December 2018 Fed Meeting and the Markets

by the Curmudgeon with Victor Sperandeo

The Fed is likely to raise its benchmark Fed Funds interest

rate by a quarter-point (25 bps) to a range between 2.25% and 2.5% at the end

of their meeting on December 19th. The CME

FedWatch tool, which is based on Fed Funds futures prices,

had forecast over a 75% chance of a rate increase for several months. The Fed tool is currently down slightly at a

73.6% probability of a 25-bps rate hike.

On December 19th, Powell will likely say

that the Fed is no longer on the one-rate-hike-per-quarter pace seen in 2017

and 2018. The Feds dot plot (too

complicated to illustrate in this article) is expected to pencil in two hikes

in 2019, down from three projected this past September. In the Feds end of December 2018 meeting statement,

the forward guidance language stating the FOMC expects further gradual

increases in the target range will almost surely be removed.

Why? Global

growth is slowing precipitously, the U.S. dollar continues to rise and is at a

yearly high (making it especially difficult for emerging market countries to

service their dollar denominated debt), and stock markets around the world are

tumbling (that really shouldnt matter as stock market stability is NOT a

mandate of the Fed- only stable inflation and unemployment are). The Fed's final projections for 2018 will

come as investors are rapidly souring on the economy and losing confidence that

the Fed will keep hiking rates as global economic headwinds hit the U.S. economy

(Germany and Japan are already in contradiction, while China growth is the

slowest in at least a decade).

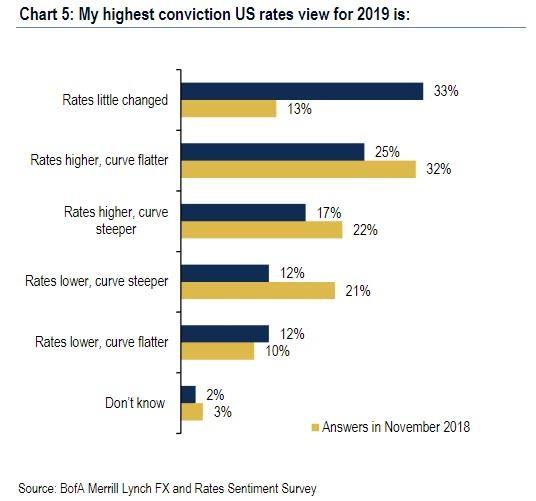

The latest Bank

of America Merrill Lynch (BofAML) FX/Rates sentiment survey saw a huge

change in opinions in just the last month.

In November 2018, 32% of respondents expected higher rates and a flatter

curve, but that number as of December has since tumbled to just 13%, with

the majority of investors now expecting little changes to rates after Fed

Chairman Powell's recent dovish commentary.

Heres BoAMLs bar chart showing recently monthly survey forecasts on

top and November on bottom.

.

Michelle Meyer, head of U.S. economics at BoAML, said

Powell must sound reassuring without sounding hawkish. The key words will be caution, patience,

risks and data dependence, Meyer said.

The reduction in the Fed dots will be seen as a

market-friendly capitulation and the market is already anticipating the move

with current market pricing suggesting less than one hike in 2019, Meyer added.

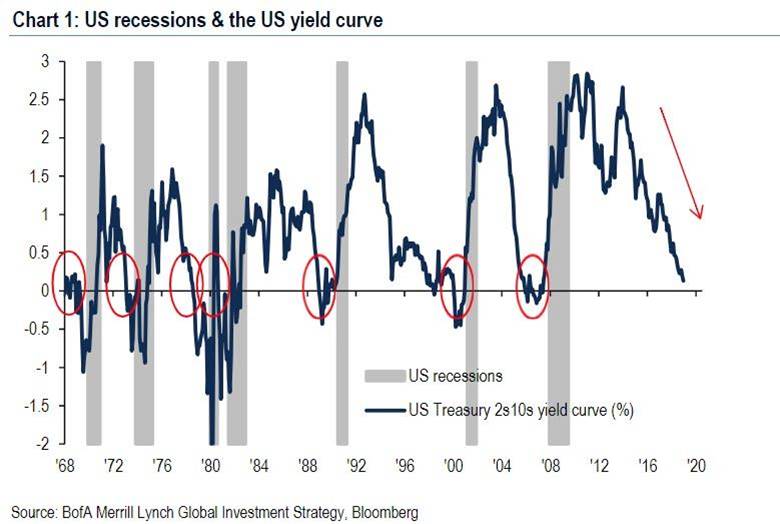

When short-term yields on government debt pop above

their longer-dated peers (an inverted yield curve), it is often a prelude to a

recession. Therefore, the flattening yield curve is an important stock market

concern. Its depicted in this chart

from BoAML:

..

Market strategists are intensely focused on the Feds

outlook for 2019, which will dictate whether the inversion seen in some parts

of the yield curve becomes more pervasive. The U.S. 2 year/5 year and 3

year/5-year Treasury notes recently inverted, which stimulated much discussion

of imminent recession. Meanwhile, the more important headline spread between

the 2 year and 10-year yields -at 15 bps- is almost flat. Its very close to

going negative for the first time since 2007.

"The real risk will be that the Fed doesnt

change the dot plot, increases fed funds and sounds generally kind of

hawkish," Ian Lyngen of BMO told Bloomberg. "That would be a

surprise, because I think consensus is now a dovish hike. So if we get a

hawkish hike (with no Fed dot plot change), it will flatten the curve even

further," he added.

We think that if the Fed refuses to budge on its three rate hike forecast for 2019, with the median 2019 dot

plot remaining at 3.1%, then the U.S. and global stock markets will plunge.

Victors Closing

Comments:

If the Fed raises rates on December 19th,

the U.S. stock market will decline another 5%.

Be aware that the Plunge

Protection Team (PPT) might step in to buy stock index futures or ETFs if

the market were to fall fast and hard.

The world economy is slowing greatly and headed for a global recession.

However, if the Fed does NOT raise rates as I expect, the stock market could experience a Santa Clause rally. Remember, we are in a bear market, so rallies are sharp and short.

Good luck and till next time

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2018 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).