Does the U.S. Government Want a Strong

or Weak Dollar?

by the Curmudgeon with Victor

Sperandeo

U.S. Treasury Secretary

Steven Mnuchin moved markets this week with his comment that a weak dollar

benefits American trade. That remark helped

plunge the U.S. currency to a three-year low and touched off a flurry of

speculation about the Trump administration’s economic plans. It also sparked a rally in gold, silver and

commodities (which are priced in dollars).

“The dollar is one of the most

liquid markets,” Mr. Mnuchin said. “Where it is in the short term is not a

concern of ours at all. Obviously, a weaker dollar is good for us as it relates

to trade and opportunities. But again, longer term, the strength of the dollar is a reflection of the strength of the U.S. economy and the

fact that it is and will continue to be the primary currency, in terms of the

reserve currency.”

“I thought my comment on the

dollar was actually quite clear yesterday,” he told reporters hours before Mr.

Trump arrived in Davos for the World Economic Forum. “I thought it was actually

balanced and consistent with what I’ve said before, which is we’re not

concerned with where the dollar is in the short term, it’s a very, very liquid

market, and we believe in free currencies. And that there’s both advantages and

disadvantages of where the dollar is in the short term. Let me say, I thought

that was clear.”

Mnuchin said on Friday he was

not trying to talk down the dollar and his comments earlier this week were

taken out of context, according to an interview with CNBC.

"I made the comment two

days ago in a press gaggle in the morning. What I said was actually

very even-handed and consistent with what I said before," Mnuchin

told CNBC from Davos, Switzerland. "I was not trying to move the

dollar."

“Treasury Secretaries

normally are highly disciplined when they speak on the dollar to ensure their

words are treated seriously when they want to signal policy shifts or to build

confidence in challenging economic moments,” said Gene Sperling, who served as

the top economic adviser to Presidents Barack Obama and Bill Clinton. “This

type of seemingly off-the-cuff and politically careless back and forth just

erodes that type of authority when it will be most needed,” he added.

James Paulsen of Leuthold Group Weighs-In:

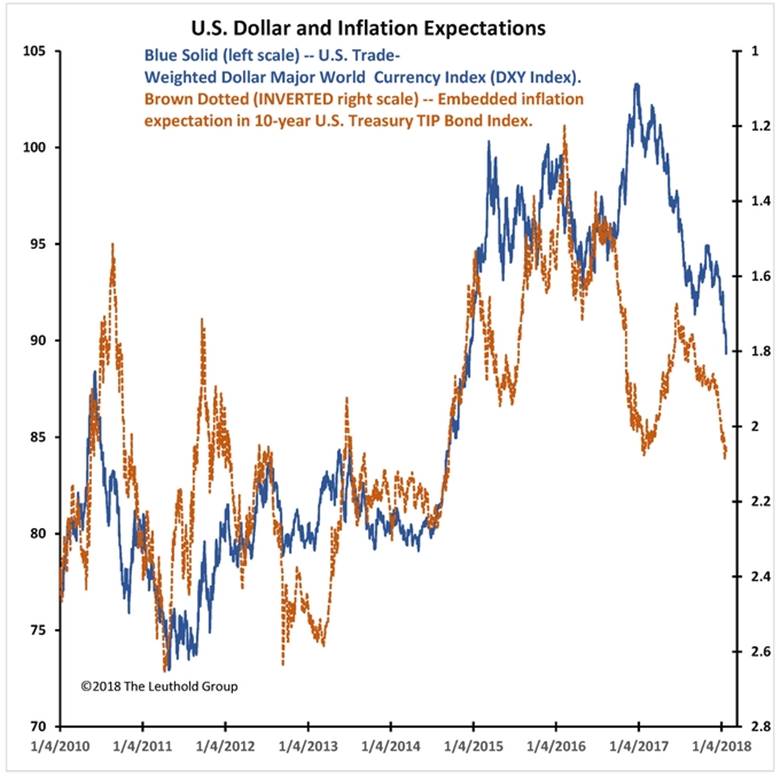

In

our view, recent weakness in the U.S. dollar reflects growing inflation

expectations which should not be considered “good news” for the financial

markets. The accompanying chart overlays the U.S. dollar index (blue solid

line) with the embedded inflation expectation in the 10-year U.S. Treasury TIP

Bond Index. The bond market’s inflation expectation is shown on an inverted

right-side scale so that as the dotted brown line declines inflation worries

are rising.

Rising

inflation destroys the relative value of the dollar. Clearly, throughout this

recovery, the U.S. dollar has been driven by inflation expectations. The dollar

did not surge in 2014 because the Fed or the bond market raised interest rates.

Rather, it increased in value because inflation expectations declined from

about 2.3% to about 1.2% enhancing the dollar’s real purchasing power. Since

last summer, inflation expectations have increased to a new three-year high

above 2.08% coinciding with the U.S. dollar recently breaking to a fresh

three-year low.

We

expect inflation evidence and inflation worries to keep climbing this year and

that implies further U.S. dollar weakness.

A

U.S. dollar trending (collapsing?) lower is likely to bring much more pressure

to a 10-year bond yield which is still below 2.7% and an S&P 500 P/E

multiple based on trailing earnings per share of about 23x.

Victor’s Comments:

The Trump Administration

wants the U.S. dollar down. Let’s look

at what happened in the late 1970s to inflation and interest rates when the

dollar tumbled.

From June 1976-77 through

1980, the U.S. dollar index declined -20.9% (DXY went from 107.05 to

84.65).

· The CPI during that time period was + 9.60% compounded.

· Fed funds went from 5.25 to 14.00% and

other interest rates also rose sharply.

In other words, inflation was

accelerating even while interest rates were rising during the dollar’s decline.

Normally, one would expect the dollar to increase in value on a strong rise in

rates. But that didn’t happen!

Also, U.S. GDP rose strongly,

but most of it was due to inflation. From 6/76 to 6/80, nominal GDP (unadjusted

for inflation) compounded at +10.8% annual rate. Yet “real GDP” only increased by +3.09%

annually!

This is the fundamental

reason the dollar will decline: the Trump

administration wants it down. The markets are predicting that inflation is

finally going to spike upwards!

……………………………………………………………………

Good luck and till next time...

The Curmudgeon

ajwdct@gmail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been

involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2018 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).