Quick Takes and Shadowstats’

Thoughts on the U.S. Stock Market

by the Curmudgeon

Introduction:

First and foremost, I hope all readers followed our

advice NOT to trade this stock market due to volatility and computer-generated

trading (front page of Dec 26, 2018 WSJ).

Victor will be interviewed on January 3rd

by Real Vision TV website (subscription required). He will be asked questions based on content

in the two previous Curmudgeon posts (Sunday and Monday of this week). We hope to share the highlights of that

interview, to be broadcast January 13th, with our readers.

Financial data

points:

· According to Greg Ip of the WSJ, the Fed Funds rate

has historically averaged 2 % above the trailing 12 - month inflation rate

(i.e. 2% real yield). Well, that hasn’t

happened in well over a decade! As of

Dec 26, 2018, it was 2.4% with a range specified to be 2.25% to 2.5%. You can monitor the actual Fed Funds rate

daily here. Inflation as measured by the YoY CPI-U rate

of change was 2.1% in 2017 and 2.2% in 2018 to date. You can check CPI-U for all years from 1913

at this Fed Minneapolis Bank website. Only now is

the real Fed funds rate positive as it’s slightly above the trailing CPI-U

inflation rate. Clearly, the Fed has not

been too tight up till now!

· Leuthold’s Major

Trend Index (MTI) improved slightly last week (ended December 21st)

to a ratio of 0.75, with a jump in the Intrinsic Value category offsetting

losses everywhere else. Leuthold’s Doug

Ramsey wrote: “The lack of more meaningful MTI improvement in response to this

month’s collapse suggests the bear has yet to fully express himself. But the

swipes he’s taken so far have hit hard….”

· Ramsey further states: “Interestingly, the same bulls

who reminded us for years that valuations are a very poor timing tool are now

calling for an imminent market bottom based on… yes, valuations! We distinctly

recall those arguments having been trotted out during the first couple months

of the last two bear markets. We don’t mean to minimize the extent of the

valuation markdowns-to-date. Last week, for example, the median trailing P/E on

the Leuthold 3000 fell into its undervalued zone (i.e., below the 30th

percentile) for the first time since late 2012. But few of our cap-weighted

valuation measures have returned to their fair valuation zones (30th-70th

percentiles), with ratios based on sales, cash flow, and Normalized EPS all showing

considerable risk.”

· Leuthold’s MTI Economic category has actually improved in the last three months even though we

expect a considerably weaker economy in coming months. Essentially all of the improvement has come from the leading

inflation components—and with the stock market having delivered a major

deflationary blow in the last few months, more “improvement” here is

expected.

· Note that we pointed out in Monday’s Curmudgeon post that inflation has been slowing in the last few

months and is likely to decrease further in the year ahead. Here’s what I wrote: “Inflation is moderating

as per November's Personal Consumption Expenditure (PCE) price index report,

published December 21st by the BEA. The

PCE is the Fed's favorite inflation metric.

It was up 0.06% month-over-month (MoM - from October to November 2018)

and is up 1.84% year-over-year (YoY). The latest Core PCE index (less Food and

Energy) came in at 0.15% MoM and 1.88% YoY Core PCE are now both below the

Fed's 2% target rate.”

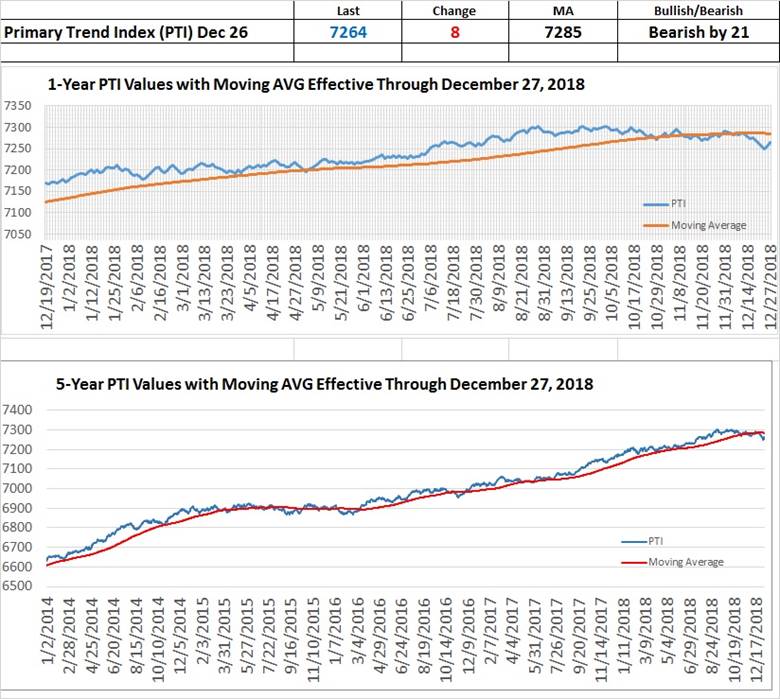

· The late Richard Russell’s PTI (now maintained by the Aden Forecast) is now bearish and below

both the 1 year and 5-year MAs. Here are

the PTI charts:

Source: Aden Forecast

....................................................................................................

Shadowstats John Williams Thoughts on the Stock Market:

· Weakening Economy, driven by Fed Tightening, and FOMC

Promises for Even

· More in 2019, Likely Were Proximal Triggers for the

Recent Stock Market Rout

· Market Turmoil Likely Has Only Just Begun

· Attempts by Fed to Mollify Impact of Recent Tightening

Could Trigger

· Flight from the U.S. Dollar and Gold Buying Portend

Greater Crises (edited by Curmudgeon)

Excerpt of

John’s latest subscribers only commentary:

The proximal

stock-selling trigger here most likely included investor reaction to a full

year of quarterly rate hikes by the Federal Reserve’s Federal Open Market

Committee (FOMC). Those rate hikes have impaired consumer liquidity, triggering

the onset of what appears to be a new recession. After the FOMC hinted that

early signs of a weakening economy could trigger a meaningful pullback in next

year’s planned rate hikes, the Fed went on to schedule the bulk of those rate

hikes anyway.

Those two sets

of actions by the Fed were traditional, proximal stock selling triggers. Raise

interest rates, and stock prices usually decline.

President Trump

expressed understandable frustration with the Fed hiking interest rates

recently, so as to slow the economy, particularly

where the economy already had been turning down.

The Federal

Reserve system was set up as separate entity from the political government, so

that that Fed could take politically unpopular actions, such as raising

interest rates, without facing political repercussions. Unlike the U.S.

President, the Board of Governors of the Federal Reserve likely could remove

the Fed Chairman, if they chose, but they currently are in

agreement with the Fed Chair. Yet, the problems and instabilities here

for the system appear to be with the Federal Reserve per se, not with a particular Fed Chairman.

The current big

issues facing the economy and financial-system have their roots in the

banking-system collapse of 2007/2008, particularly as to (1) why the banking

system failed, and as to (2) how the banking system was saved.

The ultimate

righting of the system might have to come from an Act of Congress.

Watch the U.S.

Dollar and Precious Metal Prices. The weakness seen in stock prices in recent

days increasingly was accompanied by U.S. dollar selling and gold buying. The

flight from the dollar and to safety continues as major issues for U.S. and

global financial stability.

……………………………………………………………………………………………………………………………………………….

In closing, Victor and I again wish all readers a

wonderful last weekend of 2018 and a great new year in 2019. Let us know what you liked and didn’t care

for by emailing the Curmudgeon at ajwdct@gmail.com OR reply to my tweets @ajwdct247.

Good luck and till next time.

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and

received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2018 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).