U.S. Financial Markets, Outlook, and the Fed

by Victor Sperandeo with the Curmudgeon

U.S. Markets

Review:

U.S. and international equity markets were lower

across the board in October. The Russell

2000 lost nearly -11% and the Dow Industrials was down more than -5%. The U.S. Dollar +2.3%, and the yield on the

U.S. Government 30-year Bond moved up 20 basis points. The yield curve began to widen slightly, as

the 30-year T-Bonds saw more weakness than 10 year

T-Notes.

The two most prominent issues concerning the equity,

currency, debt, and commodity markets today are interest rate increases by the

U.S. Federal Reserve, and the November 6th mid-term elections. Tariffs are also

an important factor, but while trade news results in quick, sharp moves in the

markets, it is the other two issues that are painting the long-term picture.

What Caused the

Equity Market Decline, and is it a Bear Market?

Looking back these are relatively easy questions to

answer, both fundamentally and technically.

1. Fundamental

Factors:

Fundamentally Fed Funds were increased again by 25bps

at the September 26th meeting of the U.S. Federal Reserve, which was widely

expected. However, in the statement from

the Federal Reserve a small but significant change had been made. The prior

meeting’s release included the sentence “The stance of monetary policy remains

accommodative, thereby supporting strong labor market conditions and a

sustained return to 2 percent inflation.”

That sentence was rewritten in September to show that monetary policy

was no longer defined as “accommodative.” During the question and answer

session after the Fed meeting, Chairman Jerome Powell was asked about this

wording change and explained that accommodative policy was unnecessary at this

point. This was the first clue given by the Federal Reserve of a change to a

more hawkish policy.

It was also strongly hinted by the Federal Reserve

that there would be another rate hike coming in December. The Federal Reserve

Dot Plot showed three projected rate increases in fiscal 2019, moving rates to

3.1%, and then another two in fiscal 2020 moving rates up to 3.4%. This was

coupled with a forecast showing GDP dropping -42% during the same time

period.

As a confirmation, on October 18th Goldman Sachs was

reported as having told clients that it remained "comfortable" with

its call for five more interest rate hikes through the end of 2019, which was

two more than called for in the Federal Reserve Dot-Plot. In a note to clients, Goldman said it “feels

the Federal Reserve needs to generate a significant tightening in financial

conditions to slow the economy to its potential growth pace sooner rather than

later,” and that “this will require delivering significantly more hikes than

priced in the curve." In effect Goldman Sachs was suggesting the Federal

Reserve needed to raise rates at an even faster pace than they planned.

It is also important to examine Powell’s comments to

the National

Association for Business Economics on October 2nd. He was reported to

have hailed a “remarkably positive outlook” for the U.S. economy that he feels

is on the verge of a “historically rare” era of ultra-low unemployment and tame

prices. Powell described this as

economic performance “unique in modern U.S. data,” with unemployment of below 4

percent expected for at least two more years and inflation remaining modest

even as wages rise. He also expressed the opinion that President Trump’s trade

disputes with China and other nations might lead to “one-time price hikes, but

not to persistent changes in the annual rate of inflation going forward.”

Powell added: “this forecast is not too good to be

true,” but instead “is testament to the fact that we remain in extraordinary

times.”

I believe that the Federal Reserve is walking

a very thin line at the moment by aggressively raising

rates in an attempt to slow and smooth economic growth and using the excuse

that they want to avoid inflation before it actually arrives.

The danger in this strategy is that by raising rates

too quickly (in other words, leaning too close to Goldman’s beliefs) it raises

the costs of corporate borrowing, which has helped fuel the growth we are

currently experiencing. The supposedly

omniscient U.S. Federal Reserve could easily hit the brakes too hard and too

fast, which could cause growth to drag below the low rate of inflation

predicted.

If the Democrats are able to

take control of the House or the Senate (or both) in the upcoming November 6th

mid-term elections, I believe that businesses will inevitably pause and begin

to reconsider their plans for expansion and hiring. The Fed does not seem to be

considering the effects this would have on the economy. As is often the case, the Fed believes it can

control the economy with pinpoint accuracy. One misstep and we could be stuck

back in low growth, falling interest rates, high taxes, and complex

regulations. All the economic progress of the last two years could come undone

if the Federal Reserve chooses to anticipate rather than react. Like retail

investors, the Fed often finds itself the last one in and the last one out.

2. Technical

Factors:

After the Federal Reserve meeting on September 26th,

the Dow Jones Industrials rallied five days in a row before making an all-time

high on October 3rd, the U.S. Dollar rallied seven straight days starting on September

25th , and December Crude Oil made new highs on

October 3rd , reaching levels not seen since 2014. Technically there was a

minor non-confirmation, as the Dow Industrials made a new high, while other

indexes such as the S&P 500 did not. This was a grand signal to sell (or

hedge) equities, especially when combined with Powell’s October 2nd statements,

as the decline started the day after he spoke. The key technical signal that

suggested we are in a bear market is when the S&P 500 closed below the 200-day moving average, while the 200-day

moving average also slopped downwards. This along with the Dow Theory (whose long-term trend is

still in limbo) are historically the best long-term bear market indicators.

A strong labor market, especially wage growth above

3%, keeps the Fed on track to raise its benchmark interest rate. The Fed raised

its federal-funds rate in September to a range between 2% and 2.25%, and most

officials signaled they expected to lift rates by another percentage point

through next year, with the next move in December with several more rate hikes

to follow in 2019.

………………………………………………………………………………………………………………………………………….

Curmudgeon

Comments:

1. Fundamental:

U.S. employment and wage growth are strong which will

keep the Fed on course to raise rates.

(Non-Farm) employers added 250,000 jobs to their payrolls in October,

above monthly averages in recent years, the Labor Department said Friday. With

unemployment holding at 3.7%, a 49-year low, and employers competing for scarce

workers, wages increased 3.1% from a

year earlier, the biggest year-over-year gain for average hourly earnings since

2009. Employers have added to their

payrolls for a record 97 consecutive months.

With the Fed continuing to raise rates and inflation

accelerating, there will surely be pressure on intermediate and long term interest rates.

Also, the unknown effects of tariffs and trade wars, especially with

China create economic uncertainty which is likely to temper capital investments

in plant and equipment along with digital advertising (look out Google and

Facebook). These factors appear to be

bearish for both bond and stock prices going forward.

2. Technical

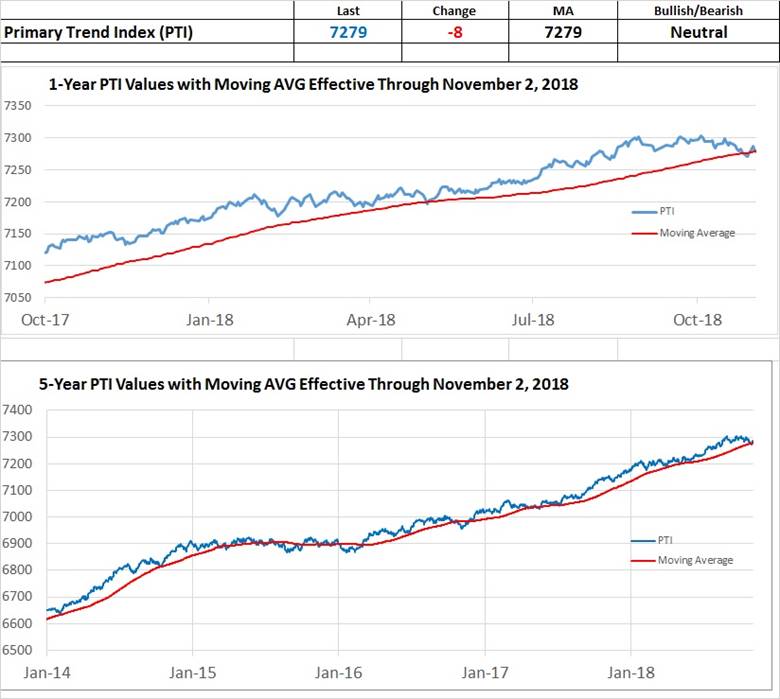

While the Dow Theory confirms the trend of the

market, its custodian is now defunct. Dow Theory Letters closed in late

September and merged with the Aden Forecast, which is now tracking Richard

Russell’s Primary Trend Index (PTI).

Here’s the latest PTI (neutral) reading and accompanying charts:

The other technical gauge we track closely is Leuthold Group’s Major Trend Index (MTI). It dropped 0.10 points in the week ended

October 26th, to a ratio of 0.67. The decline was led by a collapse of more

than 300 points in the Momentum category to its first negative reading since

early March 2016.

In early February, the Dow Jones Utility Average was

the only key domestic subgroup with a negative quantitative MTI “Chart

Score.” On October 30th, it

was the only one with a positive Chart Score. That’s not encouraging: While the

Utilities tend to peak out in advance of the S&P 500 (and are therefore one

of the eight Red Flags in a chart we’ve published in the Green Book for eons),

it’s not unusual for them to regain a bid as a bear market gets underway. For

example, while weakness in this group helped telegraph the market tops of both

2000 and 2007, the DJUA rebounded to new cycle highs in the months immediately

following both of those peaks.

…………………………………………………………………………………………………………………………………………………………….

The November 6th

Elections:

Before I proceed permit me to disclose that I

expected Obama to lose the 2012 Presidency by a large margin, so my political

prognostications are far from infallible.

In some ways we are in a similar situation to 1998.

The House and Senate were Republican at that time, with Democrat Bill Clinton

as President. There was talk about impeachment (due to the Monica Lewinsky

affair and Clinton’s perjury in the Paula Jones lawsuit), which hung over the administration.

Clinton was actually impeached by the House in

December - after the election – but that was not confirmed by the Senate. The

economy and the equity markets were booming, as they have been since Trump was

elected.

In mid-term elections counties are very important.

Trump won 2622 (+84.3%) of the counties in the U.S. in 2016, versus Hillary

Clinton’s 490 counties (+15.7%). The large populations are concentrated in

urban areas like Los Angeles or New York City, so the counties do not represent

population equally. Generally, the turnout is much lower in the mid-terms.

Therefore, my guess is the Senate will see the Republicans gain 3 to 7 seats,

while they lose 10 to 15 seats in the House of Representatives (39 Republicans

and 18 Democrats are retiring). This would mean the GOP would retain control of

both sides of Congress. The bottom line in 1998 was the people did not want

change when the economy was hot, and therefore chose to leave both the House

and the Senate in Republican hands.

Therefore, I believe that regardless of Trump’s

personality, and the machine-gun-like attacks on him from the left, voters will

leave control of both sides of the U.S. Congress in the hands of the GOP. If

this is true, a strong equity rally is likely to take place after the

election. If instead, the Democrats gain

control of the House or the Senate (or both), U.S. stocks will likely be in a bear market. That’s because I do not believe anything

will be accomplished in Washington (just like 1974 under Nixon after Watergate

was disclosed).

A critically important bellwether to the political

trend in the nation is the Florida Governor race: Andrew Gillum versus Ron

DeSantis. Gillum is endorsed by Bernie Sanders, as both Sanders and Gillum are

avowed “Democratic Socialists.” In truth, the terms Socialist and Democratic

Socialist are exactly the same; they’re just used by

different leaders (see Hugo Chavez and Nicolas Maduro). The people of Florida

are made up largely of retirees (who care most about Medicare), and includes huge

Jewish and Cuban populations. If they vote for Socialism, the U.S. is signaling

that Capitalism may be over. As a Founding Father, Patrick Henry said

“Everything I work towards in the future is governed by my past. For I have but

one lamp by which my feet are guided, and that is the lamp of experience. I

know no way of judging of the future but by the past.” Here is what “Democratic

Socialism” a.k.a. Socialism meant to well-known Political Philosopher Frederic Bastiat (translated from the original French): “The

delusion of the day is to enrich all classes at the expense of each other; it

is to generalize plunder under pretense of organizing it. Now, legal plunder

may be exercised in an infinite multitude of ways. Hence, come an infinite

multitude of plans for organization: tariffs, protection, perquisites,

gratuities, encouragements, progressive taxation, free public education, right

to work, right to profit, right to wages, right to assistance, right to

instruments of labor, gratuity of credit, etc. And it is all these plans taken as a whole, with what they have in common, legal

plunder, that takes the name of Socialism.” Written 179 years ago, it is as

true today as it was in 1840.

Closing Quote:

Lastly, allow me to give you the sentiments of one of

the greatest economists that ever lived:

Ludwig Von Mises, of the Austrian School of Economics. He lived within Socialism and said of it:

“A man who

chooses between drinking a glass of milk and a glass of potassium cyanide does

not choose between two beverages; he chooses between life and death. A society

that chooses between capitalism and socialism does not choose between two

social systems; it chooses between social cooperation and the disintegration of

society. Socialism is not an alternative to capitalism; it is an alternative to

any system under which men can live as human beings.”

Good luck and till next time…

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2018 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).