspectives with this piece on the U.S. economy. Victor weighs in with his opinions while the

Curmudgeon provides the supporting data and graphs.

Productivity Perspective:

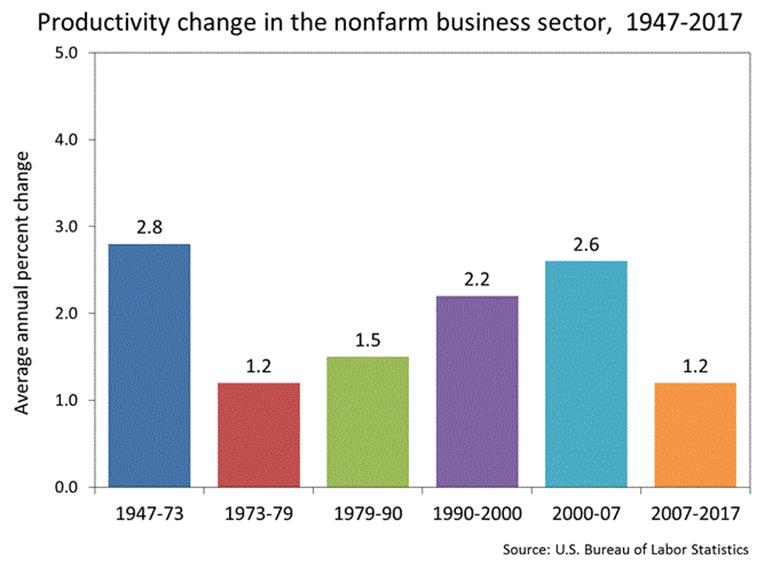

The heart of wage increases and living standards are

directly tied to productivity, or output per man hour. U.S. productivity crashed (declined by over

60%) after 2007, as can be seen in this chart:

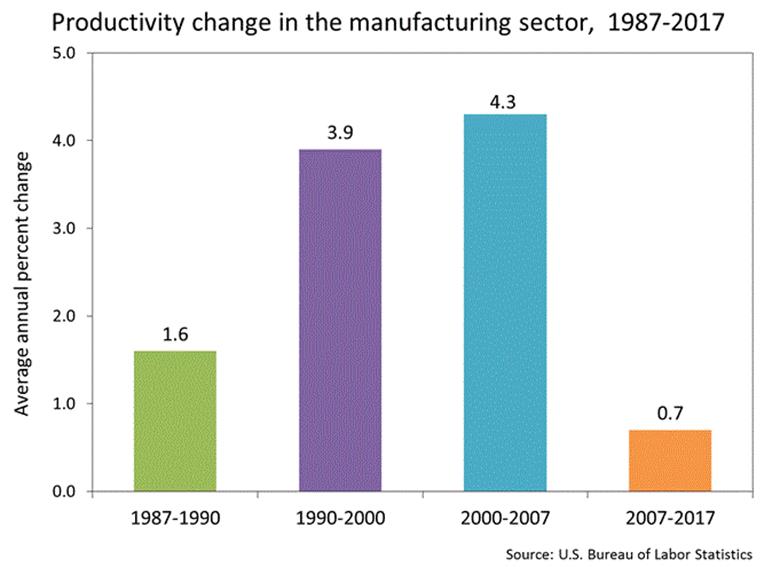

The Non-Farm Business sector between 2007 and 2017 was 1.2%, while the

manufacturing sector grew at a tiny 0.7%. Those measly productivity “growth”

rates were like workers falling off a cliff.

The steep decline in productivity occurred due to the

2008 market meltdown and economic decline (aka “The Great Recession”). The productivity decline continued during the

next 8 years due to the anti-investment policies of the Obama

Administration. Under President Trump’s

2 years in office, productivity has started to rise due to a much more favorable

business and corporate tax environment.

The key to increases in wages is corporate investing

in plant and equipment, i.e. machines that allow workers to produce more things

in the same time period. Without capital investment, companies cannot earn

sustainable profits (cost cutting has its limits) and without more profits,

workers cannot increase their earnings.

Productivity is a mirror of the fiscal and monetary

policies of the underlying government.

Low productivity implies that government leaders, including the justice

system, are not promoting policies and laws that allow risk takers to flourish.

Unless this changes, the

U.S. standard of living will continue to decline (more on this in Declines in

Wages and Middle Class Stability below).

Curmudgeon Asks:

·

Will the Democrat

controlled 2019 House of Representatives pass legislation that will provide

incentives for increased capital spending?

·

Will Congress reduce

the use of regulations that restrict companies experimenting with new business

solutions?

·

Will corporations use

some of their tax cut savings for expanding plant and equipment rather than for

stock buybacks and increased dividends?

·

Will states change or

adjust licensing requirements, which can and have inhibited investment, e.g.

pole mounting fees for broadband wireless antennas and base stations.

Entrenched interests have captured state legislators and often erect barriers

to entry, keeping wages of the privileged licensees high while harming the less

skilled looking to earn higher wages.

Declines in Wages and Middle Class

Stability:

The history of the decline in real wages (adjusted

for inflation) and employment started in 1971 when President Richard Nixon took

the U.S. off the international Gold Standard. There was no longer anything

backing the U.S. dollar, just the “faith and credit of the U.S. government.”

Shortly thereafter, Nixon invoked price controls to

curtail inflation- a policy that backfired.

On Aug. 15, 1971, in a nationally televised address, Nixon announced, “I

am today ordering a freeze on all prices and wages throughout the United

States.”

In July 1974 (after the first Arab oil embargo),

Secretary of State Kissinger negotiated the U.S. would buy oil from Saudi

Arabia and provide the kingdom military aid and equipment. In return, the

Saudis would plow billions of their petrodollar revenue back into U.S.

Treasuries and finance America’s spending.

That laid the groundwork for the U.S. to become hostage to the Saudi’s.

China’s opening up to the

rest of the world via Deng Xiaoping’s economic policies caused the decline of

the U.S. textiles and shoe manufacturing.

The decline in auto manufacturing came after NAFTA

and GATT in 1994. Think of how many foreign cars are sold in the U.S. today

versus 40 or 50 years ago?

The Guardian

newspaper identified five U.S. industries on the decline which they

assert caused voters to favor Trump in the November 2016 elections. They were:

manufacturing, coal mining, steel, textiles and cars.

Manufacturing jobs peaked in the 1990’s and decreased

from almost 20 million to a low of 11.3 million in 2010, and today is 12.75

million. Despite hopes for high tech manufacturing

to return to the U.S. it hasn’t happened.

That’s largely because of ever increasing outsourcing to China, Taiwan

and other Asian countries.

In 2017, China had a trade surplus with U.S. of

$167.3B in computers and electronics; $40B electrical equipment, $38.6B

miscellaneous manufacturing.

Also, 100% of the top 20 smart phones and tablet

computers are made in Asia. That

includes Apple’s iPhone and iPad (made in China by Foxcon)

as well as all the phones and tablets sold by Google (made in Taiwan by

HTC). Same for WiFi

routers, “white boxes,” and “bare metal switches,” all of which are made in

Taiwan or China.

In conclusion, U.S. median household income, after

inflation, has been stagnant for 20 years.

Only recently (about 2 years ago), it began to increase ever so

slightly.

The Debt Build Up:

From June 1971 to 9/30/18, U.S. government debt

compound at an 8.81% rate of increase while real GDP was 2.75% at an annual

rate. As of 12/31/2018, Total U.S. federal government

debt stood at $21,974,095,705,790.55.

That’s almost $22 trillion dollars.

It’s growing faster than ever now with $1 trillion

dollar annual U.S. budget deficits.

àWhen will that

debt reach a tipping point such that foreigners lose confidence in the U.S.

dollar and instigate another financial crisis?

Summary and Conclusions:

The U.S. government uses GDP to measure economic

growth. Therefore, the U.S. economy looks good most of the time. However, if you use “median household

income,” the U.S economy looks terrible.

The latter is what counts for stability, not the Fortune 500 or a total

of 3,000 large corporations that use accounting tricks when they report

profits.

In 2008 to 2009, big banks were bailed out, but not a

single banker lost their job or went to jail.

At the same time, many people lost their homes to foreclosure.

The 2017 federal tax cuts largely benefited

corporations at the expense of “we the people.”

In several years the personal tax cuts (which were tax increases for

those living in high tax states) will expire.

After factoring in inflation those cuts will be zero or negative.

As we import illegal immigrants it drives down wages

by increasing the supply of workers.

Outsourcing in effect transfers jobs to China and other lower cost Asian

countries.

We really don’t have capitalism in the US. Instead,

we have socialism. I touched on that in

a recent Curmudgeon

post where I said, “When loses are prohibited, you have a political

system based on Socialism.”

In recent years, there have been huge profits for

rich stock holders and low capital gains taxes when they sell stock. At the same time, the middle class is

shrinking, and the working class is struggling.

Flawed government policies are killing America, which

is thereby losing its liberty. It is

destabilizing the nation. As corporations make political donations (euphemism

for “bribe”) to change laws in their favor, and the stock holders get rich, the

general population gets poorer.

Is America is

committing suicide?

Quotes that seem relevant today:

·

Bernard M. Baruch put

Karl Marx in his place when he said: “Unless each man produces more than he

receives, increases his output, there will be less for him and all the others.”

That is the exact opposite of Marx’s theory of exploitation!

·

John Galt put it in simple

terms: “Long-term improvement in productivity is the result of a continually

increasing capital base and advancing technology. Increasing productivity is

the key to lower prices, higher wages, and thus, a higher standard of living.”

From the book: “Dreams

Come Due,” by John Galt.

·

“The United States

brags about its political system, but the President says one thing during the

election, something else when he takes office, something else at midterm and

something else when he leaves.” Said Deng Xiaoping- China’s former leader.

·

“The way to crush the

bourgeoisie (i.e. small business) is to grind them between the millstones of

taxation and inflation.” But the Marists have thrown in the working men and

women as well.) Vladimir Lenin

Good luck and till next time…

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2018 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).