Results of GOP Tax Bill: Big Surprise in

4thQ 2017 DJIA GAAP Earnings while Stock Buybacks Accelerate as Predicted

by the Curmudgeon

DJIA Companies 4th Quarter

GAAP Earnings -44% with Non-GAAP Earnings ex-tax bill up 10.5%:

FactSet reported today

that the GOP tax bill, signed into law late last year by President Trump,

reduced GAAP earnings for 28 of the 30 DJIA companies by more than 40% in the 4th

Quarter of 2017. Two DJIA companies

(Apple and Nike) did not provide any specific numbers on the impact of tax

reform in their earnings releases.

FactSet collected the GAAP EPS numbers reported by each company in the

Dow 30, weighted the GAAP EPS by the shares outstanding, and aggregated the

share-weighted earnings numbers to arrive at an approximate GAAP earnings

number for the entire Dow 30.

·

On

a GAAP basis, aggregate earnings for the DJIA were approximately $42.2 billion

for Q4 2017.

·

On

a GAAP basis excluding tax reform, aggregate earnings for the DJIA were

approximately $75.6 billion.

ΰTherefore, tax reform reduced GAAP

earnings for 28 of the DJIA companies by approximately $33.4 billion dollars

(=44%) for Q4 2017.

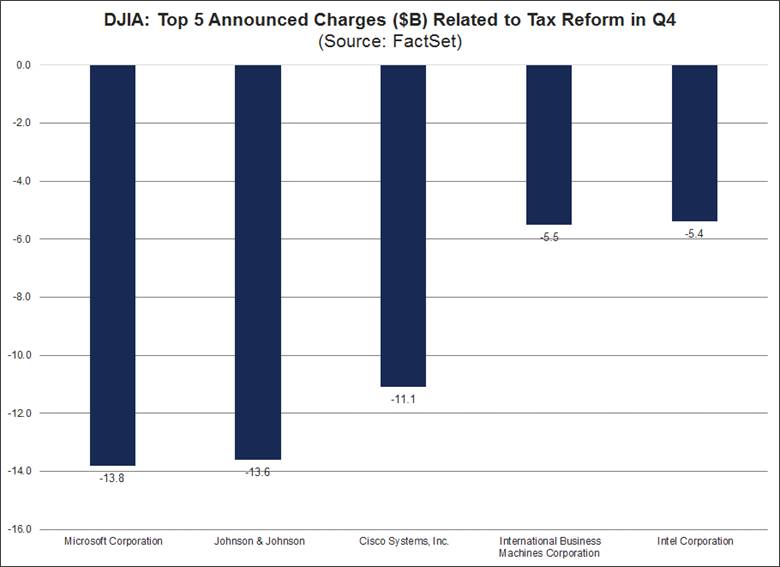

The five companies in the DJIA that announced the largest net charges due

to tax reform are listed in the chart below:

Source: FactSet

For comparison purposes, FactSet collected the non-GAAP EPS numbers reported by each company (which excluded the

net charge or gain associated with the tax law and other items selected by each

company), weighted the non-GAAP EPS by the shares outstanding, and aggregated

the share-weighted earnings numbers to arrive at an approximate non-GAAP earnings number for the index.

· On a non-GAAP basis (excluding tax

reform and other items), aggregate earnings for the DJIA were approximately

$101.8 billion.

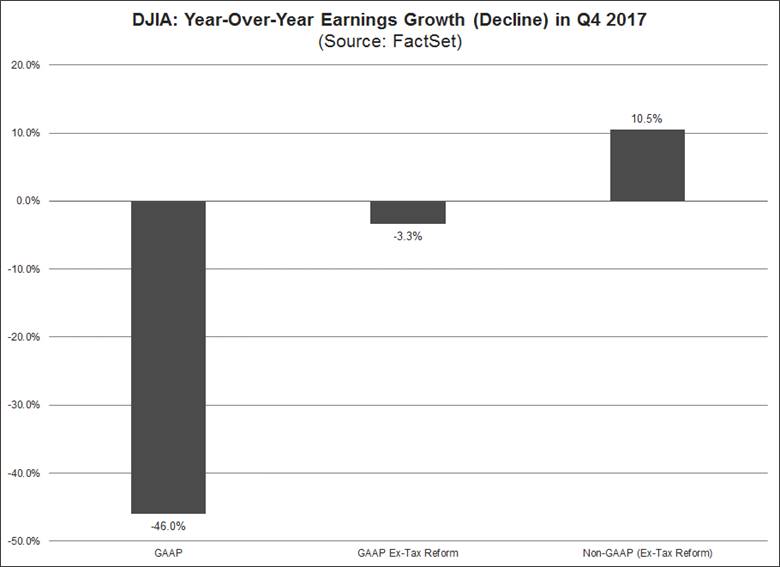

FactSet then used these numbers to calculate year-over-year earnings growth rates for Q4 2017.

·

On

a GAAP basis, the DJIA reported a year-over-year decline in earnings of -46.0%.

·

On

a GAAP basis excluding tax reform, the DJIA reported a year-over-year decline

in earnings of -3.3%.

·

On

a non-GAAP basis, the DJIA reported earnings growth of 10.5%.

This is all shown in the chart below:

Source: FactSet

Curmudgeon Comment:

We find it remarkable that there could be a 56.5% difference between the

4th Quarter percent changes in GAAP (28 DJIA company) earnings

subject to the tax bill vs. Non-GAAP earnings Ex-Tax Reform related charges.

Corporate Tax Cut Bonanza for Rich

Investors:

It was no surprise at all to read several reports that the GOP tax bill

benefits are going to shareholders rather than to employees (ex- senior

executives who are compensated largely with stock options and grants) or the

real economy.

The lead

editorial in todays New York Times was crystal clear in reporting what

most reasonable economists and investment strategists opined after the GOP tax

bill was passed in late December 2017:

As executives tell investors what they intend to do with their tax

savings and their spending plans are tabulated into neat charts and graphs, the

reports jibe with what most experts said would happen: Companies are rewarding

their stockholders.

Businesses are buying back shares, which creates demand for the stocks,

boosts share prices and benefits investors. Some of the cash is going to

increase dividends. And a chunk will go to acquiring other businesses, creating

larger corporations that face less competition.

In addition to benefiting investors, these maneuvers will end up boosting

the pay of top executives because their compensation packages are often tied to

the price of their companies stock. Finally, a small sliver of the money will

find its way into paychecks of rank-and-file employees, but it wont be a big

boost and will probably come in the form of a temporary bonus, rather than a

lasting raise.

Morgan Stanley analysts estimated that:

·

43%

of corporate tax savings would go to buybacks and dividends

·

Nearly

19% would help pay for mergers and acquisitions.

·

Just

17% would be used for capital investment

·

Only

13% would be for bonuses and raises.

Other Wall Street analysts have issued similar reports. A recent CNN article is titled: Tax

cut scoreboard: Workers $6 billion; Shareholders $171 billion.

It's raining stock buybacks on Wall Street -- thanks to President Trump's

massive corporate tax cuts. The White

House has celebrated the tax cut bonuses unveiled by the likes of Walmart

(WMT), Bank of America (BAC) and Disney (DIS).

Yet shareholders, not workers, are far bigger direct winners from the

Tax Cuts and Jobs Act of 2017.

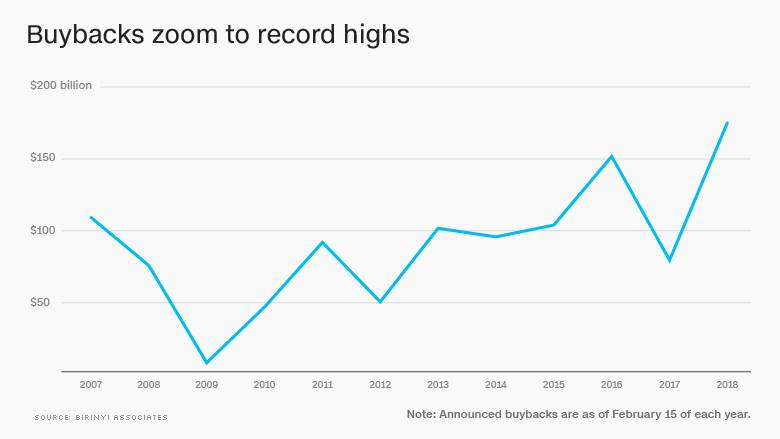

American companies have lavished Wall Street with $171 billion of stock

buyback announcements so far this year, according to research firm Birinyi Associates.

That's a record-high for this point of the year and more than double the $76

billion that Corporate America disclosed at the same point of 2017.

Wall Street loves buybacks because they tend to boost the share price in

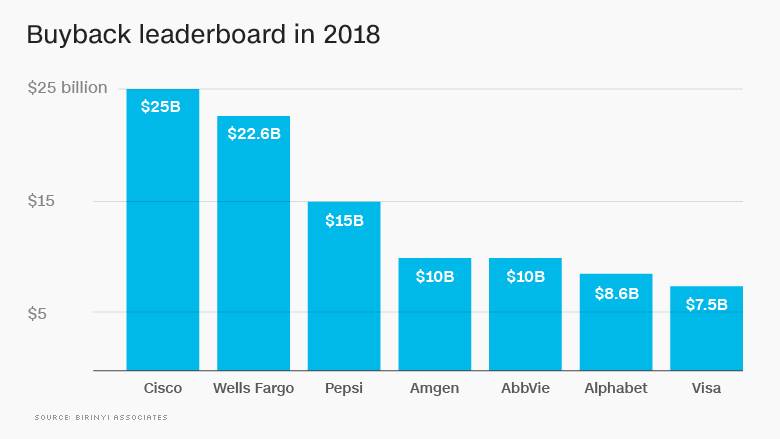

part by inflating a key measure of profitability. In just the past three days,

Cisco (CSCO), Pepsi (PEP) and drug maker AbbVie (ABBV) have promised a total of

$50 billion of buybacks.

"It's the largest ever -- and nothing has really changed, except the

tax law," said Jeffrey Rubin, director of research at Birinyi

Associates. The record highs for stock

buybacks are depicted in this chart:

"Our worst nightmare is coming true," said Frank Clemente,

executive editor of Americans for Tax Fairness, a group that fights for

progressive tax reform. "We predicted that the lion's share of the

benefits of this tax cut would go to already-wealthy shareholders and CEOs, not

to a company's workers."

The tax-inspired buyback boom may just be getting started. Bank of

America recently predicted that S&P 500 companies will use repatriated

foreign profits to buy back about $450 billion of stock.

.

In its 2nd fiscal quarter earnings report on February 14th,

Cisco said it would repatriate $67

billion of its foreign cash holdings to the U.S. this quarter. The company plans to spend much of the newly repatriated cash on share buybacks and

dividends. That amounts to about $44

billion over the next two years, according to the Wall Street Journal (on line subscription required). At the end of the quarter, Cisco had $73.7

billion of cash and equivalents, with the vast majority

held outside the U.S. Under the new tax law, the company will be able to access

its money at a significantly lower tax rate than was previously required. The tax laws impacts reduced Ciscos

earnings by $11.1 billion, including $9 billion from a transition tax.

Critics of the U.S. tax law have said

increases in share repurchases and dividends show money saved from the law is

going to shareholders instead of being invested in new U.S. jobs,

infrastructure, research and development, and related areas, according to the Wall Street Journal.

..

Meanwhile, the working man is NOT benefiting from tax reform. A recent

Politico/Morning Consult poll concluded that very few voters report seeing

bigger paychecks after tax changes. The

poll found that just 25% of registered voters said they had noticed an increase

in their paycheck because of lower tax withholding while 51% had not. The poll

also found that high-income people were more likely to notice that their

take-home pay had gone up.

Curmudgeons Closing Comment:

It is now readily

apparent that Republicans designed the new tax law to principally

benefit wealthy families while offering crumbs to low-income and middle-class

families. Also, no tax loopholes were closed as many in Congress previously

demanded. Finally, budget deficits and

the national debt will likely increase by at least 1.5 Trillion to pay for the

corporate tax cuts. The GOP deficit

hawks were silent when it came down to the final vote. Great job GOP Congress! Lets hoist a toast to increased income

inequality, financial engineering boosting stock prices, and the real economy

not benefiting much, if at all from tax reform.

Good luck and till next

time...

The Curmudgeon

ajwdct@gmail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2018 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).